- Small capitalization, or “small cap”, stocks represent the smallest 10% of the capitalization of the U.S. equity market, which includes companies with market caps to about $2 billion.

- Small cap stocks have generated attractive investment returns over the long term, but come with greater risks to consider.

- Less analyst coverage, low liquidity, capacity constraints, and volatility may account for the sources of greater potential return as well as risk. Thorough fundamental analysis may allow investors to uncover inefficiencies imbedded in small cap stocks, although information is not as readily available as with large cap stocks.

Small Cap Stocks Defined

Morningstar’s classification system divides equities into three capitalization categories – large cap, mid cap, and small cap. Large cap stocks represent stocks in the largest 70% of the U.S. equity market, and mid cap stocks represent the next 20%. The remaining 10% of the capitalization of the U.S. equity market are known as small cap stocks.

The small cap segment includes companies with market caps up to around $2 billion. While at the bottom 10% based on capitalization, the number of total companies that fall in this category is actually significantly larger than the total number of companies in the large cap and mid cap categories combined.

While it is inferred that small cap companies have market values that fall on the lower end of the spectrum of publicly traded companies, small cap companies can also be emerging growth companies, have significant share of niche markets, or niches in large but highly fragmented markets.

What Makes Small Caps Attractive?

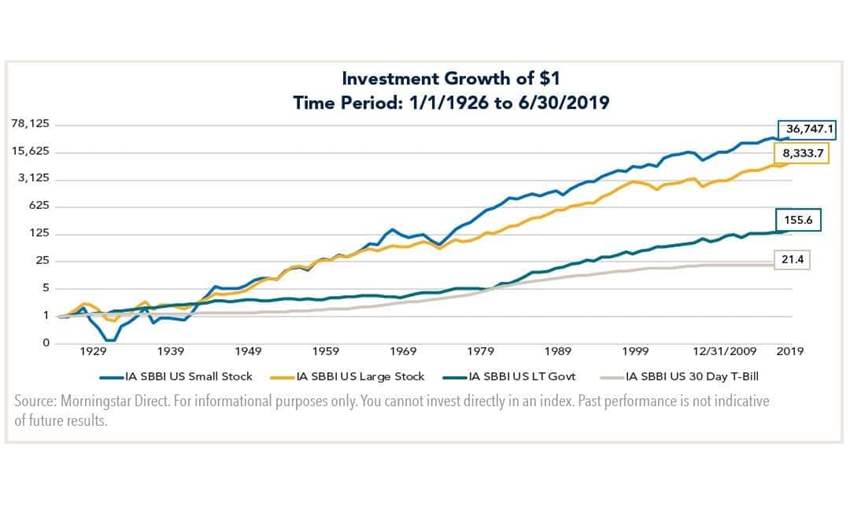

As can be observed in the chart below, small cap stocks have generated attractive investment returns relative to certain other asset classes and stock market capitalization segments over time.

| Cumulative Return | Annualized Return | |

|---|---|---|

| IA SBBI US Small Stock | 3,674,605.33% | 11.90% |

| IA US Large Stock | 833,267.17% | 10.14% |

| IA SBBI US LT Government | 15,455.83% | 5.55% |

| IA SBBI US 30 Day T-Bill | 2,041.79% | 3.33% |

Source: Ibbotson Associates data

What Are the Drivers of Small Cap Returns?

One, there is a lower than average number of analysts on the “sell-side” that write research reports on these companies compared to large cap companies. The average large cap stock is followed by over 20 analysts, while the average small cap stock typically has less than 10. In fact many small cap companies have zero research coverage due to the high volume of companies of this size.

A third efficiency factor that could make small cap stocks attractive investments is the volatility of their stock prices. Lower liquidity of small caps creates a supply and demand scenario that can cause large swings in share prices given sudden changes in sentiment. This presents significant opportunities for active managers to capitalize with their stock selection. Active portfolio management also presents the opportunity for diversification to minimize stock-specific volatility and risks.

Summary

- Recognize acquisition potential

- Identify and capitalize on inefficiencies

- Reduce the downside volatility

Fort Washington Investment Advisors, Inc. is the Sub-Advisor to the Touchstone Small Company Fund. The author, Jason V. Ronovech, CFA, is the portfolio manager of the Touchstone Small Company Fund. Touchstone Investments and Fort Washington Investment Advisors are members of Western & Southern Financial Group.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value