Table of Contents

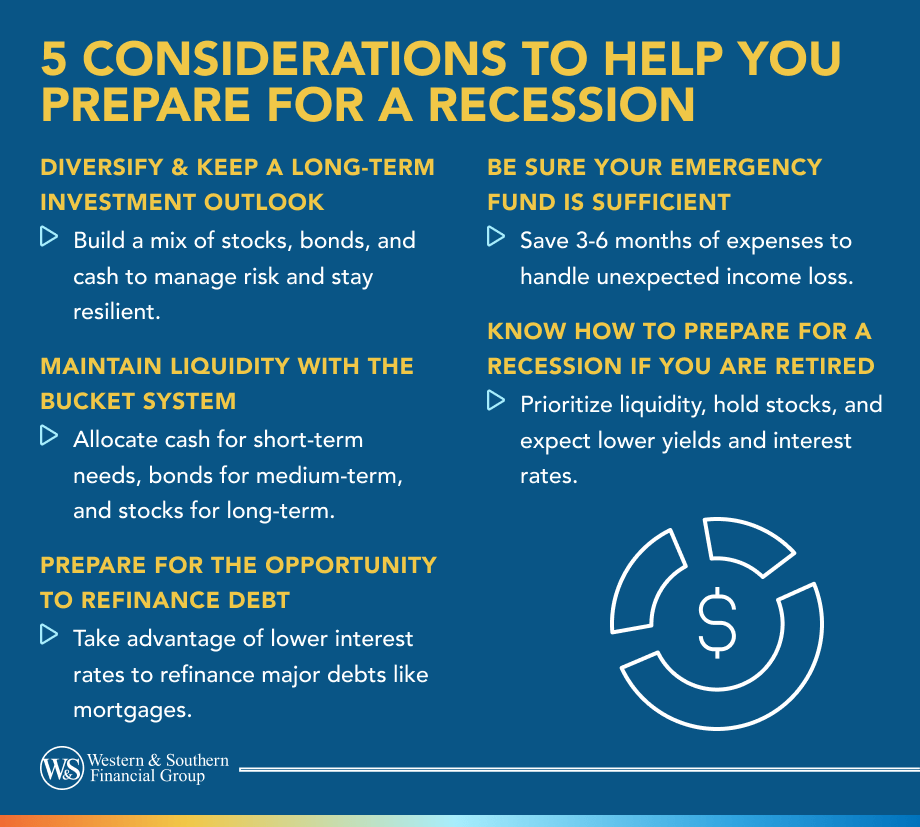

- Preparing for a Recession: What to Expect and 5 Considerations to Help You Plan

- Diversify & Keep a Long-Term Investment Outlook

- Maintain Liquidity With the Bucket System

- Prepare for the Opportunity to Refinance Debt

- Be Sure Your Emergency Fund is Sufficient

- Know How to Prepare for a Recession If You Are Retired

- Bottom Line

Key Takeaways

- Diversify investments across asset classes to reduce recession risks.

- Use the bucket system for short, mid, and long-term liquidity.

- Refinance high-interest debts during low-interest periods.

- Keep an emergency fund for three to six months of expenses.

- Retirees should focus on liquidity and expect lower yields.

Economic recessions are not always predictable and can sometimes occur suddenly. During the coronavirus pandemic, many people were wondering how they can best prepare for a recession. Their curiosity is warranted — such economic downturns can touch all areas of personal finance, especially investment planning. Accordingly, it can be helpful to know how to help prepare for a recession.

Learning the basics on what to expect during an economic downturn is a great place to start. Then, you can make better decisions about how to build or strengthen your financial plans.

Preparing for a Recession: What to Expect and 5 Considerations to Help You Plan

A recession is generally defined as a fall in Gross Domestic Product (GDP) for two consecutive quarters. Recessions are typically marked by falling demand for products and services as well as rising unemployment rates, as businesses lay off employees.

