Table of Contents

Table of Contents

Key Takeaways

- 401(k) hardship withdrawals come with potential tax implications, as you may owe income tax and, if under 59 1/2, a 10 percent penalty tax.

- Both hardship withdrawals and loans can reduce the funds available for retirement, impacting your long-term financial security.

- Taking a 401(k) loan reduces the amount of money invested in your account, potentially affecting future growth and returns.

- If you fail to repay a 401(k) loan, it can be treated as a distribution, leading to taxes and penalties.

- It's essential to explore all available options and consult a financial professional before deciding on a hardship withdrawal or loan to ensure it aligns with your overall financial goals.

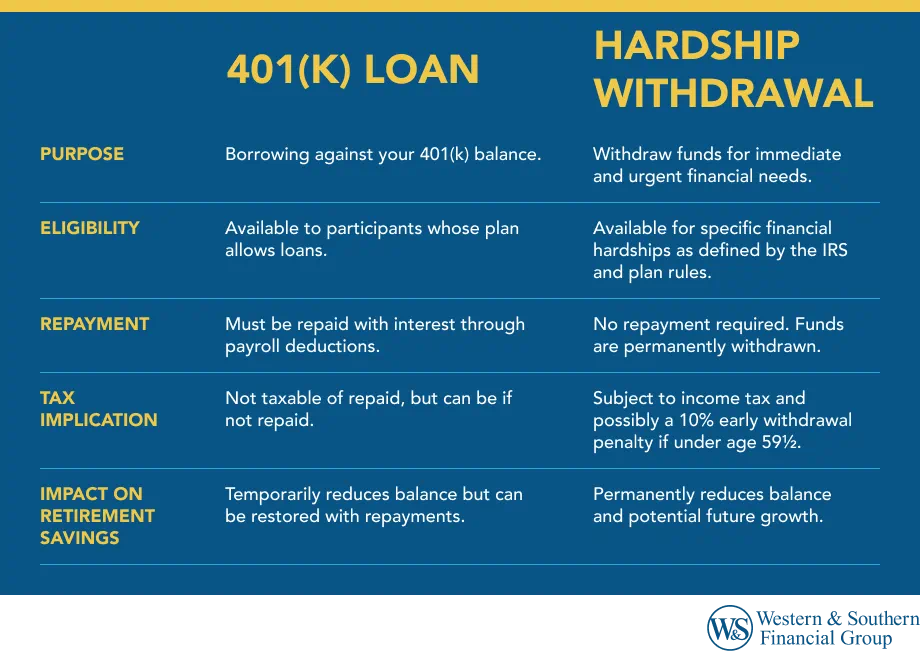

Loans and hardship withdrawals can both help give you access to money from your retirement savings but could have an impact on your retirement plans. In some situations, there may not be any attractive options and you simply need money. Here's what you should know about when you can take a hardship withdrawal or loan, and what the potential implications are of each.

When You Can Take Hardship Withdrawals

Not all 401(k) plans allow hardship withdrawals. They're only available when your employer chooses to include them. To find out if a hardship withdrawal is possible, ask your plan administrator. If hardship withdrawals are available, you need to qualify before taking one.1 The IRS requires that you face an "immediate and heavy financial need," defined by your plan, to satisfy hardship withdrawal requirements.

There are several ways to qualify, which can vary. Some examples include:

- Medical expenses for you or a family member.

- Costs related to purchasing a primary residence.

- Tuition and fees for postsecondary education.

- Payments required to prevent eviction or foreclosure on your primary residence.

Financial Impact of Hardship Withdrawals

You should be aware of several potential consequences of taking a hardship withdrawal.

Taxes Owed

According to the IRS, if you withdraw pretax money, you must pay income tax on the amount you receive. If you're under age 59 1/2, you may owe an additional 10 percent penalty tax on your withdrawal unless you qualify for an exception.2 Exceptions to the early withdrawal tax may include unreimbursed medical payments and certain expenses after terminating an employment when you're 55 or older.3

Reduced Contributions

Your 401(k) balance drops when you take a withdrawal, and will have less money available for spending in retirement. Replenishing your account after receiving a hardship withdrawal can be challenging, especially with annual contributions limits. Be mindful that the withdrawal is serving a critical need.

When You Can Take a Loan

401(k) loans, like hardship withdrawals, are optional plan features. Some employers choose not to allow loans for their employees. If your plan offers loans, you can take one whenever you want, and use the funds for any purpose. Some plans limit loans, and only have one outstanding loan at a time.4

When borrowing from your 401(k), you can take up to 50 percent of your account balance or $50,000, whichever is less.5 In most cases, you repay your loan over five years, but longer terms may be available if you use your loan to purchase a primary residence.

How a 401(k) Loan Affects Your Finances

Understanding the trade-offs of borrowing from your account is important.

Opportunity Cost

By taking money out of your 401(k), you reduce your invested account balance. As a result, there's less money earning interest, dividends and potential capital gains for your future. That may work out if investments lose money, but your savings may suffer if those investments gain value while your money is out of the markets.

No investment type can guarantee growth, and can instead lose value. Past performance also can't guarantee future results.

Potential Default

If you can't repay your loan, the IRS treats the amount you took as a distribution.6 You may have to pay income tax on that amount, and pay an additional penalty tax if you're under age 59 1/2.

Cash Flow

You need to repay your loan, which could possibly put a strain on your budget, especially if you considered taking a loan as a result of a financial rough patch. While you're making payments to eliminate the debt, it might be harder to save for retirement and delay your progress toward retirement goals.

Should You Take a Hardship Withdrawal or Loan?

Whenever possible, you may want to leave your retirement savings alone and fund your needs from other sources. Some people like the idea of a 401(k) loan vs. hardship withdrawal because they think the impact is temporary.

If you really need extra money from an additional source now, consider meeting with a financial professional to review the best options for you. Taking a complete look at all of the options available to you may help you understand the various benefits and caveats before making the right choice for your long-term financial goals.

Maximize your 401(k) benefits and build a stronger retirement foundation. Start Your Free Plan

Sources

- Retirement Topics - Hardship Distributions. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-hardship-distributions.

- 401(k) Plan Hardship Distributions - Consider the Consequences. https://www.irs.gov/retirement-plans/401k-plan-hardship-distributions-consider-the-consequences.

- Retirement Topics - Exceptions to Tax on Early Distributions. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions.

- Retirement Plans FAQs regarding Loans. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-loans#7.

- Retirement Topics - Plan Loans. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-loans.

- Considering a loan from your 401(k) plan? https://www.irs.gov/retirement-plans/considering-a-loan-from-your-401k-plan.