- 2023 was full of surprises: The U.S. economy proved resilient to monetary tightening, and inflation declined sufficiently for the Fed to signal it was contemplating pivoting policy at the December FOMC meeting. This fueled a powerful rally in both stocks and bonds.

- A key issue for investors now is how much the Federal Reserve will lower rates. The bond market is pricing in rate cuts of about 150 basis points this year, whereas the Fed’s “dot plots” are half as much.

- Political developments have not impacted markets thus far, but the 2024 elections could be a wildcard if the election is a replay of 2020. Investors need to consider whether Donald Trump would hike tariffs if he is wins, and whether Joe Biden and Congressional Democrats would extend tax cuts that are set to expire in 2025 if he is re-elected.

- While the rally may continue if inflation continues to slow, equity returns are unlikely to match the stellar 2023 results as valuations are stretched. Similarly, fixed income credit spreads are near historically tight levels, limiting total return potential.

- Valuations generally reflect a high probability of a soft landing with limited margin of safety despite continued economic uncertainty. As a result, we are maintaining a neutral risk posture within balanced investment portfolios and continue to favor a modest overweight to credit risk within fixed income portfolios.

Expectations about Fed Policy Drove the Markets in 2023

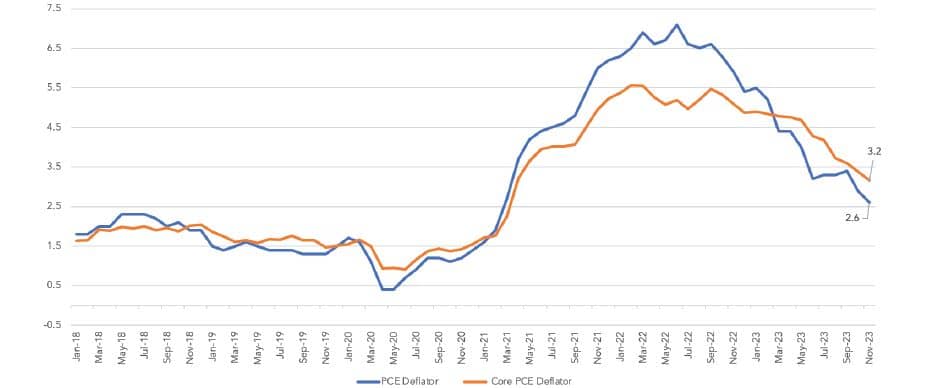

Financial markets often surprise investors, but the past year defied virtually all forecasts. The prevailing view at the start of the year was that aggressive tightening by the Fed would produce a recession. Instead, economic growth far surpassed expectations at 2.6% according to Fed estimates. At the same time, the Fed’s preferred yardstick for measuring inflation—the core personal consumption expenditure (PCE) deflator—slowed more-than-expected to 3.2% by year’s end (see Figure 1). This raised hopes that the Fed’s targeted rate of 2% was finally in sight.

Figure 1.Headline and Core Inflation (PCE Deflator)

