Highlights

- Interest rate volatility has remained elevated in Q3 following market reactions to incoming economic data, both inflation and employment figures.

- Recent labor market data has caused some investors to question the strength of the U.S. economy, challenging the “no landing” narrative.

- Investors, and the Fed, have gained additional confidence that inflation is on a sustainable path lower. The market currently expects a rate cut in September.

- Changing expectations for Fed policy continue to drive markets. The magnitude of cuts will be the focus; market anticipates 200 basis points of cuts through 2025.

- Given historically tight spreads and uncertainty around economic growth, we are positioning portfolios with risk toward the lower end of our typical range.

Economic Outlook

- We believe the labor market is largely balanced and that restrictive monetary policy is becoming more evident in the data. Rising jobless claims, rising unemployment rate, and slower non-farm payrolls are casting doubt over the continued strength of the U.S. economy.

- While the quick uptick in the unemployment rate is noteworthy, this is partially due to the increase in labor, which has been impacted by immigration.

- The first Fed rate cut is expected in September, but the path of rates is forecasted to be gradual, which implies policy will be restrictive through most of 2025.

- Lower income consumers are already feeling the pressure of higher rates. Delinquencies are above pre-pandemic levels, and many Americans are holding multiple jobs to keep up with inflation.

- Conversely, higher income households have seen a large increase in net worth, and because they are responsible for a large share of spending, have supported aggregate consumer spending.

Our expectation is for the economy to continue slowing, which we expect will soften the labor market. This weakening in the labor market should put downward pressure on wage growth, and subsequently inflation which should provide the Fed with the confirmation needed to continue cutting rates.

Inflation

- A series of lower prints, including softening services, has given the Fed greater confidence that inflation will continue toward their 2% target.

- The services component of inflation has kept the aggregate figures high, but we expect shelter to continue slowing over the next 12 months, which will bias inflation down.

- The expectation of lower inflation and a cooling labor force has paved the way for rate cuts in the near term. Currently, we anticipate a 25-basis point cut in September.

- As the first rate cut approaches, and certainly following the cut, we expect investors to become more focused on the magnitude of cuts. Currently the market is priced for 4 cuts in 2024 and 4 in 2025 leading to a terminal rate around 3.25.

Multi-Sector Portfolio Positioning

In our multi-sector fixed income portfolios, the risk budget target remains at 30%, positioning for a moderate overweight to risk. Markets are pricing in a high probability for a no landing, resulting in spreads at historically tight levels with risk/reward skewed to the downside.

The most meaningful changes to positioning have been in respect to interest rates. Portfolios were biased longer duration in July but shifted back neutral following the sharp decline in rates since the end of July.

We continue to expect opportunities for tactical adjustments as the market adjusts its expectations for the Federal Reserve’s policy. From a key rate perspective, portfolios are positioned for the yield curve to steepen, although to a lesser extent than at the end of Q2.

- The strategy has positioned duration between 4.5-5.5 years throughout the quarter as rates experience volatility, currently targeting a level around 4.5-5.0 years.

- Conviction positions include BBB-rated subordinated banking, Emerging Markets Debt high yield, and non-agency ABS/CLO/CMBS. The strategy continues to target HY credit exposure around 10% (near the lower end of the historical range) as spreads remain tight.

- The Core Plus strategy has maintained credit risk and allocations have been stable during Q3. Separately, duration has been tactically adjusted and from a key rate perspective, portfolios are positioned for the yield curve to steepen, although to a lesser extent than at the end of Q2.

- The strategy continues to hold high yield CDX protection in order to reduce overall credit exposure with HY spreads near historical tights. The strategy favors non-agency securitized sectors (i.e. ABS/CLO/CMBS/RMBS).

- The Core strategy has maintained credit risk and allocations have been stable during Q3. Separately, duration has been tactically adjusted and from a key rate perspective, portfolios are positioned for the yield curve to steepen, although to a lesser extent than at the end of Q2.

- The strategy is maintaining overweight allocations to Investment Grade Corporates through high quality subordinated financials, and Securitized, through high quality non-agency CMBS.

- The strategy has kept sector allocations and risk posture steady over the quarter and continues to favor the belly of the curve.

- Structured products are underweight relative to the benchmark due to lower exposure to Agency RMBS, but at a more detailed level we are maintaining the risk overweight through high quality non-agency CMBS.

Single Sector Portfolio Positioning

- The strategy has a modest overweight to risk relative to the index, but the team continues to look for opportunities to reduce risk in favor of higher quality issuers with good liquidity.

- Technicals for the sector are generally positive as supply is expected to decrease, average dollar prices are low, and nominal yield buyers remain robust.

- The strategy’s high conviction issuers include subordinated financials and BBB-rated industrials while looking for opportunities in cyclicals and technology on weakness.

Securitized Products

- We continue to favor non-agency exposure with an underweight to Agency RMBS. Despite meaningful spread tightening across much of the non-agency space this year, there are still pockets of attractive relative value such as high-quality non-agency RMBS (especially discount prime jumbo 2.0).

- The strategy has biased credit quality up given the spread between tranches (AAA, AA, etc.) has flattened and investors are not being compensated to take on additional credit risk.

- EMD has maintained a modest overall credit risk profile (30%-40% of maximum spread beta budget) over the past few months. High yield continues to be favored over investment grade issuers even as spreads have tightened. However, there has been a modest rotation out of single-Bs into BBs.

- The team is finding value in distressed names, countries with improving fundamentals, and corporates with solid financials that are lagging their respective sovereigns.

- Key risks to the outlook include negative growth or inflation surprises, and escalation in global hotspots such as the Middle East.

- Portfolio activity is focused towards maintaining a higher quality bias and a preference for less cyclical exposure as spreads are near historically tight levels.

- Default activity has stabilized, albeit at an elevated level, but we do not anticipate relief in the near term. Consequentially, we do not believe investors are being compensated for the downside risk of increasing defaults.

Market Performance

Rates have moved significantly lower during Q3 as investors anticipate near term rate cuts. The 10-year Treasury is down 48bps, and the curve has also steepened.

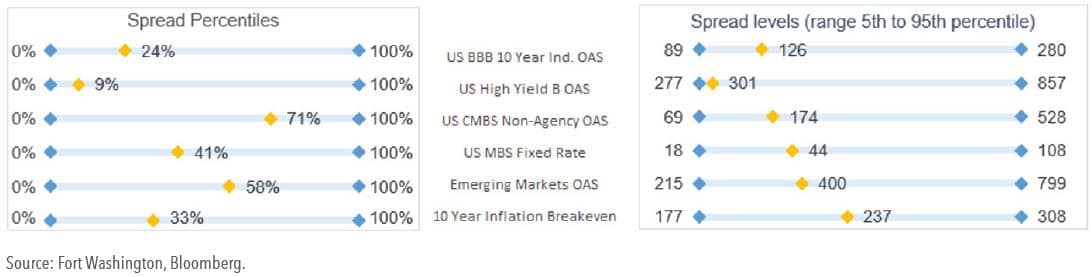

Spreads experienced volatility in early August, widening modestly from where we began the quarter. However, credit spreads remain near historically tight levels.

The Bloomberg US Aggregate Index is up ~3.4% through August 15th, driven primarily by rates.

Figure 1. U.S. Treasury Rates Since 06/30/2024 (as of 08/15/2024)

Figure 2. Spread Detail (as of 08/15/2024)

Download Mid-Quarter Fixed Income Update – 3Q 2024

Download Mid-Quarter Fixed Income Update – 3Q 2024