- Strong economic growth and robust corporate profits propelled the U.S. stock market to a record high in the third quarter, while also sending the 10-year treasury yield above the 3% threshold. The dollar also ended the quarter somewhat higher against most currencies.

- This market pattern, which has been evident since President Trump’s election, indicates investors are confident the U.S. economy will continue to perform well in the future. Fed officials appear equally confident, and they are likely to continue raising interest rates gradually into 2019.

- One risk is that further Federal Reserve tightening and a ballooning budget deficit could cause bond yields to rise, inducing investors to switch from stocks to bonds. The bigger risk for us, however, is a trade war with China, which could adversely impact emerging economies and slow global growth.

- Meanwhile, we are maintaining our investment strategy, as U.S. growth is likely to remain solid in spite of rising global uncertainties. Markets may turn volatile, but we believe strong fundamentals will outweigh these concerns for now.

Background on the Trump Trade

Following Donald Trump’s surprise election in November of 2016, the U.S. stock market surged, bond yields rose and the dollar advanced against most currencies initially — a pattern of market moves that was called “the Trump trade.” It reflected investor optimism that pro-business policies including corporate and personal tax cuts and deregulation would boost economic growth above the 2% trend rate during the expansion since mid-2009. As the economy gained momentum in 2017 and corporate profits surged, the stock market advanced steadily into January of this year, when it had generated a cumulative return of 35% (Figure 1).

The stock market then turned volatile and experienced a correction of 10% in February-March in response to two developments. The first was a report of a stronger-than-expected wage increase in January, which cause bond yields to spike. The second was an escalation of tensions with U.S. trading partners in response to duties that the Trump administration imposed on aluminum, steel, and imports from China totaling $50 billion.

In the meantime, the stock market steadied and it set a new record high in the third quarter. This occurred even though the 10-year treasury bond yield breached the 3% threshold and the Trump administration placed duties on an additional $200 billion of Chinese goods. The primary reason is investors (as well as consumers and businesses) are increasingly confident the economy is on solid ground and will continue to do well into next year. The reasons: Growth is on pace to exceed 3% this year, inflation is near the Fed’s 2% target even as unemployment has fallen below 4%, and corporate profits have been growing at more than 20% since the tax cuts were enacted.

Figure 1: Investment Returns (%)

| Nov. 8, 2016 - Jan. 31, 2018 | Jan. 31, 2018 - Jun. 30, 2018 | Jun. 30, 2018 - Sep. 30, 2018 | |

|---|---|---|---|

| Stock Market | |||

| US (S&P 500) | 35.2 | -2.9 | 7.7 |

| Russell 2000 | 33.9 | 4.9 | 3.6 |

| International (EAFE $) | 34.96 | -7.1 | 1.4 |

| Emerging Markets (MSCI $) | 43.2 | -13.7 | -1.0 |

| US Bond Market | |||

| Treasuries | -1.7 | 0.3 | -0.6 |

| IG Credit | 3.1 | -2.1 | 0.9 |

| High Yield | 10.0 | -0.4 | 2.4 |

Source: Bloomberg. For informational purposes only. You cannot invest directly in an index.

Still, there are several challenges that lie ahead. One is the Federal Reserve is likely to continue raising interest rates into next year, which along with a rapidly expanding budget deficit, could lead to higher bond yields. Some observers are concerned that rising interest rates at some point could undermine growth. Another challenge is the U.S.-China trade conflict is about to intensify, as the latest round of duties are expected to be raised from 10% to 25% at the beginning of next year. This increases the risks that something could go awry.

Risk of Higher Interest Rates

For the most part, investors have taken the rise in bond yields in stride, viewing them as being consistent with stronger economic growth. However, some observers see them as a threat to the expansion. In a Wall Street Journal article (September 27, 2018), Professor Martin Feldstein of Harvard University spelled out the reasons why they could lead to a recession next year. In his view, the stock market is significantly over-valued, and he estimates that if the P/E ratio of the S&P 500 were to decline to its historical average, 40% below today’s level, $10 trillion of household wealth would be wiped out. Feldstein goes on to posit that such a decline would reduce annual consumption by about $400 billion, shrinking GDP by 2%, and there would be added effects on business investment.

Our own take is the risk of this happening is mitigated by several considerations. First of all, we do not believe the stock market is 40% over-valued. Our own assessment, which is based on discounted earnings of companies, is the broad market is closer to being fairly valued assuming future profit growth is in line with past trends. Second, the rise in interest rates this year is mainly attributable to stronger growth rather than to higher inflation. This is an important distinction, because the risk of a market sell-off is greater if it is triggered by higher inflation rather than by stronger growth.

