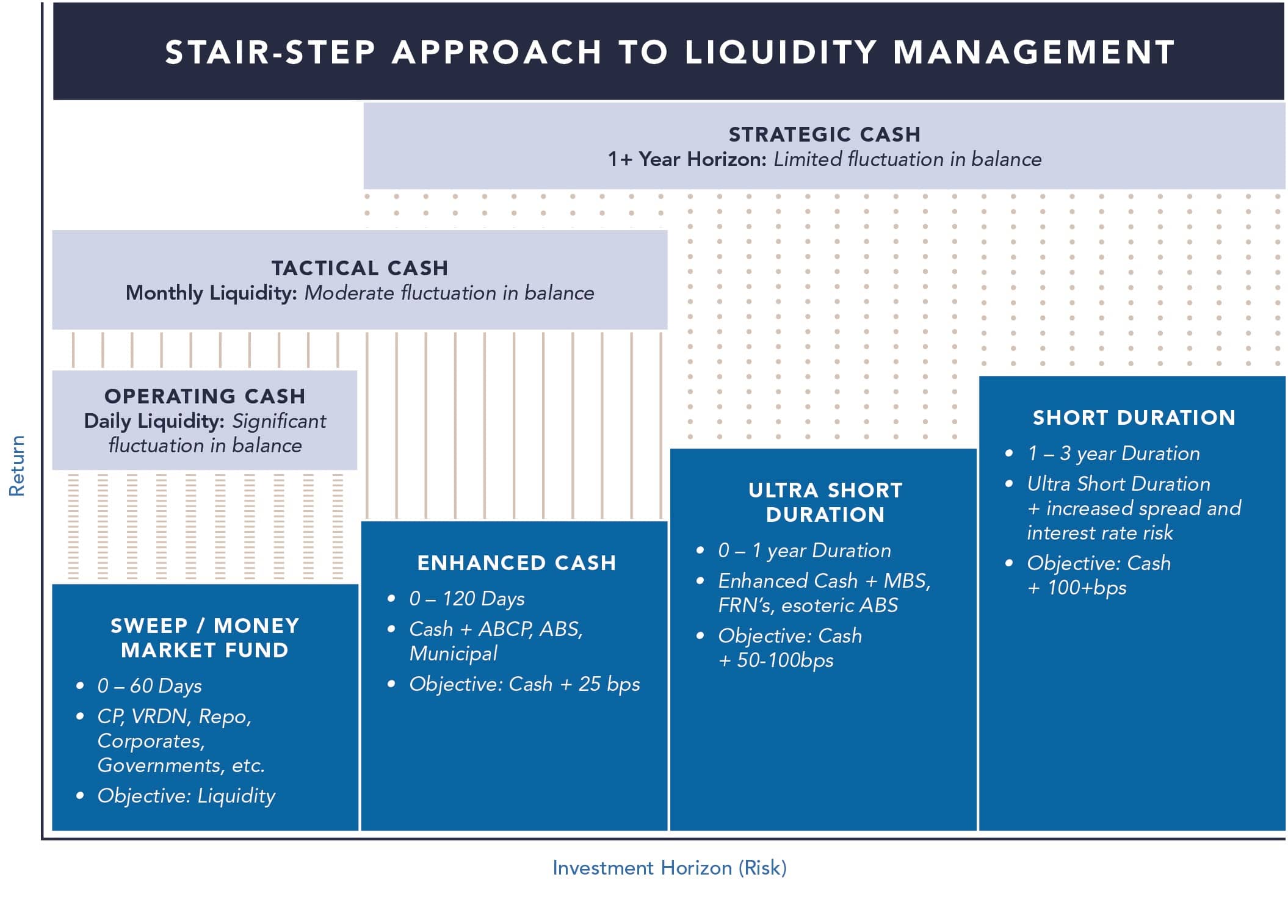

Figure 1: Stair-Step Approach to Liquidity Management

Source: Fort Washington. ABCP: Asset-Backed Commercial Paper, ABS: Asset-Backed Security, CP: Commercial Paper, FRN: Floating-Rate Note, MBS: Mortgage-Backed Security, Repo: Repurchase Agreement, VRDN: Variable Rate Demand Note. For informational purposes only. There is no guarantee that investing will result in similar results. Investing involves risks, including the potential loss of principal.

Source: Fort Washington. ABCP: Asset-Backed Commercial Paper, ABS: Asset-Backed Security, CP: Commercial Paper, FRN: Floating-Rate Note, MBS: Mortgage-Backed Security, Repo: Repurchase Agreement, VRDN: Variable Rate Demand Note. For informational purposes only. There is no guarantee that investing will result in similar results. Investing involves risks, including the potential loss of principal.

