The S&P 500 Growth Index has outperformed the S&P 500 Value Index by 5.7 percentage points per year or 255 percentage points on a cumulative basis from 2007 through 2020.1 Value has outperformed only 4 out of these 14 calendar years. This contradicts roughly a century of value outperforming growth. This contrast combined with the outperformance of value since August has many in the investor community promoting either value or growth. We have long viewed growth as a component of value, and value versus momentum as the more relevant distinction. Some investors prioritize price, some do not. Below we outline some of the complexities involved with forecasting growth versus value and discuss the area of the equity market that is least attractive in our view. We then look back at a brief history of investors who have prioritized price and discuss a forward-looking framework for value-oriented investors that avoids the need for a growth versus value call.

The Growth Versus Value Call

A helpful starting point to demonstrate the challenge of calling growth versus value is outlining the main drivers of the prolonged period of growth leadership since 2007. In our view there is one primary reason and two secondary drivers.

The primary reason has been fundamentals. The growth segment has included a higher share of companies whose fundamentals have benefited from technological disruption during this period. There is historical precedent here. Another long period of growth outperformance occurred from July 1926 to December 1941 amidst the advent of the automobile. In that period, auto manufacturers, auto suppliers, and oil companies were the growth leaders benefitting from disruptive innovation. This parallels the outcomes we have seen more recently with the wider adoption of the internet.

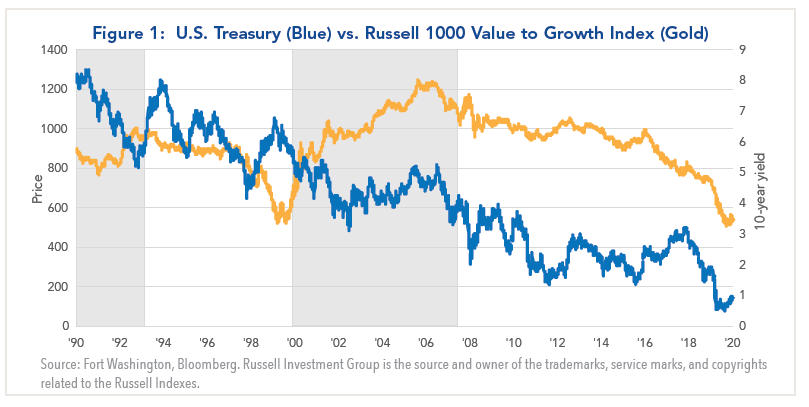

We consider interest rates an important but secondary driver for growth outperformance. Declining interest rates raise the value of long duration cash flow streams found in many growth stocks. Also, declining rates lower the profitability of many financial businesses which comprise a larger share of value than growth. Looking at history, however, value has demonstrated the ability to lead in periods with declining rates. Figure 1 below shows the 10-year U.S. Treasury yield in blue on the right axis mapped against the Russell 1000 Value/Growth Total Return Index in gold on the left axis from 1990. You can see that in two periods highlighted in gray, 1990-1993 and 2000-2007, value outperformed growth despite a declining 10-year U.S. Treasury yield. Higher rates generally support value outperformance, but there are clearly other important considerations.

The other secondary driver has been the scarcity of growth in the global economy since the Great Financial Crisis.

With a slower baseline of growth across major economies, businesses viewed as offering investors above-trend growth have received higher valuations. This dynamic has played out across the globe with growth stocks outperforming in most major economies.

With a slower baseline of growth across major economies, businesses viewed as offering investors above-trend growth have received higher valuations. This dynamic has played out across the globe with growth stocks outperforming in most major economies.

Looking at valuation, we see opportunities within growth and value where market prices are comfortably below intrinsic values. In our view, the area where valuations have been stretched for the last few years is bond proxies. Bond proxies in the equity market include mostly Consumer Staples and Utilities businesses that are relatively stable and pay attractive dividend yields. Years of low interest rates have bid up these segments and reduced the margin of safety for investors. In 2020, the backdrop was favorable for bond proxies with rates declining and volumes at consumer products companies benefitting from stay-at-home orders. Yet areas like Consumer Staples and Utilities underperformed. To us, these are the areas where investors should be cautious. While bond proxies are fully valued in our opinion, valuations within value and growth more broadly offer plenty of attractive opportunities.

Looking at valuation, we see opportunities within growth and value where market prices are comfortably below intrinsic values. In our view, the area where valuations have been stretched for the last few years is bond proxies. Bond proxies in the equity market include mostly Consumer Staples and Utilities businesses that are relatively stable and pay attractive dividend yields. Years of low interest rates have bid up these segments and reduced the margin of safety for investors. In 2020, the backdrop was favorable for bond proxies with rates declining and volumes at consumer products companies benefitting from stay-at-home orders. Yet areas like Consumer Staples and Utilities underperformed. To us, these are the areas where investors should be cautious. While bond proxies are fully valued in our opinion, valuations within value and growth more broadly offer plenty of attractive opportunities.

A sustainable value rotation will likely rely on a dismantling of some combination of the three drivers of growth outperformance since 2007. These three drivers – technological disruption, interest rates, and global GDP growth – carry considerable uncertainty. Investors calling growth versus value introduce material style risk into their portfolio and limit their ability to capitalize on attractive bottom-up opportunities across the market. Those who consider growth a component of value broaden their investable universe and improve the odds of generating attractive returns.

