Highlights

- Index-Equivalent Spread Duration (IESD) improves upon traditional measures of credit risk.

- IESD combines credit risk into a single metric that allows for apples-to-apples comparisons across different sectors.

Traditional Risk Measures

The risk budgeting process for Fort Washington is fundamentally based on managing credit risk. However, when analyzing potential ways to capture the aggregate credit risk in a portfolio, drawbacks of traditional risk measures become evident. A few examples of common metrics—along with their shortcomings—are below.

- Credit Ratings – Ratings from nationally recognized agencies provide a quick way to obtain a high overview of issuer risk, such as a company being Investment Grade vs High Yield. However, credit ratings have not historically been a great predictor of issuer credit risk, especially within the below investment grade space. Many argue that a reliance on credit ratings contributed to the financial crisis in 2008.

- Historical Metrics – Beta, VaR (Value at Risk), tracking error, and others are risk analytics that simply use historical volatility and/or correlations to quantify risk. As we know, historical performance is not an indication of future returns. The same principle holds true for risk. This concept is most apparent during times of extreme stress, such as a recession, when correlations do not follow historical patterns but risk measurement is paramount.

- Spread Duration – This is a useful analytic, but it does not represent the complete story of credit risk. While this metric shows the sensitivity of a portfolio to changes in spread, it leaves out the fact that price change is proportional to the level of spread.

- To exemplify, a portfolio that matches the spread duration of a benchmark can still take more credit risk by investing in securities with wider spreads (generally lower quality) than that of the benchmark.

Index-Equivalent Spread Duration

As a result of the above, Fort Washington has spent considerable time evaluating risk metrics that would improve the risk budgeting process, and as a result, implemented a proprietary measure that is used throughout the portfolio management process - Index-Equivalent Spread Duration. IESD is a modified version of spread duration that measures aggregate credit risk in a single figure. IESD increases the efficiency of monitoring credit risk by accounting for the following:

- Riskier bonds tend to experience larger spread moves.

- Shorter maturity bonds tend to experience more spread volatility than longer bonds.

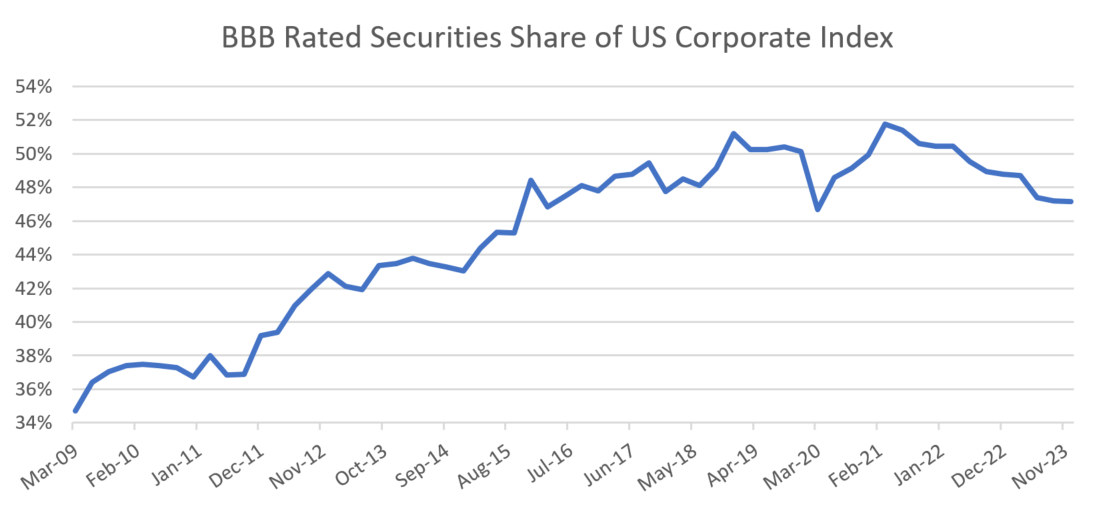

IESD, as indicated in the name, is indexed to a basket of securities. While it might be intuitive to use a broad market index for this part of the process, that has a disadvantage. Indices tend to exhibit exposure drift over time, as seen in the exhibit below. This presents a consistency issue when applying an index to a measure of risk over time. In order to control for credit inconsistencies, Fort Washington utilizes a basket of similarly rated securities to calculate IESD within our process.

Source: Bloomberg.

Source: Bloomberg.

The Value of Index-Equivalent Spread Duration

IESD adds many valuable benefits to our risk management framework:

- Improves upon traditional measures of credit risk, resulting in greater efficacy in managing portfolios.

- For the Bloomberg US Aggregate and the US Credit Indices, actual spread returns compared to the forecasted spread return by our index-equivalent spread duration have a correlation of 95% and 99%, respectively, over the last decade.

- Provides an explicit measure of aggregate risk, which is utilized within the risk budgeting process.

- Intuitive, transparent, and easy to comprehend metric expressed in years, similar to duration.

At Fort Washington, we value the importance of risk management and its ability to enhance risk adjusted returns. We believe our IESD provides us a competitive advantage when measuring portfolio level risk and adjusting it over a market cycle, which has contributed to excess returns across our multi-sector fixed income platform.