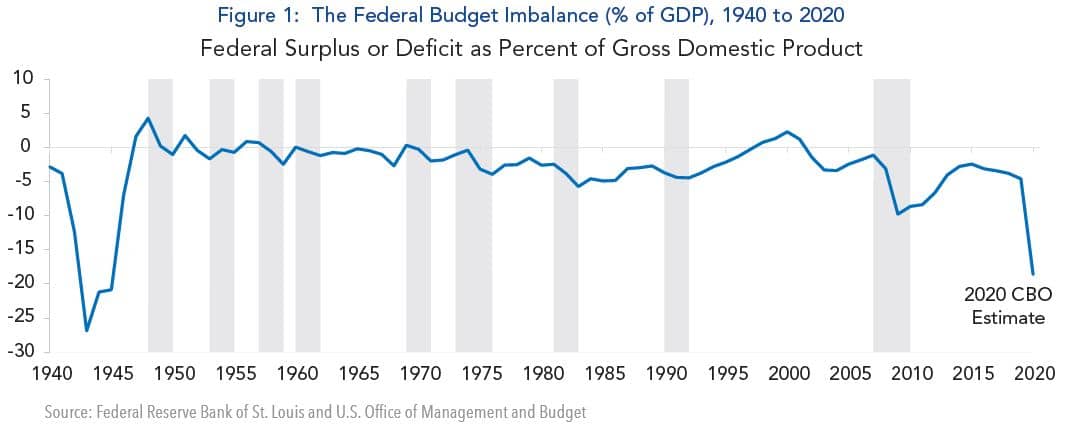

- According to the Congressional Budget Office (CBO), the federal budget deficit could reach $3.7 trillion this year, or 18% of GDP, as a result of the coronavirus pandemic.1 This is the highest ratio in the postwar era and the final tally is likely to be even larger.

- Unlike the Global Financial Crisis (GFC), there has been no public outcry, the mantra being the government should do “whatever it takes” to support the economy. However, the next phase of legislation is expected to be more partisan.

- Because inflation is not a threat and other countries are in similar straits, the risks of Treasury yields spiking or the U.S. dollar plummeting are low in the near term. Nor is there reason for concern that business investment will be “crowded out.”

- The prognosis for the long term is more problematic, because the federal debt burden will stay high throughout this decade. As the economy recovers from the pandemic, interest rate pressures may surface and taxpayers at some point will have to foot the bill of enlarged government spending.

Federal Budget Deficit to Reach Post War Highs

One question on investors’ minds is how costly the coronavirus pandemic will be for the federal government. Expenditures for programs enacted thus far total $2.7 trillion dollars, and CBO’s latest projections call for the budget deficit in fiscal 2020 to reach $3.7 trillion, or 18% of GDP. This is the highest ratio in the postwar era and nearly double that during the GFC in 2009 (Figure 1).

While federal spending of this magnitude is unprecedented, there has been little acrimony thus far. This contrasts with what happened in 2008-2009, when the Tea Party movement was launched. The primary reason is politicians on both sides of the aisle recognize the pandemic is a natural disaster that will inflict considerable economic and human damage, for which no one is at fault. Indeed, until recently the mantra has been the government must do “whatever it takes” to lessen pain and suffering.

However, the next round of relief legislation, called “Phase IV”, is expected to encounter greater resistance. Democrats worry the effects of the pandemic will linger, and they wish to expand the social safety net, obtain funding for COVID-19 testing and monitoring, and bolster state and local finances. By comparison, Republicans prefer to wait and see what impact existing programs will have on the economy. If unemployment compensation needs to be extended, their preference is to eliminate the added $600 weekly benefit in the CARES Act because it creates incentives for workers to stay unemployed, at least temporarily.

The pending legislation will also consider the role the federal government should play in assisting the states in meeting urgent fiscal obligations. Republicans do not want to let states with poor finances off the hook, and Mitch McConnell, the Senate Majority Leader, has gone so far as to suggest some should consider filing for bankruptcy. However, this extreme outcome is unlikely: State and local jobs account for 13% of total nonfarm payrolls, and a heavy round of job losses would boost overall unemployment that is expected to approach 20%.

