Table of Contents

Key Takeaways

- Employer-provided life insurance usually ends at retirement, so retirees need to consider getting their own coverage.

- Retirees should assess their finances, including savings, benefits, pension, and debt, to decide if life insurance is needed.

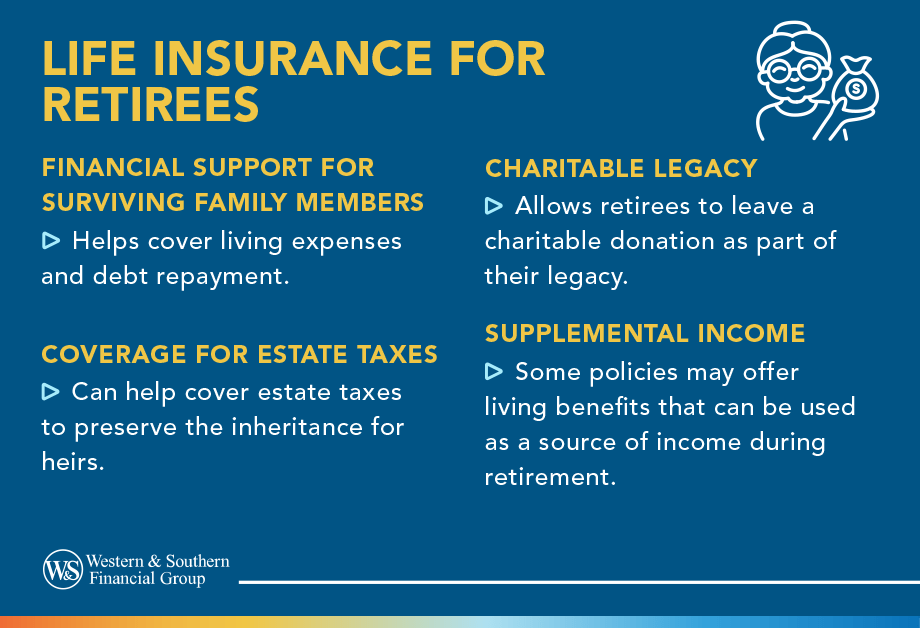

- Life insurance can support family, cover estate taxes, or leave a charitable legacy in retirement.

- Retirees should review their savings, benefits, pension, and debt to determine if they need life insurance.

- Consulting with a financial representative can help navigate available options and create a tailored life insurance plan for retirees.

After celebrating your last day on the job, you walked out of your office and — finally, after decades of hard work — into retirement. You already did all the planning, saving and working needed to get here. So, there's no need for additional planning ... right?

For some, that may be the case, but others entering retirement might be trying to answer that difficult question: When should you get life insurance? There are other things you might want to consider to help make sure that all your hard work is adequately protected after retirement.

Examine Your Finances

Before your retirement, you probably had a life insurance policy through your employer as part of your employee benefits package. It's likely that your policy ended once you left your job — meaning you won't have life insurance unless you buy it yourself.

Life insurance can serve many purposes, including helping to protect your loved ones from financial hardship after you die. So, a life insurance policy could be an important consideration for your working years and in retirement.

Before purchasing a policy, it is important to examine your finances and ask yourself a few questions.

- Can you live off of your savings and Social Security benefit? Make sure that you have carefully considered all of the variables before you allow your policy to expire — as new coverage in retirement may not be an option, or if it is available, could get expensive due to your age and any health concerns.

- Do you still earn income or receive payments from a pension? Some people continue to work to supplement their retirement savings. Others might not need to work, but also have no savings and instead rely on payments from their pension plans or other retirement programs. If this is the case for you, life insurance might be a good option. Consider how your spouse — or other dependents — would handle living expenses and other costs without your outside retirement income. If they rely on that income, a life insurance policy could help provide for them should you die before they do.

- Do you still have debt? While many people pay off debts and loans like mortgages before retirement, that's not always possible for everyone. If you still carry a balance on a loan or credit card, a life insurance policy might be a consideration to help protect your loved ones from incurring your debts. The payout from the policy can help your surviving family members pay off whatever you owe without transferring the burden of debt repayment to their own pocketbooks.

Consider Your Life Insurance Needs

It is equally important to consider your needs when putting together your plan. Is your family self-sufficient and have assets you plan to leave them? Do you want an additional estate planning tool? A life insurance policy could help add peace of mind.

If you're concerned about leaving enough liquid assets behind to cover things like estate taxes, you could purchase a life insurance policy that pays out to your beneficiaries. They could then use that payment to help cover the taxes on the assets they inherit from you.

On a similar note, you may consider continuing paying premiums on a life insurance policy if you simply want to provide a benefit for your loved ones when you die. You'll want to ensure the premiums can comfortably fit into your budget, of course, but you always have the option of maintaining a policy so the insurance will pay out to a designated beneficiary. You could even structure your policy as a charitable donation by naming an organization of your choice as the beneficiary. It may help to speak with a financial representative to walk through the different options and help plan the best way to make your life insurance policy work for you and what you care about — even in retirement.

The Bottom Line

So, when should you get life insurance? It's important to ask yourself this question no matter what life stage you're in — whether leaving your long-time career or starting another part of your life — because it could be an important part of your financial future.