- The U.S. economy has been resilient to Federal Reserve interest rate hikes thus far, and investors now accept that the Fed will keep rates “higher for longer.”

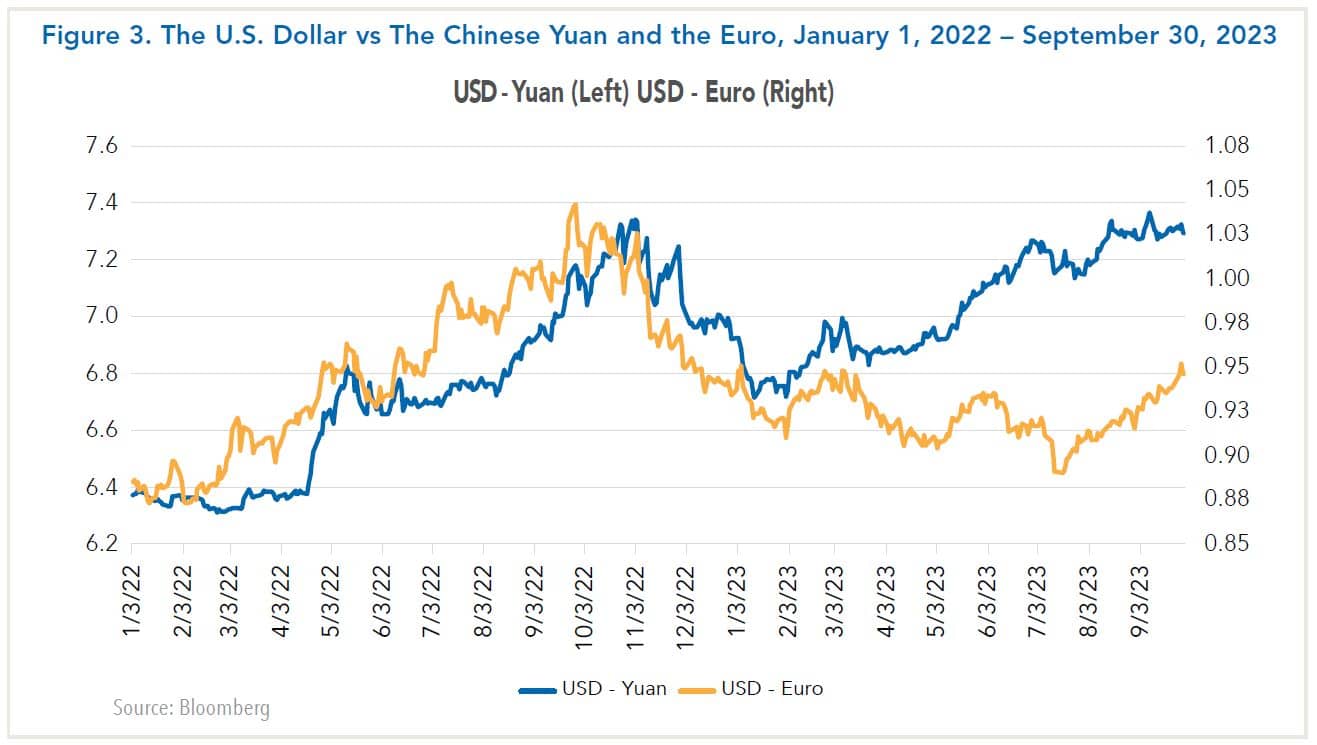

- In response, Treasury yields rose by more than a full percentage point in the third quarter and the dollar strengthened against the euro and Chinese yuan, while the U.S. stock market sold off.

- The easing in U.S. core inflation has improved the prospects for a “soft landing,” although the economy could soften as the labor market cools. By comparison, the eurozone (EU) economy appears in a mild recession while China’s economic miracle is now in question.

- Amid these developments, the risk of holding stocks has increased relative to bonds; accordingly, we are now maintaining a neutral allocation for stocks and bonds while positioning for a decline in Treasury yields.

Q3 Recap: U.S. Bond Yields and the Dollar Move Higher, While Equities Sell Off

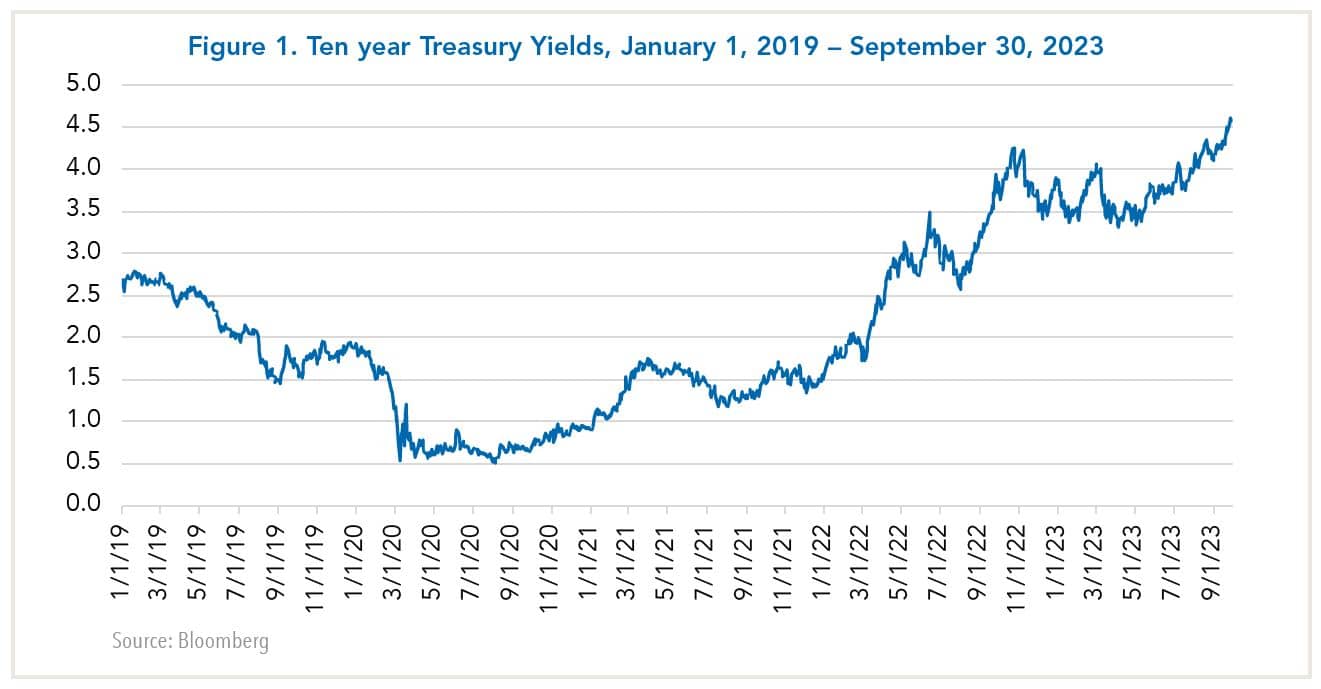

Investment results for the third quarter reversed the pattern during the first half of the year. The ten-year Treasury yield surpassed 4.6% at one point (Figure 1), the highest level in 16 years. As a result, returns on Treasuries and corporate bonds for the first three quarters of this year are now negative for the second consecutive year (Figure 2). The U.S. stock market, in turn, surrendered some gains after a strong showing in the first half.

