Inflation continues to be elusive even as growth in the economy, domestic and global, marches towards normalization. The Fed has been dismissive of its absence, stating transitory external factors are to blame and has stayed the course to unwind stimulus. Markets show little concern for future inflation, and as such, investors aren’t being compensated as seen through Treasury Inflation Protected Securities (TIPS). Determining who’s right may not matter so long as investors are able to take advantage of the mixed signals.

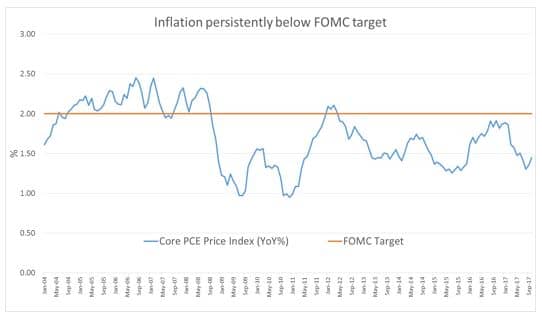

- Along with the modest pace of economic growth, inflation persistently below the Fed’s 2% target has been a hallmark of the post-crisis period (Figure 1). This has confounded policymakers as most indicators suggest that the economy has recovered sufficiently to generate higher inflation.

- The Fed has proceeded with policy normalization (rate hikes and balance sheet reduction) even with inflation well below target, confident that inflation will normalize as the economy continues to grow.

- Evaluating a broad array of market indicators, the market consensus is that the Fed will hike its key Federal Funds Rate to around 2% by 2019 in spite of low inflation and assigning little probability that inflation will rise from current levels. We believe the market is underpricing inflation risk and advocate bond investors own TIPS to mitigate this risk.

Source: Bloomberg.

Historically Inflation Follows Growth

We generally have a positive view of the U.S. economy and expect GDP growth in the 2.0-2.5% range for the next several quarters with near-term risk to higher growth. This suggests that the labor market will continue to improve and, in general, move the U.S. economy closer to full capacity putting upward pressure on inflation. Markets are right to be skeptical that inflation will rise, but we believe expectations have become overly pessimistic. Markets typically price in risk premium for future uncertainty; however, inflation expectations today are pricing in current inflation rates into the future with little or no risk premium for rising inflation. With expectations low, the hurdle for inflation to exceed these expectations is also low and is a risk that investors shouldn’t ignore.

What? The Fed Worry?

The Fed has consistently downplayed low inflation rates as “transitory” and described inflation expectations as “well-anchored”. It has continued to normalize monetary policy with confidence that inflation will return to the 2% target. In our view, depressed inflation expectations are a key issue to monitor moving through 2018, as absent a rise in expectations, Fed policymakers may have to rethink rate hike plans.

Examining both survey- and market-based inflation expectations implied by the TIPS market, it is clear to us that there has been a deterioration in inflation expectations by market participants and the public (Figure 2). If these expectations persist, we believe the Fed will likely be forced to reconsider their confidence that inflation will return to 2%. Recently, some Fed officials have begun to question whether or not the market has confidence that they can achieve their 2% inflation target, and whether or not they have an adequate understanding of why inflation remains so low. Moreover, allowing inflation expectations to remain at depressed levels for a prolonged period increases the chance that these expectations become ingrained in the markets and consumer expectations, resulting in persistently low inflation and eroding the Fed’s credibility around the inflation target.

The Fed would be well served to solidify investors’ confidence that 2% is an attainable target. We believe the Fed should strive for, and welcome, somewhat higher inflation expectations in order to mitigate these negative consequences.

Source: Bloomberg.

Source: Bloomberg.

Exploit the Disconnect

Although the Fed is likely to communicate a gradual pace of rate hikes and forecast inflation returning to 2%, the desire to see tangible progress toward the 2% target and concern over low inflation expectations will determine the ultimate path of policy. The risk to markets, given low expectations, is that actual inflation surprises to the upside and/or expectations increase, resulting in higher interest rates.

In our bond portfolios, we are emphasizing longer maturity Treasury Inflation Protected Securities (TIPS) to protect portfolios against rising interest rates due to higher inflation. With market expectations for future inflation at or near current inflation rates, risk of TIPS underperforming Treasuries is limited given our expectation for the U.S. economy. By comparison, outperformance of TIPS could be substantial if inflation rises or the Fed begins to orient policy toward generating higher inflation expectations. For these reasons, we believe TIPS represent a very favorable risk/return tradeoff relative to Treasuries.