Highlights

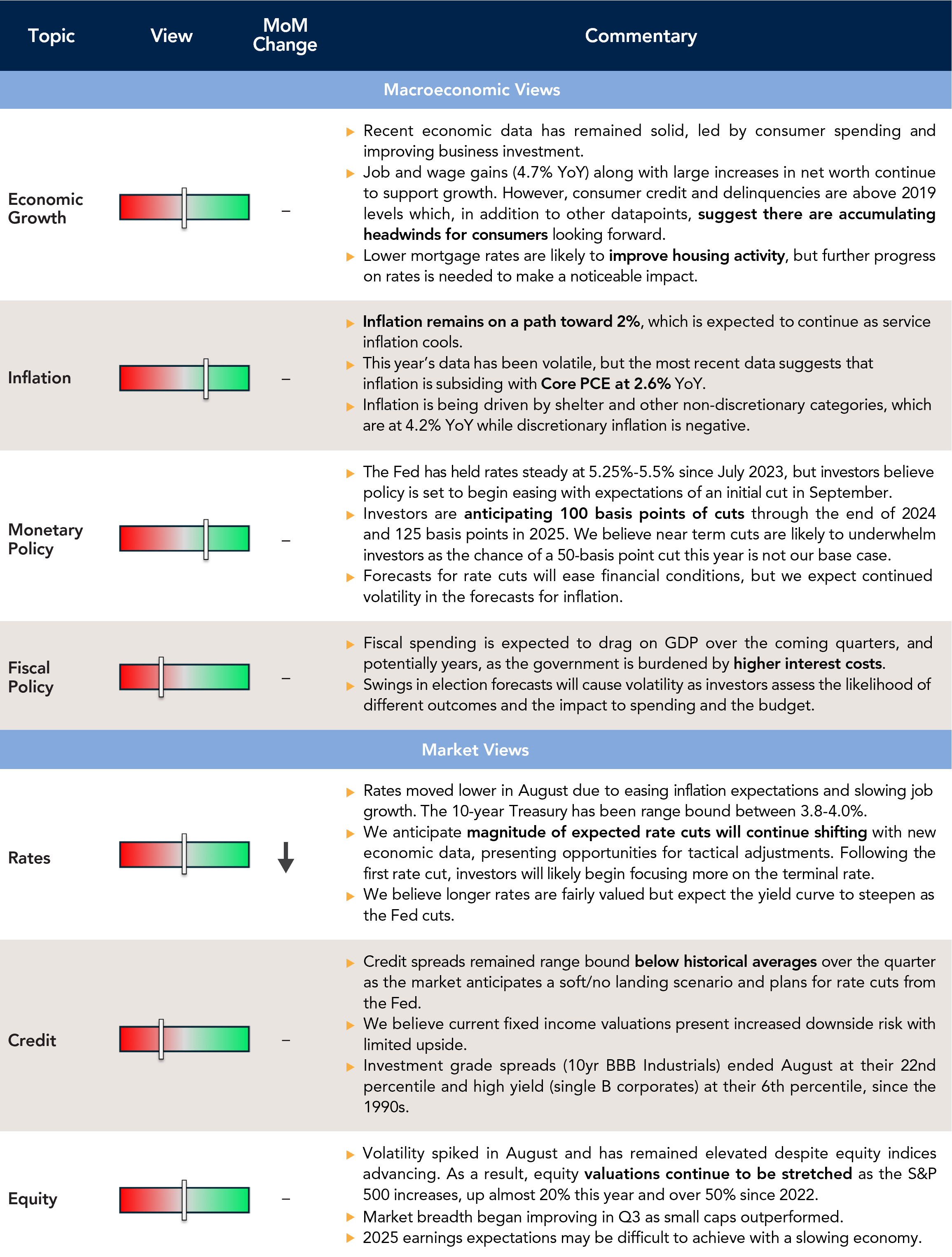

- Cuts Are Here: Continuing disinflation and a balanced labor market have led investors to expect the first rate cut in September.