Figure 1. Ten Year Treasury Yields, January 1, 2019 - September 30, 2023

Figure 2. Investment Returns by Asset Class, 2023 YTD and 2022

| STOCK MARKET | 2022 | H1 2023 | Q3 2023 | YTD 2023 |

|---|---|---|---|---|

| U.S. (S&P 500) | -18.1 | 16.9 | -3.3 | 13.1 |

| NASDAQ | -32.5 | 32.3 | -3.9 | 27.1 |

| Russell 2000 | -20.5 | 8.1 | -5.1 | 2.5 |

| International (EAFE $) |

-13.9 | 12.2 | -4.0 | 7.6 |

| Emerging Markets (MSCI $) | -19.8 | 5.1 | -2.9 | 2.1 |

| U.S. BOND MARKET | 2022 | H1 2023 | Q3 2023 | YTD 2023 |

|---|---|---|---|---|

| US Aggregate Bond | -13.0 | 2.1 | -3.2 | -1.2 |

| Treasuries | -12.5 | 1.6 | -3.1 | -1.5 |

| IG Credit | -15.3 | 3.1 | -3.0 | 0.0 |

| High Yield | -11.2 | 5.4 | 0.5 | 5.9 |

| JPM EM Debt | -17.8 | 4.1 | -2.2 | 1.8 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

By comparison, both the economies of China and the EU faltered after strong starts in the first quarter. As a result, their stock markets have lagged the U.S. market and their currencies have come under renewed pressure versus the dollar (Figure 3).

Figure 3. The U.S. Dollar vs. the Chinese Yuan and the Euro, January 1, 2022 - September 30, 2023

Looking ahead, investors are still hopeful that the Federal Reserve is about to end its tightening cycle. However, they have tempered their expectations for declines in the funds rate next year amid consistent messaging that the Fed will keep rates “higher for longer.”

Meanwhile, prospects for a soft landing have improved as core inflation has come down significantly this year. Still, investors must assess whether the U.S. economy can stay resilient now that interest rates are positive in real terms and economies abroad are weakening.

Factors That Make the U.S. Economy Resilient

In our view, the U.S. economy’s resilience reflects several considerations. First, the economy has proved to be more sensitive to the availability of credit than to the cost of credit over the past five decades. The most severe recessions were in the early 1980s and during the 2008 financial crisis when the banking system was at risk and credit conditions tightened.

Today, the banking sector is exposed to rate hikes because banks have to manage a maturity mismatch between long-term loans and short-term deposits. The failures of Silicon Valley Bank and Signature Bank this spring raised concerns about the ability of regional banks to manage interest-rate risk. By and large, however, bank problems have been contained thus far, although the Fed and market participants are monitoring a tightening in bank credit.

Another consideration is that, even though the Fed has raised rates by 525 basis points over the past 18 months, interest rates have only been positive in real terms since the early part of this year. With the funds rate now at 5.25%-5.50% and core PCE inflation in the vicinity of 3.5%, real rates are about 2%, which is restrictive. Therefore, as rate hikes filter their way through the economy, they could have more of an impact in the months to come.

The labor market is beginning to cool somewhat as reflected in declines in job openings, slower hiring, and cooler wage growth. Real consumption is estimated to have grown close to a 3% annualized rate in the third quarter, but real disposable income likely declined in the quarter. Consumers have responded be drawing on savings and much of the cushion from COVID-19 transfer payments has been eliminated. Therefore, the recent pace of spending does not appear sustainable.

Finally, several characteristics of the U.S. economy make it more resilient than most other industrial countries. First, it is highly diversified, such that shocks do not impact the various sectors uniformly. Second, the U.S. labor force is very flexible. When the COVID-19 pandemic struck and workers lost their jobs or became house-bound, many became self-employed and entered the gig workforce. This is testimony to the rapid expansion of the digital economy in America. Third, U.S. multinationals are also very dynamic and global leaders, with 15 of the 20 largest corporations in the world today headquartered in America.

China and the EU Are Struggling

Compared to the U.S., both the economies of China and the EU have faltered since spring after a strong start to the year.

Expectations for China’s economy were high when the government ended its zero-COVID policy. However, it weakened in the second quarter, and the latest indicators point to continued softness. The main concern is that the property sector, which accounts for one quarter of the economy and 70 percent of household saving, has slumped as problems with Evergrande, the country’s largest developer, have spread to other developers. On the policy front, China’s leader Xi Jinping is more committed to expand his control than to bolster economic growth. China also has less scope to bolster the economy than before with the ratio of total debt to GDP having doubled in the past 15 years to 300% of GDP.

