Asset Allocation Chart of the Month

Municipal Bonds: Tax-Efficient Income with a Strong Credit History

- With tax season top of mind, municipal bonds are worth a closer look. They have historically played an important role for investors seeking income, diversification, and potential tax advantages, particularly within investment-grade portfolios.

- The municipal market’s long term default experience has generally been very low for investment-grade issuers. For example, long run studies of U.S. municipal defaults show materially lower cumulative default rates than similarly rated corporate bonds across horizons and rating categories. A key reason municipals are often viewed as high quality is the structure of many issuers and revenue sources backing the issues (taxing authority, essential-service revenues, and oversight frameworks). That said, low default risk does not eliminate price volatility.

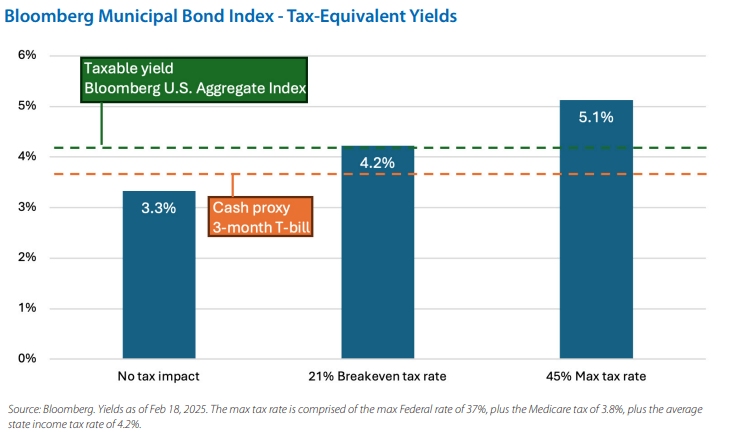

- Interest income from most municipal bonds is generally exempt from federal income and Medicare tax (and exempt from state taxes if the bonds held are issued in your home state). We believe it is helpful to compare municipals bonds to taxable bonds using tax-equivalent yield (TEY), the yield a taxable bond would need to offer to match a municipal’s after-tax income. Our chart of the month shows current municipal bond yields alongside TEYs, comparing them to the Bloomberg U.S. Aggregate (Agg) and adjusted for an estimate for the maximum tax rate.

- Although municipal yields have declined recently, the breakeven tax rate versus the Agg is likely to still capture many higher-income households, especially considering the broader tax picture.

- Municipals can also provide diversification. Their credit fundamentals (local economies, tax bases, and essential-service revenues) differ from corporations, so they don’t always move in lockstep with taxable bonds.

- While investment grade municipals have historically low default rates, there are risk considerations. The main risk is interest rate risk. Many tend to have longer stated maturities (20-30 years is common) which can make them more sensitive to changes in interest rates. Investors holding individual issues face liquidity risk as municipals tend to be less liquid in the secondary market. Lastly, call risk is often present. Many municipals can be redeemed early (e.g., after 10 years), which may require investors to reinvest at lower yields if rates have declined.

- We believe that municipal bonds can enhance an individual investor’s portfolio by providing tax-advantaged income, diversification, and potentially lower volatility within an investor’s portfolio.

The Touchstone Asset Allocation Committee

The Touchstone Asset Allocation Committee (TAAC) consisting of Crit Thomas, CFA, CAIA – Global Market Strategist, Erik M. Aarts, CIMA – Vice President and Senior Fixed Income Strategist, and Tim Paulin, CFA – Senior Vice President, Investment Research and Product Management, develops in-depth asset allocation guidance using established and evolving methodologies, inputs and analysis and communicates its methods, findings and guidance to stakeholders. TAAC uses different approaches in its development of Strategic Allocation and Tactical Allocation that are designed to add value for financial professionals and their clients. TAAC meets regularly to assess market conditions and conducts deep dive analyses on specific asset classes which are delivered via the Asset Allocation Summary document. Please contact your Touchstone representative or call 800.638.8194 for more information.

A Word About Risk

Fixed-income securities can experience reduced liquidity during certain market events, lose their value as interest rates rise and are subject to credit risk which is the risk of deterioration in the financial condition of an issuer and/ or general economic conditions that can cause the issuer to not make timely payments of principal and interest also causing the securities to decline in value and an investor can lose principal. When interest rates rise, the price of debt securities generally falls. Longer term securities are generally more volatile. Investment grade debt securities may be downgraded by a Nationally Recognized Statistical Rating Organization to below investment grade status. Non-investment grade debt securities are considered speculative with respect to the issuers' ability to make timely payments of interest and principal, may lack liquidity and has had more frequent and larger price changes than other debt securities. Equities are subject to market volatility and loss. Growth stocks may be more volatile than investing in other stocks and may underperform when value investing is in favor. Value stocks may not appreciate in value as anticipated or may experience a decline in value. Stocks of large-cap companies may be unable to respond quickly to new competitive challenges. Stocks of small- and mid-cap companies may be subject to more erratic market movements than stocks of larger, more established companies. Investments in foreign, and emerging market securities carry the associated risks of economic and political instability, market liquidity, currency volatility and accounting standards that differ from those of U.S. markets and may offer less protection to investors. The risks associated with investing in foreign markets are magnified in emerging markets, due to their smaller and less developed economies.

The information provided reflects the research and opinion of Touchstone Investments as of the date indicated, and is subject to change without prior notice. Past performance is not indicative of future results. There is no assurance any of the trends mentioned will continue or forecasts will occur. Investing in certain sectors may involve additional risks and may not be appropriate for all investors. The indexes mentioned are unmanaged statistical composites of stock or bond market performance. Investing in an index is not possible. For Index Definitions see: TouchstoneInvestments.com/insights/investment-terms-and-index-definitions

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Investment return and principal value of an investment in a Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. All investing involves risk.

Touchstone Funds are distributed by Touchstone Securities, LLC*

*A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group

Not FDIC Insured | No Bank Guarantee | May Lose Value