Table of Contents

Key Takeaways

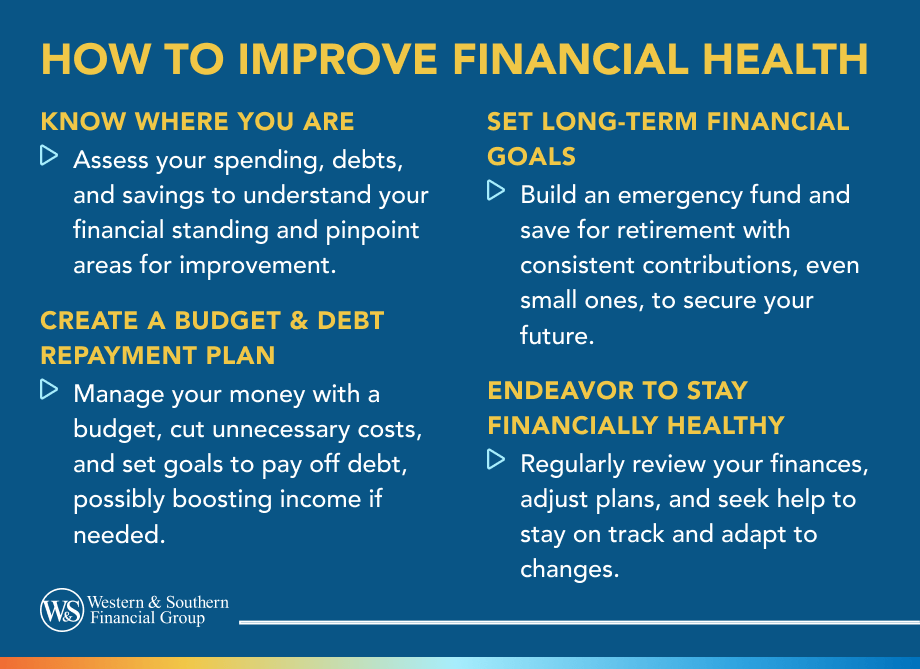

- Understand your income, expenses, debts, and savings to know your current financial situation.

- Create a detailed budget to manage money effectively and include a debt repayment plan.

- Build an emergency fund and save for retirement to achieve long-term financial goals.

- Stay disciplined and make adjustments to maintain financial health over time.

- Consult a financial advisor if you need expert guidance to improve your finances.

You probably pay close attention to your physical health and understand that eating better and exercising more are key to living a healthier life.

But there's often less discussion around how to improve financial health and the key tactics that could help you stay financially fit. Though everyone's financial situation is different, there are several strategies you can follow to help improve your financial well-being and get better control of your personal finances. Here's what to know.

What Is Financial Health?

While there's no official definition for the term "financial health," it's used to describe the state and stability of a person's finances. Achieving financial health means having the resources necessary to meet both your current needs and short- and long-term goals — whether that's purchasing a home, saving for college or retirement or enjoying retirement.

There's no official measurement index for financial health either, but the Consumer Financial Protection Bureau (CFPB) offers a Financial Well-Being Scale that allows people to assess their individual finances.1 The CFPB actually defines financial well-being as "a state wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life."

The financial health assessment asks questions such as whether you could handle a major unexpected expense, whether you feel like the money you have will last, if you feel you are just getting by and whether you feel you can enjoy life because of how you're managing your money. Answering these questions can help you understand your financial health and improve it.

4 Considerations Around How to Improve Financial Health

Thankfully, it is entirely possible to identify and enhance financial health. If you're looking to get a better understanding of your personal situation — and improve it — here are four considerations.

1. Know Where You Are

The first step toward improving your financial health is to understand your current financial situation. This means knowing how much you spend each month, your current debts (and their interest rates) and how much you've currently saved for retirement.

Going through this exercise on a regular basis can help you develop a fuller financial picture and understand what challenges you need to address to improve your financial health.

2. Create a Budget & Debt Repayment Plan

Once you understand where every dollar you earn currently goes, you can develop a plan to allocate your money more effectively. Creating a budget is a key to better financial management.

In your budget, write down all your fixed, variable and discretionary expenses, such as rent, utilities, student loan and credit card payments, car and health insurance, clothing, dining and more. While you can't adjust the fixed expenses, designate a dollar amount for discretionary expenses like dining out, clothing and gym memberships. You may also find areas where you can cut spending, such as subscriptions to streaming services or magazines. A s part of your budget, consider allocating money toward debt repayment. Debt can be tackled by paying off the highest interest rate or lowest dollar amount.

Whatever approach you choose, it's important to have a plan and set a date by which you want to pay off these debts. For example, if you want to pay off a $2,000 credit card bill in 10 months, you'd have to set aside $200 a month in your budget to do so. You might also need to find places where you can decrease your spending to pay down debt — or it may lead you to find ways to increase your income, such as starting a side hustle, finding a part-time job or finally asking your boss for a long-overdue raise.

Once you have visibility into your finances, you can take action and develop a plan. A budget can serve as your road map for how to get your finances in better shape.

3. Set Long-Term Financial Goals

Part of being financially healthy also includes setting — and reaching — long-term financial goals. As you work to pay down debt, it's a good idea to also consider how to bolster your emergency fund and cover retirement costs.

It may be difficult to do all these things at once, but it's important to get into the habit of saving, even if you can only set aside a little bit each month. An emergency fund is a critical tool for better financial health because financial emergencies can derail your progress if you aren't prepared for them, and potentially lead to even more debt.

Research has shown that 63% of Americans would not be able to cover a $400 unforeseen expense.2 Building your emergency fund is important because it can help provide a much-needed buffer when you need it most.

Saving for retirement is also crucial because financial health is a continuum — you have to take steps to help protect your financial future. Even if you can only allocate $50 or $100 a month to retirement, this can still be helpful because the potential compound interest could steadily increase your investments over time. History has shown that the earlier people start saving for retirement, the better. Generally, taking steps to improve your financial health today should include saving for tomorrow.

4. Endeavor to Stay Financially Healthy

Financial health is a journey, and sometimes along the way you may be in good shape. At other points, you may need to make adjustments to get to where you want to be.

The most important thing is to understand the current state of your finances and create a plan for improving it. You may decide to build your own knowledge and map out a plan on your own. Or you may wish to seek outside help and consult with a financial professional to get additional guidance.

The Bottom Line

As long as you take steps to become more engaged in your finances, you can gain a better understanding of your money, where it goes and how best to use it to achieve your short-term and long-term goals. Ultimately, that's the key to achieving better financial health.

Sources

- Measuring financial well-being: A guide to using the CFPB Financial Well-Being Scale. https://www.consumerfinance.gov/data-research/research-reports/financial-well-being-scale/.

- Question of the Day: What percentage of Americans would cover a $400 emergency with cash? https://www.ngpf.org/blog/question-of-the-day/question-of-the-day-what-percentage-of-americans-can-not-cover-a-400-emergency-with-cashsavings-account-emergency-fund2022/.