Source: Bloomberg

Source: Bloomberg

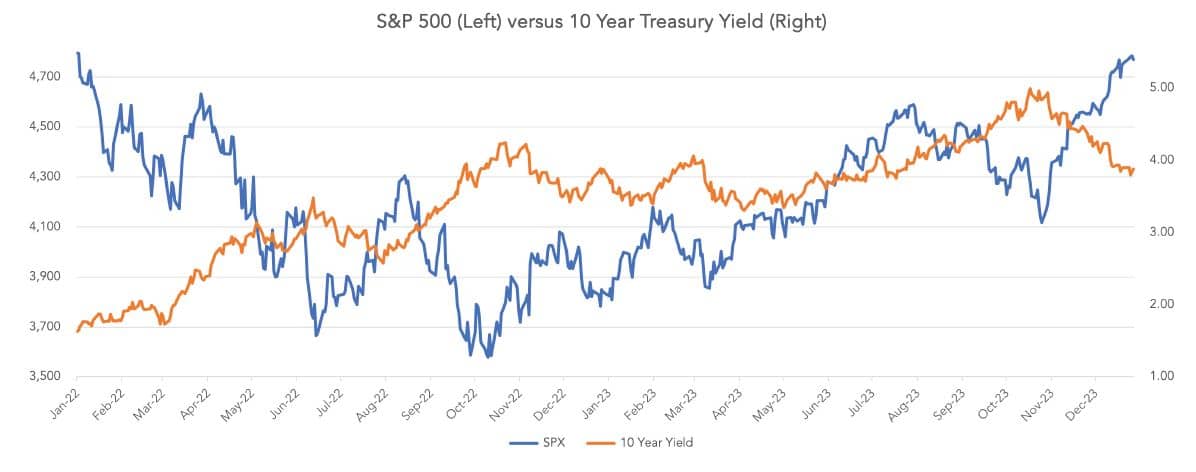

This outcome was a “Goldilocks scenario” for investors, and 2023 ended with a powerful rally for both bonds and stocks (see Figure 2). The Barclays Aggregate Index posted a total return of 5.5% for the year, following its worst showing on record in 2022 when it declined by 13%. The S&P 500 index also staged a strong recovery in 2023 as it posted a total return of 26.3% following a decline of 18% in 2022 and ended the year near a record high. The overall results were highly skewed, however, with the so-called “Magnificent Seven” far outpacing the broad market.

Figure 2. Investment Returns by Asset Class

| Equity MARKET | 2022 | 2023 Q1 - Q3 | 2023 Q4 | 2023 Full Year |

|---|---|---|---|---|

| U.S. (S&P 500) | -18.1 | 13.1 | 11.7 | 26.3 |

| NASDAQ | -32.5 | 27.1 | 13.8 | 44.7 |

| Russell 2000 | -20.5 | 2.5 | 14.0 | 16.9 |

| International (EAFE $) | -13.9 | 7.7 | 10.5 | 18.9 |

| Emerging Markets (MSCI $) | -19.8 | 2.1 | 7.8 | 10.1 |

| U.S. BOND MARKET | 2022 | 2023 Q1 - Q3 | 2023 Q4 | 2023 Full Year |

|---|---|---|---|---|

| US Aggregate Bond | -13.0 | -1.2 | 6.8 | 5.5 |

| Treasuries | -12.5 | -1.5 | 5.7 | 4.1 |

| IG Credit | -15.3 | 0.0 | 8.2 | 8.2 |

| High Yield | -11.2 | 5.9 | 7.2 | 13.4 |

| JPM EM Debt | -17.8 | 1.8 | 9.2 | 11.1 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

Thereafter, the bond market rallied in the last two months amid a series of favorable inflation readings that culminated in the Fed signaling in December that it was considering pivoting monetary policy. This represented a significant departure from the Fed’s previous message that rates would stay “higher for longer.”

Figure 3. 10-Year Treasury Yield and S&P 500 Index

Source: Bloomberg

Source: BloombergWill Rate Cuts Fall Short of Investors' Expectations?

Considering how powerful the rallies have been for bonds and stocks, a key issue this year is whether investors’ expectations about rate cuts will be met. The consensus among economic forecasters is that the Fed will wait for confirmation that inflation is under control before it eases policy in the spring. Thereafter, the bond market is pricing in rate cuts of about 150 basis points that would reduce the funds rate to 3.75%-4.0% by year’s end. This is three quarters of a percentage point below what policymakers envision.

While most forecasters expect a “soft landing” this year, they believe that rate hikes totaling 550 basis points over the past two years will slow the economy. Both the housing and manufacturing sectors already are feeling the impact of higher interest rates, and many people question how long consumers can bolster the economy as savings during the COVID-19 pandemic are depleted.

On this score, Fed policymakers concur that an economic slowdown is likely. Their median forecast based on “dot plots” of Fed officials show policymakers expect real GDP growth will moderate to 1.4% this year.

Fed officials, however, foresee only a modest rise in the unemployment rate to 4.1% by the end of this year from 3.7% in 2023. This is a key reason why they anticipate making only three 25 basis point cuts in the funds rate in 2024. However, it is also an area where Fed officials could be too optimistic. Indeed, they are projecting that inflation will approach the 2% target and that unemployment will stabilize around 4.1% in the next three years.

Amid this, the Fed’s reaction to incoming data is likely to be more sensitive to employment data than it has been in the past two years. The reason: As the Fed comes closer to attaining its target for inflation, the unemployment rate may diverge from its goal of full employment.

