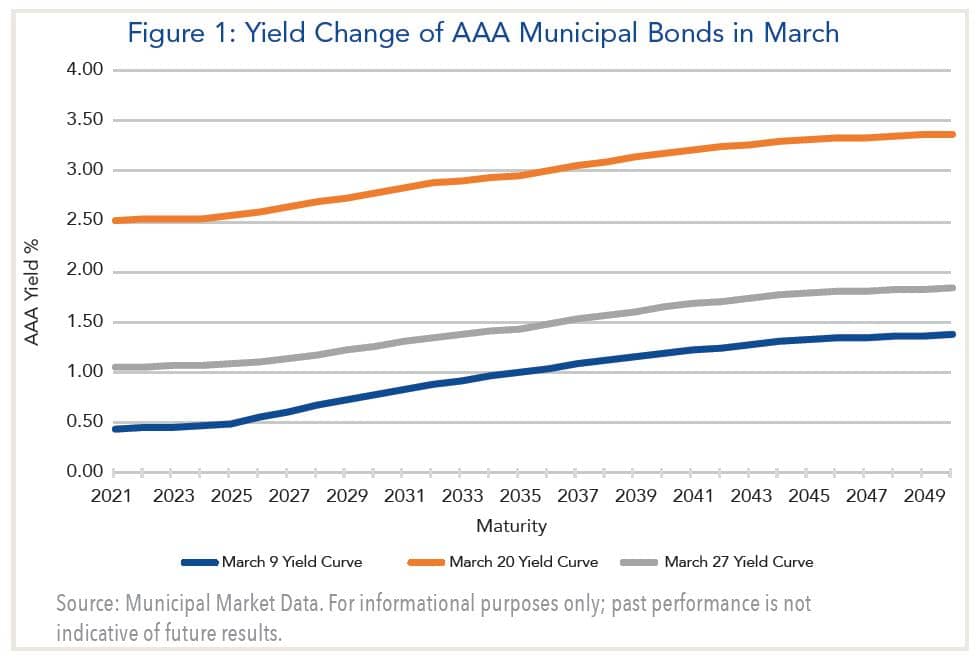

To say that the municipal market has been volatile over the last few weeks would be an understatement. To be fair though, the sector has mimicked the broader investment markets as investors try to sort out the economic impact of the coronavirus. Initially, an investor’s priority was to hold cash and safe haven investments like Treasuries. This drove Treasury yields lower, while prices of other bonds declined as investors sold to hoard cash and Treasuries, causing yield spreads to widen relative to Treasuries, while municipal yields climbed sharply higher. After reaching historic lows in the first week of March, municipal yields rose by about 2% across the yield curve (Figure 1), an unprecedented move in the market. Again, similar actions occurred in the corporate bond market where credit spreads, which measure the difference in yield between a corporate bond and a Treasury security of the same maturity, widened significantly.

Recognizing the poor liquidity in the markets, the Fed implemented a number of programs to improve liquidity across various market segments. While the Fed had previously lowered the fed funds rate to a range of 0-0.25% and announced that it would begin to buy Treasuries and mortgage backed securities (MBS), it quickly realized that additional support was needed. In response, the Fed announced a number of new programs as well as unlimited quantitative easing. Quantitative easing is the process where the Fed buys Treasuries and MBS to increase money in the banking system and effectively keep interest rates low. In addition, the Fed initiated a number of other programs to support funding in various sectors including the municipal market and individual municipalities. Finally, late last week, the federal government announced a massive $2 trillion stimulus package to support the economy. The combination of Fed measures and news of the stimulus package have eased investor worries and we have seen a positive impact in the markets. More specifically in the municipal market, interest rates have moved markedly lower, declining by approximately 1.5% and retracing 75% of the rise in yields experienced in the two prior weeks.

Recognizing the poor liquidity in the markets, the Fed implemented a number of programs to improve liquidity across various market segments. While the Fed had previously lowered the fed funds rate to a range of 0-0.25% and announced that it would begin to buy Treasuries and mortgage backed securities (MBS), it quickly realized that additional support was needed. In response, the Fed announced a number of new programs as well as unlimited quantitative easing. Quantitative easing is the process where the Fed buys Treasuries and MBS to increase money in the banking system and effectively keep interest rates low. In addition, the Fed initiated a number of other programs to support funding in various sectors including the municipal market and individual municipalities. Finally, late last week, the federal government announced a massive $2 trillion stimulus package to support the economy. The combination of Fed measures and news of the stimulus package have eased investor worries and we have seen a positive impact in the markets. More specifically in the municipal market, interest rates have moved markedly lower, declining by approximately 1.5% and retracing 75% of the rise in yields experienced in the two prior weeks.As mentioned, the volatility experienced in the municipal market over the past 3 weeks is highly unusual and the decline in yields last week occurred over a three-day period as the Fed moved quickly to provide liquidity. In addition, as referenced in my article from March 16, 2020, it is likely that the markets will be prone to bouts of volatility for the near term until a clearer picture of COVID-19’s impact emerges. The macro picture has turned negative and municipal finances will likely be affected with the depth and length of the downturn determining the ultimate impact. Municipal fundamentals were good entering this downturn, which should help many municipalities to absorb the impact. While municipal yields are down from the extraordinary levels reached at the height of the market disruption, valuations remain attractive and continue to trade at levels well in excess of yields on comparable maturity Treasuries. The market seems more settled, at least for now, and we are likely to see some new issue bonds price this week which will help better establish market levels. As such, we think municipals offer an attractive investment option to investors looking for tax-free income and continue to like high quality, intermediate maturities for individuals. More specifically, we would recommend higher quality, (AA and higher rated) general obligation bonds and essential purpose revenue bonds like water & sewer bonds. Additionally, the healthcare/hospital sector has come under pressure as issuers within this sector are clearly on the front line in the fight against the virus. This sector represents an opportunity where investors can add some additional yield; however, we would recommend higher quality issuers within this sector.