Table of Contents

Key Takeaways

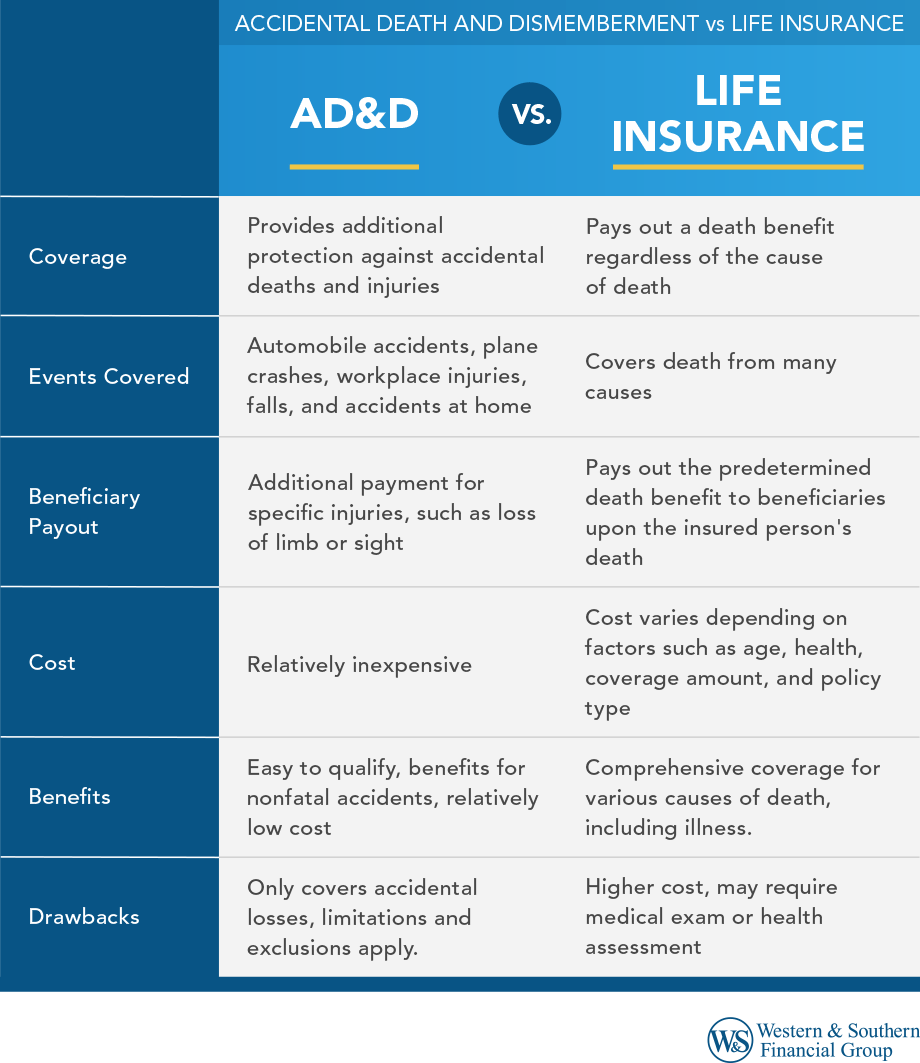

- AD&D insurance covers accidental deaths and serious injuries, offering extra financial protection for high-risk activities and jobs.

- Life insurance helps provide financial security for your beneficiaries by covering expenses like debts, funeral costs, and daily living expenses.

- Life insurance covers all causes of death, while AD&D covers only accidents, making it less comprehensive.

- Many people choose life insurance and AD&D for comprehensive financial protection.

What is AD&D Insurance?

Accidental Death and Dismemberment (AD&D) insurance covers incidents where the insured dies or sustains significant injuries from a covered accident. Unlike traditional life insurance, AD&D focuses solely on accidental causes to provide additional financial protection for unforeseen events. It can either be a standalone policy or a life insurance rider to a standard life insurance policy.

Coverage Details

AD&D insurance covers a range of scenarios, including:

- Accidental Death Coverage: If the insured dies due to an accident, the policy pays out a specified amount to the beneficiaries.

- Dismemberment Coverage: If the insured loses a limb, sight, or hearing or suffers paralysis due to an accident, the policy pays out based on injury severity, with varying amounts.

- Partial Benefits Coverage: Some policies include partial benefits for less severe injuries, such as losing a finger or toe.

