- The U.S. economy has not skipped a beat since 2024 began with the pace of activity still strong. However, there is less clarity about whether inflation will decelerate further.

- Some investors anticipate a "no landing" outcome in which inflation stays above the Fed's 2% target. Bond traders now anticipate the most likely outcome is that the funds rate will be cut two times this year.

- While bond yields have increased considerably, the stock market rally has continued, powered by growing optimism about the economy and Gen AI's potential impact on productivity.

- Amid this, we are positioning investment portfolios with a relatively modest overweight to risk. Despite our improving economic outlook, valuations remain elevated with limited margin of safety.

A Strong Start to 2024

The debate among investors at the start of this year was how long the economy could sustain above trend growth and whether inflation would continue to decelerate. In response to the strong showing for the first quarter, doubts about the economy's resilience have waned. However, progress on the inflation front stalled in the first three months, which has raised questions about whether it will be ongoing or temporary.

Consequently, there was a significant reversal in bond yields: Ten year Treasury yields increased by about 40 basis points in the quarter to close at 4.2% (Figure 1). They have since increased above 4.5% in response to a strong jobs report for March and CPI inflation that reached 3.5%. This mainly reflects a reappraisal by bond investors about the prospects for monetary policy easing this year: They now anticipate the funds rate will end the year around 5.0% versus 4.0% previously.

Source: Bloomberg

Source: Bloomberg

Equity investors were unfazed by this development, as the stock market continued to set record highs during the first quarter. The S&P 500 Index posted a 10.5% return (Figure 2) and ended the quarter up by 27% from its lows in late October. The tech sector continued to lead the way, powered by advances in AI related stocks, although there was also a broadening in the market.

Figure 2. Investment Returns by Asset Class

| Equity MARKET | 2023 | Q1 2024 |

|---|---|---|

| U.S. (S&P 500) | 26.3 | 10.6 |

| NASDAQ | 44.7 | 9.3 |

| Russell 2000 | 16.9 | 5.2 |

| International (EAFE $) | 19.0 | 5.9 |

| Emerging Markets (MSCI $) | 10.2 | 2.4 |

| U.S. BOND MARKET | 2023 | Q1 2024 |

|---|---|---|

| US Aggregate Bond | 5.5 | -0.8 |

| Treasuries | 4.1 | -1.0 |

| IG Credit | 8.2 | -0.4 |

| High Yield | 13.4 | 1.5 |

| JPM EM Debt | 11.1 | 2.0 |

Source: Bloomberg. For informational purposes only. Frank Russell Company (FRC) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information pertaining to FRC and unauthorized use, disclosure, copying, dissemination, or redistribution is strictly prohibited. This is a Fort Washington Investment Advisors, Inc. presentation of the Russell Index data. Frank Russell Company is not responsible for the formatting or configuration of this material or for any inaccuracy in Fort Washington’s presentation thereof. You cannot invest directly in an index.

Will There Be a "Soft Landing" or "No Landing?"

Looking ahead, most economists have lowered the likelihood of a recession this year considerably amid continued strong economic data. The economy appears on course to attain growth of about 2.3% in the first quarter according to the Atlanta Fed's model, following larger-than-normal increases in the second half of 2023.

The key factor buttressing the economy is consumer spending, which accounts for nearly 70% of aggregate demand. It increased by 0.4% in February, and the University of Michigan's index of consumer sentiment rose to the highest level since mid-2021, supported by strong stock market gains and jobs growth. Also, two of the weakest sectors—residential housing and manufacturing—have shown signs of stabilizing.

The debate now is whether the economy will attain a "soft landing" in which inflation declines towards the Fed's target of 2%, or "no landing" in which the economy grows at or above trend while inflation hovers around 3%.

According to a recent Deutsche Bank survey, 45% of investors now believe a "no landing" scenario is the most likely outcome. This compares with 38% of respondents who expect a "soft landing" and 17% who foresee a recession this year.

The survey was taken after Fed Chair Jerome Powell brushed aside higher-than-expected consumer price index reports in January and February. Powell told reporters at the March FOMC press conference that these reports "haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road towards 2%."

While bond investors have thrown in the towel regarding the expectation of six cuts in the feds funds rate this year, and Treasury yields have backed up accordingly, equity investors see the glass as mostly full.

