Video Transcript

Today, we're exploring a topic that might seem unusual at first but holds significant benefits and considerations for families: life insurance for children. Whether you're a new parent, grandparent, or guardian, understanding this type of insurance can help you make informed decisions about helping secure your child's future.

Child life insurance can be either term life insurance or permanent life insurance that insures the life of a minor. It is typically purchased by parents or grandparents to provide a death benefit, which can help cover funeral expenses and other costs in the event of a child's untimely death. If the policy is permanent life insurance, it may also build cash value over time, which the child could access later in life to meet various financial needs.

Child life insurance offers several important benefits to consider. It provides financial security by offering financial aid during the most challenging times, helping to alleviate the burden of unexpected expenses. Permanent policies may also accumulate cash value over time, which grows tax-deferred and can be used by your child in the future for expenses like college tuition or even a down payment on a home. Another advantage is guaranteed insurability, allowing your child to qualify for additional life insurance coverage later in life, although increases in coverage may require underwriting. Additionally, premiums for child life insurance are typically lower and often remain level throughout the life of the policy, making it an affordable and cost-effective way to ensure long-term coverage.

While there are clear benefits, it's important to consider a few key points before purchasing child life insurance. First, be mindful of emotional decision-making; it’s essential to approach this choice practically and not let emotions alone drive the decision. Second, while life insurance is often seen as a long-term financial commitment, it’s important to understand that it doesn’t have to be. You can cancel the policy and stop paying premiums at any time if your financial situation or priorities change. Lastly, consider policy features and options carefully. Compare different insurers to evaluate the types of policies available, their terms, and how the cash value may grow over time to ensure you’re choosing the best option for your needs.

Choosing the right policy involves several steps. needs and goals. Determine what you hope to achieve by purchasing life insurance for your child. Read the Fine Print: Understand the terms, conditions, and exclusions of the policy. Consult an insurance professional who can provide personalized advice based on your family's needs.

Thanks for joining us today to explore life insurance for children. We hope this discussion helps clarify how it works and assists you in deciding if it's right for your family.

Key Takeaways

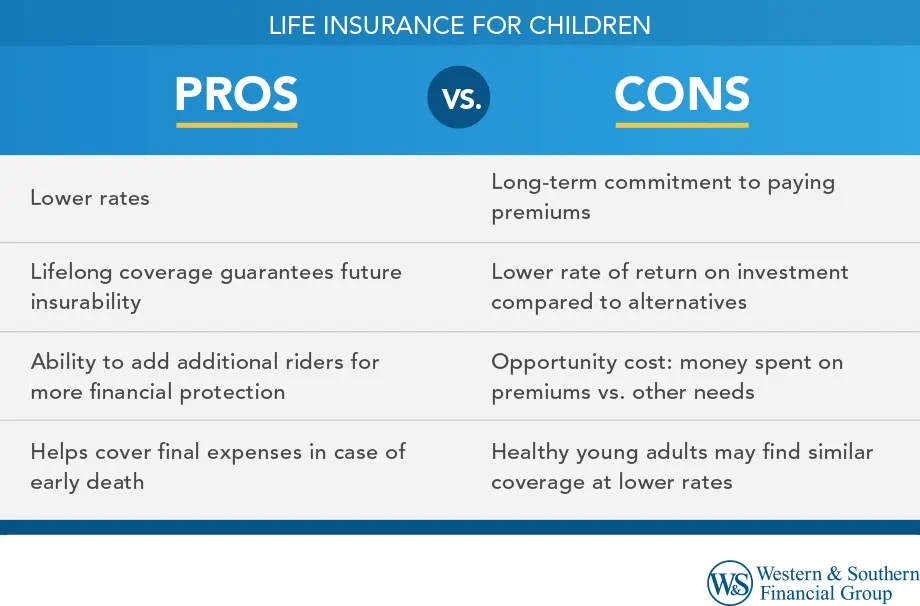

- Life insurance for children offers lower premium rates, lifelong coverage, and the potential to secure additional coverage as they grow older.

- It can provide financial protection for final expenses, relieving parents and family members of the burden during a difficult time.

- However, purchasing a policy for a child requires a long-term commitment to paying premiums and may have a lower rate of return compared to other investment options.

- Families should consider their financial circumstances and whether the additional cost aligns with their priorities and needs.

If you’re a parent, grandparent, or legal guardian of a child, you might be wondering if it’s a good idea to get a newborn or young child their own life insurance policy. For many people, the idea of purchasing a life insurance policy on behalf of a child can feel counter-intuitive. Since children don’t have dependents counting on them for support, the idea of life insurance as a way to provide income replacement to dependents doesn’t apply.

