Key Takeaways

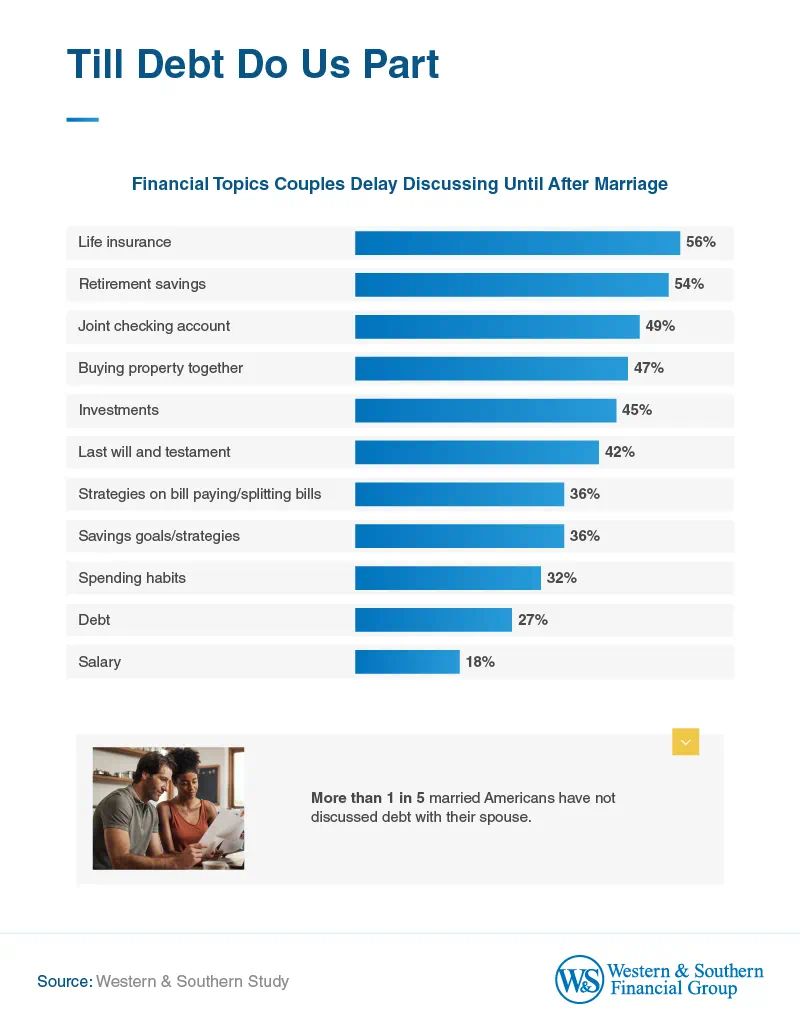

- 21% of married Americans have never discussed debt with their spouse, and over 1 in 4 (27%) have waited until after marriage to address it.