Typical Scenarios for Payouts

AD&D insurance is beneficial in situations where accidents are a higher risk, such as:

- Automobile Accidents: The policy will pay out if the insured is involved in a fatal car crash or loses a limb due to the accident.

- Work-Related Incidents: AD&D can provide vital coverage if an accident leads to severe injury or death for those working in hazardous environments like construction or manufacturing.

- Recreational Activities: Depending on the policy specifics, risky hobbies like skiing, skydiving, or other extreme sports can also be covered.

AD&D insurance offers targeted protection for accidental injuries and deaths, helping provide for those with higher exposure to unintentional risks. It can be a valuable addition to your financial plan, especially if you want additional coverage beyond what traditional life insurance offers.

What is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for regular premium payments, the company pays your beneficiaries a sum upon your death. Some life insurance benefits can help provide financial security for your loved ones, covering expenses like funeral costs, debts, and daily living expenses.

Coverage Details

Life insurance policies typically cover death due to natural causes, illnesses, and accidents. The amount of coverage, known as the death benefit, varies depending on your chosen policy. This benefit can be used for various purposes, such as paying off a mortgage, funding your children's education, or simply replacing lost income.

Types of Life Insurance Policies

- Term Life Insurance: Term life insurance covers a specific period, typically 10, 20, or 30 years, and is the most affordable option because it pays a death benefit only if you die during the term.

- Whole Life Insurance: Whole life insurance provides lifelong coverage, a guaranteed death benefit, and potential cash value growth, though premiums are higher than term life insurance. This is similar to a permanent life insurance policy.

- Universal Life Insurance: Universal life insurance is a flexible policy offering lifelong coverage and cash value, but it requires careful management.

Choosing the right type of life insurance depends on your financial goals, budget, and the needs of your beneficiaries. Understanding these basics can help you determine the coverage best suits your situation.

Differences Between AD&D & Life Insurance

When considering life insurance options, you might come across terms like AD&D (Accidental Death and Dismemberment) insurance and life insurance. Understanding the differences between these two types of coverage can help you decide which one best meets your needs.

Coverage Scope

- AD&D Insurance: AD&D insurance is more limited, paying benefits only if the insured's death is due to an accident. It also covers severe injuries from accidents, like workplace accidents, loss of limbs, sight, or hearing, with payouts often being a percentage of the total amount based on injury severity.

- Life Insurance: Life insurance provides a death benefit to your beneficiaries when you pass away, regardless of the cause. Your loved ones will receive the payout specified in your policy, irrespective of whether the death is due to natural causes, illness, or an accident.

Payout Conditions

- AD&D Insurance: AD&D insurance only pays out for accidental death or dismemberment, not for natural causes like illness or old age. It may also exclude coverage for accidents related to high-risk activities or intoxication.

- Life Insurance: The payout conditions for life insurance are straightforward. As long as the policy is active and the premiums are paid, the death benefit will be paid to the beneficiaries upon the insured's death, regardless of the cause

Cost Comparison

- AD&D Insurance: AD&D insurance is usually inferior to life insurance because it covers fewer situations. It depends on the coverage amount, the insured's occupation, and lifestyle, but it is often used as a supplement to life insurance due to its limited protection.

- Life Insurance: Life insurance premiums can vary widely based on the type of policy (term or whole life), the coverage amount, the insured's age, health, and other factors. Generally, term life insurance is more affordable than whole life insurance but only provides coverage for a specified period.

Ultimately, many people choose to have both types of insurance to help ensure they're covered in a wide range of scenarios. Consult with a financial advisor or visit a local life insurance company to help you determine the right mix of coverage to meet your needs.

Which One Should You Choose?

When securing your financial future, understanding the differences between Accidental Death and Dismemberment (AD&D) insurance and life insurance is crucial. Both policies offer benefits, but which one is right for you? Let’s break down the factors so you can make an informed decision.

Age

- Younger individuals may find AD&D more attractive due to lower premiums and a lower perceived risk of natural death.

- Older individuals may prefer life insurance, especially whole life, to help ensure coverage in later years.

Health

- Healthy individuals might lean towards AD&D if they have minimal health concerns and are more worried about accidental injuries.

- Those with health issues should consider life insurance, as it provides broader coverage and helps ensure financial support for their loved ones regardless of the cause of death.

