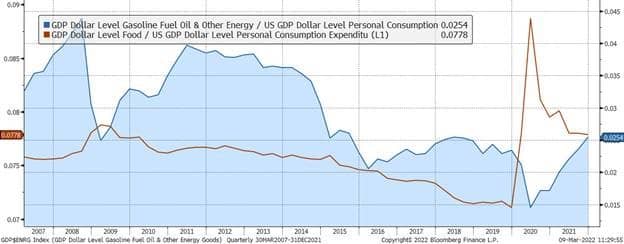

Food and energy prices are spiking and are likely to remain high assuming extended sanctions on Russia. What might that mean for inflation and spending on other items? Fuel spending as a percent of total is relatively small (2.5% as of 4Q21) and has been trending down over the last decade. This measure would certainly differ by income level. The decline in fuel spending is mainly due to incomes growing faster than fuel prices, as well as, more energy efficient vehicles. Rising fuel prices will impinge on consumers’ budgets, but is a relatively small portion of those budgets. Additionally it is important to consider the economic offset of energy production here in the U.S., which benefits from higher prices.

Food takes up a larger portion of consumers’ budgets, almost 8% as of 4Q21, and this only counts food-at-home spending. Still, this number greatly overstates the value of the agricultural input to this spending. Recently economist Ian Shepherdson shared a surprising perspective on how little grains contribute to food prices. At the time of his analysis, a 14oz box of Wheat Chex sold for $4.59. Wheat makes up 90% of the food content, but just 3.9% of the purchase price (just 18 cents). What? Most of the price is production, packaging, distribution, marketing, and profits collected from the manufacturer, distributer, wholesaler, and retailer. Therefore, if wheat prices were to double, the price of the Wheat Chex would rise by less than 4% (all else being equal). Alternatively, consider corn. For a 12oz bag of frozen corn purchased at $1.99, the cost of the corn is only about 10 cents. If corn were to double in price, it would raise the price of the bag of corn by just 5% (all being else equal).

The information provided represents Touchstone's views and observations regarding past and current market conditions and investor behaviors. The information and statements provided here are believed to be true and accurate. There can be no assurance however that the beliefs expressed herein will be consistent with future market conditions and investor behaviors.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy or a recommendation to buy, sell or hold any security. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194.

Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group

Not FDIC Insured I No Bank Guarantee I May Lose Value