Table of Contents

Key Takeaways

- Equity funds invest in stocks, categorized by market cap, objective, region, or sector.

- Large-cap funds target large companies, mid-cap funds invest in mid-sized firms, and small-cap funds focus on smaller companies.

- International funds invest outside the U.S., adding diversity but also risk.

- Growth funds focus on high-growth companies, income funds on dividend-payers, and value funds on discounted stocks.

- Bond funds are categorized by issuer, maturity, and bond credit rating.

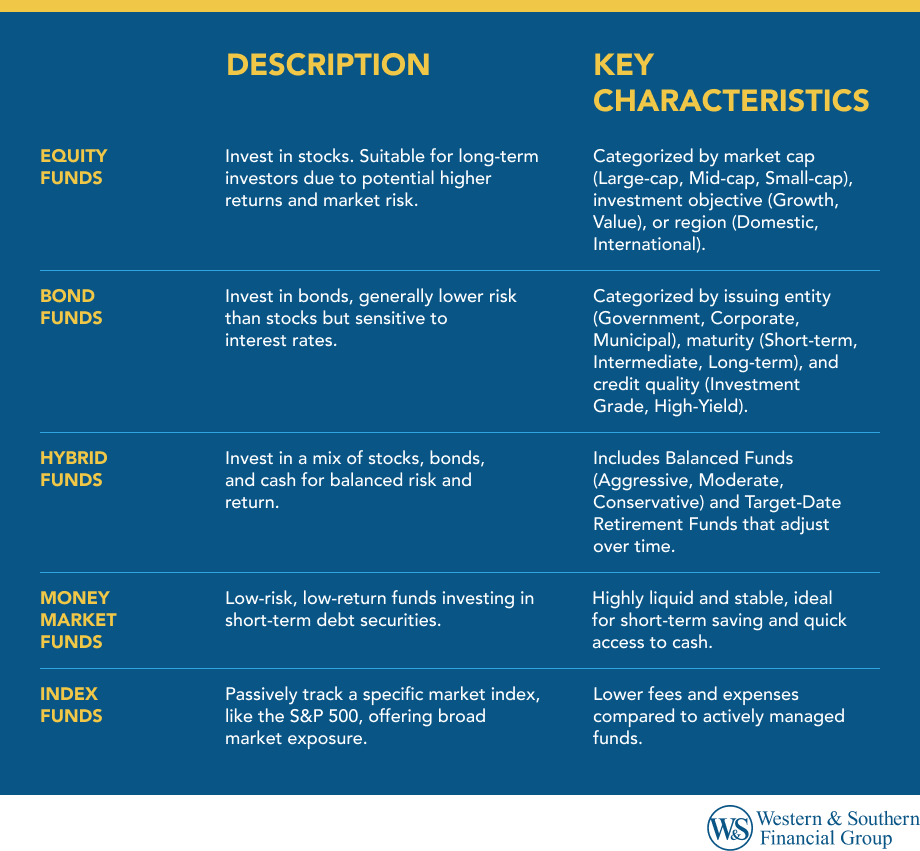

This article explains different categories of mutual funds — equity (stock) funds, bond funds, hybrid mutual funds, money market funds and other mutual funds — which are further classified into subcategories. Keep in mind that this article does not list all the type of mutual funds, but only the common mutual funds.

Equity Funds

Although an equity fund is comprised of stocks, keep in mind that mutual funds and stocks are different.

Equity funds, also called stock mutual funds, are typically more suitable for long-term investors with at least a 5-year time horizon (ideally 10 or more years) to invest. A longer holding period is typically appropriate because stocks mutual funds historically have higher returns, along with higher market risk, when compared with most other investments.

Here's how equity funds are categorized:

Market Capitalization

Equity funds may be categorized by market capitalization, or market cap, which is the total market value of a company's outstanding shares of stock. It is calculated by multiplying a stock’s market price by the number of outstanding shares. Large-cap, mid-cap and small-cap stocks are defined by their market caps:

- Large-cap stocks: Market capitalization greater than $10 billion.

- Mid-cap stocks: Market capitalization between $2 billion and $10 billion.

- Small-cap stocks: Market capitalization between $300 million and $2 billion.

Investment Objective

In addition to market cap, funds may be further categorized by the fund's primary objective, such as growth, value/income or core.

Country or Region

Funds may also be categorized by the country or region where the issuing companies of the stocks are headquartered. Stock funds are most commonly either domestic (U.S. stocks) or international (non-U.S. stocks).

Economic Sector

There are also some specialty funds that invest only in certain sectors of the economy, such as healthcare, technology or real estate.

Large-Cap Funds

Also known as large company funds, large-cap funds hold stocks of companies that are the largest in market cap. Large-cap stocks have market risk but historically have been more stable than mid- and small-cap stocks.

Mid-Cap Funds

Mid-cap stock funds hold stocks of mid-sized companies. Mid-cap stocks are generally more risky than large-caps but are less risky than small-cap stocks. Mid-cap funds may be suitable for investors who want to invest in stocks that are more aggressive than large-caps but less risky than small-caps.

