Key Takeaways

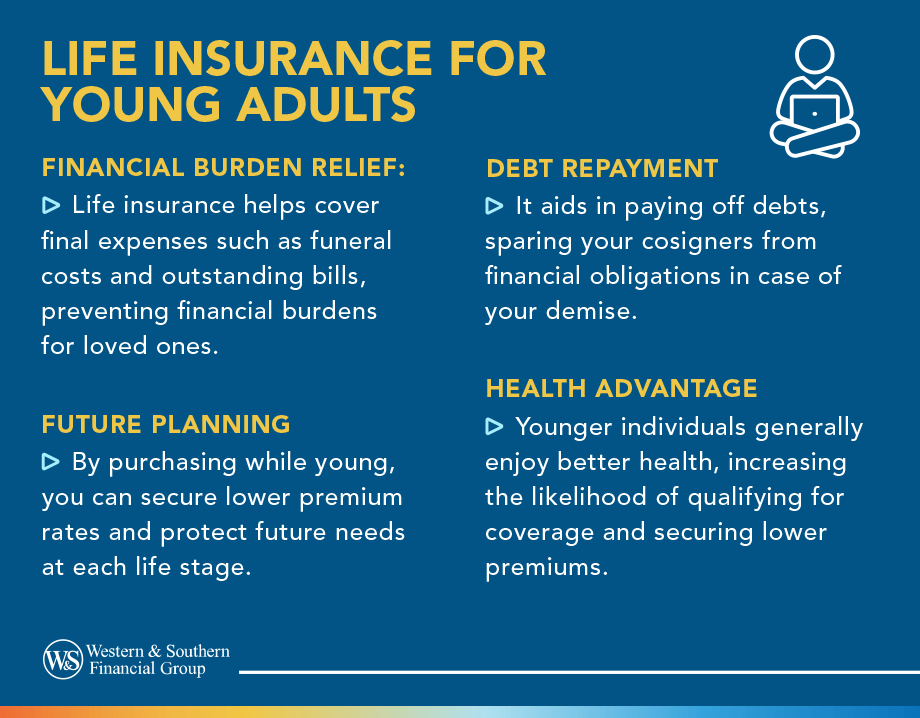

- Life insurance can help cover funeral costs and other bills associated with your death, preventing a financial burden on your loved ones.

- Life insurance can prevent your cosigner from being burdened with your debts if you pass away.

- Buying life insurance while young can protect loved ones in case of death, especially before major life events, and may secure lower premiums.

- Getting life insurance young means lower premiums and easier qualifications. Waiting raises costs and health-related issues.

- There are three common types of life insurance for young adults: term life insurance, whole life insurance, and universal life insurance.

If you're a young adult with no dependents, life insurance might not seem like much of a priority — especially given other financial concerns, such as paying off student loans or saving for a down payment on your first home.

But there are several reasons to buy life insurance when you're young. Here are some of the reasons you might consider, a brief explanation of the three most common types of life insurance, and some information on how to choose a life insurance policy.

Reasons to Buy Life Insurance as a Young Adult

While it might not seem like someone your age would need life insurance, some of the reasons a young adult might want coverage include:

To Help Cover Final Expenses

In addition to funeral costs, you might also have other bills, such as health care costs, associated with your death. With life insurance, you could cover these expenses yourself and help prevent leaving a financial burden behind for your loved ones.

Median Cost of a Funeral

To Pay Off Debt

Life insurance might also be valuable if your parents or someone else cosigned on your student loans and other debts. If you pass away, then your cosigner would still be responsible for paying off everything. Life insurance could help with these expenses.

To Prepare for Future Needs

Do you plan on buying a house, getting married or having children? A life insurance policy can help protect your loved ones in the event that you should die, and buying a policy while you're still young could potentially help you lock in a lower premium rate.

Potential Advantages of Buying Life Insurance While Young

Buying life insurance while you're young may offer several advantages versus waiting. When you apply for a policy, you go through a process called underwriting where the insurer reviews your health status and considers your risk of passing away. Based on your risk, they decide whether you qualify. You are not guaranteed to be able to buy life insurance, but when you're younger, you're typically in better health, so you have a better chance of qualifying.

