Key Takeaways

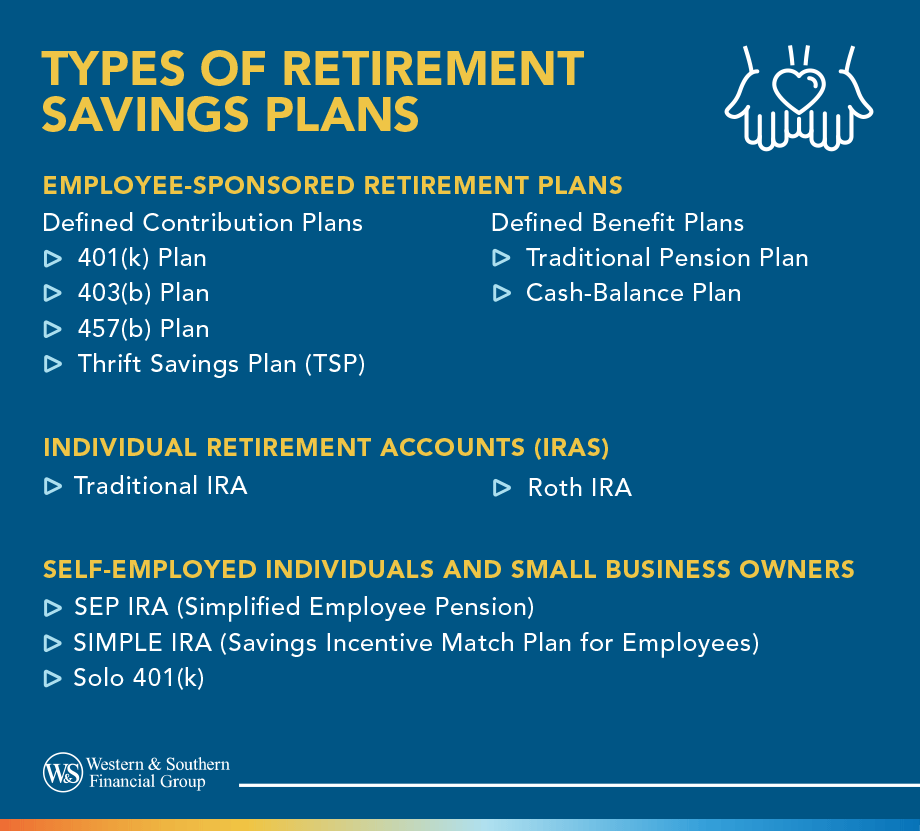

- Retirement plans fall into two primary types: employer-sponsored plans (like 401(k)s and pensions) and individual retirement accounts (IRAs).

- Employer plans are either defined contribution (e.g., 401(k)), where you manage funds, or defined benefit (pensions), which provide a guaranteed income.

- Traditional IRAs may give upfront tax deductions, while Roth IRAs allow tax-free withdrawals in retirement.

- Self-employed individuals have powerful options like the SEP IRA and Solo 401(k), which allow for significantly higher contribution limits.

- Savers aged 50 and older can use "catch-up contributions" to invest additional money above the standard limits in most retirement plans.

Retirement savings plans are primarily divided into two main categories: employer-sponsored plans and individual retirement accounts (IRAs). Additionally, there are specialized plans designed for self-employed individuals and small business owners.

A key feature of many retirement plans is the option for catch-up contributions which enable individuals aged 50 and over to contribute an additional amount above the standard annual limit. This catch-up savings can provide an opportunity to increase savings as they approach retirement. The specific amounts allowed vary by plan type.

Employer-Sponsored Retirement Plans

Employers offer these plans as a benefit to their employees. They generally fall into two categories: defined contribution and defined benefit plans.

Defined Contribution Plans

Within a defined contribution plan, the employee and/or the employer contribute to an individual account for the employee. The retirement benefit is not fixed; instead, it depends on the amounts contributed and the investment performance of the account over time. The employee typically chooses how their funds are invested from a list of investment options provided by the plan.

| Plan Type | Description | Key Features |

|---|---|---|

| 401(k) Plan | The most common type of employer-sponsored retirement plan for private companies. |

|

| 403(b) Plan | Similar to a 401(k), but offered to employees of public schools, non-profit organizations, and some religious institutions. |

|

| 457(b) Plan | A deferred compensation plan available to state and local government employees, as well as some non-profit employees. |

|

| Thrift Savings Plan (TSP) | A retirement savings and investment plan for federal government employees and members of the uniformed services. |

|

Defined Benefit Plans

In a defined benefit plan, the employer promises a specific, pre-determined benefit to the employee at retirement. The employer is responsible for funding the plan and bears the investment risk.

| Plan Type | Description | Key Features |

|---|---|---|

| Traditional Pension Plan | Promises a specific monthly benefit at retirement, based on a formula that considers salary and years of service. |

|

| Cash-Balance Plan | A "hybrid" plan that is technically a defined benefit plan but looks like a defined contribution plan. It expresses the benefit in terms of a stated account balance. |

|

Individual Retirement Accounts (IRAs)

IRAs are retirement savings plans that individuals can open on their own, regardless of whether they have a workplace retirement plan.

| IRA Type | Description | Key Features |

|---|---|---|

| Traditional IRA | Contributions may be tax-deductible, and investments grow tax-deferred until retirement. |

|

| Roth IRA | Contributions are made with after-tax dollars, meaning they are not tax-deductible. |

|

Retirement Plans for Self-Employed Individuals and Small Business Owners

Several retirement plan options are tailored to the needs of those who work for themselves or own small businesses.

| Plan Type | Description | Key Features |

|---|---|---|

| SEP IRA (Simplified Employee Pension) | Allows self-employed individuals and small business owners to make contributions for themselves and their employees. |

|

| SIMPLE IRA (Savings Incentive Match Plan for Employees) | A retirement plan that can be established by employers with 100 or fewer employees. |

|

| Solo 401(k) | A 401(k) plan for self-employed individuals with no employees (other than a spouse). |

|

Conclusion

Choosing the right retirement savings plan, or a combination of plans, depends on your individual circumstances, including your employment situation, income level, and retirement goals. It is often beneficial to consult with a financial advisor to determine the most suitable approach for your financial future and retirement security.

Small steps now can lead to big savings for your future retirement. Start Your Free Plan

Sources

- Types of Retirement Plans - Internal Revenue Service (IRS). https://www.irs.gov/retirement-plans/plan-sponsor/types-of-retirement-plans

- IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) - Internal Revenue Service (IRS). https://www.irs.gov/publications/p590a

- Retirement Accounts - Financial Industry Regulatory Authority (FINRA). https://www.finra.org/investors/learn-to-invest/types-investments/retirement