Table of Contents

Key Takeaways

- Establishing target amounts and goals to hit them is one of the most effective retirement strategies.

- If you plan to take part in expensive leisure activities such as traveling or joining a private club when you retire, you'll likely want to increase your target amount.

- If you see yourself moving into a smaller home or relocating to a state with a lower cost of living, you may be able to retire comfortably with a slightly smaller amount at a typical age.

- The average adult will need substantial income from other sources to supplement Social Security once they leave full-time work behind.

- Building assets that you can draw on for multiple decades requires discipline and prudent investing.

If you're investing part of each paycheck and choosing an age-appropriate mix of investments, you generally have a solid foundation for your retirement savings. But how do you know whether you're on track to actually have enough assets by the time you leave the workforce?

The truth is, without having a good yardstick by which to measure success, you're stumbling in the dark. Establishing target amounts and goals to hit them by is one of the most effective retirement strategies.

Below, we outline target retirement savings by age — for 25-, 35-, 50- and 65-year-olds — so you can have a better sense of where you stand. This guide may end up confirming that you're on a good trajectory already. Or you may realize that you need to tweak your approach to reach your long-term goals.

So, How Much Retirement Savings Should You Have?

Everyone's retirement goals vary somewhat, which makes it tricky to use a one-size-fits-all metric for retirement savings. Some plan to leave their job at age 55 and enjoy a long retirement while they're in great health; others want to keep working as long as they're able. There are those who can't wait to travel or enjoy other hobbies they couldn't always pursue while working full time; others plan to downsize and focus on simpler pleasures.

However, general guidelines can be helpful, too. Without a clear target in mind, it's difficult to measure your progress. The key is to adjust these guidelines based on your particular circumstances.

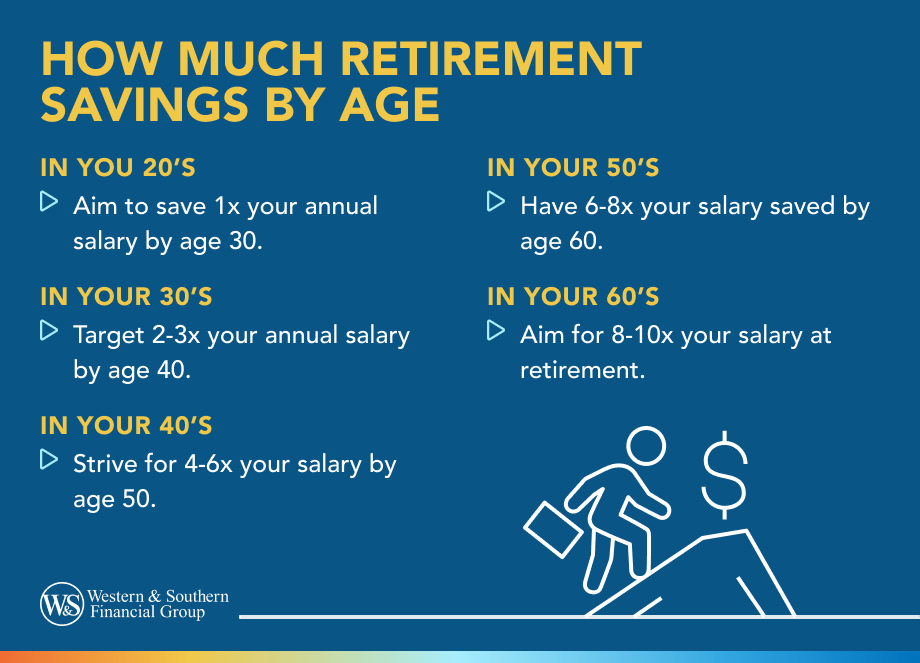

For a typical American worker, it's generally recommended to have this much of an annual salary saved for retirement:

- Age 25: Up to 1x your salary

- Age 35: 1x to 2x your salary

- Age 50: 5x to 6x your salary

- Age 65: 10x to 11x your salary

It's important to keep in mind that these target amounts apply to an average worker, not every individual. In this case, "average" means someone who plans to retire in their mid-60s, has no pension and will need to withdraw roughly 4% of their assets each year in retirement. Individuals who prefer to feel safer withdrawing at a lower rate should increase their savings target accordingly.

This projection includes certain general assumptions as well. It anticipates, for example, that one's wages will rise moderately over time and that the individual has a balanced investment portfolio that grows at a pace typical of historic returns.

Customizing Retirement Strategies

Again, it's important to adjust this guidance based on your individual situation. If you plan to take part in expensive leisure activities such as traveling or joining a private club when you retire, you'll likely want to increase your target amount. Conversely, if you see yourself moving into a smaller home or relocating to a state with a lower cost of living, you may be able to get by with a slightly smaller amount and still retire comfortably at a typical age.

Your age at retirement is another critical factor that will influence how much you'll want to have saved when you leave the workforce. The numbers above assume a typical retirement age. However, those planning to retire before that point will want to increase their savings goals accordingly. Not only would you potentially be drawing down your assets for a longer period of time, but you would have fewer years to accumulate retirement savings.

