These programs enabled consumer spending to return to pre-crisis levels in July, even though the unemployment rate remained elevated at 10.2%. Along with a highly accommodated monetary policy, they also helped prop up the stock market, which is now back to its record level before the pandemic. That’s the good news.

The issue investors must now consider, however, is whether the recovery will continue unimpeded if additional federal support is not forthcoming.

Because lawmakers presumed the worst of the pandemic would be over by summer, many provisions in the CARES Act expired at the end of July, including added weekly unemployment benefits of $600. Meanwhile, the two political parties are far apart in passing new legislation. Democrats favor an omnibus bill with $3 trillion in support while Republicans seek to cap spending at $1 trillion.

Until recently, market participants believed a compromise would be reached. However, the picture became muddled when President Trump issued an executive order that would provide added weekly unemployment benefits of $300 from the federal government and an additional $100 from state funds. Yet, thirty states reportedly may reject the proposal because they lack the funding or have difficulty administering it.

According to Cornerstone Macro, the likelihood of a Congressional deal has lessened now. The reason: Republicans do not appear concerned if governors of blue states refuse federal support or cannot take advantage of it. Moreover, as the election date approaches they may be less inclined to pass legislation they believe is not essential.

This situation raises the specter of a looming “fiscal cliff”: Federal stimulus is likely to decline from more than $1.6 trillion in the second quarter to $700 billion in the current quarter and less than $200 billion quarterly thereafter if added support is not forthcoming.

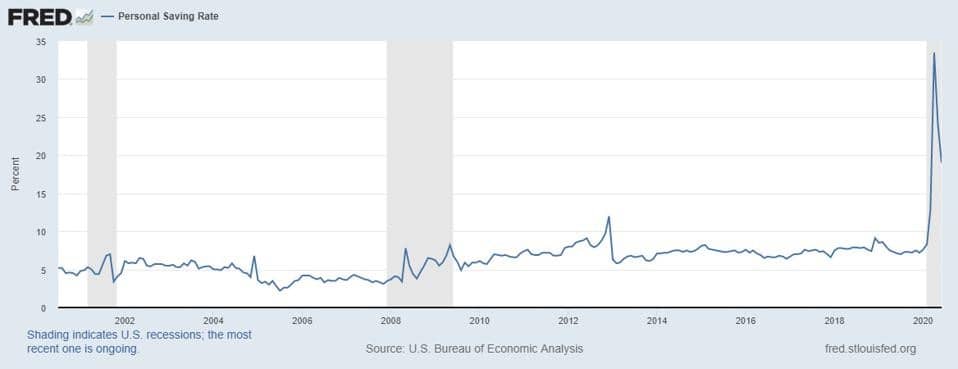

Markets have not reacted to this prospect thus far, as investors still seem to believe a deal will be struck in September. Also, with the saving rate still elevated at 19% of personal income, many households have a cushion that should tide them over until then.

However, this begs the issue of what type of deal will be struck. Republicans reportedly favor a “skinny bill” that would include a renewal of Principal Paycheck Protection (PPP) funds for small businesses, modest support for schools, liability protection for employers and a gradual curtailment of the added $600 per week benefit included in the CARES Act.

The most difficult area of contention is aid for state and local governments. Republicans did not include it in their plan, whereas the bill House Democrats passed included a trillion dollars of support.

Jim Glassman of JPMorgan Chase (August 16 report) believes two areas are particularly vulnerable: (i) the educational system and the communities that service them; and (ii) state and local governments in the upper Midwest and northeastern states whose populations and tax bases have been growing more slowly than other regions.

Glassman sees the financial shortfalls of the state and local governments to be the most pressing. They are not the result of increased unemployed, as federal transfers have covered their lost income. Rather, the lost revenues they face are mainly due to the slowdown in air travel.

The toll on state and local finances is visible in job losses: Employment for state and local government fell by nearly 2 million from February to April, and it has recovered by only 328,000 since then. Much of the hemorrhage is centered in education, where school-related jobs have declined by nearly 1 million.

In the end, investors need to weigh whether a slimmed down bill or no bill would threaten economic recovery. My take is that the recovery is unlikely to be derailed in either event, although the pace of economic activity would be slower than in recent months. If so, the stock market rally could stall, but it would likely not necessarily reverse.

The wild card would be a second wave of COVID-19 that forced shutdowns of schools and businesses. Depending on how widespread it would be, it could have a more pronounced impact on the economy and require significant added federal support. It would also likely spawn a stock market correction, as it is not priced into markets.

A version of this article was originally posted to Forbes.com on August 20, 2020.