Occupation

- High-risk jobs (like construction or law enforcement) might make AD&D more appealing due to the higher likelihood of accidents.

- Lower-risk professions might benefit more from the comprehensive coverage of life insurance.

Financial Goals

- Short-term financial planning may favor term life insurance or AD&D for affordable coverage.

- Long-term financial stability might lead you to choose whole life insurance, which also acts as a savings vehicle.

Situational Examples

Example 1: The Young Professional

Sarah is 28, healthy, and works as a graphic designer. She has a mortgage and wants to help ensure her family isn’t burdened if something happens to her. She opts for term life insurance for broader coverage and affordability.

Example 2: The High-Risk Worker

James, 35, works in construction. Given his high-risk job, he gets AD&D and term life insurance. The AD&D policy covers accidents on the job, while the term life policy helps ensure his family is covered no matter what.

Example 3: The Health-Conscious Senior

Maria, 60, has health concerns and wants to leave a financial legacy for her grandchildren. She chooses whole life insurance, ensuring she’s covered for life and can build cash value over time.

Example 4: The Middle-Aged Office Worker

Tom, 45, works in an office and has no significant health issues. He balances cost and coverage by choosing a combination of AD&D and a minor term life policy, which gives him peace of mind for accidents and other unforeseen events.

Choosing between AD&D and life insurance depends on your circumstances and financial goals. Evaluate your age, health, occupation, and what you want to achieve financially. Consider talking to a financial advisor to find the best solution. Remember, the right choice today can help provide security and stability for your loved ones tomorrow.

Common Myths & Misconceptions

When it comes to protecting your loved ones, understanding the differences between Accidental Death and Dismemberment (AD&D) insurance and life insurance is crucial. Let's explore and debunk common myths and misconceptions about these two types of insurance.

Myth 1: AD&D Insurance Covers All Types of Death

Many people think AD&D insurance covers any death, but it only covers deaths and injuries from accidents. Unlike standard life insurance, AD&D insurance does not pay for deaths from natural causes, illness, or non-accidental circumstances.

Myth 2: Life Insurance and AD&D Are the Same

Many think life insurance and AD&D insurance are the same, but their coverage differs significantly. Life insurance pays out upon the insured's death from any cause (except for some exceptions), while AD&D insurance only covers accidental death or specific severe injuries.

Myth 3: AD&D Insurance Is Sufficient for Comprehensive Coverage

Some think having AD&D insurance alone is enough to help protect their family's financial future. However, AD&D only covers accidents, so comprehensive protection usually requires a combination of AD&D and life insurance.

Myth 4: Life Insurance Is Too Expensive Compared to AD&D Insurance

Many believe life insurance is prohibitively expensive compared to AD&D insurance, but the cost often reflects its broader coverage. Options like term and whole-life policies can cater to different budgets and needs, helping offer peace of mind that justifies the higher price.

Myth 5: Only Breadwinners Need Life Insurance

Many people assume only primary earners need life insurance, but it's also crucial for stay-at-home parents. Life insurance can cover expenses related to child care, household tasks, and other services, ensuring the family's financial stability during a difficult time.

Understanding the differences between AD&D and life insurance is essential for making informed financial protection decisions. While AD&D offers valuable coverage in specific situations, it is not a substitute for comprehensive life insurance, so consulting a financial planner can help tailor the right combination of policies for your needs.

Conclusion

Choosing between AD&D and life insurance depends on your circumstances and financial goals. Evaluate your age, health, occupation, and what you want to achieve financially. Consider talking to a financial advisor to find the best solution. Remember, the right choice today can help provide security and stability for your loved ones tomorrow.

Frequently Asked Questions

Do I need both AD&D and life insurance?

AD&D and life insurance can offer broader coverage, as life insurance pays out regardless of how you pass away, while AD&D provides additional coverage for accidents. This combination can provide extra financial protection for your loved ones.

Is accidental death and dismemberment insurance a good deal?

Accidental death and dismemberment insurance can be a good deal if you work in a high-risk job or want extra coverage for unexpected accidents. However, it should differ from a comprehensive life insurance policy, as it only covers specific incidents.

Is an overdose considered an accidental death?

Yes, an overdose can be considered an accidental death if it is unintended and unexpected. Insurance companies typically classify it as accidental if there is no evidence of intentional self-harm or suicide.