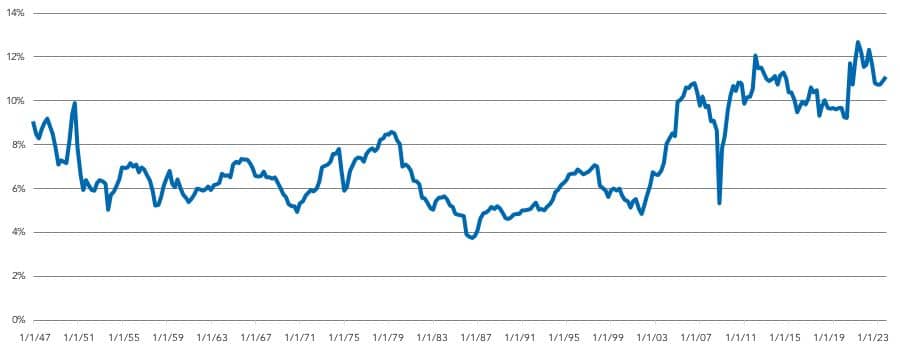

One reason equity investors are optimistic is they believe it is only a matter of time before the Fed eases monetary policy, most likely by mid-year. And, although interest rates are up considerably from levels earlier this decade, they are below levels for most of the post-WWII era.

Figure 3. U.S. Corporate Profits After Tax (without IVA and Depreciation)/GDP

Source: St. Louis FED

Source: St. Louis FEDIn this regard, many investors are optimistic that Gen AI will contribute to a productivity surge such as the one that eventually accompanied the tech boom during the 1990s.

Risks to the Bullish Outlook

So, what could put a damper on this bullish outlook?

One risk is that Fed officials could alter their prognosis for monetary policy if inflation does not show signs of receding by mid-year. While some investors interpret Chair Powell's stance as being "dovish" since the December FOMC meeting, he and other FOMC members have not indicated they would be willing to settle for inflation around 3%. If they were to do so, it could undermine the Fed's credibility as an inflation fighter. Therefore, the stock market could be vulnerable if Fed officials lessened how much they would consider lowering interest rates.

A second risk is that investors are over-estimating the extent to which Gen AI is likely to boost productivity in the short-to-medium term. Although it has the potential to be transformative over the long term, there are typically long lags between the initial adoption of new technologies and their impact on the economy. This was true, for example, both of the computer revolution in the 1970s and the adoption of the internet in the mid-1990s.

A third risk is on the political front, both at home and abroad. This year's U.S. elections are shaping up to be some of the most consequential in history, with President Biden and former President Trump offering completely different visions of how they would govern. Simultaneously, there is a chance that the leadership of both chambers of Congress could switch for the first time, if the Republicans were to win control of the Senate and the Democrats were to win control of the House.

The outcome is hard to predict, as the races for President and Congress are shaping up to be very close. While investors have not placed significant bets on the outcomes thus far, markets could turn more volatile after Labor Day, when the campaigns are in full swing.

Positioning Investment Portfolios

Investment portfolios had a strong start to 2024, despite continued volatility. Looking forward, full valuations are likely to limit upside while the market looks for rate cuts to spur continued growth.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. Despite our improving economic outlook, elevated asset prices result in only a modest overweight risk posture within the strategy. Valuations generally reflect a high probability of a soft/no landing scenario with limited margin of safety at current levels, though there are still risks to the downside as policy remains restrictive.

In fixed income, we are positioning portfolios with a modest overweight to credit risk. Credit spreads tightened further over the quarter and remain at historically tight levels, representing limited upside from current levels. However, the improving economic outlook should support tight spreads, and portfolios seek to take advantage of periods of strength by incrementally improving credit quality and liquidity. Interest rates increased over the quarter and represent balanced risk reward. While the Fed is expected to begin easing monetary policy in 2024 as inflation trends toward its target, they will likely remain in restrictive territory for some time.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations have become stretched for the aggregate market following a strong start to the year, which was driven by limited market breadth, though showing signs of improving. Earnings are expected to grow by high single digits in 2024 following nearly flat earnings growth last year. We are prioritizing high barrier to entry businesses with high returns on capital and maintaining a moderately defensive posture within portfolios.