- A confluence of factors has increased the risk of a global downturn in 2023.

- The main threat to the U.S. economy is the Fed could raise interest rates beyond what is priced into markets.

- Higher energy costs tied to Russia’s invasion of Ukraine poses a threat to the EU, which is on the cusp of recession.

- China’s economy no longer is a growth engine: The property sector is unravelling, and strict COVID policies are hampering production.

- Amid these developments, global markets are likely to stay volatile amid unusually high uncertainty.

The Fed's Aggressive Policy Tightening Disappoints Investors

Following a steep sell-off in financial markets in the first half of this year, U.S. markets rallied in July and into August. The catalysts were declines in prices of oil and other commodities that raised investors’ hopes that inflation had peaked and the Federal Reserve would slow the pace of monetary tightening.

At the Jackson Hole meeting in late August, however, Fed Chair Jerome Powell disappointed investors when he emphasized that inflation was too high and the Fed’s top priority was to bring it down to its 2 percent target. He acknowledged that this will likely require a sustained period of below-trend growth and a softening in labor market conditions.

Following a worse-than-expected inflation report for August, the Fed subsequently raised the funds rate by 75 basis points for the third consecutive FOMC meeting to 3.0%-3.25%. The latest plots by Fed officials show the funds rate reaching 4.6% by early next year and then plateauing. This would imply it could be raised by 75 basis points and 50 basis points, respectively, at the next two FOMC meetings followed by a quarter point hike in early 2023.

Amid these developments, Treasury bond yields set new highs for this year and became inverted between two-year and long-dated instruments (Figure 1). At the same time, spreads between corporate bonds and Treasuries widened further. As a result, returns on U.S. bonds measured by the Barclays Aggregate Index were negative for the quarter (Figure 2).

| STOCK MARKET | Dec. 31, 2021 - Jun. 30, 2022 | Jun. 30, 2022 - Sept. 30, 2022 | Dec. 31, 2021 - Sept. 30, 2022 |

|---|---|---|---|

| U.S. (S&P 500) | -20.0 | -4.9 | -23.9 |

| NASDAQ | -29.2 | -3.9 | -32.0 |

| Russell 2000 | -23.4 | -2.2 | -25.1 |

| International (EAFE $) | -19.2 | -9.3 | -26.7 |

| Emerging Markets (MSCI $) | -17.5 | -11.5 | -27.0 |

| U.S. BOND MARKET | Dec. 31, 2021 - Jun. 30, 2022 | Jun. 30, 2022 - Sept. 30, 2022 | DEC. 31, 2021 - SEPT. 30, 2022 |

|---|---|---|---|

| Bloomberg U.S. Aggregate | -10.4 | -4.8 | -14.6 |

| Treasuries | -9.1 | -4.3 | -13.1 |

| IG Credit | -13.8 | -4.9 | -18.1 |

| High Yield | -14.2 | -0.6 | -14.7 |

| JPM EM Debt | -20.3 | -4.6 | -24.0 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

At the same time, the summer rally in stocks has reversed, and the U.S. stock market is back into bear territory. The best performing asset has been the U.S. dollar, which has appreciated by 16% against the major currencies this year and is at more than a two-decade highs against the euro and the Japanese yen.

Will the U.S. Experience a Hard Landing?

The Fed’s updated economic projections in September suggest that it is a close call. The forecasts call for flat growth of 0.2% this year and 1.2% next year. In that event, the debate about whether there is a “technical recession”—two consecutive quarters of negative growth—is likely to persist. However, the more important issue for policymakers is how high the unemployment rate needs to rise to bring inflation under control.

On that score, Fed officials appear upbeat that unemployment needs to rise only marginally higher. For example, the latest FOMC projections call for the unemployment rate to reach a peak of 4.4% next year and into 2024, while its preferred measure of inflation the Personal Consumption Expenditure (PCE) deflator falls from 5.4% this year to 2.8% next year and 2.3% in 2024.