A full economic cycle, which includes recession, will average between five and seven years. The average length of a recession is about 11 months.1 A bear market for stocks, which is defined as a 20% or more decline in prices from the previous high, typically accompanies recession.2

When forming or reviewing your financial plans for recession, here are five key strategies to consider implementing:

1. Diversify & Keep a Long-Term Investment Outlook

A properly constructed investment portfolio can help you weather an unexpected recession. When building or reviewing your portfolio, check to see if you are diversified among a variety of asset classes, which might include stocks, bonds and cash. Diversification cannot guarantee profit or protection against loss in a declining market.

It's also a good idea to maintain diversity within your asset classes. For example, the stock portion of your portfolio can be spread out among different categories, such as large-cap stock, small-cap stock and international stock.

2. Maintain Liquidity With the Bucket System

The idea of the bucket system (and how it relates to recession) is that your portfolio can be prepared for any eventuality. If a recession hits tomorrow, this can help ensure you have enough cash to withdraw throughout the economic downturn. If the recession is longer than average, you may be able to tap a secondary bucket for backup, which can potentially keep you from having to access other holdings during a downturn.

This allocation structure includes three primary asset classes — cash, bonds and stocks:

- Cash bucket: Any money you may need within three to six months , you would keep allocated to cash.

- Bond bucket: For money you may need in two to five years, consider bonds or bond mutual funds.

- Stock bucket: For money you don't need for at least five or more years, consider allocating that to the stock or stock mutual funds bucket.

If you think you'll need to withdraw any money from your investments in the foreseeable future, the bucket system could work for you. Keep in mind that all investments are subject to market risk and may lose value. While this strategy is designed to help mitigate the risk of being invested only in one type of asset, it is possible that all asset classes could decline in value at the same time.

3. Prepare for the Opportunity to Refinance Debt

During a recession, the Federal Reserve may lower interest rates to help stimulate the economy. This may be a good time to review your largest debts — such as a mortgage — and consider consolidating and refinancing to lower rates.

To remain prepared for the opportunity to refinance debt, consider reviewing your credit report annually at AnnualCreditReport.com.3 At this site, you can see your official FICO score from all three credit bureaus: Equifax, Experian and TransUnion.

4. Be Sure Your Emergency Fund is Sufficient

A common rule of thumb says that most people need to keep three to six months of living expenses in an emergency fund . The reason for such a high amount is to be prepared for the worst case scenario, which would include losing your primary source of income. In such an event, it could take three to six months (or longer) to replace that income, so ensuring your emergency savings are well funded is a good idea.

5. Know How to Prepare for a Recession If You Are Retired

For retirees, prepping for a recession isn't too different. Depending on your unique situation, you may need to focus more on a few key areas of your retirement planning. If a recession occurs after you've left the workforce, here are a few actions to consider taking:

- Maintain focus on liquidity: If you rely on investments for income, keep in mind that recessions often bring lower stock prices and lower dividend yields. For this reason, you may need to be prepared to rely more on your cash accounts.

- Prepare to hold stocks: Ideally, you would hope to ride out the recession by avoiding the need to sell stocks at low prices.

- Expect lower yields & interest rates: While lower rates can be good for refinancing debt, the downside is that you may see lower yields on dividend stocks and lower interest rates on savings accounts and certificates of deposit.

Bottom Line

While recessions may share certain similarities, each economic downturn is unique in terms of its cause, intensity and duration. Also, each person's financial goals are unique, which means that the way you prepare for a recession will also be unique. For this reason, you may consider seeking the guidance of a financial professional, who can help you prepare for a recession in a way that suits you best.

Sources

- How Long Do Recessions Last? https://smartasset.com/financial-advisor/how-long-do-recessions-last.

- What Is a Bear Market? Definition and How to Invest During One. https://www.nerdwallet.com/article/investing/how-to-invest-during-a-bear-market.

- Annual Credit Report.com. https://www.annualcreditreport.com/index.action.