Small-Cap Funds

Small-cap stock funds hold smaller companies that are not household names like larger mid-cap and large-cap companies tend to be. Although these companies are lesser known, small-cap stocks have historically outperformed large-cap stocks. Small-cap stocks typically have higher market risk than mid- and large-cap stocks.

International Funds

Also known as foreign stock funds, these funds generally invest in stocks of companies outside of the U.S. International stocks tend to be riskier than U.S. stocks, but they can help add diversity to a portfolio by expanding the holdings outside of the U.S. Just keep in mind that diversification cannot guarantee profit or protection against loss in a declining market. International investing carries the associated risks of economic and political instability, market liquidity, currency volatility and differences in accounting standards. The risks associated with investing in foreign markets are magnified in emerging markets due to their smaller economies.

Growth Funds

Growth stock funds invest in stocks of companies that demonstrate the potential to grow at a faster rate than the rest of the stock market. Growth funds are considered to be aggressive investments because they have a higher risk-return profile than other types of stock funds.

Income Funds

Often called income funds, dividend funds or dividend equity, income stock funds typically invest in stocks of companies that pay dividends. Dividend funds also may focus on stocks of companies that pay above-average dividends or stocks of companies that have a history of increasing their dividends. There is no guarantee that these funds will pay a dividend.

Value Funds

Value stock mutual funds invest in stocks of companies that are believed to be selling at a price that is lower than the intrinsic value of the stock. In other words, value stock investors are looking for bargains or stocks selling at a discount.

Sector Funds

Sector funds specialize by investing in just one sector of the economy — such as health care, technology, transportation or communication services. Although some sectors may outperform the broader economy, investing in one or two sectors can be more unpredictable than investing in a more diversified mutual fund that represents multiple sectors of the economy.

Bond Funds

There are multiple types of bond mutual funds, but they can be broken down into primary categories and subcategories.

Issuing Entity

Bond funds are primarily categorized by the entities that issue the bonds. These entities can be a government, municipality or a corporation. Investors can also select bonds issued by other countries.

Maturity/Duration

Bonds are further categorized by maturity or duration of the bond holdings. These subcategories are short term, intermediate term and long term.

Credit Rating/Risk

Bond funds are also categorized by the average credit rating of the underlying bond holdings. The credit ratings can help investors evaluate the credit risk. Bonds with the highest credit ratings, such as AAA, historically have the lowest risk — but they often have the lowest yields as well. Bond funds that hold low credit quality bonds are often referred to as high-yield bond funds or "junk" bond funds.

Investors should note that bond funds can include any or all of these qualities within their respective categorization. For example, you can buy a high-yield, long-term corporate bond fund. Or you may choose to buy an intermediate-term, AAA-rated municipal bond fund. There are multiple combinations of qualities that make up the categories of mutual funds.

As an investor evaluating the various types of bond funds, you also should remember to take interest rate risk into consideration. While bond funds are generally lower risk/reward investments than equity funds, you still assume interest rate risk when you put your money into a bond fund. When interest rates increase, bond prices decrease, so it’s beneficial to evaluate both long-term and short-term bonds in relation to current interest rates. For example, if you purchase a long-term bond and interest rates increase by 1%, the price of that long-term bond will go down, which means you are assuming more risk with that investment. Even though long-term U.S. government bonds are among the safest bonds for investors, the value of this type of long-term debt can still change over time based on interest rates.

Government Bond Funds

Government bond funds invest in U.S. government bonds, which are backed by the U.S. Department of the Treasury and are generally considered to be among the highest rated and lowest risk bonds on the market. These bonds invest in debt issued by the U.S. government to support government spending. Like other bond funds, government bond funds can hold short-, intermediate- or long-term bonds.

Investors also can buy bond funds that hold non-U.S. government bonds, which are generally riskier but may pay higher interest rates than U.S. government bonds.

Municipal Bond Funds

Municipal bond funds hold bonds that are issued by a municipality, such as a city or state government. The primary distinction of municipal bond funds is that the interest paid typically receives favorable federal tax and potentially state tax treatment.

Corporate Bond Funds

Corporate bond funds invest in debt securities that are issued by corporations and sold to investors. The backing for a corporate bond is generally the company’s ability to repay, which depends on the firm’s prospects for future revenues and profitability. Since corporate bonds are not backed by a government, they typically have higher yields and involve higher relative risk than government and municipal bonds.

Short-Term Bond Funds

Short-term bond funds invest in bonds with maturities of less than five years. Any entity can issue short-term debt, including governments, corporations and companies rated below investment grade. These bond funds generally pay lower interest rates and have lower market risk compared with intermediate- and long-term bond funds.

Intermediate-Term Bond Funds

Intermediate-term bond funds hold bonds with maturities between five and 10 years. These bond funds generally pay higher interest rates and have higher market risk than short-term bonds, but they frequently have lower interest rates and lower market risk compared with long-term bond funds.

Long-Term Bond Funds

Long-term bond funds invest in bonds with maturities of more than 10 years. These bond funds generally pay higher interest rates and have higher market risk compared to short- and intermediate-term bond funds.