This outcome, however, seems very optimistic for many observers. For example, former Treasury Secretary Lawrence Summers, who made the correct call about U.S. inflation more than a year ago, believes the unemployment rate would need to reach 6.5% for wage pressures and inflation to subside to the Fed’s 2% target.

The outcome will have an important bearing on financial markets. If a mild recession were to ensue, the stock market would anticipate a quick recovery, whereas if it were deep and prolonged the market sell-off would be protracted.

Our view is that if a U.S. recession were to materialize, it is likely to be less severe than the 2008 Global Financial Crisis for two reasons. First, there are no major sectoral imbalances and the financial sector is less exposed to the housing market and better capitalized today.

It is also likely to be less impactful than the first two oil shocks because the U.S. is energy self-sufficient today, and oil prices have declined significantly from their peak earlier this year. Furthermore, inflation expectations are not as deeply embedded as they were in the 1970s and early 1980s.

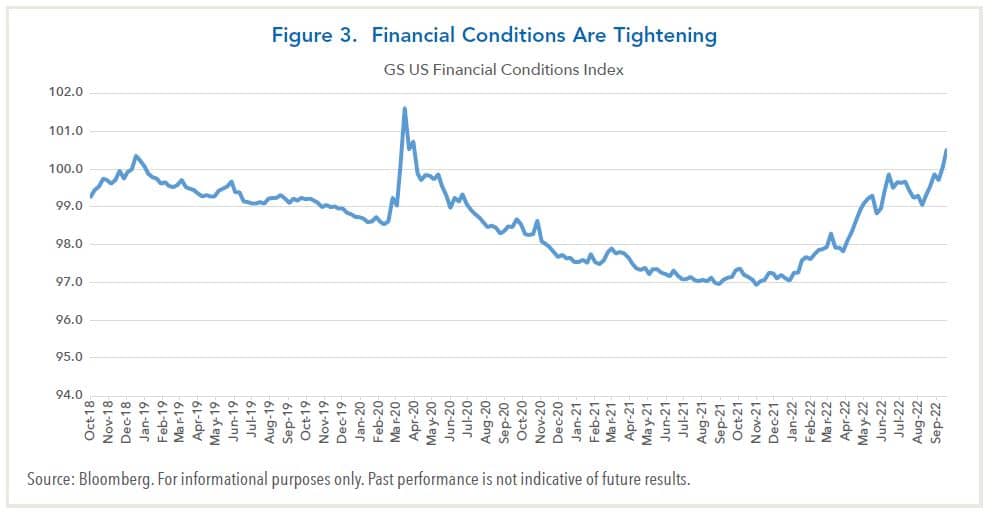

In the end, we believe that interest rates need to become positive in real terms to curb inflation. The risk is that they may need to reach 5%-6% to do so. In that event, financial conditions may tighten further as asset prices soften and the dollar strengthens (Figure 3.)

Europe is on the Cusp of Recession

By comparison, economic conditions in Europe are more daunting mainly because it is heavily dependent on Russia for natural gas and is currently experiencing a squeeze in supplies from Russia.

European policymakers are scrambling to lessen the burden consumers will face if the squeeze is maintained through the winter. The most urgent need is to curb price increases for electricity and heating fuel. Manufacturers are furloughing workers and shutting down production and face spikes in energy bills when contracts expire in October. Meanwhile, the Eurozone Manufacturing Purchasing Managers’ Index declined in September for the third consecutive month to the lowest level since June 2020.

The European Commission recently outlined a plan to redistribute $140 billion of windfall profits from energy companies to consumers and businesses to soften the blow. The plan calls for a cap of 180 euro per megawatt hour on revenue earned by lower-cost non-gas producers of electricity. It would also require coordination with EU member governments that are implementing their own plans; consequently, it is unclear how effective these measures will be.

Further exacerbating the situation is a spike in consumer price inflation in the Eurozone to 9%. The European Central Bank (ECB) has responded by ending its decade-long policy of negative interest rates. The ECB has boosted rates by a total of 75 basis points at the last two policy meetings and is poised to raise rates further.

