- Worries about U.S.-China trade tensions and possible sanctions against Mexico have contributed to a steep drop in Treasury yields. The bond market is now pricing in nearly four interest-rate cuts by the Federal Reserve through 2020 (Figure 1).

- The challenge for investors and the Fed is two-fold. First, will President Trump follow through on his threats? Second, what impact will they have on the U.S. and global economy? Both are difficult to know, because Trump likes to be unpredictable; yet this could undermine confidence in the economy.

- Our take is that while Trump backed away on Mexico due to political opposition, he will continue to pressure China. With inflation under control and downside risks to growth higher, we expect one Fed rate cut and possibly two this year.

- U.S. bond yields will likely stay low for the balance of this year, and we are neutral on duration in bond portfolios. Corporate credit spreads versus Treasuries are also reasonable with the expansion likely to continue throughout this year.

Background: Here We Go Again!

The on-again off-again saga over the use of tariffs by the Trump administration has been in full display since early May. Just when it seemed the U.S. and China were close to striking a deal over trade, President Trump pulled the plug by announcing that China had backed away from prior commitments, and the U.S. government responded by increasing tariffs on $200 billion of Chinese imports from 10% to 25%. Moreover, Trump has subsequently warned that duties could be extended to another $300 billion of imports if China does not comply with U.S. demands.

At the end of May, President Trump added a new threat to the equation – this time against Mexico. He warned the U.S. would levy duties of 5% on imports from Mexico, and potentially up to 25%, if Mexico did not take stronger action to stem the tide of illegal immigrants from Central America. This time, however, there was a strong backlash from investors, businesses and even Congressional Republicans, who worried the President had gone too far in using tariffs to solve a political issue.

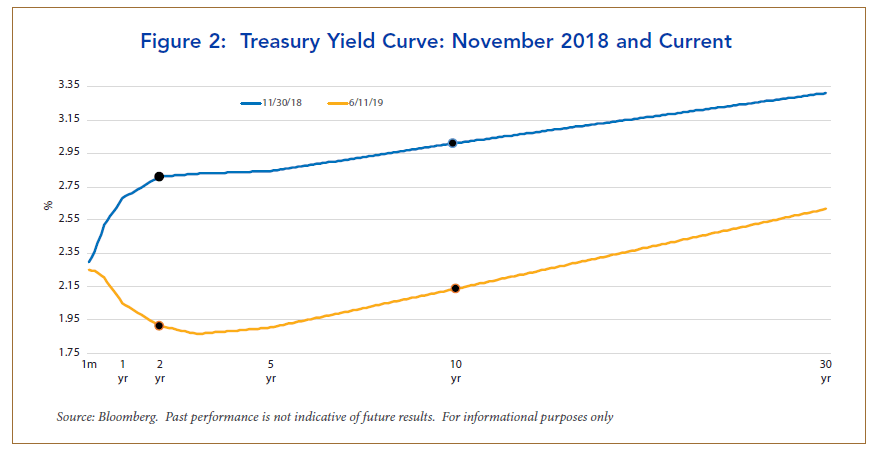

These developments heightened worries about the global economy and the possible spill-over to the U.S. economy. Ten-year yields currently are around 2.1%, their lowest level since mid-2017, and about 115 basis points below the high of 3.25% reached last November.

The recent decline in yields reflects investors’ expectations that the Federal Reserve will need to lower interest rates to offset the impact of a slowing economy. The bond market, for example, currently is pricing in two 25 basis cuts in the Federal funds rate this year and two additional cuts next year. This move, together with an inversion of the front end of the Treasury yield curve ( Figure 2), suggest bond investors perceive the risk of recession has increased over this period. Equity investors, however, are more hopeful that Fed easing will extend the U.S. economic expansion, and the stock market has rallied from its recent lows.

Coping With Unpredictability

That said, I concede it is not always easy to separate statements and actions by the President. The reason: I believe Trump relishes being unpredictable, because he believes it confers an advantage in bargaining. Thus, there are times when he will make threats, and then back down; but there are also times when he will follow through on his threats. Unfortunately, this leaves investors and policymakers with the quandary of deciphering what he will do.

In this regard, the recent conflicts with China and Mexico are instructive. Both countries would be hurt if the U.S. imposed tariffs on them, as China is the largest exporter to the U.S. ($505 billion in 2018) while Mexico ranks second ($346 billion) just ahead of Canada. However, Mexico would feel the impact much more than China, because the U.S. market accounts for 80% of Mexico’s exports compared with 18% of China’s exports. Consequently, many observers believe the Mexican economy would slip into recession if the U.S. imposed tariffs on it.

