Keep A-Knockin' (But You Can't Come In)

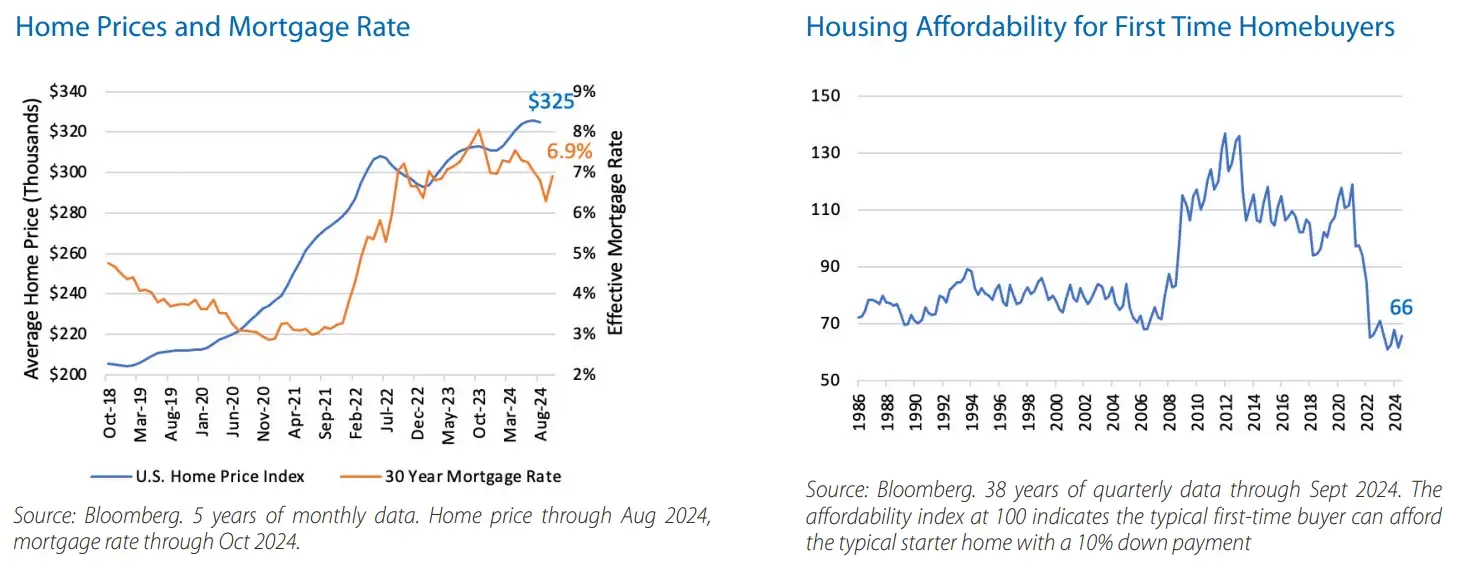

Without a recession, housing demand is likely to continue outpacing supply, keeping upward pressure on home prices. Mortgage rates are also expected to remain above 6%.

Given tight labor conditions and the absence of a financial crisis, we believe a recession is unlikely in the near future. While this is broadly good news, it leaves unresolved aspects to this economic cycle.

Without a recession, the Federal Reserve’s (Fed) goal is to normalize rates rather than cut them to a level that would stimulate the economy. This raises a critical question: where does the Fed stop cutting rates? What constitutes a “normal” funds rate for this cycle?

We believe this “normal” rate is likely to be much higher than the low rates maintained during the previous cycle. Here’s why:

- Economic Resilience: Despite one of the most aggressive rate-tightening campaigns in history, the economy remains robust. This suggests the economy can tolerate higher interest rates.

- Stronger Household Finances: U.S. households are in better financial shape. Debt as a percent of disposable income has significantly declined since the great financial crisis, and many homeowners have locked in low-rate mortgages.

- Policy Impact: The GOP’s election sweep and the incoming administration’s proposals could also put upward pressure on the landing spot for Fed Funds. Several policy proposals appear to be economically stimulative (deregulation, lower taxes), could create higher prices (tariffs), or higher wages (deportations).

Based on these factors, we estimate the Fed Funds rate will settle around 3.5%, which is above the Fed’s dot plot average of just under 3%. Even under the Fed’s more conservative forecast, it is difficult to see mortgage rates dropping much below 6%. Historically, under “normal” monetary policy conditions, mortgages have traded at a 3-5 percentage point premium to the Fed Funds rate. Another consideration is the Trump administration’s proposal to privatize Fannie Mae and Freddie Mac. Without the implied government backing, investors may require even more spread for mortgages issued by these agencies.

The housing market is in a tough spot. Homeowners who stay put benefit from rising home prices, but those looking to buy their first home or move to a larger home face an increasingly unaffordable market. With higher mortgage rates and home prices, many prospective buyers are priced out.

- According to the National Association of Realtors, only 24% of home sales in 2024 were to first-time buyers – a record low.

- The median age of first-time buyers has climbed to 38.

- Affordability and access to financing have declined. The Federal Reserve Bank of New York reports mortgage rejections have risen to 21%, the highest since 2013.

In past cycles, rising mortgage rates dampened housing demand and increased supply, exerting downward pressure on home prices. This cycle is different as home prices have risen with interest rates. The rise in mortgage rates has dampened demand, but supply has fallen even more.

In 2021 mortgage rates fell to all-time lows, below 3%. A large percentage of homeowners took advantage of those rates and refinanced. Then in two years time, mortgage rates surged to just over 8%. This combination of locked-in low rates and high current rates has created a significant incentive to stay put. While mortgage rates have come down there is still about a 3 percentage point difference between current mortgage rates and the effective rate of interest on outstanding mortgages.

Higher home prices would typically spur new home construction. However, this relief valve has not worked as expected. Higher rates have increased the borrowing costs for builders, and land availability for development remains limited. Deportations could further raise the cost of new home building (as undocumented workers represent a significant part of the construction labor force).

What could unlock the housing market? If higher mortgage rates shut the housing market down, it seems reasonable to expect lower rates are needed to bring housing back. While the economy’s resilience is a positive story, a recession may be necessary to bring rates down far enough to rebalance supply and demand in the housing market. Absent that, the market will need time to adjust gradually.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.

A registered broker-dealer and member FINRA/SIPC.

Touchstone is a member of Western & Southern Financial Group