Isabel Schnable, a member of the Executive Board of the ECB, has spelled out the reasons for tightening policy even as a recession unfolds. She argues that central banks face a choice of proceeding with caution or of determination by moving forcefully even at the risk of lower growth and higher unemployment. She favors the latter approach as essential to maintain investor confidence in monetary policy and contends that failure to do so would result in a worse outcome.

Faced with these uncertainties, it is too early to assess the severity of a European recession. The optimistic view is the worst will be over by next spring when the impact of the supply shortages should abate. However, it is impossible to predict the outcome of Russia’s invasion of Ukraine.

China: No Longer a Locomotive

Meanwhile, China’s economy is being buffeted by problems in its property sector over the past year since Evergrande, the country’s property developer, was unable to service its debt obligations. They have been exacerbated by the government’s zero tolerance policy toward COVID, in which parts of the country have been shuttered in response to outbreaks. Economic growth was barely positive in the second quarter of this year, and several overseas securities have cut their forecasts of economic growth this year to 3% or less.

Meanwhile, problems are beginning to spill over to China’s banks, which are being squeezed on two fronts. The asset side of their balance sheets are under pressure from bad loans to developers, and loans that are property-related account for about 30% of all bank loans. The liability side of some smaller banks has been impacted by runs from their depositors.

The Chinese authorities have responded by lowering interest rates to make mortgage payments more affordable. They are also trying to shore up property developers by providing financial relief. The State Council recently passed a plan to establish a fund worth up to 300 billion yuan ($44 billion) to support multiple property groups. However, these measures appear insufficient to stem the problem.

The outcome, however, ultimately hinges on how Chinese households respond if property values continue to decline. The main risk is that China would confront a loss of confidence by households at a time when business confidence is shaky due to the government’s clampdown on technology companies and other private businesses. This combination could result in a growth recession if not outright recession.

Given the prominence of China’s economy in the global economy and international trade, a weakening would have spill-over effects to its main trading partners in Asia, Europe, and North America. According to calculations by JPMorgan Asset Management, China’s strong showing in the decade following the 2008-09 Global Financial Crisis accounted for roughly 30% of world economic growth.

Accordingly, if China’s economic locomotive were to stall now it would likely reverberate throughout global markets. Emerging economies that borrow in U.S. dollars would be particularly vulnerable if Fed rate hikes boosted the dollar further against their currencies.

Investment Implications

Weighing these considerations, we believe the risks of a global recession have increased next year, with Europe decidedly in recession while the two largest economies—the U.S. and China—experience little or no growth. That said, valuations appear to be pricing in an increased risk of recession.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. While acknowledging downside risks remain, equity valuations have adjusted to reflect increased economic risks and uncertainty, making the risk/reward compelling. Should further weakness materialize, portfolios are positioned to prudently increase exposure if warranted.

In our fixed income portfolios, we are positioning portfolios with an overweight to credit sectors, focusing on investment grade corporate bonds, emerging markets debt, and high-quality securitized products (CMBS, ABS, CLO, MBS). If the economy slows more or faster than expected, credit spreads are likely to widen further. However, if a soft landing is achieved or a recession is shallow, the current level of spreads is attractive. Weighing these scenarios, we believe the risk/reward in credit spreads is compelling and supports a modest overweight to risk in portfolios. With regard to interest rates, we are positioning portfolios with a slight long duration bias, focused in the intermediate part of the curve. We believe the current level of rates reflects an appropriate amount of Fed tightening, and that the growth and inflation outlook will bias interest rates lower over the next several months.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities while reducing outperforming defensive names where valuations have become stretched. Earnings expectations remain stubbornly high and are at risk to fall amid slowing economic growth. Despite most equity indices ending the quarter in a bear market, downside still remains should equity earnings deteriorate.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Past performance is not indicative of future results.