Table of Contents

Key Takeaways

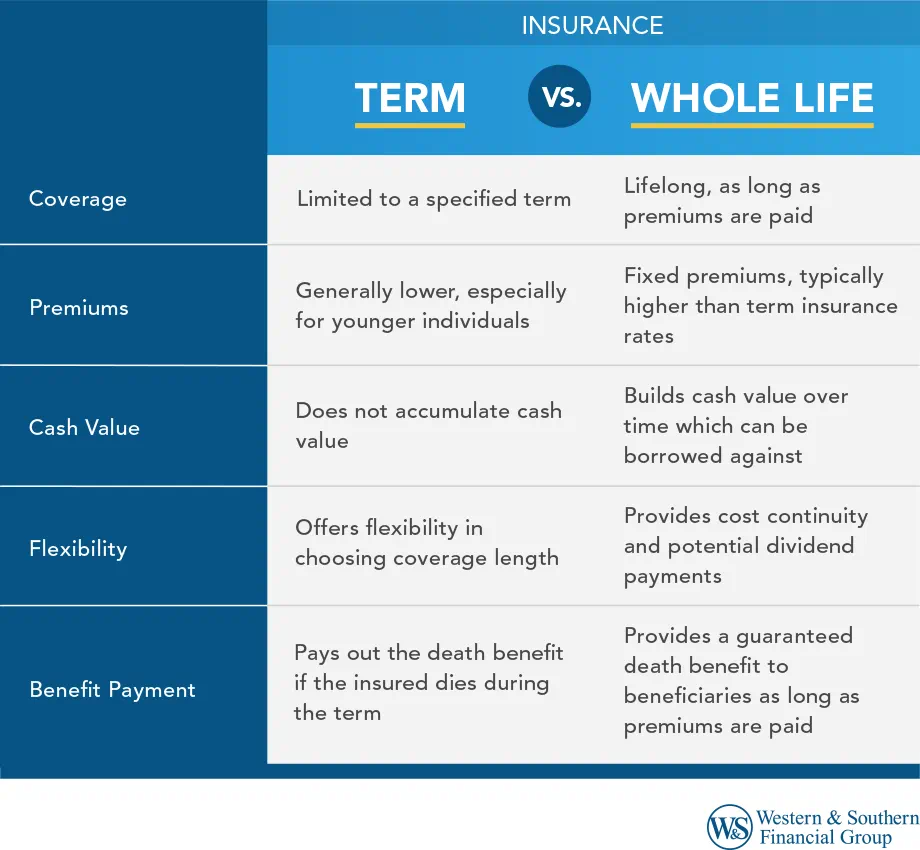

- Term life insurance covers you for a set amount of time, while whole life insurance covers you for as long as you pay your payments. Whole life insurance has a cash value that can be used to borrow or cash out.

- Term life insurance is cheaper and provides greater flexibility, while whole life insurance has set premiums and a guaranteed death benefit, making it a good choice for people who want to be covered for the rest of their lives.

- Cash value in a whole life insurance policy can be accessed through loans or withdrawals, but these can lower the death benefit and cash surrender value, and if not paid back, the insurance can be canceled.

Most people know that life insurance is a contract between an individual (the insurance policyholder) and the insurer. The life insurance company commits to paying a certain sum of money to the insured’s designated beneficiary upon the policyholder’s death.

While that seems pretty straightforward, there’s more to understanding life insurance and how it works. A good place to start is by understanding what term life insurance is, what whole life insurance is, and how the two types of policies differ.

This article covers the basics of how these two types of life insurance policies work so you can decide which is better suited for your situation.

What is Term Life Insurance?

Generally speaking, life insurance is a legal contract between an insurance company (the insurer) and the insurance policyholder (the insured). The insurer promises to pay a designated beneficiary a certain sum of money upon the insured’s death (as long as the insured pays the required premium).

Specifically, term life insurance is a type of life insurance that’s in effect for a stated amount of time or term. Under the contract, the benefit will only be paid out to the beneficiary if the insured dies when the policy is in effect.

Typically, term life insurance policies are written for terms covering 10, 15, 20, or 30 years.

What Happens to Term Life Insurance at the End of the Term?

People considering whether to purchase a term life insurance policy often wonder what happens when the policy term ends.

Simply stated, you no longer have death benefit coverage when the policy expires. You’ll receive a notice from the relevant carrier that your policy is no longer in force, and then you’ll simply stop paying the premiums on the policy. In addition, any corresponding coverage benefits, such as rider coverage, will also expire at the end of the term.

Any time you buy a term life insurance policy, you risk losing the money you paid in premiums. To avoid this outcome, policyholders will sometimes purchase a return-of-premium policy.

With this type of life insurance policy, you get your premiums back if you live beyond your term life insurance expiration date. You pay a higher price for this option, as the premiums for return-of-premium policies are typically higher than regular term life insurance premiums. For most people, this type of policy is cost-prohibitive. You can read more about this below.

If you want to maintain term life insurance after your current policy terminates, you have two choices: start over and buy a new policy or purchase a convertible term policy.

In some instances, you can even get your premiums back when your policy expires — and, if you want, apply them to a new policy. This option has the potential to cost more.

- Buy a new term policy. This might be a desirable option for a younger person who’s healthy and looking for a cost-effective way to maintain life insurance to protect their family for a certain period of time. People with school-age children often pick this option so their family is assured financial stability while the kids are in school or until they complete college. The catch is that the policyholder needs to undergo a medical evaluation and medical exam. Their rates could increase if they’ve developed any health issues since their last policy was underwritten. Alternatively, they can sign on to a shorter-term policy. This could result in premiums being the same or even lower than before, depending on their age when they sign up for the new policy.

- Buy a policy conversion rider before your current term policy expires. If your policy contains a term conversion rider, you’ll have the option of converting your term policy into a permanent insurance policy before the term ends. This can be a good option for individuals who want to continue coverage but don’t want to go through an application process that could require a medical exam. If your policy is within a year of expiration and you think this could be a good option, consider investigating the cost of adding a term conversion rider to the policy you already own. This is especially warranted if your health has declined since your last life insurance application.

What is Whole Life Insurance?

Whole life insurance differs from term life insurance in some significant ways. For starters, whole life is permanent life insurance.

This means the policy won’t expire after a certain amount of time. Instead, the policy will remain in force as long as you pay the premiums. When you die, your designated beneficiary will receive the policy benefit amount.

Along with no expiration date, another benefit of whole life insurance is that the premiums are fixed. Once you sign up for the policy and agree to a certain price, that premium price will never change (even based on age or health status).

Can You Cash out Whole Life Insurance?

One of the biggest benefits of a whole life insurance policy is its potential for cash value. A whole life policy can accumulate value as you pay premiums.

Depending on the terms of surrendering your policy, you can cash it out and receive its full value (usually some portion of the premiums you paid plus interest). Some fees might be involved in the cash out, which will reduce the amount you receive.

Of course, you’ll be canceling the guaranteed death benefits your beneficiaries would have received if you surrender your whole life insurance policy. You’ll also lose any annual dividend payments that your policy may have issued.

If you need access to cash from your life insurance policy but want the policy to remain in force, you can take out a policy loan or withdrawal. You’ll need to pay back any loan you take out, while a withdrawal — which doesn’t have to be paid back — will reduce the eventual payout to your beneficiaries. It’s important to note that loans of this type accrue interest and may generate an income tax liability. Additionally, loans and withdrawals will reduce the death benefit and cash surrender value of the policy. Failure to repay such a loan or withdrawal may cause your policy to lapse.

While you can seek whole life insurance at any time, insurers like Western & Southern offer whole life insurance plans that are attractive to younger people looking to lock in low premiums for a lifetime.

What’s the Difference Between Term Life vs. Whole Life Insurance?

Since both term and whole life insurance provide a death benefit to the policyholder’s designated policy beneficiaries it can be difficult to distinguish between the two types of policies.

As a rule, whole life insurance generally has higher premiums than term life insurance policies. Other differences must be taken into account when choosing a policy, as well. The following outlines the key benefits of each type of policy and highlights their key differences.

The key benefits of term life insurance are:

- Affordability. Term life insurance costs are usually lower than whole life insurance rates.

- Flexibility. Since term life insurance is for a set period of time, you get to determine your length of coverage (10, 15, 20, 25, or 30 years). Shorter-term policies can be purchased to cover shorter-term debts, while a 20-year term policy could cover family expenses that will see your kids through college.

- Simplicity. Term life insurance is generally straightforward and fairly simple. You decide which insurer to go with, the amount of coverage you need, and how long you need it.

With whole life insurance coverage, you can tap into the following key benefits:

- Cost continuity. Your whole life insurance premium payments will never go up, even as you age, if you get sick, or if you engage in risky activities. You lock in your rate and that is it for your entire life.

- Cash value component. Your whole life policy’s cash value grows on a tax-deferred basis. Under certain conditions, you can borrow against the policy or cash in some of its value without losing coverage. Some policies even pay monthly dividends.

- Guaranteed death benefit. Whole life insurance provides a guaranteed death benefit to designated beneficiaries so long as premiums are paid.

Is Term Life or Whole Life Insurance Better?

The decision about whether to go with a term life policy for a certain number of years or a whole life insurance policy that provides permanent coverage will depend on your life stage, your budget, your financial goals, and how and when you want to provide financial protection for your intended beneficiaries. Young people often choose a whole life policy to lock in a low premium rate and build cash value over time.

Later in life, they can leverage that cash value to borrow money to meet financial needs like paying off a mortgage, taking care of medical expenses, caring for elderly parents, or providing a safety net for potential financial issues.

Seniors getting ready for retirement might also find a whole life policy attractive as an estate planning tool. They might opt for a lower benefit so their premium is lower but they still get an adequate coverage amount to ensure their final expenses will be taken care of after their passing.

If you only need coverage for a specific period of time — maybe you want to make sure your child’s college tuition is covered in the event of your death — you can purchase a policy to last long enough to see them through graduation. You can take advantage of the lower rates that come with term coverage.

Term length policies are also a great alternative for people who want the peace of mind of knowing that their loved ones are looked after without the extensive health screenings often required to obtain a whole life policy at lower whole life premiums.

The Bottom Line

Determining the best term life or whole life insurance product for you and your family depends on your unique goals and circumstances. Western & Southern has experts on hand to help you find the right type of coverage to meet your particular needs.

Frequently Asked Questions

What are the benefits of term life insurance?

Simplicity, affordability and flexibility are the three main benefits of term life insurance. However, buying the right policy depends on your personal situation, so understanding the different types of term life insurance and their specific features and benefits can help you decide what best meets your needs. Explore the benefits of term life insurance and learn about what distinguishes level term, decreasing term and renewable/convertible term from each other.

What are the benefits of whole life insurance?

Some of the key benefits of whole life insurance include the ability to build cash value, guaranteed fixed premiums that don’t increase, potential dividend payments and various tax advantages. Figuring out if a whole life insurance policy is the right choice for you depends on your life stage, the purpose of the policy, your current amount of life insurance coverage and whether you want to supplement an existing policy. A thorough understanding of the benefits of whole life insurance can help you plan effectively for your family’s financial future.

What is permanent life insurance?

Permanent life insurance provides coverage for your entire lifetime, as long as you continue to pay your premiums. The most common types of permanent life insurance are whole life, universal life, variable life and variable universal life. Learn more about the key features of permanent life insurance, including the different types and how they work, the advantages and disadvantages of permanent life insurance and cost information.