- We believe small cap stocks are an inefficient asset class that have the potential to generate attractive long-term returns.

- Capitalizing on the inefficiencies of the asset class requires the consistent application of a differentiated investment philosophy.

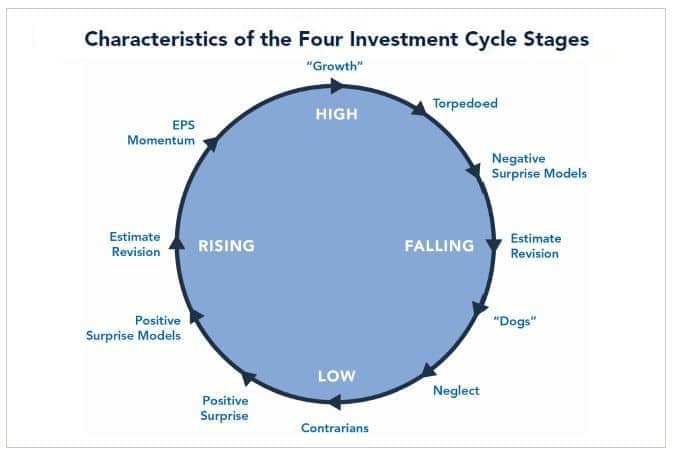

- Equities experience four investment cycle stages, and fundamental analysis should be tailored to each stage.

- Minimizing downside risk must be a priority to realize the full potential of an allocation to small cap stocks.

Exploiting Inefficiencies

We believe small cap stocks are an inefficient asset class and that the key to capitalizing upon these inefficiencies is through the application of a consistent, differentiated approach that focuses on minimizing downside risk.Inefficiencies in the asset class are generally due to a shorter-term focus on current business trends and industry conditions, which can create a disconnect with the long-term fundamental market valuation of the business. In particular, there generally is a significant disconnect when a business model has the potential to inflect to a higher rate of growth and profitability than the market expects. Moreover, this asset class has less analyst coverage, low liquidity, capacity constraints, and volatility.

The Touchstone Small Company Fund utilizes a differentiated approach designed to capitalize on these inefficiencies, which centers on evaluating and researching stocks in the context of four investment cycle stages. It seeks to capture the positive long-term returns of investing in small cap stocks while minimizing the volatility inherent in the asset class.

Our belief that equities experience a four stage investment cycle drives this research process, which focuses on the dynamics that apply to each stage.1 Analysis is tailored to each stage of this investment cycle, seeking to identify disconnects between current fundamentals, future expectations, and market valuations.

Breaking Down the 4 Stages: Research Focus

We define the first stage of the investment cycle as including companies where the market has low expectations. These stocks tend to be out of favor and have discounted valuations. The key to investing in “stage one” stocks is that while the majority of investors find the company unattractive with a backward looking view, our analysis develops conviction in the stability of the business model.

Once companies have exhibited stability in the business model, it is critical to identify whether they have the ability to improve the business model and move to the second stage of the investment cycle, characterized by rising expectations. Research here seeks to identify sustainable business model improvements to drive upside potential over their investment horizon.

Our objective is to initiate and add to positions in the first and second stage of the investment cycle, where we have conviction in the stability of the business model that will provide us downside risk mitigation and a thesis for why there will be a sustainable improvement in the business model leading to rising expectations (stage three). Conviction in the business model is generated by first conducting an industry stability assessment, both on the supply side competitive dynamics and demand side secular/cyclical growth trends. We believe that industry dynamics dictate the range of potential business model changes for a company. Therefore, the team must be confident industry conditions are stable.

The next step focuses on company analysis and includes financial statement analysis, as well as evaluation of management experience, strategy, and execution. This will involve a conference call or in-person meetings. Then, we combine our industry and company analysis to form our investment thesis, centered on four primary business model factors:

- Revenue growth

- Profit margin

- Free cash flow conversion

- Capital deployment expectations

Next, we apply relative and target valuations to our business model forecasts. The resulting list of investment candidates have the potential to generate long-term outperformance and move to the third stage of the investment cycle.

In the third stage, companies are operating near peak potential and have fundamentally high expectations. The vast majority of the market recognizes the positive attributes of these companies, which is reflected in a high valuation. The focus of our research for stage three companies is to monitor critical business model trends with a goal of maximizing returns while maintaining the discipline to respond to negative changes since there is limited downside protection from a valuation perspective. A corporate strategy change or deceleration in critical business model factor trends could result in a reevaluation of the investment thesis and a sale of the position.

In the fourth and final stage, companies are experiencing falling expectations and should be avoided. These falling market expectations could be caused by either broken growth stocks that missed high expectations or broken value stocks whose business models are deteriorating. When a company enters the fourth stage, the research focus is on determining if the business model changes are transitory or permanent, with a goal of minimizing capital losses.

Summary

The Touchstone Small Company team seeks to drive successful investment outcomes through a differentiated approach, evaluating stocks in the context of four investment cycle stages and executing a consistent research approach that identifies positive business model changes.

Glossary of Investment Terms and Index Definitions

Fort Washington Investment Advisors, Inc. is the Sub-Advisor to the Touchstone Small Company Fund. The author, Jason V. Ronovech, CFA, is the portfolio manager of the Touchstone Small Company Fund. Touchstone Investments and Fort Washington Investment Advisors are members of Western & Southern Financial Group.

This commentary is for informational purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security. There is no guarantee that the information is complete or timely. Past performance is no guarantee of future results. Investing in an index is not possible. Investing involves risk, including the possible loss of principal and fluctuation of value. Please visit touchstoneinvestments.com for performance information current to the most recent month-end.

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. To obtain a prospectus or a summary prospectus, contact your financial professional or download and/or request one on the resources section or call Touchstone at 800-638-8194. Please read the prospectus and/or summary prospectus carefully before investing.

Touchstone Funds are distributed by Touchstone Securities, Inc.*

*A registered broker-dealer and member FINRA/SIPC.

Not FDIC Insured | No Bank Guarantee | May Lose Value