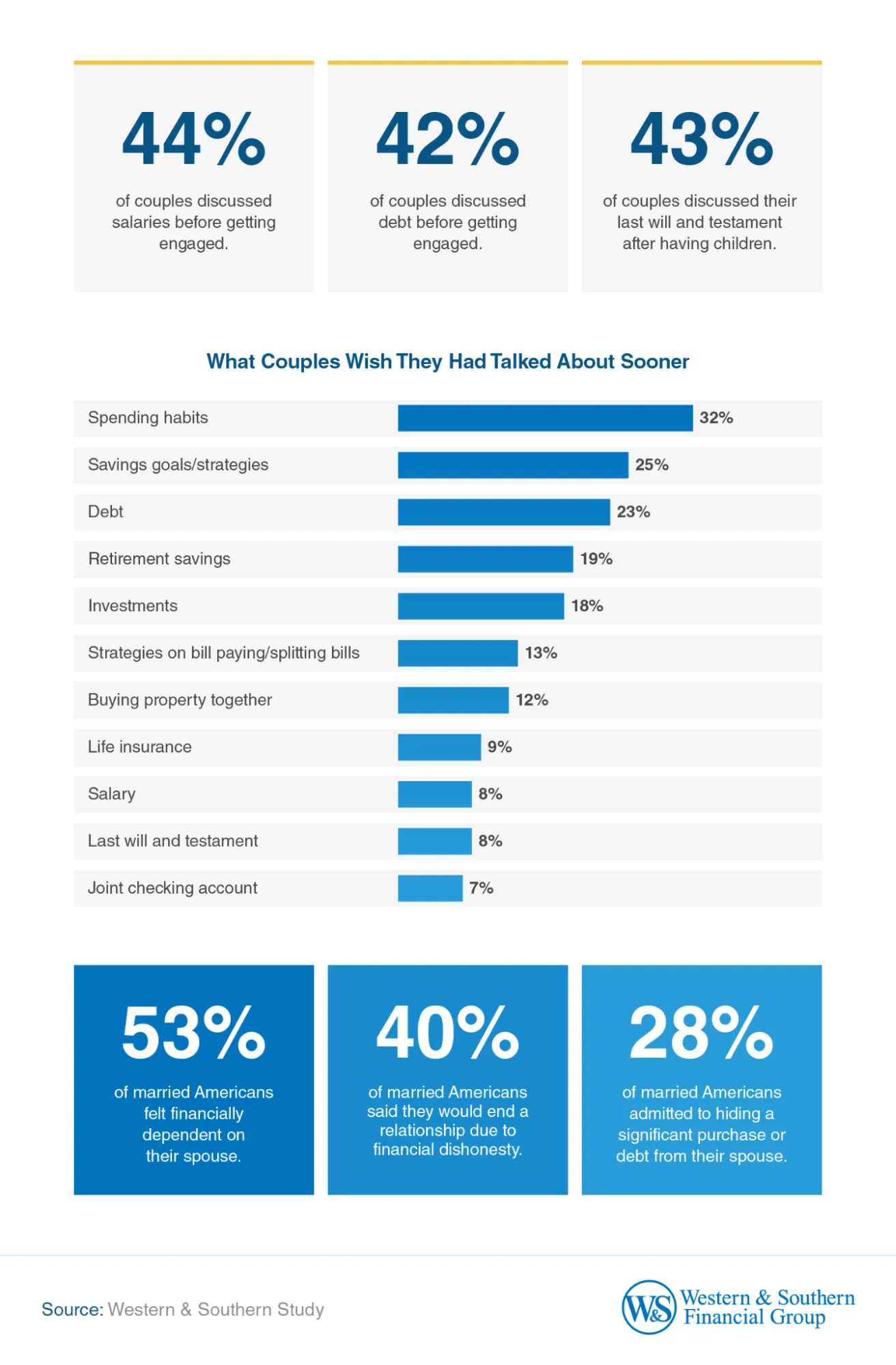

- 28% of married Americans admit to hiding significant purchases or debt from their spouse, and 40% would end a relationship due to financial dishonesty.

