The traditional 60/40 allocation has long been a staple of Multi-Asset portfolios using Modern Portfolio Theory to develop well diversified strategic allocation targets. While this approach has certainly been popular, it often underperforms expectations when risk increases in periods of meaningful dislocation due to reduced benefits from diversification. This approach quantifies risk in terms of correlations and volatility and does not factor in valuation. For example, when the S&P 500 is at a peak, volatility is typically low. However, it’s at this time when prices are the highest that the risk is also the greatest, and balanced portfolios may fail to deliver. In such times of extreme market distress as we have recently experienced, correlations tend to break down and approach 1.0. In other words, multiple asset classes tend to lose value at the same time, and portfolio returns disappoint expectations.

An alternative approach rests on forward looking scenario analysis when setting tactical targets for balanced portfolios. We believe this to be the best approach as it depicts what to expect from a growth shock or recession. We prefer to characterize risk as the quantification of potential loss, not volatility. Knowing the implication on investment returns in a worst case scenario is important for investors to understand as it provides them with the comfort of knowing the amount of loss they may incur. This focus on loss avoidance guides the optimal allocation mix. We believe it is in an investor’s best interest to focus on cause and effect relationships when building diversified portfolios rather than depending on correlations that have typically proven to be unstable over time.

Contrasting the two methodologies in a simple Up/Down Capture chart demonstrates the effectiveness of our forward looking scenario analysis. A manager with an up-capture ratio greater than 100% has outperformed the market index during periods of positive market performance, and a manager with a down-market capture ratio of less than 100% has outperformed the market index during periods of negative market performance. The chart below demonstrates our methodology in action. Ultimately our process has historically outperformed in up markets and minimized losses during down markets.

An Improved Approach

In managing balanced portfolios, Fort Washington employs two proprietary tools designed to overcome some of the shortcomings of typical balanced account mandates: Risk Budgeting and Forward Looking Scenario Based Analysis.

A Risk Budget is a tool that allows the portfolio management team to monitor the potential downside risk of a portfolio relative to a strategic benchmark through the use of a risk lens. This tool allows us to not only efficiently allocate risk within our portfolios, but also use one common metric to track exposure across several asset classes with varying characteristics. If financial conditions are supportive, sentiment is positive, economic growth is improving, and asset class valuations are attractive, a higher degree of risk will typically be taken in the portfolio. Importantly, risk is focused on loss of principal, not volatility.

Fort Washington utilizes a proprietary asset allocation approach focused on Forward Looking Scenario Based Analysis that performs the following:

- Focuses on cause and effect rather than correlations

- Allows for the application of a common downside risk measurement for all assets

- Increases awareness that higher returns in stable markets might result in much lower returns in volatile markets

- Drives the manager to find better asset combinations, increasing return per unit of risk

The combination of a Risk Budget and Forward Looking Scenario Based Analysis allows for the potential for optimally designed portfolios that meet expectations in both good times and bad.

Active Management

Knowing when markets are going to bottom is a very difficult call to make. Emotion during times of stress exacerbates this difficulty. Using previously established scenarios provides a method for disciplined decision-making based on valuations, economic conditions, and market conditions. Given the right process behind efficient and consistent sector allocation decisions in a diversified portfolio, managers can not only weather the storm but may add additional value to their portfolio. This approach to active management, focusing on measurement not forecasting, is a key tenant of our philosophy.

In addition to active management with respect to these sector allocations, meaningful alpha can be generated by exploiting the more inefficient asset classes such as International Equities or certain sectors within Fixed Income such as Securitized Assets, Investment Grade Credit, and High Yield. Certain Fixed Income markets, for example, are less efficient and provide managers with a variety of opportunities to add alpha. The exploitation of these opportunities can be accomplished in a much tighter risk management construct when compared to Equities. If a Fixed Income allocation in a traditional 60/40 portfolio is able to provide an additional 1.50 – 2.00% alpha over the market, the end results could be significant, particularly on a risk adjusted basis.

Results

| Q1 2020 Return |

1 Year Return |

3 Years Return |

5 Years Return |

10 Years Return |

|

|---|---|---|---|---|---|

| FWIA Multi-Strategy Composite (Gross) | -11.39% Rank: 27 |

-0.13% Rank: 12 |

6.01% Rank: 9 |

5.59% Rank: 10 |

7.89% Rank: 26 |

| FWIA Multi-Strategy Composite (Net) | -11.45% | -0.43% | 5.70% | 5.27% | 7.54% |

| eVestment US Balanced Median | -13.20% | -3.87% | 3.26% | 3.90% | 6.72% |

| S&P 500 Index | -19.60% | -6.98% | 5.10% | 6.73% | 10.53% |

| Bloomberg Barclays Aggregate Index | 3.15% | 8.93% | 4.82% | 3.36% | 3.88% |

Diversified portfolios have provided investors with attractive returns with manageable volatility over long- term investment horizons. Furthermore, actively managed balanced portfolios with a disciplined allocation philosophy based on risk budgeting and forward-looking scenario analysis can enable managers to act efficiently in volatile markets. This well-defined approach can generate alpha while ensuring that investment objectives are being fulfilled. It is the unencumbered approach to making these timely decisions that can make the diversified portfolio so appealing.