A Look Back at Value Frameworks

The concept of value has had a long and winding path in the investment discipline. Benjamin Graham published the Intelligent Investor in 1949. He profiled the difference between price and value caused by the emotional tendencies of investors, which he described as Mr. Market. Graham and his colleague David Dodd focused primarily on asset values to find stocks with a margin of safety to intrinsic value. Fast forward to the 1990s, Kenneth French and Eugene Fama popularized a quantitative multiple-based expression of the idea that stocks which are currently out of favor outperform stocks that are currently in favor over longer-term periods. The wide acceptance of this concept produced a host of investment strategies anchoring on disciplined adherence to low multiples (price to earnings, price to book, etc.). Despite notable differences, many investors confuse the multiples-based value factor framework popularized by Fama and French with Graham and Dodd’s value investing. With this background, our view is that today’s value investors need to keep several important themes top of mind.

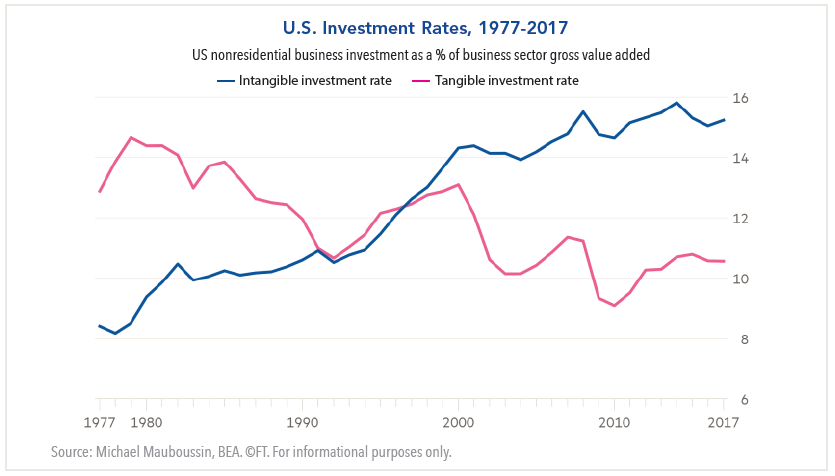

- Multiple denominators are becoming less relevant. Earnings and book value have become distorted as we have moved from the manufacturing-led economy that preceded Fama and French’s seminal 1992 research study to a service-led economy. Today’s value investors must be equipped to make the proper adjustments to account for the growing share of intangible investments. These investments effectively understate earnings and result in a lower book value relative to similarly sized investments in plant, property or equipment for example. Overall, this dynamic has reduced the utility of multiples for investors.

- Even setting aside the rise of intangibles, multiples-based investing still has material limitations. Investors using multiples to screen for opportunities often rely on a cheap stock reverting to a historical or comparable multiple level. This can be troublesome in a business climate where strong barriers to entry often increasingly reward successful firms. Compare this with a forward-looking approach that uses a discounted cash flow (DCF) model to disaggregate how much future value creation is priced into the current share price. Assessing an opportunity as having a free option on future value creation combined with a deep understanding of the company’s barrier to entry provides much more insight than concluding, for example, that a business is being purchased at 10x earnings, an 8x EBITDA multiple, or an 8% cash flow yield.

- Value is underweight technological disruptors. As of December 31, 2020, the Russell 1000 Value was underweight Information Technology (i.e. Apple and Microsoft) by 35.5 percentage points, Consumer Discretionary (i.e. Amazon) by 9.1 percentage points, and Communication Services (i.e. Netflix, Facebook, Google) by 1.4 percentage points relative to the Russell 1000 Growth. This cuts two ways for value factor investors. They own more of the segment of the economy that has been getting disrupted and less of the segment that has benefited from technological progress.

Forward-Looking Framework for Value-Oriented Investors

Fort Washington’s Focused Equity team developed a modern extension of the Graham & Dodd investing framework to incorporate many of the timeless principles of value investing while addressing the challenges. We build a concentrated portfolio of competitively advantaged businesses that are undervalued regardless of whether they are classified as value or growth. In our eyes, all our names are value-oriented; again, growth is a component of value. For over a decade, the team’s process has benefited security selection in a challenging environment for many value investors. By relying on returns on capital-based DCF models rather than multiples, properly adjusting for the presence of intangible investment, studying how barriers to entry evolve with technological disruption, and linking valuation to barriers to entry, the team has found many undervalued opportunities outside of traditional value segments.

From a top-down view, value investors with a framework to consider high quality companies with growth prospects rather than filtering stocks based on multiples can benefit from additional flexibility. Tracking the growth factor of the Fort Washington Focused Equity portfolio in 2020 provides a good demonstration of the output of this in practice. The strategy had a 400 basis points overweight to the growth factor relative to the benchmark at the end of the first quarter shortly after the market trough. The team then began selectively trimming more fully valued holdings with higher levels of growth and adding several attractive opportunities in COVID-impacted, value areas. The portfolio was 400 basis points underweight growth factor at year end despite the significant outperformance of growth in between. With growth outperforming most of the year and value outperforming late, the team’s approach provided a portfolio positioning tailwind in 2020.

We believe value investing, properly applied with a forward-looking framework, continues to have a bright future regardless of whether the value or growth factor leads going forward.