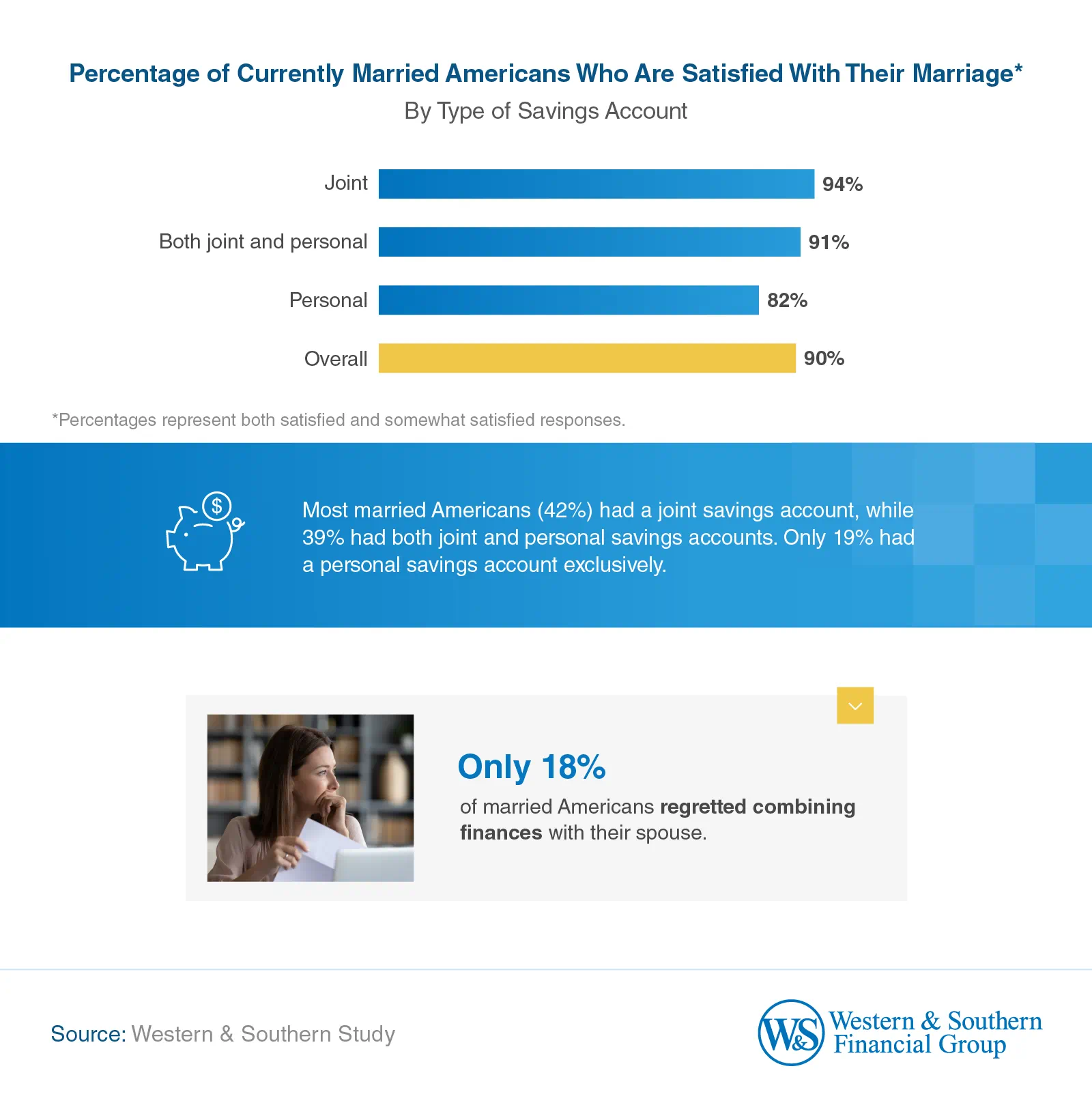

- Married couples with joint savings accounts report the highest marital satisfaction (94%), compared to those with only personal accounts (82%).

- Only 1 in 4 married Americans entered marriage with a formal financial plan. Gen Z were the most likely to have done so (48%).

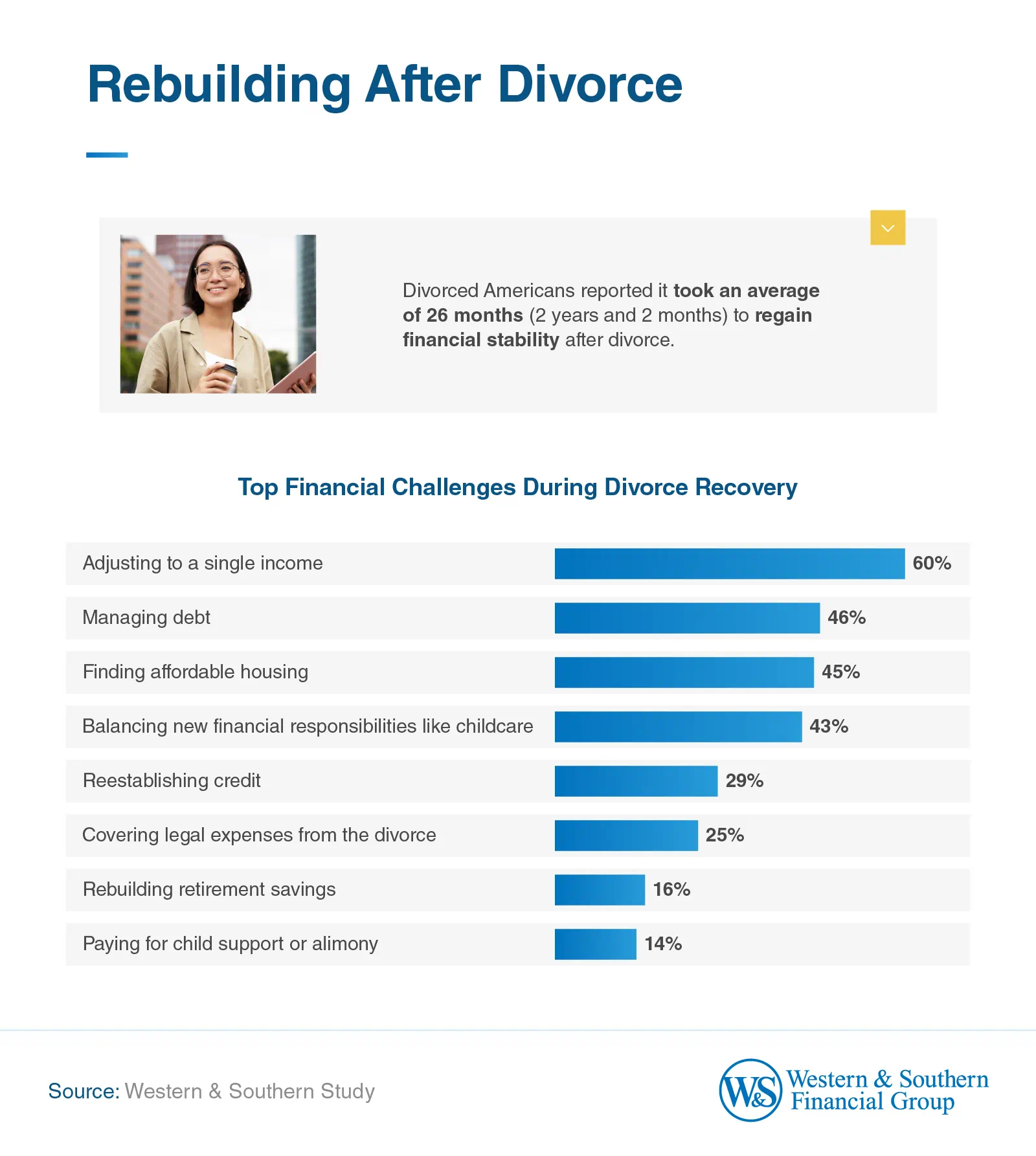

- It took an average of 26 months (or 2 years and 2 months) for divorced Americans to regain financial stability after their divorce.

- Divorced Americans are over 3x more likely to suggest keeping finances separate than married Americans (25% vs. 8%).

Critical Financial Discussions in Marriage

When it comes to a healthy marriage, being open about finances is essential. Transparency impacts everything from everyday spending to big-picture financial goals, not to mention the trust between partners. While financial transparency is crucial for a healthy marriage, many couples delay discussing key topics until after tying the knot. From life insurance and retirement savings to joint checking accounts and debt, these delayed conversations can impact both short-term decisions and long-term financial security.

For many couples, money communication was shaky from the start. Over 1 in 4 married Americans (27%) waited until after tying the knot to discuss debt, and 21% said they've yet to talk about it with their spouse.

The survey also highlighted generational and gender differences in financial independence. Women reported feeling financially dependent on their spouse at nearly twice the rate of men (67% vs. 35%).

Among age groups, Gen Zers expressed the highest levels of financial dependence on a spouse (66%), exceeding millennials (53%), Gen Xers (51%), and baby boomers (49%). Gen Z was also more likely than other generations to regret not discussing debt sooner than they did (38%).

More than a quarter of married Americans (28%) admitted to hiding big purchases or debt from their spouse. Meanwhile, 40% said financial dishonesty would be a dealbreaker, with women more likely than men to end a relationship over it (42% vs. 36%). Women were also more likely to hide financial matters, with 31% having concealed large purchases or debt from their spouse compared to 25% of men.

These financial tensions are often tied to regrets about not discussing certain topics earlier. Gen Z (15%) was more likely than Millennials (7%), Gen X (9%), and Baby Boomers (11%) to wish they had discussed life insurance sooner. Baby Boomers, on the other hand, led in wishing they had talked about retirement savings earlier (26%). Across all generations, spending habits consistently ranked as the most common regret, with Baby Boomers (36%) reflecting the highest levels of remorse.

Joint vs. Separate Finances

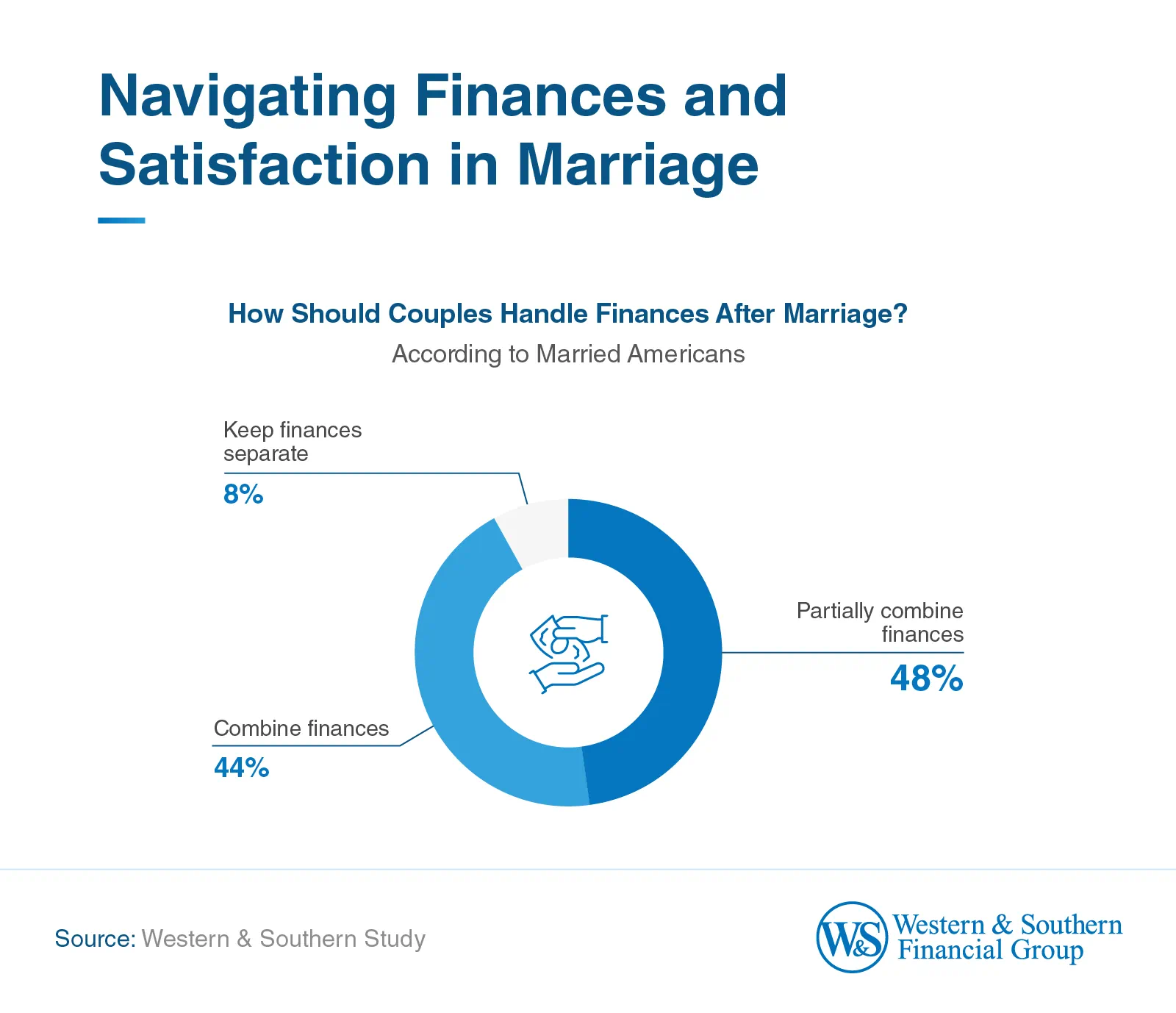

How couples manage their money — whether they combine accounts or keep things separate — can significantly influence relationship satisfaction.

According to our study, nearly half of currently married Americans (48%) opt to partially combine their finances, while 44% fully merge their accounts. Only 8% keep their finances entirely separate — a decision that may influence their overall relationship dynamics. Managing money together also seemed to boost satisfaction, with couples who shared savings accounts reporting the highest levels of satisfaction (94%), compared to 82% among those who kept only personal accounts.

Couples who were married at the time of this survey and prioritized financial planning before entering their current marriage tended to have stronger relationships. Those who entered that marriage with a formal financial plan were more likely to feel satisfied in that marriage (94%) compared to those who didn't (89%). Despite this benefit, only 1 in 4 married Americans took this proactive step. Among generations, Gen Z stood out, with 48% of respondents saying they entered their current marriage with a financial plan.

Financial readiness was a concern for many couples. Only 30% of married Americans felt fully prepared for unexpected financial shocks. Nearly half (49%) felt somewhat prepared, while 21% admitted they weren't prepared at all. When it came to individual savings, more married women (23%) than men (15%) reported keeping separate savings accounts.

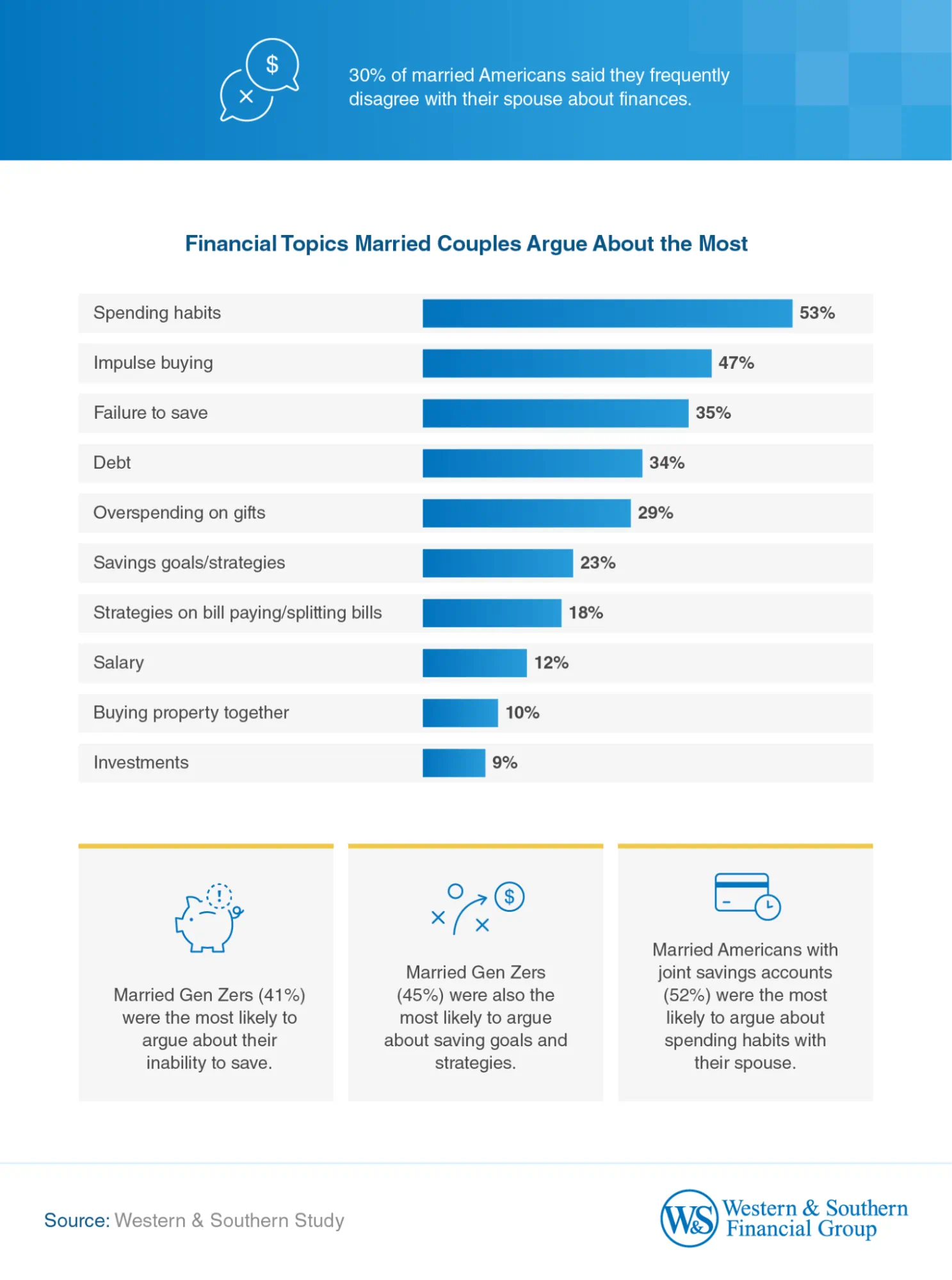

Financial disagreements can be a common source of tension in marriage, with spending habits, impulse buying, and failure to save topping the list of topics couples argue about.

Financial behavior played a key role in dating decisions prior to respondents' current marriage, with irresponsible spending being the top deal breaker for 41% of respondents. Credit card debt (22%) and a lack of financial literacy (21%) were also major concerns, while still living with parents (13%), and not having a savings account (12%) ranked lower. When it came to income expectations, Americans reported having sought a partner with an average minimum salary of $33,292.

Financial Challenges During Divorce Recovery

Divorce can cause major financial disruptions, affecting everything from daily expenses to long-term stability. The survey revealed key differences in how men and women face financial recovery after divorce.

On average, regaining financial stability after divorce took individuals 26 months. Women had a longer recovery time than men (27 vs. 24 months).

Women reported more difficulty adjusting to financial change post-divorce. Nearly 7 in 10 (69%) said transitioning to a single income was their biggest financial challenge, compared to 44% of men. More women (51%) than men (28%) also said balancing new financial responsibilities like childcare and bills was difficult for them.

Men had their own unique post-divorce struggles. They were more likely than women to have trouble covering legal expenses (29% vs. 23%) and were significantly more impacted by ongoing financial obligations. Over a third of divorced men (35%) cited paying child support or alimony as a top challenge, compared to just 3% of women.

