- Plunging bond yields and heightened stock market volatility have caused investors to worry that the global slowdown could morph into a recession. Europe already is on the cusp, and bond yields in the major European countries are negative and falling further.

- In the United States, investors are counting on the Federal Reserve to ease monetary policy to preserve the ten-year expansion. But this begs the issue whether it can bolster the economy when the principal cause of the global slowdown is uncertainty over trade. Our view is a further slowing of the economy is likely, but we do not yet see signs of recession.

- Unfortunately, a solution to the U.S.-China dispute is not in sight. With both sides playing a game of brinksmanship, financial markets may be headed for more turbulence if trade tensions persist.

Reconciling Stock & Bond Markets

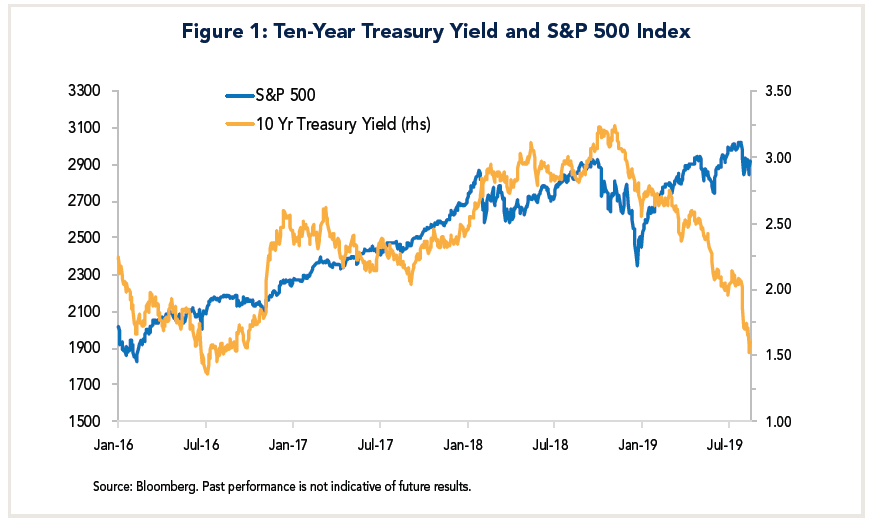

Consider the dilemma investors face today: Over the past nine months, ten-year Treasury bond yields have plummeted by more than 160 basis points, while the U.S. stock market is off only modestly from a record high (Figure 1). Normally, such a precipitous decline in yields would be associated with a flight to quality and a sell-off in equities and other risk assets. However, this had not been the case until this week, when the stock market posted its worst day of the year. It has since recouped most of its losses, leaving investors torn about what to do.

The principal factors supporting risk assets are two-fold. First, investors expect the Fed will lower short-term interest rates by about 100 basis points over the next two years. Second, they believe this will keep the ten-year economic expansion going.

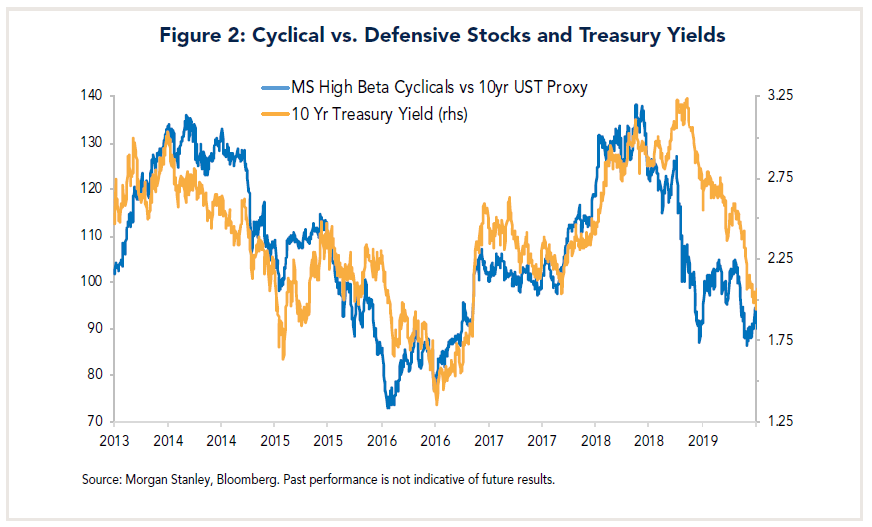

This conviction has bolstered the stock market even though corporate profits have been lackluster.1 That said, defensive sectors of the stock market have out-performed cyclicals in an environment of slower growth and falling interest rates (Figure 2). In this respect, equity investors are not oblivious to risks in the global economy.