- Market Breadth: The rotation to small cap stocks has been a theme in Q3 but will require a soft landing for the economy to persist.

- Asymmetric Risk: Current asset prices, in both stocks and credit, suggest more downside risk than upside to our base case expectations.

Macro Insights

Regime Change?

After a sharp sell-off to start the month, U.S. equities ended the month higher as exaggerated economic concerns following the July jobs report subsided and attention shifted to more soft-landing supportive data. Continued moderating of inflation data and commentary from the Federal Reserve (Fed) regarding the timing of interest rate cuts also supported risk assets in the month. Fed Chair Jerome Powell stated, "The time has come for policy to adjust," paving the way for the Fed to begin the process of normalizing rates at the September meeting (see this month's Spotlight on the following page for more detail).

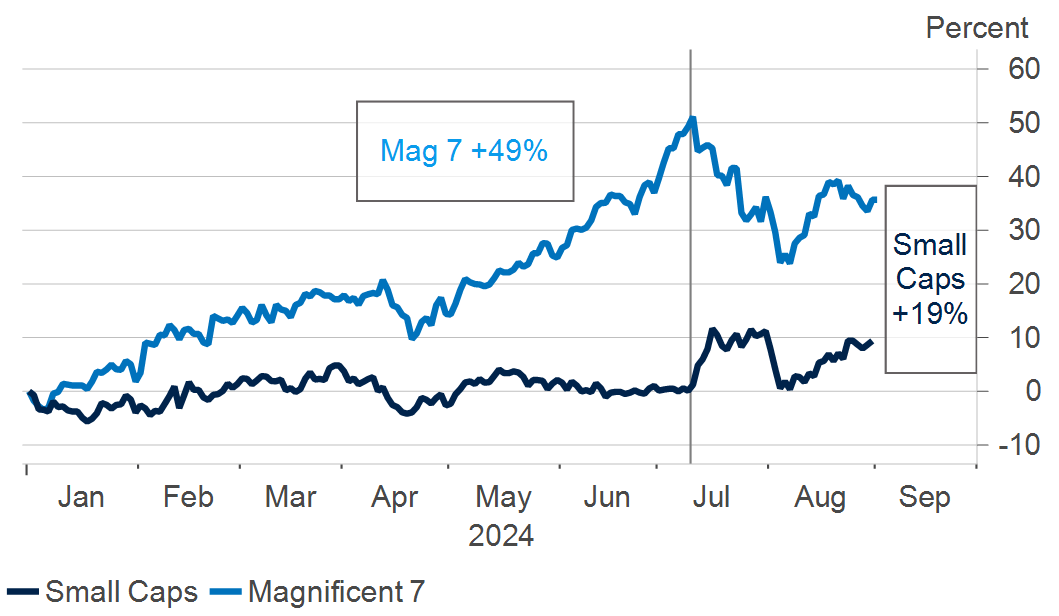

Eight months into the year, the S&P 500 has shown a nearly 20% total return, following a 26% gain in 2023. While the mega-cap tech AI-driven names are still comfortably leading the market this year, recent performance has shown a broadening of gains. The so-called Magnificent 7 trailed in August, while small caps outperformed. With the Fed on the cusp of lowering rates and the slowdown in the economy over the next year unlikely to prove recessionary, in our view, we like the outlook for relative performance from laggards such as small caps.

With inflation moderating and the direction of Fed policy seemingly well understood, we believe the focus of the market will shift to the durability of the labor market and economic growth. The nearly wrapped-up second quarter earnings season has highlighted a slowdown in consumer spending in discretionary categories, greater sensitivity to value, and a weakening of personal travel. We will be watching these trends closely to see if the issues remain concentrated among less affluent consumer cohorts or if we see a broadening that would more substantively impair economic growth. Consumer activity, combined with the trajectory of the labor market, will likely influence equity and bond prices more notably from here than the modest economic boost associated with the gradual lowering of front-end rates.

