Table of Contents

Key Takeaways

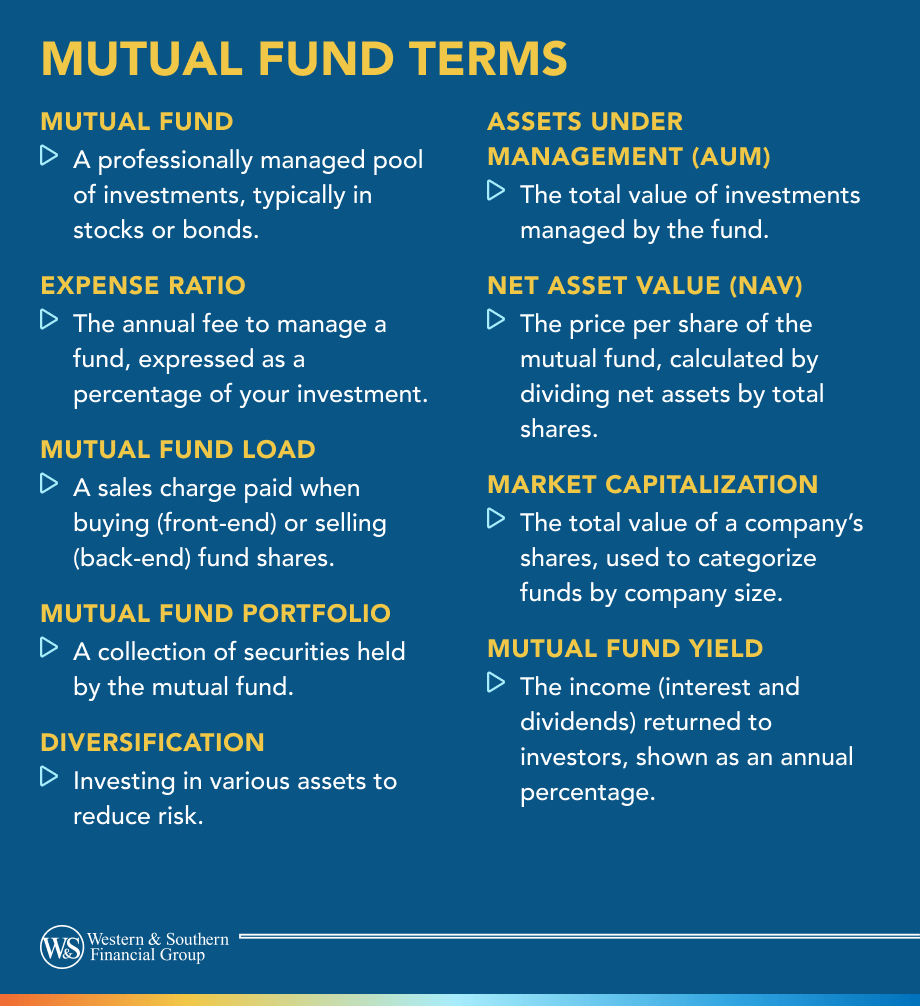

- Mutual funds are professionally managed investment pools that invest in various securities such as stocks and bonds.

- The expense ratio is an annual fee for the fund shown as a percentage of your investment, while a mutual fund load is a fee or sales charge paid by the investor.

- Diversification involves investing in multiple assets to reduce risk and limit exposure to a single asset type.

- Assets under management (AUM) are the total value managed by the fund, and net asset value (NAV) is the fund's value per share.

- Market capitalization is the total value of a company's outstanding shares, and mutual fund yield is the income returned to investors as an annual percentage rate.

It's important to understand certain mutual fund terms and concepts to be an informed investor. Although there are many different terms you can research and learn, you may want to start with the basics to give yourself a foundation of understanding. Here's a brief overview of nine mutual fund terms.

1. Mutual Fund

A mutual fund is a pool of investments that is funded by investors and professionally managed. Rather than investing in individual securities, such as a stock or a bond, mutual fund investors are investing in a collection of securities. A mutual fund will typically invest in stocks, bonds or a combination of these and other security types.

2. Expense Ratio

The expense ratio of a mutual fund is the annual fee for the fund expressed as a percentage of your investment. The expense ratio is usually expressed as a number with two decimal places. For example, if a mutual fund's expenses are 1.5 percent of the fund's assets under management, the expense ratio would be expressed as 1.50.

3. Mutual Fund Load

A mutual fund load is a fee, sales charge or commission paid by the investor. The load is a percentage of the purchase or sale amount and is typically charged at the time of purchase (front-end load) or at the time of sale (back-end load) of fund shares. Investors pay front-end loads when purchasing class-A share funds, and may have to pay a back-end load on class-B shares or class-C shares. A contingent deferred sales charge (CDSC) is a type of back-end load that depends on the holding period.

4. Mutual Fund Portfolio

A portfolio is a set of multiple investment securities held by one individual, organization or investment company. For example, an individual who holds five mutual funds in an individual retirement account (IRA) may refer to all the combined investments in the account as one portfolio. Sometimes a mutual fund's holdings, which are the securities, such as stocks or bonds, are collectively referred to as the fund portfolio.

5. Diversification

Diversification is a concept that refers to the process of investing in a variety of assets, primarily for the purpose of reducing market risk. The idea behind diversification is to limit exposure to any one asset type.

For example, a diversified portfolio of investments may include a variety of stocks and bonds. This concept is expressed in the saying, "Don't put all your eggs in one basket." Keep in mind that diversifying your portfolio does not ensure a profit or protect yourself against a loss.

6. Assets Under Management

A mutual fund's assets under management (AUM) figure represents the total market value of investments managed by the fund. Put differently, a fund's AUM is the total value of the assets held in the fund. If a mutual fund has multiple share classes, the AUM may represent the total of the assets for all of the share classes combined.

7. Net Asset Value

A mutual fund's value is expressed as net asset value (NAV), as opposed to a share price with stocks. The NAV represents the fund's net value (assets minus liabilities) divided by the total number of shares outstanding. The NAV is the price at which shares or units of the fund are invested or redeemed.

8. Market Capitalization

Market capitalization, commonly referred to as "market cap," represents the total value of the outstanding shares of stock for a company. To calculate market cap, multiply the total shares outstanding by the share price of the stock. The primary categories of mutual fund market capitalization include mega-cap, large-cap, mid-cap and small-cap funds. When a mutual fund is categorized by market cap, this indicates the size of the companies in which the fund invests.

9. Mutual Fund Yield

A mutual fund's yield refers to the income that is returned to investors. The income includes interest and dividends, and is generated by the fund's investments. A mutual fund's yield is typically expressed as an annual percentage rate.

The Bottom Line

Investing in a mutual fund is simple and grants investors access to an array of investments with a single product. By learning just a handful of basic mutual funds definitions, you can be a more informed investor.