With interest rates historically low and traditional cash investments earning close to 0%, the value of optimizing short-term monies has never been more important. Moreover, changes in bank regulations have made it easier to move cash balances away from traditional banking deposit relationships (Basel III banking regulations levy a punitive capital “charge.” As a result, it is less attractive for banks to manage clients’ non-operating deposits).

The combination of near 0% sweep rates and the change in traditional bank deposits has many companies looking for alternatives. Fort Washington has worked with a wide variety of liquidity management clients. This includes smaller companies where a CFO uses traditional bank sweep vehicles to large public companies with in-house treasury functions and sophisticated investment committees. By fostering strong communication, thoroughly understanding clients’ cash needs, and how these needs change on a real-time basis, Fort Washington can provide a scope of service beyond what is typically expected of investment managers. In fact, many clients view our team as a complement to their internal treasury function. In addition to partnering with many external clients, Fort Washington also has more than 30 years of experience managing the liquidity needs of its Fortune 500 parent company, Western & Southern Financial Group. Fort Washington manages a myriad of portfolios for its parent company and understands the importance of recognizing unique needs and investment objectives.

Cash Management in Action

Fort Washington has partnered with numerous clients over the years to manage short-term monies. Our experience with these portfolios comes with a unique set of circumstances and goals for each client, and the portfolio management team works closely with them during each stage of the process to make sure they provide tailored portfolios to meet specific needs. The following scenarios highlight instances in which we have worked with clients to maximize their return on cash while balancing their need for safety and liquidity.

Cash Flow Immunization Strategies

Fort Washington has over 20 years of experience managing immunization strategies for institutional clients. We have worked on numerous multi-year construction draw schedules for a variety of organizations including healthcare institutions who want to expand existing structures or construct new wings for advancing services as well as universities that are updating facilities and constructing new administrative and classroom facilities. By immunizing the construction draws and optimizing returns on what would have been idle cash, we have been able to add measurable value. Often, these timelines are unpredictable with extensions and/or accelerated draws. However, by fostering open communication and maintaining a dynamic liquidity plan, we have been able to be flexible with these changes and meet liquidity targets while optimizing investment income.

Other immunization examples include bond/debt repayment schedules, programmatic stock buy-backs and, more recently, funds distributed through the Medicare Accelerated and Advance Payment Program (MAAP). Fort Washington works with several hospitals managing these short-term MAAP monies, which were originally expected to be repaid 120 days following disbursement. The funds were invested to maximize returns with the 4 month immunized horizon date. However, Congress may extend repayment terms and the investment portfolios have been dynamically adjusted to remain liquid while providing a return advantage over the hospitals’ traditional sweep vehicles.

Complement to Internal Treasury Function

Fort Washington’s liquidity management team offers a more dynamic solution for companies with larger cash balances and more frequent cash movements, effectively serving as a complement to the traditional treasury function. For these larger clients, real time communication allows us to provide a higher level of service with weekly and daily liquidity and facilitating inter- company transfers of cash or in-kind securities to meet larger corporate strategic objectives while continuing to optimize investment income.

Determining Proper Allocations for a Cash Segmentation Strategy

The Liquidity Management team at Fort Washington has helped clients analyze their cash balances and develop allocation targets that satisfy liquidity needs, risk tolerance, and investment income targets. For example, a current healthcare client provided the team with 5 years of historical cash balances and outlined potential future cash needs. A statistical analysis was performed, producing confidence intervals for various drawdown levels. This statistical data set, combined with the establishment of risk parameters for Enhanced Cash and Ultra Short Duration accounts, created a framework that allowed the client to comfortably allocate cash to the liquidity management strategies and optimize investment income while maintaining appropriate balances for both operating and short-term strategic needs.

Flexibility to Move at Your Own Pace

Several of Fort Washington’s liquidity management clients have been interested in making their cash work harder, but have been hesitant to change the risk profile of their cash positions in light of limited investment acumen or conservative boards and investment committees. By starting with an enhanced cash strategy, investing in cash and near-cash instruments very similar to those used by money market funds, those clients have become more comfortable with the various securities, reporting, accounting, and expected portfolio volatility. Fort Washington’s emphasis on communication and managing expectations is intended to build trust with our clients. We have found that over time, client investment policy statements tend to be liberalized as a result of the demonstrated expertise and trust that has been established with the team. Consequently, cash segmentation portfolios have expanded to more opportunistic strategies providing additional return potential or investment income for clients.

Why Fort Washington?

Fort Washington strives for ongoing communication with clients to better understand their needs and expectations. We want to have a thorough understanding of risk tolerance, anticipated investment returns, investment policy construction, and compliance. We work to go beyond what is typically expected of investment managers to help organizations realize the benefits of cash segmentation. Contact us to learn more about how partnering with us can help enhance your organization’s bottom line.