Key Takeaways

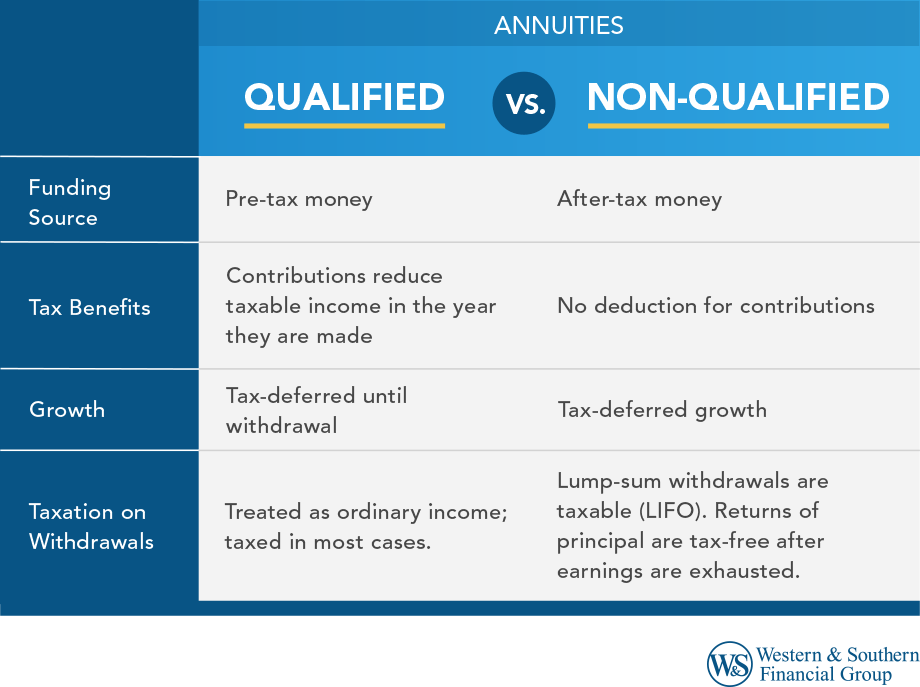

- Qualified annuities are funded with pre-tax money and withdrawals are taxed as ordinary income.

- Non-qualified annuities are funded with after-tax money, and only earnings are taxed upon withdrawal.

- Tax treatment of withdrawals varies, with qualified annuities generally taxed fully and non-qualified annuities having a more complex tax structure.

- Qualified annuities can be beneficial for tax-deferral and guarantees, while non-qualified annuities offer tax-deferred growth and potential tax benefits during withdrawals.

- Consult a tax expert to navigate the complexities of qualified and non-qualified annuities.

Annuities provide unique features that can help you plan for retirement. For example, you could get an income stream that's guaranteed to last for as long as you live, and some contracts include growth guarantees that may offer predictability and help you manage risk.

As you explore annuities, it's helpful to know about all the options available. One of the most important distinctions to understand is the tax status of an annuity. Your annuity's tax status will determine whether it's qualified or non-qualified.

Qualified vs. Non-Qualified Annuity: What's the Difference?

You can fund an annuity with pre-tax dollars or after-tax money. Your eventual tax payments depend on the type of annuity you choose and how you withdraw money from your contract.

Qualified annuities

An annuity funded with pre-tax money is a qualified annuity. Pre-tax savings might come from pre-tax contributions you make to a retirement plan at your job, or you might qualify for deductible IRA contributions. Those contributions can reduce your taxable income in the year you contribute, helping to make saving more affordable. Plus, any growth in most retirement accounts and annuities is tax-deferred. In other words, you typically don't report the earnings or pay tax each year if you leave the money in your account.

Non-qualified annuity

A non-qualified annuity is one you fund with after-tax money — such as money in an individual or joint account. You don't get a deduction for contributions into these contracts, but any growth inside of the annuity is tax-deferred.

When Do You Pay Taxes?

With qualified annuities, the money generally has never been taxed. Because of that, withdrawals from a retirement account or a qualified annuity are generally treated as ordinary income. Those withdrawals result in taxes in most cases, but it depends on the details of your tax return.

With non-qualified contracts, tax treatment depends on several factors. The IRS requires you to treat lump-sum withdrawals as last-in-first-out (LIFO). As a result, those withdrawals are taxable earnings. But after you exhaust the earnings and start drawing from your original investment, you can take tax-free returns of your principal.

If you "annuitize" a non-qualified annuity (or convert the account balance into a stream of lifetime income), each payment you receive might be partially taxable. For example, a portion of the payment may be treated as a tax-free return of your principal, and the remainder will be taxable earnings. This "exclusion ratio" might enable you to spread out tax payments over many years. But after using up all the principal, payments may become fully taxable.

As you might imagine, things can get complicated quickly. Be sure to speak with a tax expert to avoid surprises and discuss the tax implications of using a qualified vs. non-qualified annuity.

Optimize your retirement plan with tax-efficient annuity options. Start Your Free Plan

When You May Want to Purchase an Annuity

Annuities can provide features such as principal protection and a lifetime stream of income. If you want the guarantees available from an insurance company, it may make sense to use an annuity. However, note that an annuity guarantee is not a guarantee of investment performance; rather, it's a guaranteed amount of income you'll receive when the annuity enters the payout phase. The guarantee is made by the insurer and is based on its claims-paying ability.

Qualified annuities

A qualified annuity may be appropriate when you're making pre-tax contributions to your retirement savings. For example, if you believe you're in a higher tax bracket now than you will be later, a qualified contract could make sense. You can also roll existing pre-tax retirement accounts into a qualified annuity contract. All qualified annuity withdrawals are subject to ordinary income tax, and withdrawals taken before the age of 59½ generally will incur an additional 10% tax penalty. While you don't get additional tax-deferral benefits (because retirement accounts are already tax-deferred), you can take advantage of the guarantees available from an insurer.

Non-qualified annuities

Non-qualified contracts allow you to save a substantial amount in a tax-deferred account. Only the earnings are taxed when you receive income or take a withdrawal from a non-qualified annuity. So, if you want to shelter any growth on your assets from annual taxation, these annuities might make sense. Then, if you decide to take lifetime income from your contract, you can potentially spread out the taxes using the exclusion ratio. As with qualified annuities, you also have access to insurance company guarantees. It's also important to note that withdrawals taken before the age of 59½ generally will incur an additional 10% tax penalty.

The Bottom Line

Whether you're saving money with pre-tax or after-tax dollars, annuities can help you plan for the future and provide unique guarantees. With qualified contracts, you might get a tax break up front, but it's important to plan for eventual taxes that may be due on withdrawals. Non-qualified annuities enable you to save as much as you want inside of an annuity, and you only owe taxes on any growth inside of the contract.

As you plan for the future, it can help to figure out how much you'll pay in taxes from all your income sources. With that information, you'll be better prepared to estimate how much after-tax spending you can afford in retirement.

Benefit from steady income streams through strategic annuity planning. Start Your Free Plan