High-Yield Bond Funds

Also known as "junk" bond funds, high-yield bond funds generally invest in corporate debt securities that pay higher interest rates because they have lower credit ratings than investment-grade bonds. Because of their lower credit quality holdings, these bond funds often pay higher yields and have higher market risk than other bond funds.

Foreign & Emerging Markets Bond Funds

Foreign and emerging markets bond funds invest in bonds issued by the governments or corporations of the world’s developed and developing nations ex-U.S. (outside of the United States). Emerging market economies include many economies around the world. Some of the most recognizable include China, India, Brazil and Russia. Emerging market bonds are seen as higher risk because less developed countries are not as stable due to political turmoil, economic swings and other disruptions. Foreign and emerging markets bond funds are generally higher risk than U.S. bonds, but they often pay higher interest rates.

Hybrid Mutual Funds

As the category name suggests, hybrid mutual funds invest in multiple asset types, which will typically be some combination of stocks, bonds and cash. The main subcategories of hybrid funds are balanced funds, target-date retirement funds and lifestyle funds.

Balanced Funds

Balanced funds typically maintain a relatively fixed allocation and will invest according to the stated objective of the fund, which may be aggressive, moderate or conservative.

Aggressive Allocation Balanced Funds

These balanced funds have a high-risk allocation of stocks, such as 80% to 90% of the portfolio, with a small allocation to bonds, such as 10% to 20%.

Moderate Allocation Balanced Funds

These balanced funds have a moderate, medium-risk allocation of stocks, such as 50% to 70% of the portfolio, with a lower allocation to bonds, such as 30% to 50%. The remainder is a small allocation to cash, such as 5% to 10%.

Conservative Allocation Balanced Funds

These balanced funds have a low-risk, conservative allocation of stocks, such as 30% to 50% of the portfolio, with a higher allocation to bonds, such as 40% to 60%, and a low allocation to cash, such as 10% to 20%.

Target-Date Retirement Funds

Also known as life-cycle funds or target retirement funds, target-date retirement funds are professionally managed portfolios that are designed to be a single-solution fund, sometimes called a "set it and forget it" fund. The fund manager will maintain an allocation that evolves over time in a way that is suitable for the target retirement date.

For example, a target retirement fund with a target date of 2050 would have a high allocation to stocks, such as 80% of the portfolio, and a low allocation to bonds, such as 20%. Over time, the allocation may gradually shift to a lower proportion of stocks and a higher proportion of bonds.1

Lifestyle Funds

Lifestyle funds are balanced funds that are designed to match a particular investment style. Like other balanced funds, lifestyle funds typically maintain a fixed allocation of stocks, bonds and cash. The objective of the fund may be geared toward a specific goal such as retirement income, long-term growth or outpacing inflation.

Money Market Funds

A money market fund — generally classified as a low-risk, low-return investment — provides you with a highly stable asset with very low volatility by investing exclusively in cash and short-term debt securities like certificates of deposit (CDs) and U.S. Treasury bills. These liquid short-term investments carry a high credit quality, which measures creditworthiness. They also invest in commercial paper, which money mutual funds prefer since its short team maturity and low risk.

As a money market fund investor, you are paid income in the form of dividends. Because money can be easily transferred between the cash instruments and other securities within the fund, the portfolio manager has the freedom to buy or sell shares on a daily basis. Money market funds, which try to keep their value at $1 per share, offer you a low-risk investment choice with high liquidity, giving you quick access to cash.2

Other Mutual Funds

Two other types of mutual funds you may consider are index funds, which are passively managed, and actively managed funds.

Index Funds

An index fund is a mutual fund whose portfolio is constructed to match or track a particular index, such as the S&P 500, the Dow Jones Industrial Average (DJIA) or the NASDAQ. Index funds offer lower expenses and fees than actively managed funds.

Actively Managed vs. Passively Managed Funds

Mutual funds can be either actively managed or passively managed. Because index funds often mimic their respective indexes in terms of their security holdings and weights, and therefore follow them very closely, they are referred to as passively managed funds. An actively managed fund, however, is different from its benchmark index and does not follow its index very closely. Managers of actively managed funds use their financial expertise, evaluating analytical research and market forecasts, to decide on which securities to buy, hold and sell within their portfolios. Actively managed funds differentiate themselves from index funds insofar as they may help investors with downside protection and long-term wealth creation.

There are many types of mutual funds, which can make it a challenge to choose the right funds for your needs. Understanding the basic types of funds and how they are categorized can help give you the tools to build a portfolio that will align with your personal investment objectives. However, working with a financial professional may be the best way to help inform your investment decisions.

Footnotes

- Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed at any time, including at or after the funds target date.

- You could lose money by investing in a money market fund. Because the share price of the fund will fluctuate, when you sell your share they may be worth worth more or less than what you originally paid for them. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporations or any other government agency. The fund's sponsor has no legal obligation to provide financial support to the fund and you should not expect that the sponsor will provide financial support to the fund at any time.