The story gets murkier when one considers that the term premium, as measured by the spread between the yield on the ten-year Treasury and the 3-month T-bills, recently fell to a record low below minus 100 basis points. This means that whoever buys a ten-year Treasury gives up 100 basis points to the alternative of rolling a treasury bill for the next ten years.

The story gets murkier when one considers that the term premium, as measured by the spread between the yield on the ten-year Treasury and the 3-month T-bills, recently fell to a record low below minus 100 basis points. This means that whoever buys a ten-year Treasury gives up 100 basis points to the alternative of rolling a treasury bill for the next ten years.

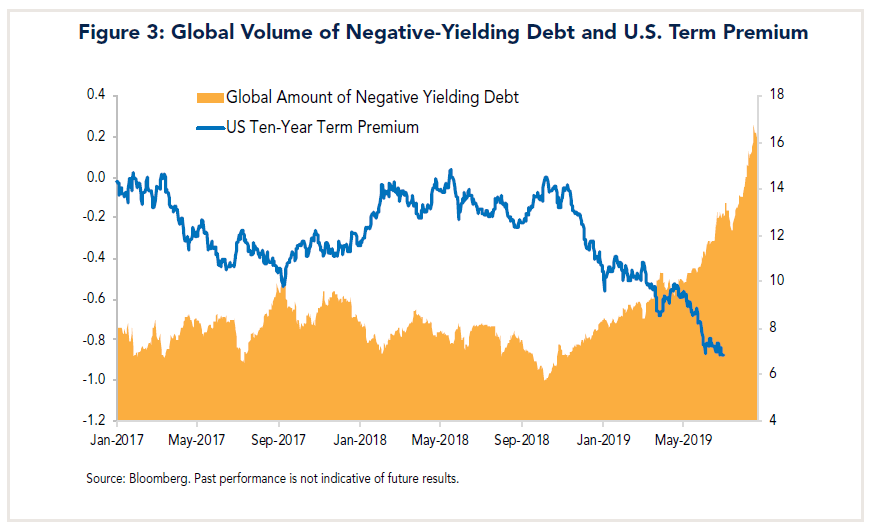

A host of global factors including large central bank balance sheets, negative yields abroad and absence of inflation risks are commonly cited to explain this phenomenon. Over the past nine months, for example, the volume of negative-yielding debt outstanding worldwide has nearly tripled, to $15½ trillion (Figure 3).

According to Roberto Perli of Cornerstone Macro, this phenomenon is mostly a result of central bank policies in Japan and Europe.2 He believes investors effectively are treating Europe as if it were Japan: Bond markets in both areas are pricing short-term rates to stay negative for more than 15 years. Furthermore, bond yields in the European periphery — including the so-called PIIGS (Portugal, Ireland, Italy, Greece, and Spain) are close to or below those in the U.S., largely because Germany’s yield curve is now negatively-sloped across the entire yield spectrum.

According to Roberto Perli of Cornerstone Macro, this phenomenon is mostly a result of central bank policies in Japan and Europe.2 He believes investors effectively are treating Europe as if it were Japan: Bond markets in both areas are pricing short-term rates to stay negative for more than 15 years. Furthermore, bond yields in the European periphery — including the so-called PIIGS (Portugal, Ireland, Italy, Greece, and Spain) are close to or below those in the U.S., largely because Germany’s yield curve is now negatively-sloped across the entire yield spectrum.

In the United States, many observers pointed to a mild inversion of the U.S. Treasury yield curve as signaling a possible recession. However, Perli contends the U.S. bond market is not unduly pessimistic about prospects for the U.S. economy. His calculations show that U.S. growth expectations have declined since the beginning of this year, “but they are far from signaling recession or even a pronounced slowdown for the U.S. economy.”3

If this interpretation is correct, it would suggest the differences in expectations between stock and bond investors are not as great as is commonly perceived.

Still, we believe there are two key risks that need to be considered. One is that, with interest rates already very low or negative in many countries, policy easing by central banks may not revive economic growth. The other is the ongoing U.S.-China trade dispute may cause growth abroad to weaken further and eventually spill-over to the U.S.

Risk #1: Wanting Effectiveness of Monetary Policy

One of my main concerns with the rosy performance of the U.S. stock market this year is the rally has been based almost entirely on expectations the Fed and other central banks will ease monetary policies. Many economists, however, question whether policy easing will be effective in reviving growth. The reasons: There are massive excess reserves in global banking systems, artificially low and negative policy rates and a growing proliferation of negative yields on government bonds.

