- Many investors, including Endowments & Foundations, Pension Plans, and Insurance Companies, are increasingly turning to non-traditional fixed income strategies as a way to complement their traditional Core and Core Plus portfolios.

- Non-traditional approaches, such as Multi-Sector and Unconstrained Fixed Income, may provide investors with enhanced returns, higher yield, portfolio diversification, flexibility, and exposure to unique asset classes.

- Investors must be prudent when allocating to the space and should understand the risks associated with the different non-traditional fixed income approaches.

- Unconstrained—or go anywhere funds—often take large interest rate bets and have a high degree of credit risk, which can produce unfavorable results in times of distress. Unconstrained funds are also wide ranging in scope, resulting in a high degree of uncertainty around their risk and return profile and what investors can expect over time.

- A well-managed Multi-Sector approach with a focus on risk management that balances interest rate risk with credit risk can be well suited for investors seeking to enhance risk adjusted returns and income over the long run.

What Are the Common Multi-Asset Fixed Income Approaches?

Traditional

Core. Core fixed income strategies are often managed against a common benchmark, such as the Bloomberg Barclays US Aggregate Index. The opportunity set is often constrained to index-only constituents, which includes a meaningful allocation to U.S. Government securities and excludes non-investment grade rated securities. Duration is typically managed close to the benchmark, resulting in moderate interest rate exposure that approximates the overall fixed income market. The result is a lower risk strategy that can provide modest outperformance vs. the Bloomberg Barclays US Aggregate Index (~0.50% to 0.75%).

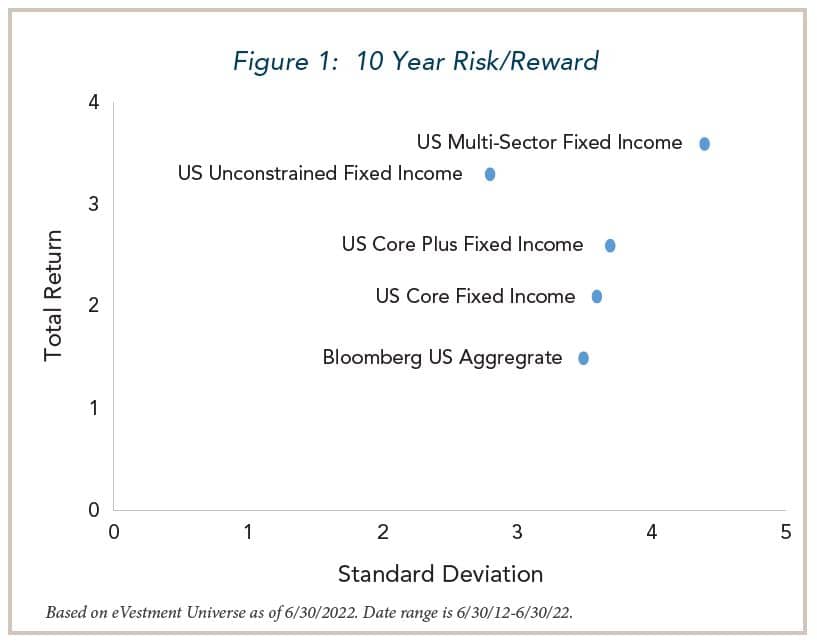

Core Plus. Core Plus strategies are similar to Core mandates but include “plus” sectors. Plus sectors are non-index sectors that are often non-investment grade rated, with most strategies allowing up to 40% to 50% of their portfolio in plus sectors. Such sectors include High Yield and Emerging Markets Debt. Additionally, Core Plus strategies often employ derivatives and modest leverage, and duration is managed close to the benchmark, similar to Core mandates. Core Plus strategies have higher risk compared to Core but have provided excess returns over time that have been almost double that of Core strategies (~1.0% to 2.0%) (Figure 1).

Non-traditional

What Are the Risks and Benefits Associated with Non-Traditional Approaches?

Benefits

Enhanced Return. Multi-Sector bond strategies have historically outperformed traditional strategies.2

Flexibility. Having the flexibility to react to market dislocations in a timely manner is a benefit of non-traditional fixed income approaches. Their agility and ability to take positions in various sectors and instruments is an important aspect of generating alpha.

Expanded Opportunity Set. Core and Core Plus strategies are largely invested in index-only sectors and securities. Multi- Sector and Unconstrained approaches venture beyond index sectors into areas that may be less trafficked, providing more opportunities for outperformance.