While our base case is a "soft landing" of slower but non-recessionary growth, we see somewhat asymmetric risks to the market from here – the risk of the economy underperforming our expectations appears higher than outperforming. Valuations in equities appear rich at the index level, though valuations away from mega-cap tech look closer to long-term averages. As a result, we are cautiously optimistic about certain parts of the equity market landscape, including small caps.

Magnificent 7 vs Small Caps: YTD Returns

Relative performance pre-and post the July CPI print.

Source: Fort Washington, Bloomberg, and Macrobond. | Chris Shipley, Senior Vice President, Co-Chief Investment Officer.

What to Watch

The focus of the month ahead will be labor market data as investors assess the magnitude of slowing for the U.S. economy. In addition, markets will seek confirmation that the trend of lower inflation will continue.

- August Employment Report (unemployment, non-farm payrolls, etc.), released September 6th, will be closely watched following the weaker-than-expected July print that provoked volatility in the markets.

- CPI is released on September 11th, which will be the first inflation indicator for August. It would likely take a large miss to move markets materially, but investors will be looking for continued disinflation.

- The most noteworthy event of the month is the FOMC meeting on September 18th where the Fed is expected to begin the rate cutting cycle. However, Powell's comments about the magnitude and path of cuts will also be a focus.

Monthly Spotlight

Rate Cuts Are Here, but the Magnitude Remains Uncertain

Expectations for the path of Fed policy have experienced significant volatility this year. Bond investors came into the year projecting over 150 basis points of cuts in 2024. However, expectations shifted multiple times due to incoming inflation reports and other economic data. During April, markets anticipated as little as 25 basis points of cuts throughout 2024 after a string of higher-than-expected inflation reports. However, more recent inflation readings have given the Fed greater confidence that inflation will continue cooling. As a result, a rate cut in September has been largely solidified, especially as evidence of a cooled labor market also emerged.

Fed Chair Powell discussed this greater confidence in disinflation during his press conference at the July FOMC meeting and he effectively confirmed the markets' expectation for a September rate cut, during his remarks at Jackson Hole. Rate cuts will also support the labor market, of which recent data suggests some softening. The Fed is increasingly sensitive to labor market conditions and would like to head off any further weakening. Now that the cutting cycle is here, we expect the market to increase its focus on the magnitude of cuts.

Currently, the market expects about 225 basis points of cuts through 2025, indicating a terminal rate of around 3%. We believe this is a reasonable forecast given our outlook for inflation and growth. The risk to this forecast is a further weakening of the labor market, which would increase the size and pace of cuts.

Focusing on near-term cuts, we don't believe there is sufficient evidence to support a 50-basis point cut in September. Rather, our near-term base case is for one cut at each meeting this year. The primary reason is that while the labor market has cooled, we are not currently experiencing broad layoffs. This balanced labor market provides the Fed with the flexibility to continue demonstrating patience and staying data-dependent. However, we will be watching indicators, such as those below, for signs of further slowing in employment.