An added consideration is that the November elections may narrow the window for the Fed to ease policy. Normally, Fed officials would prefer to stay on the sidelines when campaigns are in full swing after Labor Day, so it is not perceived as trying to the influence the outcome. If so, the Fed’s window to act would be about six months, and we do not foresee it moving in 50-basis point increments unless there are signs of recession.

All told, the degree of easing in 2024 is likely to be in the range of the Fed (75 basis points) and the market (150 basis points). Should the Fed fall short of current market expectations, their guidance of continued easing in future periods will likely be enough to satisfy investors.

Will Geopolitical Events and the 2024 Elections Impact Markets?

Thus far, political developments—whether geopolitical or domestic—have had only a temporary impact on financial markets. The stock market sold off in early 2022 when Russia invaded Ukraine and oil prices spiked. However, it subsequently stabilized as oil prices fell back to levels before the invasion. More recently, Hamas’ attack on Israel and the ensuing conflict has had little impact on the markets, mainly because investors do not expect it will result in an oil embargo such as what occurred during the Arab-Israeli conflict fifty years ago.

Similarly, on the domestic front, the squabbling between Republicans and Democrats over the federal budget deliberations have had only limited impact on the Treasury market. The reason: most observers do not believe Republicans would be willing to risk a default on U.S. government debt.

A wildcard that investors need to consider, however, is how the outcome of the 2024 elections might impact financial markets. The prevailing view is that the presidential election will be a replay of the Trump-Biden contest in 2020. If so, it is not clear that the outcome will matter: The stock market surged following Trump’s surprise win in 2016 until the COVID-19 pandemic struck in 2020, and it continued to perform well under Biden’s tenure, except for 2022 when the spike in inflation caused the Fed to tighten aggressively.

There are two looming economic policy issues, however, that will matter to investors. One is the possibility that Trump, if elected, would follow through on his pledge to adopt a universal 10% hike in tariffs. When Trump raised tariffs on a broad spectrum of imports from China, the EU, and other countries in 2018, the stock market sold off amid uncertainty about whether a trade war would escalate. This time, the market impact could be greater because a hike in tariffs would likely boost prices for imported goods, which could deter Fed easing.

Another policy issue is whether Biden, if re-elected, would extend the sweeping Trump-era tax breaks established by the Tax Cuts and Jobs Act of 2017. While the legislation made some tax cuts for businesses permanent, lowered individual tax cuts will expire at the end of 2025 and will revert to pre-2017 levels. The outcome depends on which party controls the White House and Congress, and in the event there is a divided government, a compromise will likely be worked out. However, it is too early to discern what it might be.

Positioning Investment Portfolios

Investment portfolios generated strong results in 2023 despite a challenging economic environment. Looking forward, we do not expect investment returns in 2024 to match the prior year, largely as a result of full valuations amid continued economic uncertainty.

In balanced portfolios, we favor a neutral allocation to equities relative to fixed income. Although improving, ongoing economic risks coupled with full valuations results in low risk levels within investment portfolios. Valuations generally reflect a high probability of a soft landing with limited margin of safety at current levels, though there are still risks to the downside for the economy as policy remains restrictive and economic growth is set to slow.

In fixed income portfolios, we are positioning portfolios with a modest overweight to credit risk, and we continue to find opportunities in securitized products, primarily CMBS and MBS, and segments of emerging markets debt. Domestic corporate credit spreads ended the year near historically tight levels, representing limited upside from current levels. That said, the improving economic outlook should support tight spreads and result in positive returns from carry. Interest rates represent balanced risk/reward as the Fed pivots to rate cuts in 2024, and portfolios are generally positioned neutral duration as a result.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations have become stretched for the aggregate market following strong performance in 2023 despite nearly flat earnings growth for the year. We are prioritizing high barrier to entry businesses with high returns on capital and maintaining a moderately defensive posture within portfolios.

This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. The securities identified do not represent a complete list of all securities purchased, sold, or recommended; please contact Fort Washington for a complete listing of securities held, sold, or purchased over the last year. Opinions expressed in this commentary reflect subjective judgments of the author based on the current market conditions at the time of writing and are subject to change without notice. Information and statistics contained herein have been obtained from sources believed to reliable but are not guaranteed to be accurate or complete. Past performance is not indicative of future results.

© 2024 Fort Washington Investment Advisors, Inc.