Risks

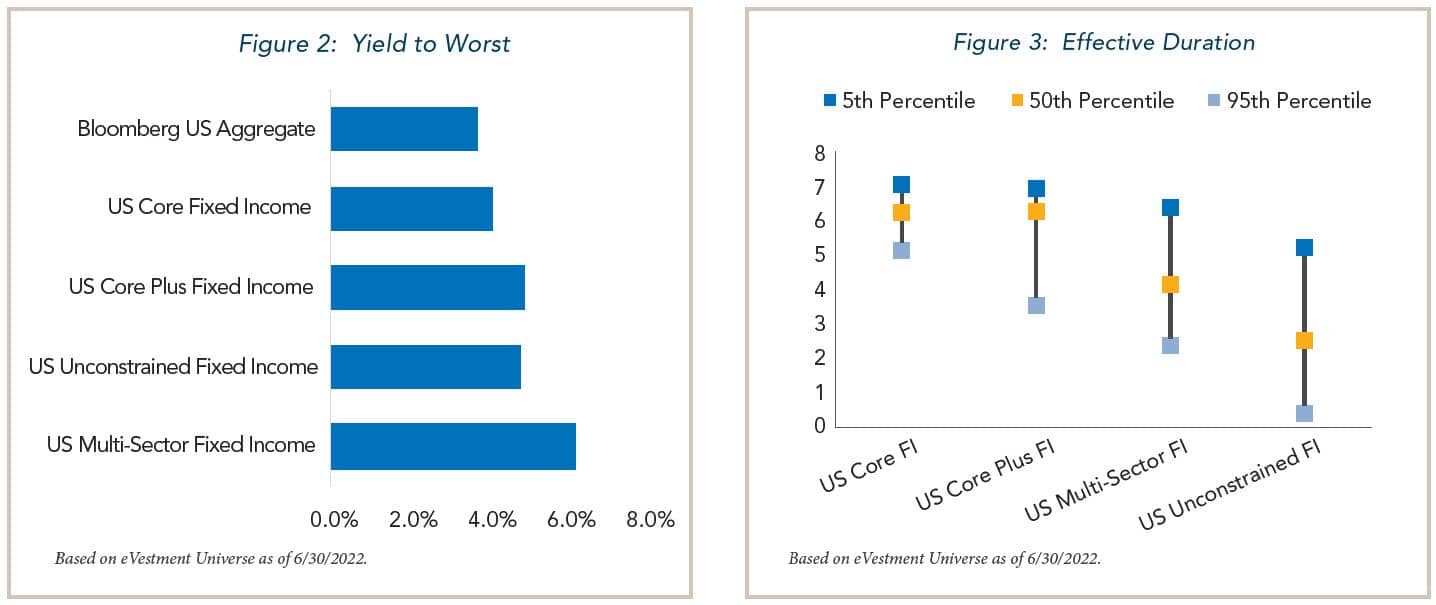

Interest Rate Risk. Unconstrained strategies often make large bets on the direction of interest rates, which traditionally have proved to be unreliable sources of return in for portfolios. This leaves investors with significant credit risk and limited downside protection.

Credit Risk. Multi-Sector and Unconstrained funds often have higher credit risk compared to traditional approaches. Plus sectors (High Yield, Emerging Markets Debt, etc.) can be up to 100% of the portfolio, compared to 40% to 50% for Core Plus.

Diversification. Concentrated risks can pose issues for investors in Unconstrained funds, which often take outsized positions in various markets, including credit, currency, equity, and interest rates.

Risk/Reward Uncertainty. Unconstrained funds have limited restrictions around their fund objectives and guidelines, resulting in high uncertainty around their risk and return profile and what investors can expect over time.

Summary of Non-Traditional Approaches

| Multi-Sector | Unconstrained | |

|---|---|---|

| Strategy | Defined objectives | Go anywhere |

| Interest Rate Risk | Moderate | Wide ranging |

| Credit Risk | Moderate to High | High |

| Diversification | High | Moderate to Low |

| Leverage | Modest | Variable |

| % "Plus" Sectors | 0% - 100% | 0% - 100% |

| Sectors | Core Plus + ABS, CLO, CMBS, Loans, Preferreds, Privates, Equity |

Go anywhere, short and long |

Where Do Non-Traditional Approaches Fit in an Investor's Portfolio?

Who Should Consider Non-Traditional Fixed Income?

- Foundations & Endowments. One benefit of non-traditional fixed income is the above average yield. The yield on the Bloomberg Barclays US Aggregate has been well below 5% for the past 10 years, creating a difficult environment for those reliant on a high income stream. Non-traditional fixed income funds typically have yields well above traditional strategies, making them an attractive allocation for Foundations & Endowments needing to meet their spending requirements.

- Pension Funds. Many defined benefit pension plans have become fully funded due to the strong bull market we’ve seen over the past decade. As a result, investors are looking to reduce equity exposure. Non-traditional fixed income is a viable alternative to equities as pension plans de-risk, offering higher yields and returns than traditional fixed income, while having less risk than equities. Alternatively, those looking to increase returns due to unfunded status may do so by shifting their fixed income portfolio into non-traditional opportunities that can potentially increase returns while maintaining traditional fixed income benefits of capital protection. Defined contribution plans can offer non-traditional fixed income as an alternative exposure for those looking to diversify their fixed income portfolio or enhance their overall return without adding excessive risk.

- Insurance Companies. Non-traditional fixed income strategies often provide enhanced returns in a capital efficient manner, making them attractive for most insurance investors. Dedicated high risk asset allocations, such as high yield or equities, carry high capital charges making them less efficient from a capital standpoint. Non-traditional approaches have large investment grade allocations that have favorable capital treatment.

- Corporate. Corporations seeking to improve absolute and risk-adjusted returns may benefit from the flexible nature of non-traditional fixed income approaches. The agility inherent in these strategies becomes increasingly important as investors navigate through the later stages of the cycle.\

- Individuals. Non-traditional fixed income approaches offer differentiated, uncorrelated returns to traditional asset classes. This helps to reduce volatility for investors’ portfolios while also providing a valuable income stream that exceeds that of most asset classes available to retail investors.

1 eVestment US Multi-Sector Fixed Income universe as of 6/30/2022.

2 Morningstar Multisector Bond Universe and Intermediate-Term Bond Universe as of 6/30/2022.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable but are not guaranteed to be accurate or complete. Neither Fort Washington nor its sources for the content herein are responsible for any damages or losses arising from the use of this information. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington.