Table of Contents

Table of Contents

Key Takeaways

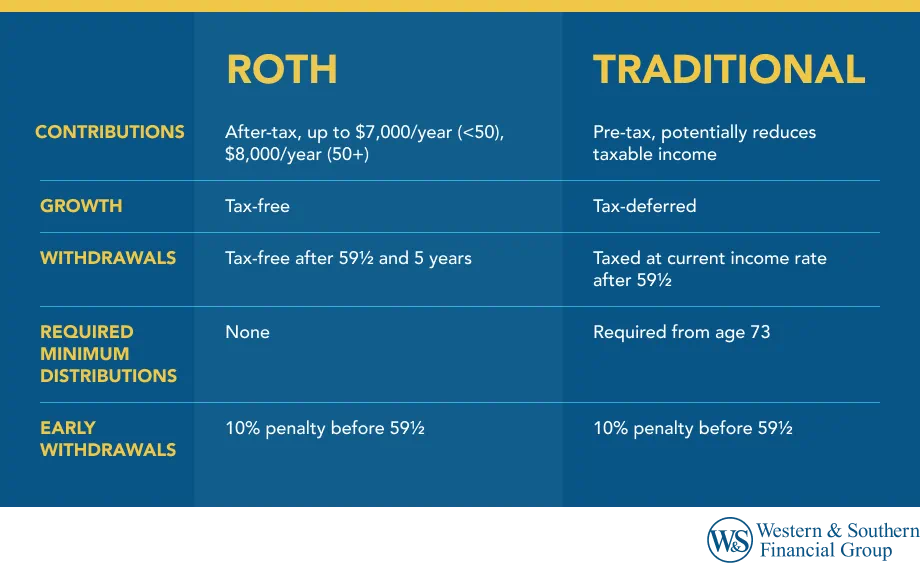

- Roth IRA advantages include after-tax contributions for tax-free withdrawals in retirement, tax-free growth on investments, and no required minimum distributions (RMDs) for added flexibility.

- Traditional IRA advantages encompass pre-tax contributions to reduce current taxable income, tax-deferred growth on investments, and the option for high-income earners to make non-deductible contributions

- Key differences between Roth and traditional IRAs lie in their tax treatment. Roth IRAs use after-tax contributions with tax-free withdrawals, while traditional IRAs use pre-tax contributions with taxable withdrawals, and Roth IRAs have no RMDs, unlike traditional IRAs.

It's important to understand the differences between a Roth IRA and traditional IRA. Each has similar benefits and features, but they also have unique qualities that set them apart.

To help you decide which retirement account is right for you, here are some considerations.

Potential Advantages & Roth IRA Features

A Roth IRA is a type of individual retirement account created to assist people in saving for retirement on an after-tax basis. While they are kept in the Roth IRA, gains and interest from investments are not taxed. With certain conditions, withdrawals from a Roth IRA made after the age of 59 1/2 are free from taxes and penalties.1

The following are the primary attributes and potential advantages of a Roth IRA:

- You can make after-tax contributions up to $7,000 per year under age 50, or $8,000 per year for individuals age 50 and over.

- Growth on investments held in the account typically does not incur taxes.

- Withdrawals at retirement are typically not subject to taxes if the Roth IRA has been open for at least five years and you are at least age 59 1/2.

- There is only a 10% penalty on early withdrawals made prior to age 59 1/2.

- Typically, withdrawals of up to $10,000 for first-time home purchases are not subject to taxes or penalties.

- There is no required minimum distribution (RMD) at any age.

Potential Advantages & Characteristics of a Traditional IRA

A traditional IRA is a type of individual retirement account created to aid in pre-tax retirement planning. While kept in the account, investments in a traditional IRA grow tax-deferred. Traditional IRA withdrawals made after the age of 59 1/2 are taxed at the individual's current federal income tax rate but are free of penalties.2

Here are the main potential benefits and features of a traditional IRA:

- Those under age 50 can make pre-tax contributions up to $7,000 each year, or up to $8,000 a year for individuals age 50 and over.

- Contributions reduce the individual's taxable income by the same amount as the contribution for the tax year it is contributed.

- Growth on investments held in the account is tax-deferred.

- First-time home purchasers can make penalty-free withdrawals of up to $10,000.

- There is a 10% penalty on early withdrawals made prior to age 59 1/2.

- Withdrawals after age 59 1/2 are penalty-free and taxed at the individual's current federal income tax rate.

- RMDs generally begin at age 73 (beginning January 1, 2023) and at age 75 (beginning January 1, 2033).

- There is no income limit on nondeductible contributions.

Roth IRA vs Traditional IRA: Key Differences

Traditional and Roth IRAs have similar features and benefits. Investors should be aware of a few important distinctions between a Roth IRA and traditional IRA before selecting a retirement account, though.

Here are some key differences that you should know about a Roth IRA vs traditional IRA:

- Tax treatment on contributions: Roth IRA contributions are made on an after-tax basis, whereas traditional IRA contributions are made on a pre-tax basis.

- Tax treatment on growth: Typically, investments grow without incurring taxes in a Roth IRA, whereas traditional IRAs offer tax-deferred growth. The bottom line effect is similar. As long as you keep your money in a Roth or traditional IRA, you will not be taxed.

- Tax treatment on withdrawals: Roth IRA withdrawals are typically exempt from taxes if they meet certain qualifications, whereas traditional IRA withdrawals are taxed at the individual's current federal tax bracket during the year they are withdrawn.

- Income limits on contributions: For Roth IRAs, contribution limits begin to phase out and are reduced incrementally starting at $150,000 for single filers and $236,000 for married couples filing jointly. For traditional IRAs, contribution limits begin to phase out starting at $79,000 for single filers and $126,000 for married couples filing jointly.3

- Non-deductible contributions: There is no income limit on nondeductible contributions to a traditional IRA. Roth IRAs do not have this feature. This can be beneficial for high-income earners.

- Required minimum distributions: There are no RMDs for Roth IRAs, whereas RMDs for traditional IRAs must begin no later than April 1 of the calendar year after you reach age 73 (beginning January 1, 2025) and at age 75 beginning January 1, 2035.

Bottom Line

When choosing between individual retirement accounts, you're basically choosing when you want to be taxed — now or at retirement. Generally, it may be helpful to contribute to a Roth IRA when you are younger and presumably in a lower tax bracket. Traditional IRAs are generally desirable for high-earning individuals who will benefit from reducing taxable income now.

Compare Roth and Traditional IRAs to find the best fit for your retirement goals. Start Your Free Plan

Sources

- Roth IRAs. https://www.irs.gov/retirement-plans/roth-iras.

- Traditional IRAs. https://www.irs.gov/retirement-plans/traditional-iras.

- 401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000. https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000.