But there can be other reasons to buy a life insurance policy for an infant or young person other than securing death benefits for a policy’s beneficiaries. The right life insurance policy can be beneficial in setting a child or grandchild on a path to a financially sound future.

How Does Whole Life Insurance for Kids Work?

Like all life insurance, a life insurance policy purchased on behalf of a child is a contract between the policy owner and the insurance company. As long as the premiums are paid, the policy’s designated beneficiaries will receive a lump sum of money - known as a death benefit - should the child pass away while the policy is in force.

Did You Know?

Typically, caregivers buy whole life insurance for a child.

Whole life insurance is a form of permanent life insurance. Unlike a term life insurance policy that expires after a set amount of time, a whole life insurance policy never expires as long as you stay current on the premium payments. Further, whole life insurance policies are designed to help with a lot more than just paying for funeral expenses or supporting dependents.

What's the Best Age To Buy Life Insurance for Children?

Some policies let you buy life insurance starting the day your child is born up to 14 days old. So, you can purchase life insurance for your infant, small child, or teenager. The younger the child, the lower the premium. This means you might be able to lock into a lower price that the policyholder (your child) can maintain throughout their lifetime.

How Much Does Whole Life Insurance for Kids Cost?

A new life insurance policy premium for a child will be a lot less than the same amount of coverage for an adult. That’s because the older you are, the more you’ll pay for coverage. Premium amounts are calculated based on life expectancy.

Because children have a longer life expectancy, you can lock in a lower premium for them. Besides age, other factors go into calculating the cost of a life insurance policy, including the benefit amount. Consult with a life insurance expert to find out what a particular policy will cost.

Pros of Life Insurance for Children

There are a number of reasons to get a life insurance policy at a young age for your children or grandchildren. In fact, the gift of a life insurance policy for a child can provide huge financial benefits to them over their lifetime. Some of these benefits include:

- Lower rates. When you buy insurance for a young child, the rate will be substantially lower than you could get for an older child or young adult.

- Lifelong coverage. When you buy a whole life insurance policy for a young child, you are guaranteeing future insurability - that they will have life insurance coverage their entire lives - even if they later develop a medical condition that would interfere with coverage options. Once you lock in a policy, it’s theirs for life. They will never have to undergo a medical exam to continue coverage, regardless of whether they develop what would otherwise be considered a preexisting condition.

- Guaranteed insurability rider and additional riders. Depending on the policy you pick, your child might be able to buy additional insurance for even more financial protection when they are older, even if they develop health issues.

- Final expenses. As unthinkable as it might be, a person could pass away at an early age. Having a life insurance policy in force can greatly help grieving parents and family members, as the benefits will relieve them of funeral costs and let them focus on grieving and healing.

Start early with whole life insurance for compounded benefits as your child grows. Get a Life Insurance Quote

Cons of Life Insurance for Children

There is a downside to procuring life insurance for a child, including:

- Long-term commitment. When you buy a whole life insurance policy for a young child, you can expect to pay premiums for many years. If money gets tight and you miss a payment or cancel the policy, you’ll have paid all that money for nothing.

- Lower rate of return. It could be a decade or two before the policy accumulates enough cash value to equal the amount you’ve paid in premiums. You could make other investments with that same money - such as a tax-deferred college savings plan - that could yield a higher rate of return over the same amount of time.

- You could use that money for other things. Raising children is expensive. If you commit to paying life insurance premiums for an extended period, that could mean you have to forgo paying for other things your child needs as they grow up. It’s not in every family’s interest to incur this additional cost.

- Healthy young adults might be able to find substantially similar coverage. Since healthy adults in their early 20s are likely to secure competitive life insurance rates, you could save a lot of money if you wait to purchase health insurance on their behalf (as long as no health conditions manifest that could shut them out from an affordable policy).

Considering Life Insurance for Your Child: A Crucial Decision

The decision of whether and when to buy a life insurance policy for a child can be an important one. There’s a lot to consider, including issues surrounding affordability; whether you can commit to maintaining the payments; the coverage you’ll be getting for your money; whether locking in a low rate early is necessary under the circumstances; and how useful having the policy will be once your child reaches adulthood.

Determining which insurance products, if any, and what coverage amounts make sense for your child or grandchild is a personal decision that warrants careful consideration and consultation with a knowledgeable resource. Fortunately, Western & Southern’s life insurance experts are on hand to help you through the process of determining whether a child life insurance policy is right for you. If it is, we’ll help you find a policy that will meet your child’s needs today and in the future.

Get whole life insurance early to lay a strong financial foundation for your child's growth. Get a Life Insurance Quote