Some observers are now questioning whether the country’s development model that transformed it from a backward agrarian economy in the 1970s to the world’s second largest economy today is at risk. Three pillars of the strategy are being challenged:

- China has moved away from reforms that promoted growth of the private sector to favor inefficient state-owned enterprises.

- Public investment is now confronting diminishing returns due to over-building that has led to bankruptcies.

- China’s ability to export and to attract foreign direct investment has diminished as a result of heightened tensions with the U.S.

Consequently, some forecasters now believe the country’s long-term growth rate could be halved to 2.5%-3% per annum from 5% currently.

The eurozone economy has also weakened since the second quarter after a strong start. Germany’s economy, which accounts for one quarter of eurozone GDP, was flat in the second quarter, and the Kiel Institute recently revised its forecast for this year to minus 0.5 percent. This mainly reflects declines in industrial output and construction activity and soft consumer spending.

The main issue being debated now is whether German weakness is cyclical or structural. Economists at UBS argue that Germany’s problems are more structural than cyclical: Germany’s economy has lagged peers such as France and Italy since 2019, a full year before the COVID-19 pandemic. The main culprit on the demand side has been under-investment, which is estimated to have detracted 0.4 percent from annualized growth.

In this context, Germany’s economy is being impacted on several fronts:

- First, it has been forced to reduce its reliance on Russian natural gas and shift to alternative sources of energy that are more expensive.

- Second, Germany’s export capability has been hampered by the weakening of China’s economy since the onset of the coronavirus pandemic.

- Third, the construction industry, which makes up 12 percent of German GDP, has been hurt by a confluence of factors that threaten to leave builders on the brink of collapse.

These factors have increased the risk that the eurozone will experience a mild recession in the remainder of this year and into next year. Meanwhile, the European Central Bank is committed to keep interest rates high until inflation recedes towards its 2% target.

Positioning Investment Portfolios

The bottom line is that the U.S. economy has weathered Fed rate hikes much better than expected, but there are two key risks that could cause it to weaken. One is that the cumulative effect of Fed rate hikes could dampen economic activity, particularly in interest rate sensitive sectors. The other is that weakness abroad, coupled with renewed dollar strength, could hamper U.S. exports. In our view, downside risk to economic growth is more pronounced. Against the backdrop of market expectations are for a soft landing, caution is warranted when constructing portfolios.

In balanced portfolios, we favor a neutral allocation to equities relative to fixed income. Volatility has increased in recent months, but equity markets generally reflect a high probability of a soft landing. Our cautious economic outlook coupled with fair to expensive valuations and low conviction results in relatively low risk levels within investment portfolios. Should further weakness materialize, portfolios are positioned to prudently increase exposure if warranted.

In fixed income portfolios, we are positioning portfolios with a modest overweight to credit sectors, focusing on investment grade corporate bonds, emerging markets debt, and securitized products (CMBS, ABS, and MBS). If the economy slows more than expected, credit spreads are likely to widen from current levels. However, if a soft landing is achieved or a recession is shallow, credit spreads would likely narrow somewhat. Weighing these scenarios, we believe the risk/reward in credit spreads supports a modest overweight to risk in portfolios. With regard to interest rates, we are positioning portfolios with a slight long duration bias. We believe that the growth and inflation outlook will continue to bias interest rates lower over the next several months.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations have adjusted to more normalized levels and earnings expectations have fallen, but continued slowing in economic growth will weigh on both valuations and earnings. We are prioritizing high barrier to entry companies with high returns on capital and maintaining a defensive posture within portfolios.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The securities identified do not represent a complete list of all securities purchased, sold, or recommended; please contact Fort Washington for a complete listing of securities held, sold, or purchased over the last year. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Past performance is not indicative of future results.