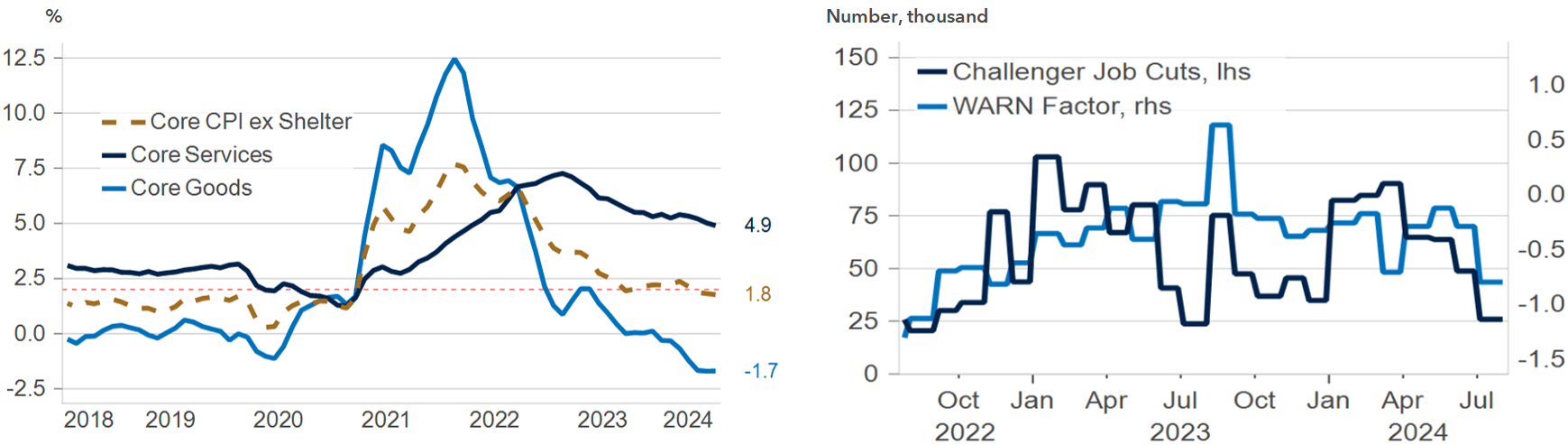

Disinflation & Layoffs

Core CPI Components (%YOY) |

Job Losses |

|

|

| Source: Fort Washington, BLS, Challenger, Gray & Christmas, openICPSR, and Macrobond. |

|

- Excluding shelter, inflation has been at or below the Fed’s 2% target for about a year. We believe disinflation is likely to continue, especially as shelter cools further.

- Both the Challenger Job Cuts and WARN (Workers Adjustment and Retraining Notification) Factor indicate job losses have remained at reasonable levels.

