Table of Contents

Key Takeaways

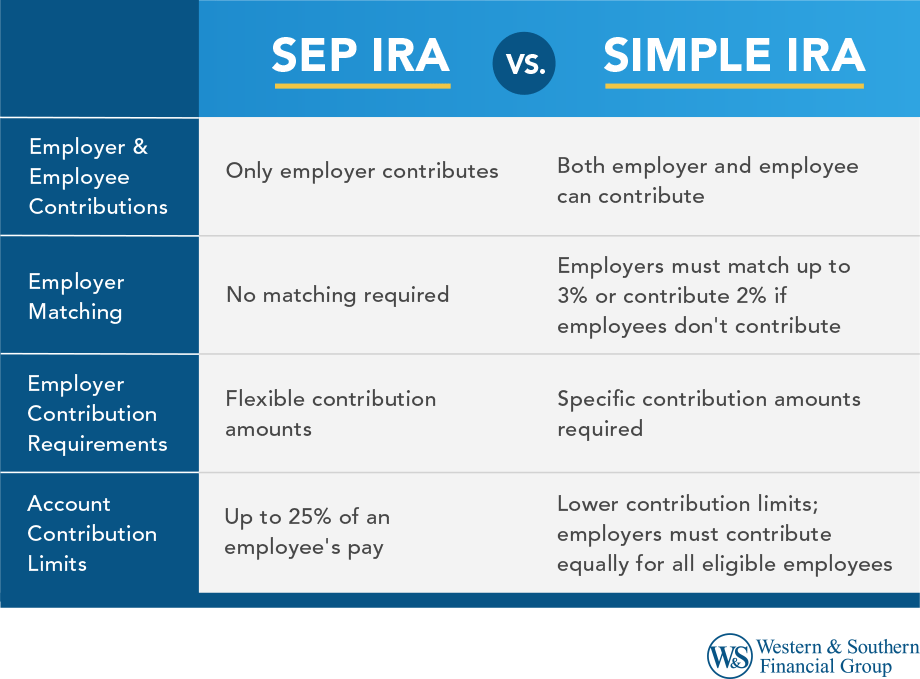

- Sep IRA and SIMPLE IRA are small business retirement plans, with SEP allowing only employer contributions and SIMPLE permitting both employer and employee contributions.

- SEP IRAs allow employers to contribute up to 25% of pay, while SIMPLE IRAs require a 3% match or 2% contribution if employees don't contribute.

- SEP IRA is flexible for fluctuating cash flow, while SIMPLE IRA has specific employer contribution requirements.

- SIMPLE IRA allows employees to participate in their retirement savings by contributing to their accounts, fostering employee engagement in the plan.

- SEP and SIMPLE IRAs provide tax-deductible benefits and are cost-effective compared to 401(k) plans.

As a small business owner, you don't just worry about saving for your own retirement — you also worry about how your employees will save for theirs.

Many large corporations offer 401(k)s as part of their employee benefits packages. These retirement savings plans give employees and employers an incentive to save. But while most large corporations can afford to provide and maintain 401(k)s, some small-business owners cannot — and need to consider a different strategy.

This is where simplified employee pension (SEP) and savings incentive match plan for employees (SIMPLE) individual retirement accounts (IRAs) come into play. These retirement savings accounts could help ensure that you and your employees can save for tomorrow.

What Is a SEP IRA?

A SEP IRA is a retirement plan that allows employers to save for themselves and their employees. Only the employer contributes to SEP IRAs. One reason these retirement plans are attractive to many small-business owners is the cost — they don't come with large price tags like many 401(k)s.

SEP IRAs allow employers to contribute up to 25 percent of each employee's pay, according to the Internal Revenue Service (IRS), and are available to businesses of any size.1

What Is a SIMPLE IRA?

A SIMPLE IRA is a retirement plan available to small businesses with 100 or fewer employees. With these retirement plans, both employers and employees can contribute to the account.

With SIMPLE IRAs, the employer is required to make a matching contribution of up to 3 percent of compensation, according to the IRS.2 If the employee chooses not to contribute to their account, the employer must contribute 2 percent for each eligible employee (up to $333,000 for 2023).

It's important to note that contribution limits do change and are subject to cost-of-living adjustments.3 Also, if your business offers another type of retirement plan, it wouldn't be eligible for SIMPLE IRAs.

What Are the Key Differences?

Both SEP and SIMPLE IRAs could be cost-effective ways for business owners to save for retirement while also encouraging their employees to put money away for their golden years.

But there are a few key differences:

- Employer & employee contributions: With SEP IRAs, only the employer contributes to the retirement accounts. With SIMPLE IRAs, employees are also able to contribute to their accounts.

- Employer matching: SIMPLE IRAs require employers to match employee contributions up to 3 percent — or contribute up to 2 percent if employees don't contribute to their accounts. For SEP IRAs, only an employer can contribute.

- Employer contribution requirements: With SIMPLE IRAs, employers are required to meet a specific contribution amount.4 With SEP IRAs, contribution amounts are more flexible.5

- Account contribution limits: With SEP IRAs, employers can contribute up to 25 percent of an employee's pay.5 SIMPLE IRAs have a much smaller contribution limit than SEP IRAs, but employers must contribute equally for all eligible employees.4

Which Is the Right Choice for My Business?

Is cash flow an issue for your business? If so, a SEP IRA could help provide more flexibility with contribution requirements. Let's imagine you own a landscaping company that makes most of its annual revenue in the spring and summer. The fall and winter may be more volatile for your business regarding cash flow. As a result, you could choose a SEP IRA because you might not be able to meet the specific SIMPLE IRA requirements all year round.

Do you have predictable cash flow? If so, a SIMPLE IRA could make sense — especially if you don't want the sole responsibility of funding your employees' retirement plans. With SIMPLE IRAs, your employees could also help fund the program.

Regarding employer tax benefits, both plan types are deductible expenses that will lower your self-employment tax. How much you can lower that tax depends on the contributions.

Regardless of which route you choose, offering a retirement plan as part of your employee benefits package is a win-win for everyone. Benefits create loyalty among your employees and give you (as the employer) a tax break. Additionally, since SEP and SIMPLE IRAs are more cost-effective than 401(k)s, you could get many of the same benefits without the hefty price tag.

Sources

- Simplified Employee Pension Plan (SEP). https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep.

- SIMPLE IRA Plan. https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan.

- COLA Increases for Dollar Limitations on Benefits and Contributions. https://www.irs.gov/retirement-plans/cola-increases-for-dollar-limitations-on-benefits-and-contributions.

- Retirement Topics - SIMPLE IRA Contribution Limits. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-simple-ira-contribution-limits.

- SEP Contribution Limits (including grandfathered SARSEPs). https://www.irs.gov/retirement-plans/plan-participant-employee/sep-contribution-limits-including-grandfathered-sarseps.