One feature about the Treasury bond market makes it transparent for investors. They can discern the time profile of Fed funds rates that are priced into the market by looking at Treasury futures. Prior to the December Federal Open Market Committee meeting, investors were optimistic about the Fed easing policy in 2024, and the bond market was pricing in rate cuts of a full percentage point to between 4.25% and 4.5% by year’s end.

The Fed did not disappoint this time. Chair Jerome Powell signaled it was close to pivoting monetary policy when he recently said that rate cuts were “coming into view” and “clearly a topic of discussion.” This represented a significant departure from his previous message that rates would stay “higher for longer.”

Fed is More Confident Inflation is Moving in the Right Direction

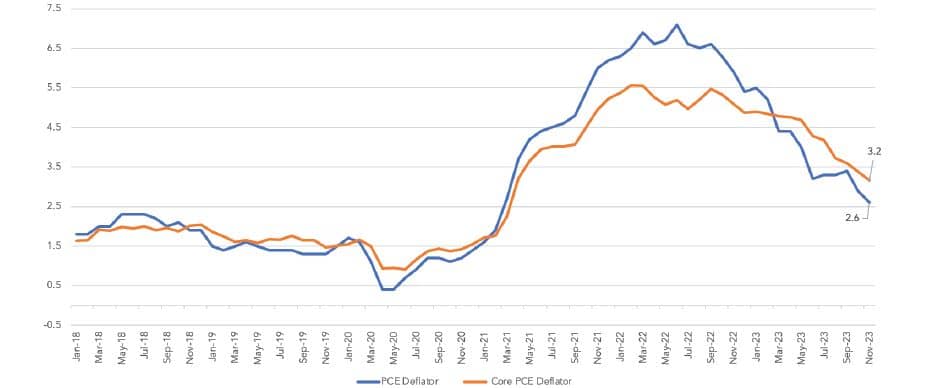

The main reason for the change in tone is Fed officials are more confident that inflation is on the path toward its 2% target. The median expectation of Fed officials in the December FOMC projections calls for the core rate of personal consumption expenditures to fall to 2.4% next year from 3.2% this year in the wake of a series of benign readings. In the meantime, core PCE rose just 0.1% in November and was up 3.2% from a year ago (see chart below). On a six-month basis, it was up 1.9% or slightly below the Fed’s 2% annual target.

Figure 1. PC Inflation: Headline and Core in Percent, PCE Deflators (YoY%)

Source: Bloomberg

Source: Bloomberg

These developments have spawned a powerful rally in the bond market in which the 10-year yield plummeted to 3.85% by year’s end, down from a peak of 5% in mid-October. In the process, bond investors now anticipate additional rate cuts that would bring the funds rate down to 3.75% to 4.0% by year’s end. This is 0.75% below what Fed policymakers envision.

The consensus among private forecasters is the earliest the Fed is likely to ease policy would be this spring. The reason: Fed policymakers are reluctant to declare victory over inflation prematurely, and they prefer to wait for incoming data to confirm that it is under control.

Thereafter, investors see the Fed moving somewhat aggressively because they believe the economy will soften. While most forecasters have thrown in the towel about a looming recession, they still believe that rate hikes totaling 5.5% over the past two years will eventually take a toll on the economy. Both the housing and manufacturing sectors already are feeling the impact of higher interest rates, and many people question how long consumers can bolster the economy as savings amassed during the COVID-19 pandemic are depleted.

On this score, Fed policymakers concur that an economic slowdown is likely. Their median forecast based on dot plots show policymakers expect real GDP growth will moderate to 1.4% this year from 2.6% last year.

Unemployment Rate Projections Vary

Fed officials, however, foresee only a modest increase in the unemployment rate to 4.1% by the end of this year from 3.8% in 2023. This is a key reason why they anticipate making only three 0.25% cuts in the funds rate in 2024. But it is also an area where Fed officials could be too optimistic. The Congressional Budget Office, for example, has a similar growth rate forecast as the Fed, but it projects the jobless rate will reach 4.4% in 2024.

Amid this prediction, the Fed’s reaction to incoming data is likely to be more sensitive to employment numbers than it has been in the past two years. The reason: As the Fed comes closer to attaining its target for inflation, the unemployment rate might diverge from its goal of full employment.

Meanwhile, one consideration that could constrain the Fed’s maneuverability is the 2024 elections. Normally, the Fed’s preference would be to stay on the sidelines in the period from Labor Day until November, as it does not want to be perceived as trying to influence the outcome. This means that if the Fed begins easing policy in the spring, it will have a window of about six months to act before the 2024 campaign is in full swing.

Mickey Levy, a visiting scholar at the Hoover Institution, observes in a recent Wall Street Journal commentary that the Fed has only altered its policy to influence a presidential election on one occasion. It occurred during 1972, when Fed Chair Arthur Burns purposely kept rates low to enhance Richard Nixon’s re-election prospects. All told, in the 16 presidential elections since 1960, the Fed has raised rates seven times, lowered them seven times, and left them unchanged twice (2012 and 2016).

What Will the Fed Do in 2024?

My take is that the Fed most likely will lower rates by about 0.75% to 1%, assuming core PCE inflation falls to about 2.5% and the unemployment rate approaches 4%, as the Fed’s projections indicate. This outcome would imply a real interest rate of 1.5% to 2%, which is close to the economy’s long-term potential rate.

In order for the Fed to move more aggressively, it would have to be concerned that the unemployment rate is rising faster than it expected and the risk of recession is increasing. In that event, the outcome bond investors anticipate could materialize; however, it is not my base case.

A version of this article was posted to Forbes.com on January 3, 2024.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Past performance is not indicative of future results. © 2023 Fort Washington Investment Advisors, Inc.