Have you been frustrated getting a mortgage approved from a bank when your finances are more than adequate and you have deposits with the institution? If so, rest assured you are not alone. After speaking with family members and friends who have encountered roadblocks getting mortgages approved in a timely manner, I decided to investigate what is going on, and here is what I learned.

As is well known, the most important factors influencing the ability to get a mortgage are your borrowing history and FICO credit score. According to Fidelity,1 a minimum FICO score of at least 620 is required to qualify for a conventional mortgage, and you will typically pay a higher interest rate if the score is under the mid-700s.

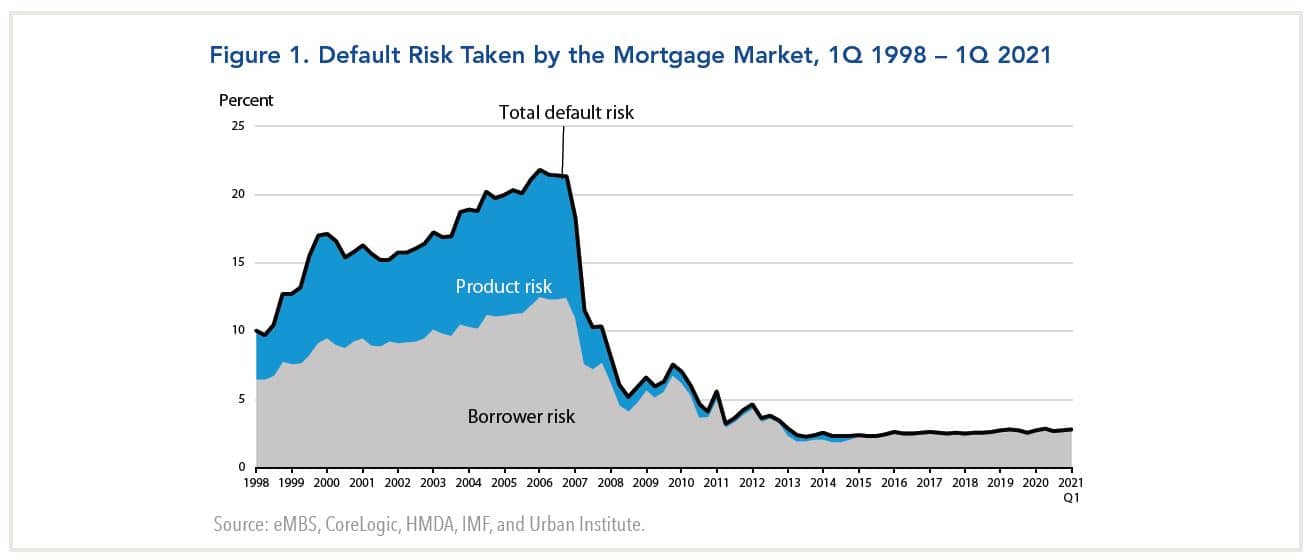

In approving loans, lending institutions will also take into account the state of the economy. For example, when the coronavirus pandemic hit in the spring of 2020, it was difficult for many people to get a mortgage. However, mortgage availability has increased somewhat since the spring of this year as the economy and jobs have improved. Still, it is well below levels during the housing boom of the mid-2000s.

Second, your ability to get a mortgage also hinges on the size of the down payment you make. According to a Wall Street Journal report in early April of this year, more home loans were being made, but they were going almost exclusively to borrowers with pristine credit histories and sizable down payments. A survey by the National Association of Realtors in May 2021 showed that more than half of the mortgages approved contained a down payment of at least 20%.

A third consideration is the type of mortgage you are seeking—whether fixed rate or variable rate. During the housing bubble of the mid-2000s, many borrowers with low credit scores opted for mortgages that were variable and which contained “teaser” interest rates for one year. Today, by comparison, most borrowers have opted for fixed rate mortgages, either with terms of 15 years or 30 years, because long term rates are near record lows.

As I have argued in a previous Forbes.com commentary, the above considerations suggest that while the housing market is pricey today, it is less risky than in the mid-2000s. In this respect, the tightening of lending standards is positive for financial stability.

One issue that is less clear, however, is why premium borrowers—i.e. those with high credit scores and large down-payments for jumbo loans—often face extensive delays in the mortgage approval process. Several borrowers I know reached the point where they either considered financing the purchase on their own or arranging bridge financing so they would not be declared in default because they could not close on time.

While investigating this matter, I found several factors at play.

The most important is that banks face much greater regulatory oversight since the 2008 financial crisis. Lax underwriting standards then meant that many borrowers obtained mortgages when they could not service them. Because financial institutions are now subject to fines and other penalties for lax underwriting, they are much stricter in underwriting mortgages.

Meg Burns, currently an EVP with the Housing Policy Council, stated in a Washington Post article that: “The regulatory atmosphere changed from a risk-management regime to a zero-tolerance and 100 percent compliance regime. Not only were new regulations implemented, but new regulators like the Consumer Financial Protection Bureau were created.”

The cost of complying with new regulations and risk of making mistakes, in turn, drove many banks to reduce their mortgage business. A Washington Post article noted that the three biggest banks—JPMorgan Chase, Bank of America and Wells Fargo—accounted for one half of all new mortgage money lent in 2011. By September 2016, their share had dropped to 21 percent while that for non-banks rose to one-half. By 2020, The Wall Street Journal reported that non-bank lenders issued more than two thirds of mortgages, their highest share on record.

In the process, banks shifted their focus to the safest borrowers—ones with high incomes and strong balance sheets. Yet, it is people such as these who are often frustrated by the mortgage application process.

One reason is that banks face challenges finding experienced underwriters and client service representatives, and they often hire people straight out of college. A friend who was a former executive at Goldman Sachs mentioned that his representative was unclear about the forms that he was being sent, and he actually had to explain to the rep what they were.

Just because a person has a large deposit with an institution does not mean they will be assured special treatment. In fact, it can be quite the opposite. For example, a family member who was financing 50% of a home purchase was unable to close well after the initial due date. He was relieved that his application had been approved just in time to avert a default. However, the morning of the close he was told to demonstrate evidence of his employment even though he had provided several pay stubs previously. He asked why he never received a standard check list of documents that were required.

So, what can a borrower do in these circumstances to survive the process? The following are several tips to consider:

First, understand that the underwriter may be isolated (or at home since the coronavirus pandemic) and could care less about “relationships.” He or she is living in fear of missing a piece of paper and losing his/her job and license to underwrite.

Second, having a good relationship with your bank rep means nothing. They are not allowed to lobby on your behalf, and even worse are afraid they might aggravate the underwriter.

Three, make sure to respond to every question in writing and spell out everything in simple terms. Spoon feed every documentation with an explanation of why it is being provided (particularly with multiple sources of income).

Fourth, actively manage the process. Don’t assume that the required time frame to close your contract means anything to the underwriter. Also, know that the process is painful and inefficient and expect it to take longer than what you are told.

Finally, you should write bank executives about your experience and urge them to improve the process. What many banks fail to appreciate is a home mortgage is more than an ordinary business transaction. It directly impacts a client’s mobility and is often the biggest investment decision they make. Consequently, the client’s experience in obtaining a mortgage will influence the decision to do future business more than any other transaction.

1 https://www.fidelity.com/spire/mortgage-loan-approval-factors-that-determine-your-ability

A version of this article was posted to Forbes.com on October 1, 2021.