When looking at retirement savings by age, you should also consider your ability to generate income in your later years through part-time work. The ability to supplement your investment withdrawals can help you get by with fewer retirement assets. At the same time, earning income beyond threshold amounts set by the IRS could mean paying income taxes on a larger portion of your Social Security benefit.1

Investment Return Acceleration

You'll notice that the retirement savings targets, as a percentage of current income, grow larger as you get older. The guidance of 1x to 2x salary for a 35-year-old jumps to 5x to 6x salary for someone reaching their 50th birthday. It then soars to 10x to 11x salary when you reach age 65.

The reason for this is that over time, investment returns tend to accelerate because of compounding interest. When you reinvest capital gains, dividends and interest to acquire more shares — which is typically what happens in a 401(k) or individual retirement account (IRA) — that money is also able to generate returns. Market results are notoriously hard to predict over short periods, but account balances tend to snowball over longer timeframes.

That should be heartening if you're in the middle of your career and it looks like you could be short of your goal. For instance, if your portfolio generates a 7% average return, your balance would roughly double in the decade before your retirement.2 Note, though, that investments cannot guarantee growth or sustainment of principal value; they may lose value over time. Past performance is not an indication of future results.

How Much of Your Paycheck Should You Save?

Now you have an idea of how much you should have in your 401(k)s and IRAs at specific ages. But that begs an important question: How much do you need to sock away in order to try and reach those marks? Financial professionals recommend investing 15% of paycheck into a retirement account.3

Reaching the 15% mark may seem like a tall order, especially if you're earning an entry-level wage and still paying off student loans. Don't fret. You can start with a more manageable contribution level and gradually increase your allocation as your earnings increase and you shed some of your debts. Just know that if you get out of the gate slowly, you may have to contribute more than 15% in order to meet your retirement goals.

Looking for a more personalized view of your savings? Our retirement calculator estimates how much you'll have to save to reach your objectives, given your current assets, length of retirement and assumed rate of return.

5 Tips for Building Retirement Assets

The average adult will need substantial income from other sources to supplement Social Security once they leave full-time work behind. Building assets that you can potentially draw on for multiple decades is certainly feasible for most people, although it requires discipline and prudent investing.

Here are five ways you can help make sure you're saving enough:

1. Start Early

With compounding returns, the dollars you invest when you're in your 20s are likely to be more valuable than a dollar you save in your 50s. That's because, historically, the rate of return on stocks and bonds has exceeded the pace of inflation over long periods of time. So invest what you can when you're young, even if 15% of your income isn't practical just yet.

2. Stick to Your Savings Target

The average worker will need to divert 15% of their paycheck into retirement savings to build the assets they need. Perhaps you intend to invest slightly less or more than that based on your financial situation. The important thing is to have a clear target in mind and stick to it. That might mean cutting back on dining out or buying a used car instead of a new one, but it may be worth it in the long run.

3. Automate Your Savings

Roughly two-thirds of private-sector workers had access to a workplace retirement plan in 2023, according to the Bureau of Labor Statistics. Many government workers were eligible for workplace plans, too.4 If you're fortunate enough to be in that category, all you have to do is select the amount of your paycheck that you want to invest, or some employers will automatically enroll you. But even if you don't have access to a 401(k)-style plan through your job, you can still open an IRA of your own. And if you divert those contributions before they hit your bank account with automatic payments, it may remove the temptation to spend the money on other things.

4. Use Tax-Advantaged Accounts

Workplace plans such as 401(k)s allow you to write off contributions up to eligible amounts, and your money grows on a tax-deferred basis until you withdraw it after age 59½. Those tax benefits can dramatically increase the amount of your hard-earned money you get to keep. If you've maxed out your workplace plan or don't have access to one, IRAs offer vital tax advantages as well.

5. Choose an Age-Appropriate Asset Mix

Reaching your retirement goals isn't just about how much you put in — it's also a function of how well your assets perform relative to your risk tolerance. Younger investors who are several decades away from retirement may want to consider a diversified, stock-heavy asset allocation with the potential to enhance their growth potential. As you get closer to retirement age, you may want to shift more of your assets toward high-quality bond funds that tend to experience lower volatility.

If you're thinking you could use a helping hand in planning for your retirement, consider reaching out to a financial professional for assistance. These individuals can take a personalized look at your financial situation and provide valuable insights.

Sources

- Retirement benefits: Income taxes and your Social Security benefit. https://www.ssa.gov/benefits/retirement/planner/taxes.html.

- What is the Rule of 72? Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/rule-of-72-double-investment/.

- How Much of My Paycheck Should I Save? https://www.wsj.com/buyside/personal-finance/how-much-of-my-paycheck-should-i-save-01671734785.

- Changes in access to retirement benefits, 2010–23. https://www.bls.gov/opub/ted/2024/changes-in-access-to-retirement-benefits-2010-23.htm.