The current situation is completely unprecedented. If Europe were to slip into recession, it would mark the first time a central bank began an easing cycle when interest rates already were negative.

In these circumstances, the traditional channel through which monetary policy operates – namely, increased loans from banks – is largely broken. Instead, the primary channel is through capital markets and the associated wealth effects on households and businesses.4

One of the main lessons from the post-Global Financial Crisis (GFC) experience, however, is that it is much harder to jumpstart economies than it is to boost financial markets. As Mickey Levy observes5:

“Weak economic conditions reflect factors that are nonmonetary in nature and well beyond the scope of monetary policy to remedy, including slower growth in China and world trade, disruptions and tensions stemming from bruising U.S.-China trade negotiations, and U.S. President Trump’s erratic behavior, Brexit, and now the Middle East flare up.”

Therefore, while equities and other risk assets may continue to hold up in the interim, they could form asset bubbles if underlying economic fundamentals fail to improve.

Risk #2: The Global Economy Deteriorates Further

A second concern is that the prolonged U.S.-China trade war is taking a toll on overseas economies that may be difficult to reverse. When the slowdown began last year, the prevailing view among economists was it would be similar to what happened in 2015-2016. China’s economy softened then in response to prior policy tightening, and oil and other commodity markets were impacted. However, they subsequently reversed when the Chinese authorities eased policy. The principal difference today is the slowdown is more pervasive, and it is directly linked to the effects of uncertainty about international trade that has impacted manufacturing worldwide.

The region most at risk is Europe. Germany’s economy, which has long been the locomotive for Europe, posted mildly negative growth in the second quarter and unemployment has increased in one quarter of the regions surveyed. Despite this, the German government is reluctant to pursue fiscal stimulus. Accordingly, the burden for supporting the economy rests completely with the European Central Bank, when the German yield curve is negative across the maturity spectrum for the first time in history.

The situation in Britain is even more precarious: It faces the prospect of Brexit at the end of October with no solution in sight and with the British economy on the cusp of recession. Meanwhile, both Italy and France face political challenges of their own: Italy’s most powerful politician, Matteo Salvini, is attempting to bring down the coalition government, as he seeks to become Italy’s next prime minister, and French Prime Minister Macron faces challenges from the so-called “yellow jacket” movement.

Asian economies are also feeling the fallout from the U.S.-China trade dispute, as exports throughout the region have contracted. This could become even more pronounced in the months ahead for two reasons. First, duties eventually will be levied by the U.S. on all imports from China, although a portion will now be delayed until December. Second, China was able to counter some of the earlier rounds of tariff hikes by shipping goods in advance of the dates they become effective. However, this strategy can only work for a limited time, and the Chinese economy eventually will feel the impact of declining exports.

Implications for the U.S. Economy & Markets

Thus far, the U.S. economy is holding up reasonably well. The main reason is consumer spending, which accounts for roughly two thirds of aggregate demand, has been bolstered by healthy growth in real disposable income and a strong jobs market.

U.S. businesses, however, have turned cautious, and capital spending has softened amid the uncertainty about trade and the global economy. And the latest annual revisions to the national income statistics resulted in downward revisions to overall profits and profit margins. If profits remain lackluster, companies are likely to respond by slowing hiring and capital spending.

The message from Fed officials is they are prepared to act quickly if the economic expansion is in jeopardy. According to Roberto Perli, both the Fed and the markets likely have learned the lessons of the past, and the Fed will take the funds rate to zero quickly when the next recession comes in sight. That said, as noted previously, interest rate cuts may be ineffective when the weakness is global and linked to trade rather than to monetary conditions.

Meanwhile, the U.S. economy is likely to continue to slow while recession risks are increasing. In these circumstances, it is vital that tensions between the U.S. and China lessen. The biggest threat we see is that President Trump will follow through on his threat to impose duties of 10% on imports of consumer goods from China, which could eventually be raised to 25%. If so, consumer confidence would suffer and markets could be headed for a bout of turbulence such as occurred in December of last year.

1See my commentary, “U.S. Stock Market Confronts Lackluster Earnings,” July 29, 2019.

2Roberto Perli, “The New World We Live In: Five Extreme Bond Market Charts (and A Reassuring One),” Cornerstone Macro, August 13, 2019.

3Ibid. p.4.

4Another channel is via currency depreciation, but this is ultimately a zero-sum game if all countries try to weaken their currencies.

5Mickey Levy, “More Monetary Easing: No Economic Impacts and Mounting Costs and Risks, So Why Do It?” Berenberg Securities, June 26, 2019.