Balancing Risk & Reward Through Cash Segmentation

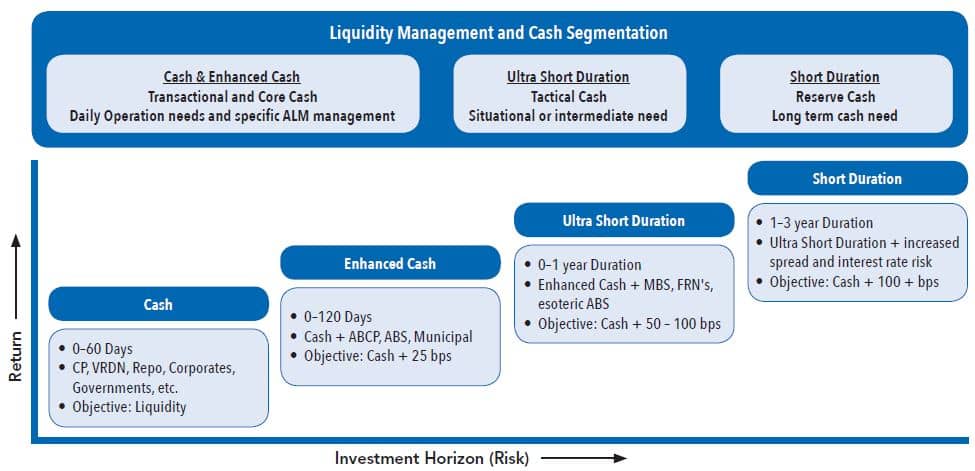

Since the implementation of money market reform on October 14, 2016, not only has the market seen a shift in the makeup of money market assets, investors are exploring new products across the money market spectrum and beyond. Although the fundamentals of cash management have not changed, the landscape has changed dramatically. By having a thorough understanding of your liquidity needs, as well as the different styles of investing within cash segments, investors can navigate amongst the various product offerings to find that optimal risk/return balance.

- Investment Horizon/Objective – Knowledge of the different cash buckets: Transactional and Core Cash, Tactical Cash, and Reserve Cash.

- Liquidity/Maturity – Understanding the liquidity/maturity parameters appropriate for each cash bucket or product subject to your specific cash flow and liquidity needs.

- Credit/Structure – Knowing the "true risk" of the product and the underlying securities in which you are invested.

Updating Your Cash Investment Policy Statement

From regulatory changes to an array of multidimensional cash investment vehicles, investors are confronted with a multitude of new risks to manage. In this new cash era, investors not only need to adapt, but incorporate these market changes in their cash investment policy statement (IPS). By updating and maintaining your cash IPS, investors can identify parameters for both risk tolerance and liquidity to ensure preservation of capital. The following are just a few of the many factors that should be reviewed when updating your cash IPS.

- What new regulatory changes conflict with my current IPS, covenants, or bond indentures?

- How are cash balances viewed and what are the return and other investment objectives (i.e. cash segmenting)?

- What is my risk tolerance (credit, interest rate, liquidity, spread, and diversification) and liquidity need?

- What cash vehicle(s) will I choose and will the product be managed internally or externally?

What Is Your Optimal Liquidity Solution?

As with any type of investing, each investor's needs and objectives are unique. A prudent investor keeps current with the regulatory environment and understands all investment objectives, as well as options. By having a thorough understanding of your liquidity need and properly segmenting your cash, you can add a significant amount of value to your organization.

About Fort Washington Institutional Fixed Income

- Supported by team of 30+ investment professionals

- Ultra Short Duration strategy 4 star rating by Morningstar + ranked top quartile for 1 & 3 year periods1

- Cash Management team awarded “Best Money Fund of the Decade”2

1 Morningstar. Fort Washington serves as sub-advisor to its affiliate’s funds. There is no guarantee that investing will result in similar results; investing involves risks, including the potential loss of principal.

2 Source: Crane’s Money Fund Intelligence, Best Money Funds of the Decade, January 2015. Ranking based on performance of prior 10-years of affiliate money market fund advised by Fort Washington until its liquidation. This is for informational purposes only and is not investment advice.