Highlights

- Fissures are showing in segments of the market for leveraged credit. Strategic portfolio positioning is crucial.

- Disaggregated data indicate that the high yield market is bifurcated between BB and B-rated credits versus CCCs, where it is significantly discounting underperforming credits. Default risks are also increasing in the leveraged loan space due to aggressive Federal Reserve tightening.

- Yield spreads between corporate bonds and U.S. Treasuries are a standard method investors use to analyze risks in holding investment grade and high-yield bonds. Based on current metrics, the perceived risk of default appears modest, as junk bond spreads are unusually low.

- However, the average credit quality of the junk bond market today is considerably higher than before the 2008 financial crisis and the passage of Dodd-Frank legislation. This is mainly due to the rapid growth of leveraged loans and private credit, both of which now rival the size of the junk bond market and account for a large share of leveraged buyout (LBO) and M&A financings.

What Junk Bond Spreads Signal About Recession Risks

Since the Fed began tightening monetary policy aggressively two years ago, investors have been looking for signs that the U.S. economy is on the cusp of recession. The most cited indicator is the shape of the Treasury yield curve, which has been inverted since mid-2022, as short-term rates have increased considerably more than long-term bond yields.

Previously, a yield-curve inversion had accurately predicted the last nine U.S. recessions. However, it now appears that the streak may be over, as a recession has not materialized two years into the tightening cycle. We attribute this to the current economic cycle being different from previous ones.

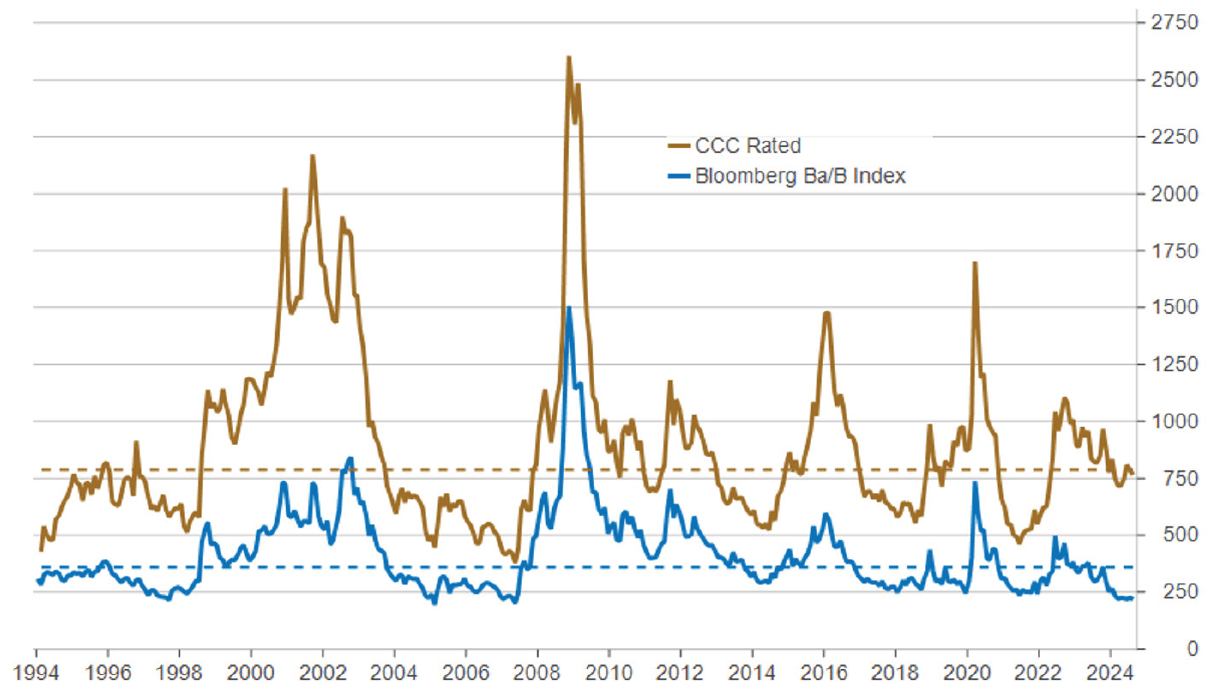

Another indicator investors typically use to gauge the probability of recession is the spread between yields on corporate bonds and U.S. Treasuries. When the risk of recession increases, corporate credit spreads – for both investment-grade and high-yield bonds – typically widen significantly. Yet, this is not happening, and corporate credit spreads for high-yield bonds are well below their long-term average (see Figure 1 below).

Figure 1. Credit Spreads Versus U.S. Treasuries, Investment Grade, & High Yield

US Corporate High Yield Spreads

Source: Bloomberg.

At first glance, this is surprising because one would expect credit risks to increase since the Fed raised the funds rate by 525 basis points. However, the use of historic credit spreads in the junk bond market has become a less reliable gauge because of changes in the market for below-investment-grade credit since the 2008 financial crisis.

One of the most important changes was the passage of Dodd-Frank legislation, which increased the capital requirements for commercial banks, forcing them to reduce leverage on their balance sheets. Consequently, much of the lending to small and medium businesses is now being financed in other segments of the market.

Whereas the junk bond market was previously the dominant market for leveraged credit, there has been explosive growth in leveraged loans and private credit over the last 15 years. Each asset class is now in the range of $1.4 trillion–$1.7 trillion (see Figure 2). Accordingly, junk bonds represent only one-third of the leveraged credit market today.

Figure 2. Changing Composition of the Market for Leveraged Credit (2010-2023)

Source: Fort Washington.

Source: Fort Washington.

Many of the current financings in leveraged loans and private credit, moreover, would have been low B or CCC-rated bonds if done in the high-yield bond space. This implies that average quality of the high yield market today is higher than the historical average, as most LBO and M&A financings have been done outside the junk bond market. CCC-rated bonds account for only 6% of high-yield bond issuance in the last 18 months compared with nearly one quarter of all issuances from 2004-2007.

When the high yield market is disaggregated by credit quality, there is a clear bifurcation in how investors are assessing default risks. For example, the credit spreads for BB and B-rated bonds currently are in their lowest deciles, while that for CCC-rated bonds is close to the median. This suggests that the high yield market is already significantly discounting underperforming credits, but defaults are expected to be meaningfully lower than in other cycles.

Perspective From Leveraged Loans

The story for leveraged loans is similar to high-yield bonds, but there are also some important differences.

One is that financing for leveraged loans is on a floating rate basis of LIBOR +/- 300 basis points, whereas high-yield bonds are fixed rate. This has resulted in a significant increase in debt servicing costs for borrowers, with financing costs climbing from 3%-4% before the Fed tightened its policy to 8.5% since mid-2023.

With many companies leveraging their balance sheets by a factor of six times, some are having difficulty absorbing the increased interest expense. Fitch Ratings recently revised its leveraged loan default rate estimate for 2024 to 5.0%-5.5% from 3.5%-4.0% previously. This mainly reflects cash flow pressures from slowing GDP growth and high interest rates that are "posing challenges to highly-levered issuers' liquidity positions and ability to service debt."

The growth of the leveraged loan market and the Collateralized Loan Obligation (CLO) market are two sides of the same coin. The movement of assets towards being 'private' and the drive for securitizing asset pools have driven new leveraged financing towards loans that can be packed into CLOs, which account for approximately 70% of the leveraged loan market.

The rapid growth of the CLO market and demand for paper have allowed covenant protections that were historically associated with loans to erode. Previously, loans had covenants that needed to be adhered to or they would require a waiver from the lenders. However, covenant-lite loans now account for more than 90% of the leveraged loan market and no longer have maintenance covenants.

This development, along with the syndication of loans to a broader market, has eroded protections creditors once enjoyed. Coupled with an increase in leverage, it has led to lower recovery rates when companies default or restructure.

The dominance of CLO ownership has also led to material changes in liquidity in the market for leveraged loans. Performing loans or ones that can be placed in a CLO portfolio are liquid. However, underperforming or stressed loans are in a vacuum in which there is not a large and natural secondary market for leveraged loans outside of CLOs. This void has led to extensive liquidity management exercises for distressed companies and much of the creditor disputes that have been written about lately.

The Private Credit Market

The private credit market, which refers to lending to small and medium-size companies by non-bank institutions, has also experienced rapid growth in recent years. It now rivals both the junk bond market and leveraged loan market in size at $1.5 trillion.

One advantage of using private credit rather than bank loans is they can be tailored to meet borrowers' needs in terms of size, type of credit, and timing of transactions. The majority of private credit lending is in the form of floating-rate investments.

There are four common types of private credit: (1) direct lending to private non-investment-grade companies; (2) "junior capital" for debt that is not secured by assets and ranks below senior loans for repayment in the event of default or bankruptcy; (3) financing for distressed debt for companies undergoing operational turnarounds and balance sheet restructuring; and (4) special situations that may include companies undergoing M&A transactions or other capital events that are driving their borrowing needs.

Given the risks entailed in this segment of the market, creditors need to closely analyze borrowers' earnings and cash flow projections, as well as their liquidity management. While borrowing costs have increased significantly over the past two years, most borrowers in the market have been able to manage their liquidity, according to Morgan Stanley.

The main reason private credit is attractive to investors is the flexibility and control it offers: Because deals are not broadly syndicated, lenders can work with companies to accommodate changes in performance and cash flows. In many ways, it is similar to the bank loan market in the past when banks would hold loans on their balance sheets.

One difference is the private credit market today is more leveraged than before, with leverage closer to six times than three times. However, lenders in the private credit market are large, consolidated, and have control of their underlying investment if required.

Positioning High Yield Portfolios

In sum, we do not believe the incoming economic data and financial market indicators point to a recession on the horizon. However, there are signs of fissures in the lowest rated segments of the credit markets.

In this context, we are positioning investment portfolios in the high yield market at the lower end of our risk budget as performing credit spreads are currently near their highest decile. Therefore, the predominance, if not all, of the return comes from coupon and income. Accordingly, we are positioned to maximize income in the portfolio from being overweight BB and higher-rated credit and underweight most cyclical sectors. We are relying on credit selection and idiosyncratic risk to outperform.

Download Leveraged Credit Markets: Then and Now

Download Leveraged Credit Markets: Then and Now