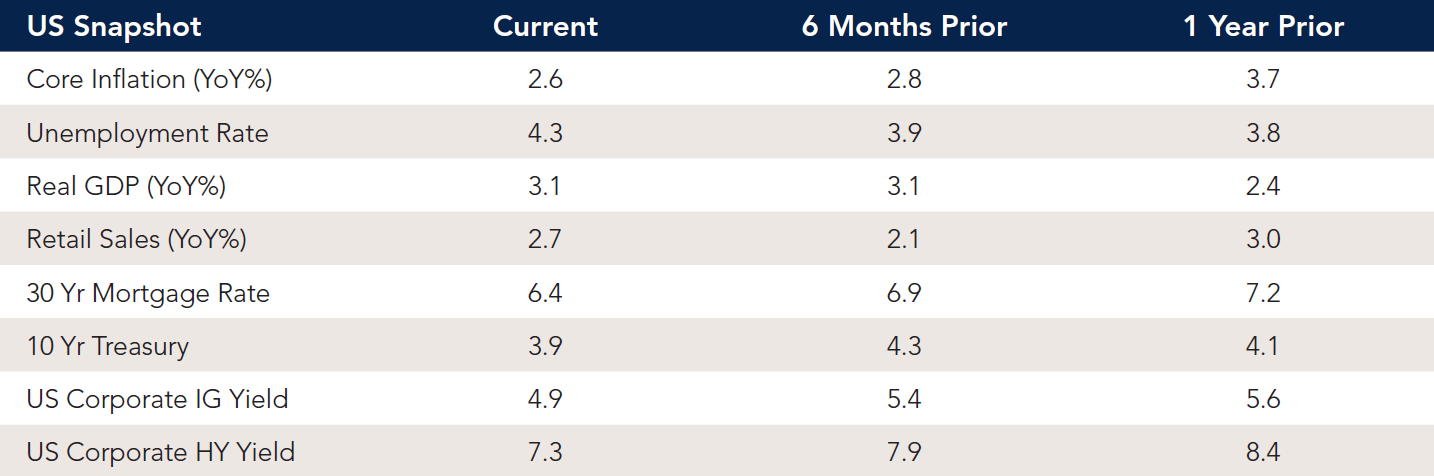

Current Outlook

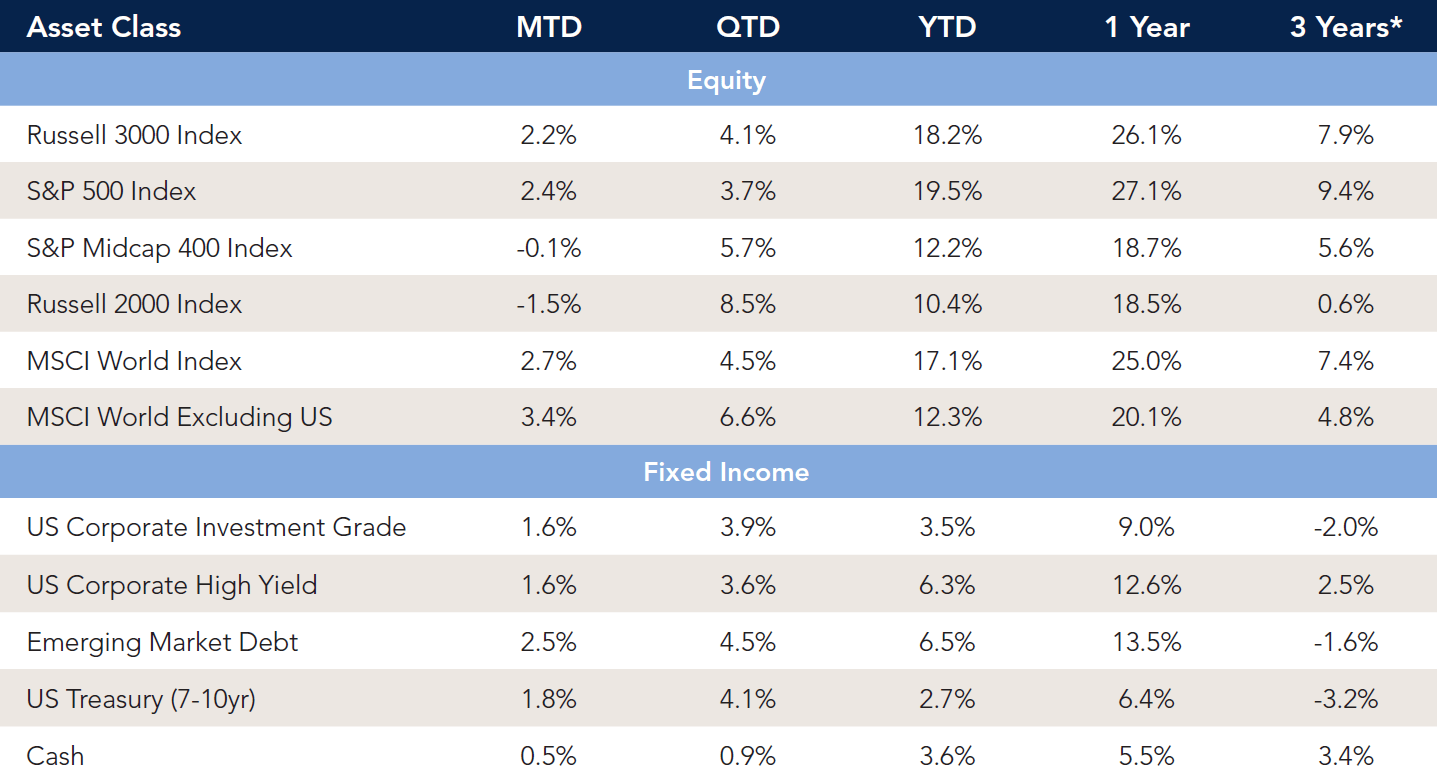

Market Data & Performance

As of 08/31/2024

Source: Fort Washington and Bloomberg. *The 3-year returns are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – September 2024

Download Monthly Market Pulse – September 2024