For their part, Federal Reserve officials share the more benign view of the economy. At the September FOMC meeting, they raised the range for the federal funds rate by 25 basis points to 2.0%-2.25% and also indicated they would likely move again in December. If so, it would bring the rate within a range that is considered to be neutral for the economy. The Fed also raised its forecast for economic growth this year to 3.1% from 2.8% previously, and it expects the economy to growth at a solid, albeit more moderate, pace of 2.5% next year as the effects of income tax cuts fade. Fed officials also expect core inflation to stay close to its 2% target, even as the unemployment rate remains below 4%. In this context, they could raise rates three times in 2019 based on the latest survey of views of Fed officials.

Amid this favorable view of economic conditions, one negative factor is the budgetary picture, which has deteriorated considerably as a result of tax rate cuts and spending increases. It is now estimated that the federal budget deficit for the fiscal year 2018 just ended was in the vicinity of one trillion dollars, compared with a deficit of $666 billion in fiscal 2017. Moreover, the Congressional Budget Office is projecting the deficit will remain above the one trillion dollar level into the coming decade, as retiring baby boomers place added burdens on social security and Medicare/Medicaid. While the bond market has not reacted to this development, bond yields could spike at some point.

Risk of a Trade War

The immediate risk, in our view, is the threat of an escalating trade war with China. The Trump administration imposed duties of 10% on $200 billion imports from China in September, which raised the tally to roughly one half of all Chinese imports. Moreover, President Trump has indicated the duties could be raised to 25% at the beginning of 2019 if China does not acquiesce to U.S. demands to open up its markets to U.S. goods and investments. Furthermore, the President has threatened that tariffs could be applied to all imports from China if there is no progress to resolve the trade dispute.

These actions have not had a market impact thus far for several reasons. First, some investors cling to the belief that these threats are a bargaining ploy by President Trump, which he will not follow through on. Yet, this flies in the face of a steady escalation in the conflict this year. Second, there is no evidence that the actions to date, including tariffs on aluminum and steel that impact trading partners in Europe, Japan, and Canada, have adversely impacted the U.S. economy in the aggregate. Indeed, as noted earlier, growth has been robust. Therefore, investors appear to be adopting a wait-and-see posture.

In our view, the impact of the tariffs will first show up in overseas economies before it spills over to the U.S. Thus far, it is most apparent in China, where the stock market has declined by more than 20% in U.S. dollar terms since tariffs were implemented. China’s policymakers have responded to the threat of a slowdown by lowering short-term interest rates, allowing the yuan to depreciate against the dollar, and boosting public spending.

The impact is also apparent in broad-based declines in emerging market currencies, and it has added to interest-rate pressures on countries such as Turkey, South Africa, and Argentina, who confront internal problems. The prevailing view is that the risks in emerging markets are idiosyncratic rather than systemic. However, we contend it is too early to tell considering that the escalation in the trade war has just begun.

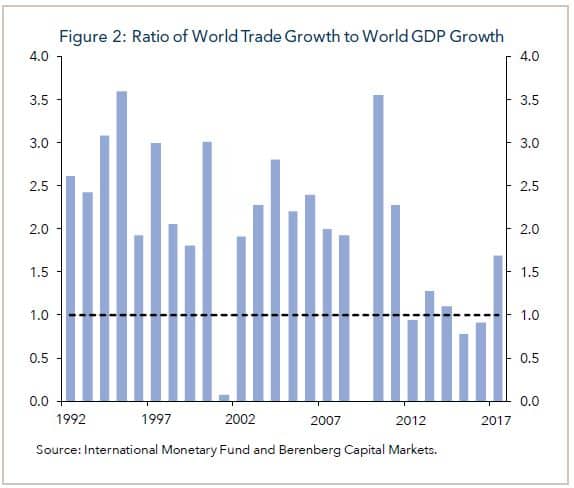

In the meantime, we will be monitoring trends in the volume of global trade (exports plus imports) to assess the impact of the U.S. actions. As shown in Figure 2, there is a close relationship between growth in trade volume and global growth: The two periods in which trade volumes contracted coincided with global recessions in the early 2000s and the Global Financial Crisis, whereas periods of strong global growth have been accompanied by faster growth in world trade. This relationship illustrates that growth of world trade is a positive development for the global economy, and actions that disrupt trade risk a slowdown in global growth.

Investment Strategy: Staying the Course for Now

Amid these uncertainties, our equity strategies continue to emphasize high-quality names with franchise value. We expect earnings growth to remain strong, supported by solid U.S. economic fundamentals. Volatility will likely remain elevated, with the markets primary focus on escalation of the trade conflict with China and potential spillover effects to global economies.

In our bond portfolios, we remain comfortable with a modest overweight to credit risk. Credit spreads have tightened, now approaching the low levels experienced earlier this year. Confidence in the U.S. outlook and reduced near-term effects of trade conflicts improved investor appetite for the additional yield offered by non-Treasury sectors. In terms of interest rate risk, we are positioning portfolios similar to market benchmarks, but would look to add interest rate risk if trade tensions escalate and create uncertainty for growth and the Fed rate outlook.