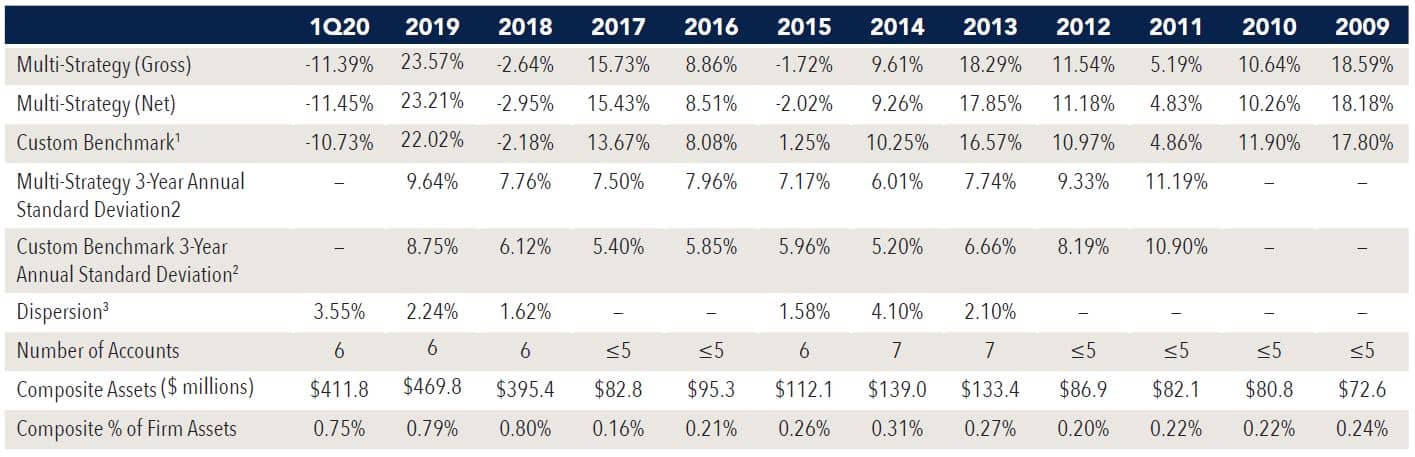

Multi-Strategy Composite Disclosures

Composite inception and creation date: 04/01/04.

1 Custom Benchmark is rebalanced annually. The current benchmark is 59.3% S&P 500 and 40.7% Bloomberg Barclays Aggregate and historical blended benchmark allocations are available upon request.

2 The 3-Year annualized ex-post standard deviation is calculated using monthly returns to measure the average deviations of returns from its mean.

3 Dispersion is not calculated for years in which the composite contains five portfolios or less. Dispersion is calculated as the equal weighted standard deviation of returns for those portfolios held in the composite during the entire period.

Composite Gross and Net returns for 2017, 2016, 2014, and 2013 have been revised due to incorrect values in prior presentations.

Past performance is not indicative of future results.

The Fort Washington Multi-Strategy Composite utilizes asset specific strategies managed by Fort Washington, sub-advisors, or mutual funds/ETFs to achieve medium to long-term client goals. Over and underweight evaluations are performed at least quarterly through a committee that analyzes the equity and fixed income markets to take advantage of extremes. When there is significant misalignment in the markets between those asset classes, and at the recommendation of the committee, the portfolio manager will determine to increase or decrease the asset allocation within the constraints of the client’s investment policy.

Portfolios in this composite include cash, cash equivalents, investment securities, interest, and dividends. Cash is maintained, within each separately managed account segment, in accordance with our asset allocation ratio. The U.S. dollar is the base currency. The specific securities identified and described do not represent all of the securities purchased, sold, or recommended.

Returns are presented gross and net of management fees and include the reinvestment of all income. Gross returns will be reduced by investment advisory fees and other expenses that may be incurred in the management of the account. Net of fee performance was calculated using the actual management fees charged. Individual portfolio returns are calculated on a daily valuation basis. Past performance is not indicative of future results.

Fort Washington Investment Advisors, Inc. (Fort Washington), a wholly owned subsidiary of The Western and Southern Life Insurance Company, is a registered investment advisor and provides discretionary money management to a broad range of investors, including both institutional and individual investors. Assets under management include all portfolios managed by Fort Washington and exclude assets managed by and marketed as its Private Equity business unit.

Fort Washington claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS Standards. Fort Washington has been independently verified for the periods 7/1/94 – 12/31/17. A copy of the verification reports are available upon request. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm's policies and procedures are designed to calculate and present performance in compliance with the GIPS standards. Verification does not ensure the accuracy of any specific composite presentation. Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. To receive a complete list and description of composites, contact Fort Washington by phone at 888.244.8167, in writing at 303 Broadway, Suite 1200, Cincinnati, Ohio 45202, or online at fortwashington.com.