Table of Contents

Table of Contents

Key Takeaways

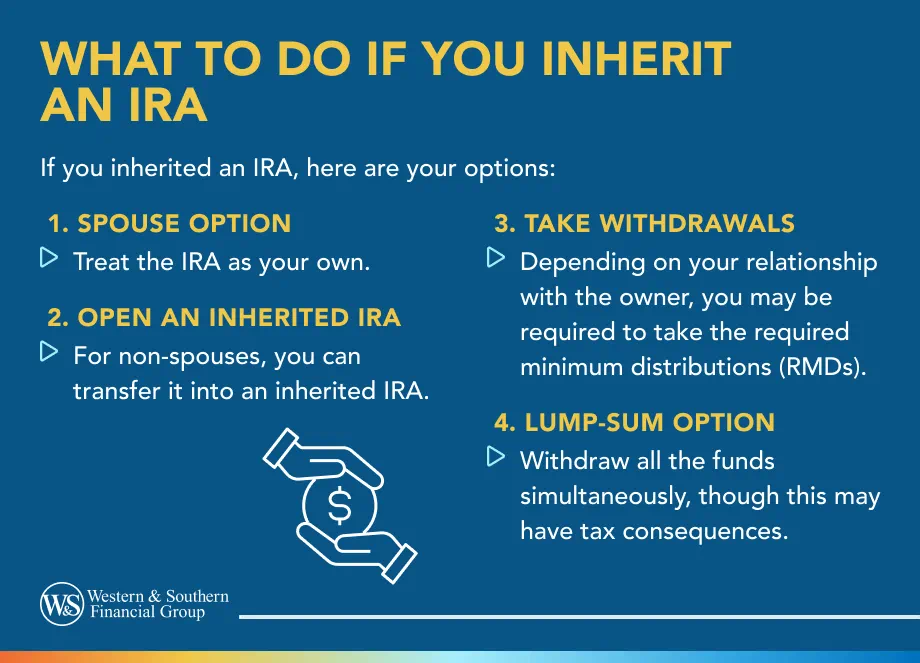

- When you inherit an IRA from someone, you have several options for handling the assets.

- If you are the spouse of the deceased and inherit an IRA, you have more flexible options than non-spouse beneficiaries.

- Non-spouse beneficiaries have different options for managing an inherited IRA.

- Non-spouse beneficiaries who keep the funds may need to take annual Required Minimum Distributions (RMDs) based on life expectancy.

- Non-spouse beneficiaries can also choose the "5-year rule," allowing them to distribute all the funds within five years after the account owner's death.

Inheriting assets can be a difficult event. If the emotional burden of adjusting to life without a loved one wasn't enough, you may also find yourself managing a host of financial logistics. Sometimes inheriting an individual retirement account (IRA) is part of that journey, and you may want to know what the next steps and your potential options are.

If you're unsure of what to do if you inherit an IRA, here are some considerations.

What Is an Inherited IRA?

The owner of an IRA can choose a beneficiary to take over their account when they die. When you're the beneficiary, and you inherit assets in an IRA, you may be able to cash out the account or keep the funds in the IRA. If you choose to keep the money in an IRA, you may continue to enjoy some of the benefits of IRAs, such as the potential for tax-deferred growth on earnings in a traditional account. But an inherited account has specific rules, and what to do if you inherit an IRA will likely depend on your relationship to the person who passed away and the decedent's age at death.

Spousal Beneficiaries for an Inherited IRA

When you inherit an IRA from your spouse, you likely have a broader range of options than other types of inheritors, according to the Internal Revenue Service (IRS).1 Here are a couple of the common options:

- Treat it as your own: Your first option is to treat the IRA assets as if they were yours. If you take that approach, you are not required to use an inherited IRA. Instead, you can update the decedent's IRA so that it is under your name (assuming the custodian allows that) or you can roll funds from your late spouse's IRA into your own IRA.

- Use an inherited IRA: If you prefer not to treat the inherited IRA assets as your own, you can move the funds to an inherited IRA like a non-spouse beneficiary might. One reason to consider this option is if you're under age 59 1/2 and you want to take distributions from the account — inherited IRA distributions are not subject to an early distribution penalty — and it may be useful in other situations as well.

Non-spouse Beneficiaries for an Inherited IRA

If you're not a spousal beneficiary, you have different options available for an inherited IRA. Keeping funds in an IRA may allow you to avoid annual tax reporting on gains in the account, and may also enable you to take funds from the account over several years. But if you want to cash out the entire account sooner, you're free to do so (but you may face income taxes and complications as a result of the distribution).

If you're not ready to take the funds immediately, be aware that IRS rules may prevent you from leaving assets in an IRA indefinitely. However, you may be able to take annual required minimum distributions (RMDs) or follow the five-year rule.2 Here is some more information on both options:

- Taking RMDs: If you plan to take RMDs, you have to begin that process before December 31 of the year following the account owner's passing. The RMD calculation depends on the account owner's age at death. If the account owner died on or after they were required to take RMDs, you must take RMDs based on the longer life expectancy between you or the decedent before their passing. If the account owner died before they were required to take RMDs, you must take RMDs from the inherited IRA, and they are calculated based on your life expectancy.

- "5-year rule": If you don't want to take RMDs, you can distribute everything in the account within five years after the account owner's death.1 The IRS refers to this as the "5-year rule." You are not required to take RMDs each year, but you must complete distributions by December 31 of the fifth year after the IRA was inherited. For example, if an account owner passes away any time in 2025, their beneficiary must empty the inherited IRA by December 31, 2030.

The Bottom Line

When you inherit an IRA, you'll likely want to identify your options and decide what to do with the assets relatively soon after the account owner dies. That may be difficult as you cope with the loss of a loved one, and inherited IRA rules can be complicated. Ask a qualified financial professional for guidance, and remember that you may be able to take out more than the RMD in years when you need more money.

Transform your inherited IRA into a reliable source for your retirement planning. Start Your Free Plan

Sources

- Publication 590-B (2023), Distributions from Individual Retirement Arrangements (IRAs). https://www.irs.gov/publications/p590b#en_US_2018_publink1000230538.

- Retirement Topics — Required Minimum Distributions (RMDs). https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds.