- During the first half of this year, the U.S. bond market turned volatile while the stock market entered a new bull phase even as the Federal Reserve signaled it would resume raising interest rates.

- The economy has been resilient to rate hikes thus far, but it is not out of the woods. Manufacturing and housing are weak, and there are some signs that consumer spending could soften.

- Headline inflation has fallen noticeably as commodity prices have weakened and supply chain disruptions have eased. However, the core rate that the Fed is focused on is well above its 2% target, and it is committed to keep rates higher for longer.

- Recession risk remains elevated and is not fully appreciated by financial markets following the strong performance of risk assets during the first half of the year. As such, we are maintaining a cautious stance within investment portfolios.

Market Backdrop: Bond Yields Gyrate While Stocks Turn Bullish

The first half of this year was full of surprises. It began with a stronger-than-expected performance for the economy and job market that caused bond yields to surge initially. Yields subsequently fell back in early April when several regional banks encountered problems that caused investors to worry about a possible credit squeeze. By midyear, however, yields had risen again as the economy proved resilient to Fed rate hikes.

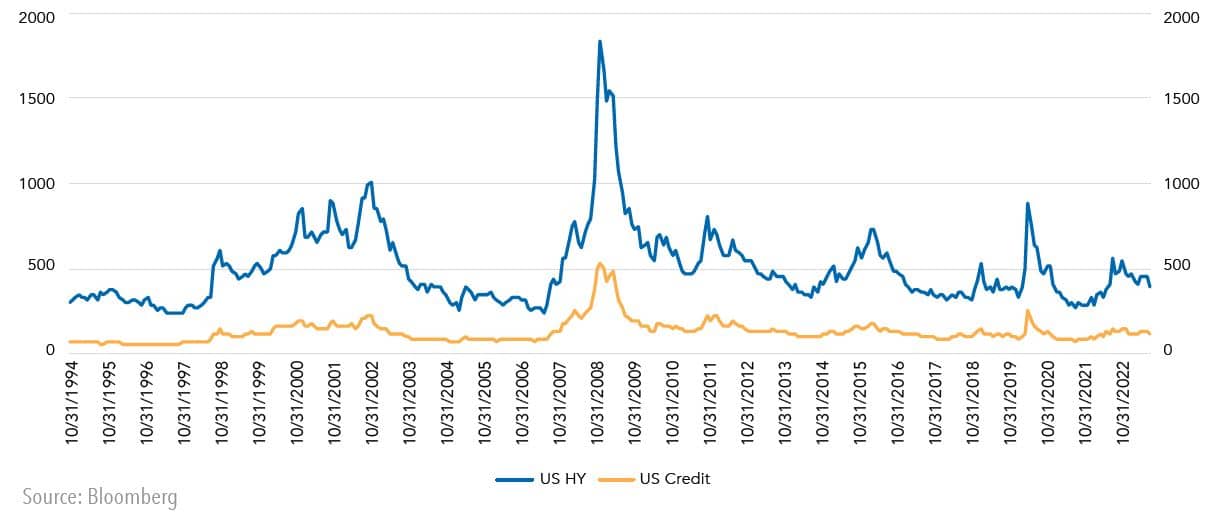

The end result is that the Treasury yield curve is now inverted by more than 100 basis points: The 2-year yield finished the second quarter at 4.88%, while the 10-year treasury yield closed at 3.82%, roughly where it began this year. Many observers view it as a recessionary signal. However, spreads between corporate bond yields and treasury yields remain relatively low both for investment grade and below investment grade bonds (see Figure 1.) The message from the bond market, therefore, is mixed.

Figure 1. Credit Spreads for Corporate Bonds versus Treasuries

Meanwhile, the S&P 500 Index, which had fluctuated in a broad trading range since mid-2022, broke decidedly to the upside in the second quarter, reaching its highest level since April 2022. The index has now entered a new bull phase in which it has advanced by more than 20% from its October low and by 16% this year (see Figure 2). The rally has been powered by a narrow group of tech stocks that are perceived to be beneficiaries of the take-off in artificial intelligence (AI). Excluding these names, the remainder of the index is up by about 6% this year.

Figure 2. Investment Returns by Asset Class, 2002 to Q12023

| STOCK MARKET | 1st Quarter | 2nd Quarter | First Half 2023 |

|---|---|---|---|

| U.S. (S&P 500) | 7.5 | 8.7 | 16.9 |

| NASDAQ | 17.0 | 13.1 | 32.3 |

| Russell 2000 | 2.7 | 5.2 | 8.1 |

| International (EAFE $) | 8.7 | 3.2 | 12.2 |

| Emerging Markets (MSCI $) | 4.0 | 1.0 | 5.0 |

| U.S. BOND MARKET | 1st Quarter | 2nd Quarter | First Half 2023 |

|---|---|---|---|

| US Aggregate Bond | 3.0 | -0.8 | 2.1 |

| Treasuries | 3.0 | -1.4 | 1.6 |

| IG Credit | 3.5 | -0.3 | 3.1 |

| High Yield | 3.6 | 1.7 | 5.4 |

| JPM EM Debt | 1.9 | 2.2 | 4.1 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

Consumers Bolster the Economy

One reason is that the economy is inherently more interest-rate resilient than many observers appreciate. The main areas that have shown weakness include the manufacturing sector, where purchasing manager indexes have fallen below the 50% threshold, and residential housing, where higher mortgage rates and home prices have made houses unaffordable for many Americans.

The most important component of spending, however, is personal consumption, which accounts for 70% of overall demand. Apart from autos and other durable goods, most items people consume are not highly sensitive to interest rates. Rather, overall spending mainly depends on personal income growth that is impacted by the strength of the job market and wages.

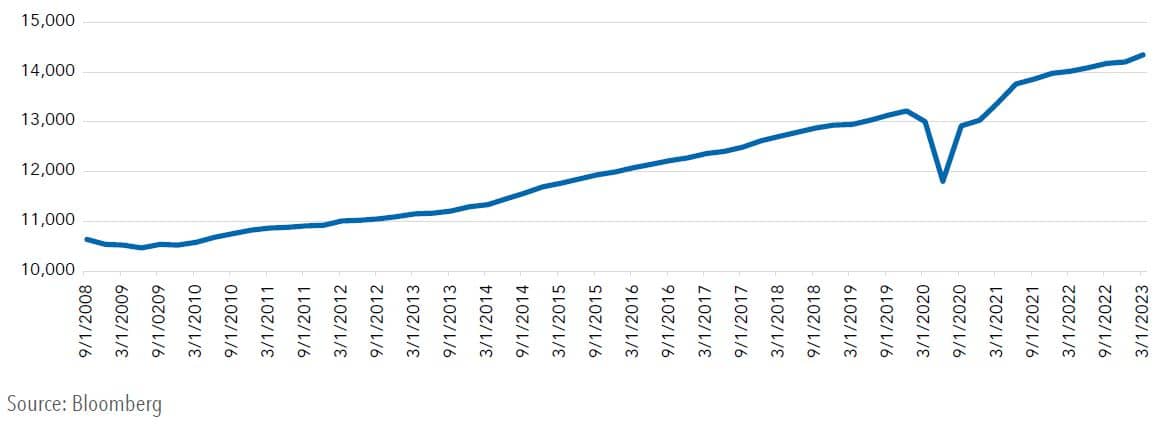

As shown in Figure 3, consumer spending plummeted when the COVID-19 pandemic struck in early 2020. However, it has now fully recovered thanks to massive government transfer payments that allowed households to add to their savings. One reason that recession cannot be ruled out is that spending softened in the second quarter, while the personal saving rate declined to its lowest level in two decades after spiking in 2020 and 2021. Looking ahead, therefore, consumer spending will become even more reliant on the strength of the job market.

Figure 3.U.S. Personal Consumption

The Fed Sends a Clear Message

Another reason for the economy’s resilience is that interest rates have not been unduly restrictive. When measured against core inflation, for example, rates are close to zero. Moreover, even if core inflation were to fall to 4% or so later this year, interest rates would not be unusually high in real terms.

Against this backdrop, the Fed has sent investors a clear message that it intends to keep interest rates higher for longer in order to bring inflation down to its 2% average annual target. While it paused at the June FOMC meeting, Fed officials have indicated that they foresee making two additional hikes of 25 basis points each in the second half of this year. If so, it would imply a terminal funds rate of 5.5%-5.75%. Thereafter, the Fed has indicated that it is prepared to keep rates high into next year. In fact, Chair Jerome Powell recently stated that it could take until 2025 for core inflation to reach the Fed’s stated target.

Bond market participants are heeding this message, but equity investors surprisingly are defying one of the oldest Wall Street maxims – “Don’t Fight the Fed.” The bull rally suggests they believe inflation will come down more quickly than the Fed thinks. If so, it would enable the Fed to ease policy sooner and increase the odds of a “soft landing.”

The main risk for the stock market is that it would be vulnerable if core inflation stays elevated. That said, the risk of stagflation — in which slow growth is accompanied by high inflation — has lessened as commodity prices have fallen and supply chain bottlenecks linked to the COVID-19 pandemic have eased. Therefore, if a mild recession were to ensue, bond yields would likely decline and offer investors some downside protection.

One risk that has lessened is the nation’s largest banks passed the Federal Reserve’s stress tests, which confirms the banking system is sound despite runs that led to the failure of Silicon Valley Bank, Signature Bank, and First Republic Bank. The Fed’s report, however, did show some weakness among mid-size banks and super-regional banks, which will require ongoing monitoring.

Positioning Investment Portfolios

We believe the risk of a recession remains elevated, even as recent economic data has exceeded expectations. The lagged effects of Fed tightening, and more restrictive bank lending standards, are important downside risks over the next several months. Despite more restrictive financial conditions and elevated inflation, the resilience of the labor market has supported consumer spending thus far. If continued, an economic downturn is likely to be relatively shallow compared to past recessions. Financial markets have performed well in recent months, resulting in valuations that aren’t fully reflecting increased economic risks. As such, we are maintaining a cautious stance within investment portfolios.

In balanced portfolios, we favor a neutral allocation to equities relative to fixed income. Equity markets have adjusted higher to reflect more resilient economic growth. Amid still elevated economic risks and uncertainty, we believe the risk/reward is balanced. Should further weakness materialize, portfolios are positioned to prudently increase exposure if warranted.

In our fixed income portfolios, we are positioning portfolios with a modest overweight to credit sectors, focusing on investment grade corporate bonds, emerging markets debt, and securitized products (CMBS, ABS, and MBS). If the economy slows more than expected, credit spreads are likely to widen from current levels. However, if a soft landing is achieved or a recession is shallow, credit spreads would likely narrow somewhat. Weighing these scenarios, we believe the risk/reward in credit spreads supports a modest overweight to risk in portfolios. With regard to interest rates, we are positioning portfolios with a slight long duration bias. We believe that the growth and inflation outlook will continue to bias interest rates lower over the next several months.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations have adjusted to more normalized levels and earnings expectations have fallen, but continued slowing in economic growth will weigh on both valuations and earnings. We are prioritizing high barrier to entry companies with high returns on capital and maintaining a defensive posture within portfolios.

Past performance is not indicative of future results. This publication contains the current opinions of the author but not necessarily those of Fort Washington Investment Advisors, Inc. Such opinions are subject to change without notice. This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable and are accurate to the best of our knowledge. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc.

© 2023 Fort Washington Investment Advisors, Inc.