Amid this, there is considerable uncertainty about what shape the Phase IV bill will take. What is clear is that, whatever the outcome, the federal government’s final bill for fighting coronavirus will be larger than the latest CBO projections.

Ameliorating Factors

Thus far, investors have taken the news about the budget deficit in stride, because several factors lessen the risk of a spike in U.S. Treasury yields or a U.S. dollar crisis. The principal consideration is the low likelihood that it will lead to a surge in inflation, because the coronavirus shock has had a deflationary impact on the economy. The Federal Reserve has responded by lowering the federal funds rate to zero and expanding the array of programs it launched during the GFC to bolster financial markets and the banking system. At that time, some observers warned the expansion in the Fed’s balance sheet would fuel inflation. However, it did not materialize because banks chose to hold excess reserves rather than extend new loans.

Meanwhile, there is little indication that foreign investors have grown wary of the U.S. dollar: The trade–weighted index has increased by about 8% since the beginning of this year. The main reason is other advanced economies are in similar straits as the U.S. According to the IMF, gross government debt worldwide will rise by more than 13 percentage points this year to more than 96 percent of GDP.2 Moreover, bond yields in Japan and many European countries are negative; hence there is little incentive for investors to shift out of dollars.

Another ameliorating factor is that stepped-up government spending is not “crowding out” private spending. Business investment was soft before the outbreak of the pandemic, and it declined at an 8.6% annual rate in the first quarter. Also, a much larger decline is anticipated in the current quarter and the outlook in the next year or two is highly uncertain.

How Sustainable Is the Debt Build-Up?

Still, there are legitimate reasons to question the sustainability of the recent surge in federal government debt. According to The Committee for a Responsible Federal Budget (CRFB), a nonpartisan think tank, the ratio of publicly held debt to GDP will exceed 100 percent of GDP in the next fiscal year. Moreover, it is on a trajectory to surpass the 107% threshold during World War II in ensuing years.3

Views are divided about whether this poses a problem in the long term. So-called “deficit hawks” worry it could lead to debt problems or inflation down the road. However, others cite the experience of Japan, where debt/GDP has doubled since the 1990s to more than 200 percent without any problems. The principal reasons are the Japanese government issues debt in its own currency, maintains a flexible exchange rate, and inflation has been negligible. The same is true of the United States, although it is more heavily dependent on foreign financing.

Ironically, President Trump and Paul Krugman agree on one thing: Today is a good time for the federal government to borrow because interest rates are at record lows. Provided government spending boosts economic growth above the cost of borrowing, the spike in debt to GDP will be temporary.

But this does not mean the U.S. can count on growth alone to ensure debt sustainability. Prior to the coronavirus pandemic, the federal government’s finances were set to deteriorate steadily throughout this decade, mainly due to rising medical costs associated with an aging population. For example, CBO’s forecasts at the beginning of this year called for deficits to average $1.3 trillion per year and to rise from 4.6% of GDP in 2020 to 5.4% in 2030.

Now, in the wake of the pandemic, holes in the social safety net have become evident that will entail added government spending in the future. In these circumstances, it is difficult to fathom how this spending can be sustained without taxpayers footing the bill at some point.

Investment Implications: When Will the Treasury Market Turn?

The big unknown is when bond investors will become concerned about the steady expansion in federal government spending.

During 2019, Treasury bond yields declined by more than a full percentage point, even though the budget deficit rose to $1 trillion and the economy stabilized. So far this year, they have fallen further to record lows despite unprecedented government spending, because investors believe global economic weakness will result in sustained low inflation. We concur with this assessment and have positioned portfolios for bond yields to stay low throughout this year.

As the global economy recovers from the coronavirus pandemic in the next year or two, we would expect Treasury yields to rise. However, a spike is unlikely as long as inflation stays low. Over time, the risks of higher interest rates increase if, as we expect, the budget deficit remains elevated even as the economy recovers. If so, investors should be prepared for higher taxes in the out years.

1 CBO, April 24, 2020.

2 IMF Fiscal Monitor Press Briefing, April 15, 2020.

3 Chuck Jones, “Coronavirus, CARES and PPP Will Explode The Federal Deficit and Debt,” Forbes, April 25, 2020.