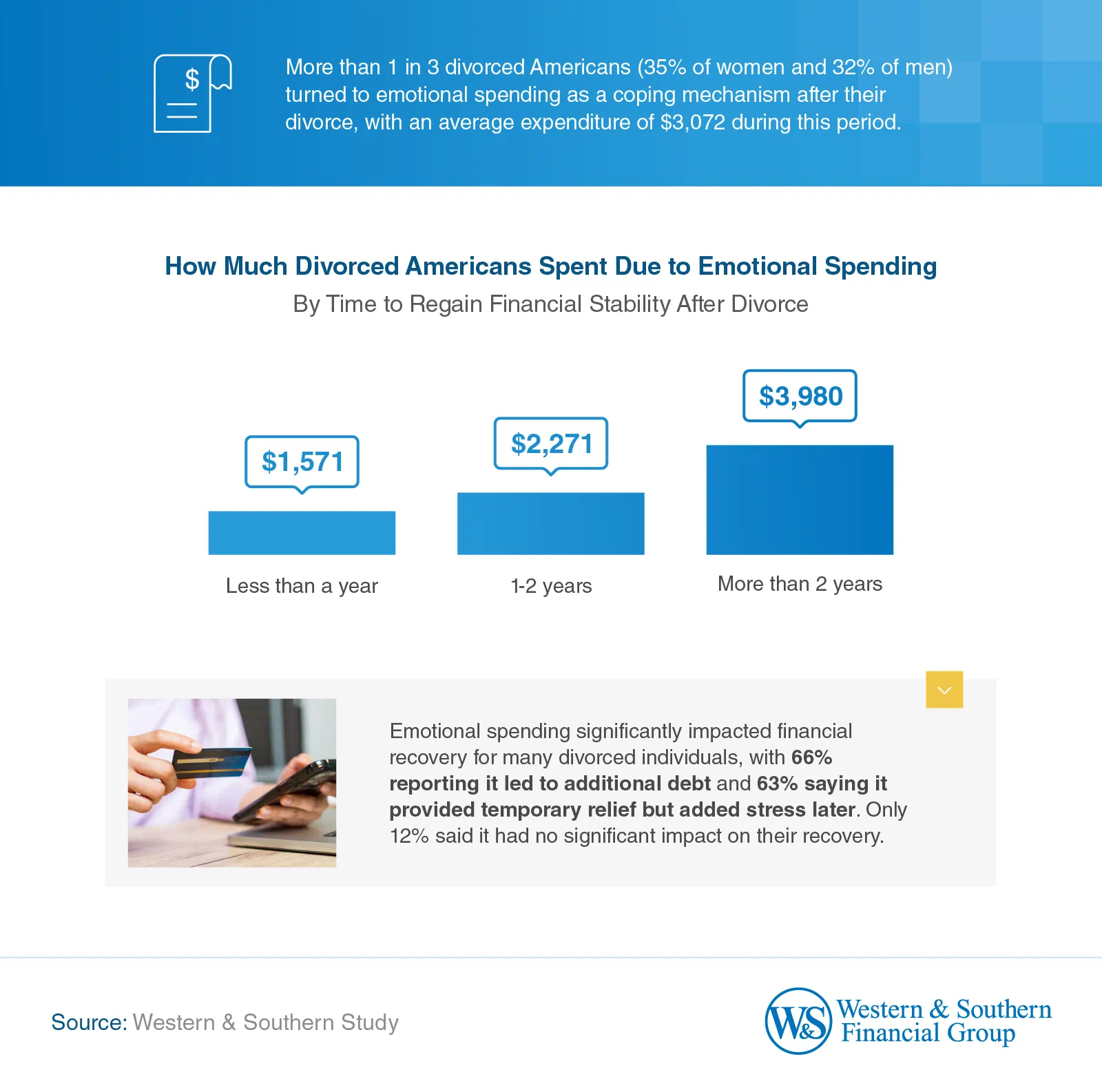

More than 1 in 3 divorced Americans (35% of women and 32% of men) turned to emotional spending as a coping mechanism after their divorce, averaging $3,072 during this period. Post-divorce emotional spending often led to financial setbacks: 66% reported it resulted in additional debt, and 63% admitted it provided only temporary relief while adding stress later.