Insurers also use this information to determine the premium you pay. The younger and healthier you are, the more likely you are to get a lower rate. On the other hand, if you wait until you're older to buy, the cost of insurance will likely be more expensive. There's also the chance that you could develop a serious health condition by then, which can make it more difficult to qualify.

Use life insurance to prepare for future life stages in advance. Get a Free Life Insurance Quote

Opportunities for Life Insurance at New Life Stages

Being a young adult can mean reaching new life stages, one after the other. Here's what you could be thinking about for your insurance and finances, depending on where you are.

Newly Graduated

If you just finished school and are looking for a job, chances are your budget might be a little tight. If you can swing it, you may want to consider buying a term policy. At your age, it will likely be more affordable. That way, should the worst happen and you pass away, you wouldn't leave the financial burden of covering your final expenses to your family.

Some term policies give you the option to convert into permanent ones later — including those with cash value — without a medical exam. This can give you the option to swap once you start working and can afford to put more toward your financial goals.

New to the Workforce

If you just joined the workforce, consider putting together a budget (if you don't already have one). Money can go fast if you don't watch your spending. Consider putting at least some of your paycheck toward your long-term financial goals, such as saving for retirement.

The money you put aside now has decades to grow, which may make reaching your retirement target easier than if you start later in life.

A permanent policy such as whole or universal life could help you build this wealth through cash value. Another option is to set up an affordable term policy to prepare for the future. That way, you'd have your insurance coverage in place to prepare for having a family one day or to leave a financial cushion for your beneficiaries. Plus, you could convert to permanent coverage once you're ready.

New to Selecting Your Own Benefits

If you're just starting your career, it's possible that you might not have needed to select workplace benefits before. Perhaps this is because your first job didn't have them or you stayed on your parents' health insurance until age 26.

Navigating company benefits can feel a little overwhelming at first, especially if there are multiple programs such as a retirement plan, health insurance, disability, dental and life insurance. A financial representative can help you sort through the choices so you can take advantage of every benefit you've earned.

If your employer offers life insurance at work, that can be a way to get affordable coverage. Just keep in mind that there can be downsides, such as losing coverage if you change jobs. Because of that, it may make sense to still have a personal policy to go with any work coverage.

Types of Life Insurance for Young Adults

There are three common types of life insurance: term life, whole life and universal life. Here's a brief overview of each.

- Term life insurance is temporary, lasting a set time, and ends if you outlive the term. It's usually more affordable, especially for young adults, and a good option for those on a smaller budget.

- Whole life insurance offers permanent coverage without an expiration date. As long as you pay the premiums, it lasts your entire life. Although the initial premium is higher than term insurance, it doesn't increase over time. Buying young can lock in a lower premium for life.

- Universal life insurance is permanent coverage that lasts your entire life if premiums are paid, with the flexibility to adjust payments based on your needs. Keep in mind, coverage increases require underwriting, and you must maintain enough cash value to cover monthly charges to keep the policy active.

There are a number of reasons to consider buying life insurance when you're young. For more information, consider meeting with a financial representative.

How to Choose a Life Insurance Policy

If you decided that you would like life insurance, the next step is choosing a policy. To apply, you could schedule a meeting with a financial representative. They can help you go over your situation and explain the different types of coverage to help you decide what makes sense for your needs.

From there, the representative would run the numbers and put together a quote, showing the cost and benefits. There's no obligation to sign up, and you can compare several options at once.

If you're happy with the quote, you can apply. You may need to go through health underwriting, but at a young age, you likely have a good chance of qualifying for a policy. With your life insurance in place, you can feel good knowing a key part of your financial plan is covered.

It's never too soon to protect your future with life insurance. Get a Free Life Insurance Quote

Sources

- 2023 NFDA General Price List Study Shows Inflation Increasing Faster than the Cost of a Funeral. 2023 NFDA General Price List Study Shows Inflation Increasing Faster than the Cost of a Funeral .