Furthermore, because trade in goods between the U.S. and Mexico may cross the border multiple times for auto and machinery assembly, key sectors of the U.S. are likely to be adversely impacted. As a result, the U.S. stock market sold off markedly when President Trump threatened sanctions on Mexico, and there was also an outcry within the U.S. business community.

Beyond this, President Trump encountered considerable opposition from Congressional Republicans. Many were troubled that tariffs were being used to combat a political issue – illegal immigration. An added concern was that the U.S. government was about to vote on the new trade agreement between the US, Canada, and Mexico to replace NAFTA, and duties on Mexico could threaten its passage. Consequently, President Trump was under considerable pressure when he announced a deal had been reached with the Mexican government.

By comparison, the President does not face the same pressure with respect to China. Both Democrats and Republicans in Congress believe China has taken advantage of the World Trade Organization (WTO) and that it practices violations of intellectual property and technology transfer, while also subsidizing state owned enterprises (SOEs). Accordingly, the main uncertainty now is whether President Trump will follow through on his threat to extend duties of 25% on an additional $300 billion of imports from China if President Xi Jinping does not meet with him at the G-20 summit on June 28-29.

The Fed's Response

Chair Powell, for example, issued the following statement on June 3, when markets were roiled by the threat of tariffs on Mexico:

A word about recent developments involving trade negotiations and other matters. We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.

We interpret this to mean that the Fed is now more concerned about downside risks from a trade war, but it prefers to wait to see how the situation evolves before it acts. With core inflation below the Fed’s 2% target and inflation expectations declining, downside risks to growth make rate cuts more probable. However, the magnitude and timing will likely hinge on how the economy performs and whether an escalation in the trade conflict with China weakens the global economy.

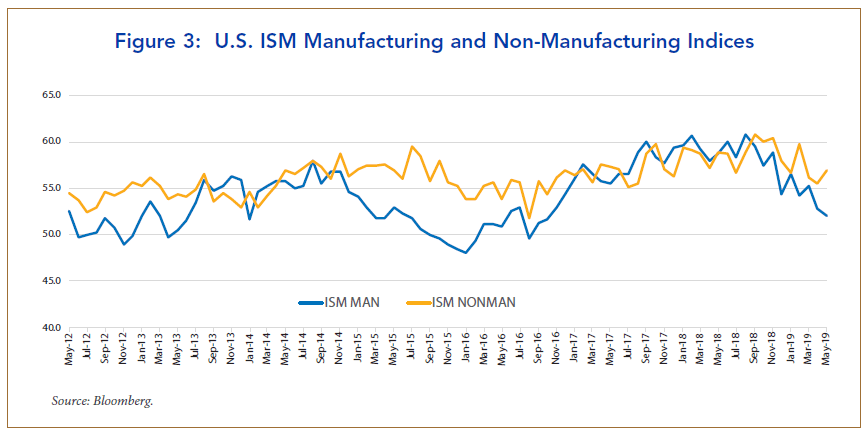

At present, the pace of U.S. growth is moderating toward its former trend of 2%-2 ¼% after expanding by nearly 3% in 2018. The slowdown is most apparent in the manufacturing sector, which has felt the brunt of a slowdown in world trade, whereas the non-manufacturing sector has held up better (Figure 3). Jobs growth has also been solid, although it slowed in June, and wage increases have stayed moderate. Nor do we foresee a recession in the second half of this year, although a full blown trade war with China would increase the risks for 2020.

A lot hinges on how consumers and businesses respond to the increased uncertainty. Thus far, consumer confidence has stayed strong, as households were partly shielded from the initial impact of tariff hikes on China. That said, the latest round and any subsequent rounds will have a greater impact on consumer goods. However, the main risk we foresee is that businesses will pare back capital spending plans, because the investment environment is too uncertain, especially now that the effects of corporate tax cuts are fading.

Investment Conclusions

We believe the bond market is fairly valued now both in terms of duration and credit risks. In this context, the evolution of data and the policy responses – trade and monetary – will determine the performance of risk assets such as equities and lower-rated bonds. While they have rallied of late, we believe caution is warranted.

1Nicholas Sargen, Investing in the Trump Era: How Economic Policies Impact Financial Markets, Palgrave Macmillan, 2018.