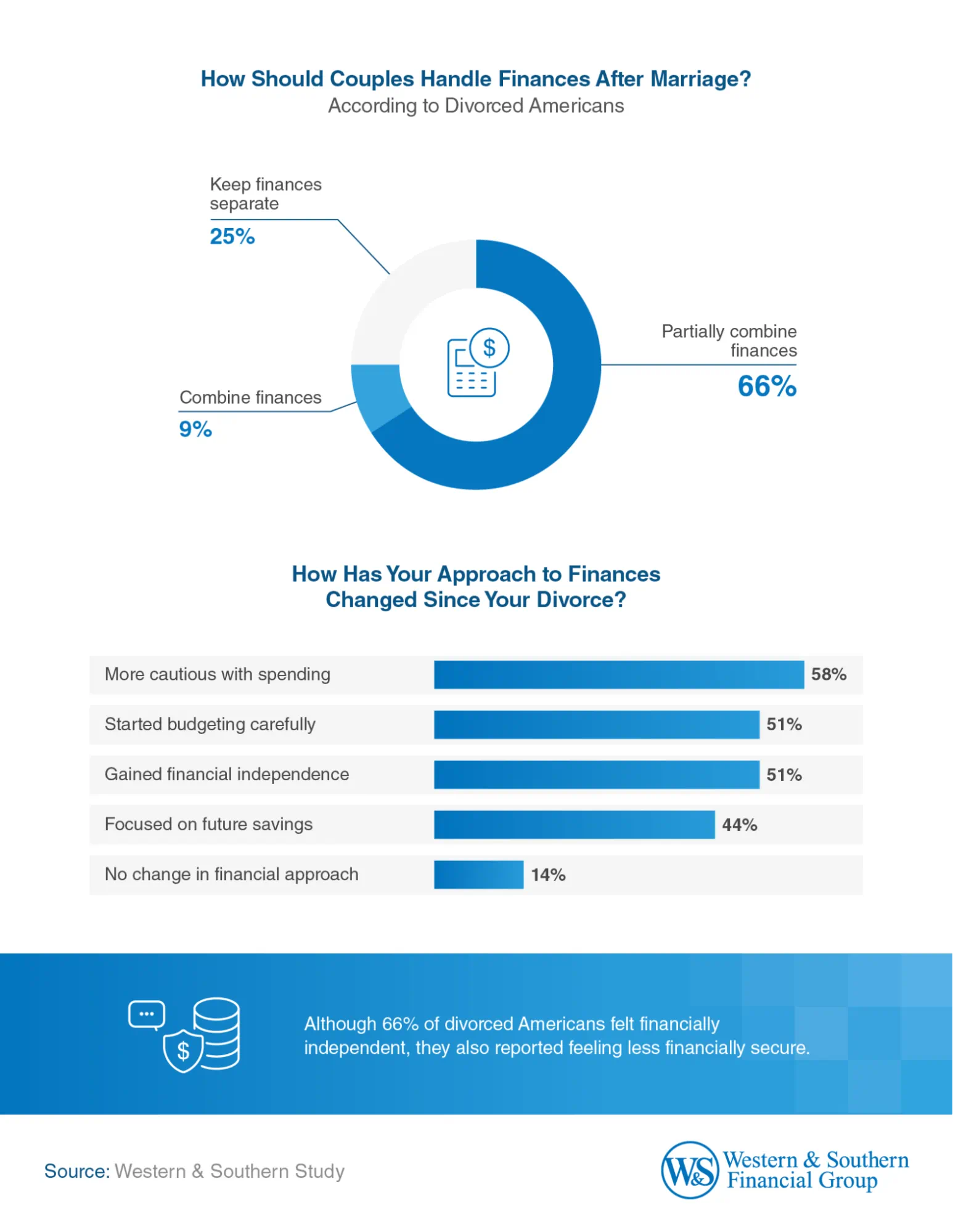

Divorce often reshapes financial attitudes. For example, divorced Americans were over three times more likely to advocate for keeping finances separate (25%) than married ones (8%). Over half (58%) have also become more cautious about spending and have started budgeting carefully (51%).

More divorced women (71%) than men (56%) reported feeling less financially secure post-marriage. When seeking financial help, nearly 3 in 4 divorced individuals (74%) turned to family and friends, while 44% pursued self-education to improve their earning potential. Modern financial tools also came into play, with 15% using online budgeting tools, 14% utilizing expense management apps, and 12% seeking professional financial counseling.

Building Financial Trust Together

Are you and your partner aligned when it comes to money? It could be a talk worth having or revisiting. While many couples wait until after marriage to discuss finances, those who start these conversations early and keep things transparent tend to report happier relationships. If you're aiming for a lasting partnership, open financial dialogue — before and after the wedding — might just be one secret to long-term success.

Methodology

Western & Southern surveyed 1,010 Americans about finances in their marriages. Among them, 80% were married, and 20% were divorced. The data was collected in December 2024.

About Western & Southern Financial Group

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500® company at No. 284, is the parent company of a group of diversified financial services businesses. Its assets owned ($80 billion) and managed ($42 billion) totaled $122 billion as of Sept. 30, 2024.1 Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company,2 Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fabric by Gerber Life; Fort Washington Investment Advisors, Inc.;3 Gerber Life Agency;4 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;3 Touchstone Securities, Inc.;5 W&S Brokerage Services, Inc.;3,5 and W&S Financial Group Distributors, Inc.6 Western & Southern is a title sponsor of several major community events every year. From 2002 to 2023, it served as title sponsor of Cincinnati’s longtime professional tennis tournament – now named the Cincinnati Open – an ATP Masters 1000 and WTA 1000 event and one of the world’s largest tournaments. The company continues to serve as a major sponsor of the event.

1 The financial information presented here is preliminary and unaudited.

2 Gerber Life is a registered trademark. Used under license from Société des Produits Nestlé S.A. and Gerber Products Company.

3 A registered investment advisor.

4 In the State of California, Gerber Life Agency, LLC is known as and does business as Gerber Life Insurance Agency, LLC.

5 A registered broker-dealer and member FINRA / SIPC.

6 W&S Financial Group Distributors, Inc. (doing business as W&S Financial Insurance Services in CA).

Review our current financial ratings.

From Fortune ©2024 Fortune Media IP Limited. All rights reserved. Used under license. Fortune and Fortune 500 are registered trademarks of Fortune Media IP Limited and are used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse the products or services of Western & Southern Financial Group.

Fair Use Statement

This content may be shared for non-commercial purposes only, with appropriate credit to Western & Southern and a direct link to the original study.