Table of Contents

Table of Contents

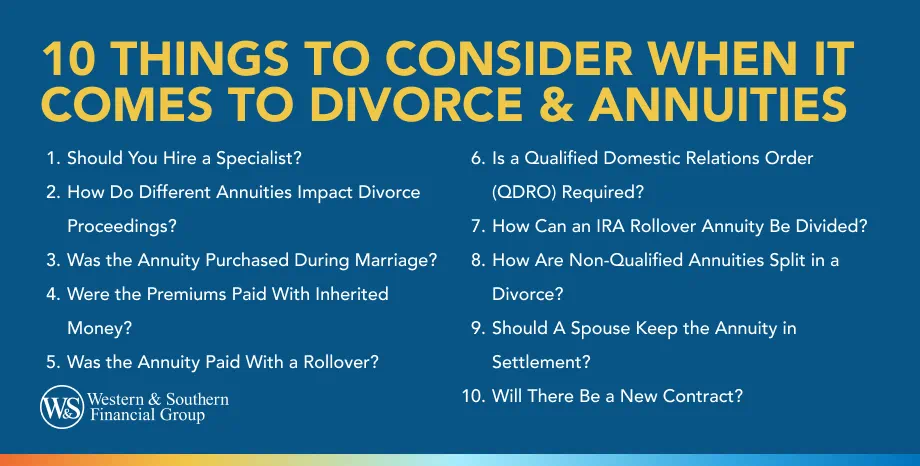

Key Takeaways

- Evaluate annuity values, tax implications, and potential benefits in divorce.

- Understand annuity type, source of funds, and ownership for proper asset division.

- QDRO may be needed to access annuity details within qualified retirement plans.

- Professional analysis helps determine equitable splits and tax consequences.

- Consider alternatives to splitting, such as supplementing one spouse's entitlement.

The process of a divorce can be complicated, both emotionally and financially. Factor together the complexities of a divorce and annuities, and you could end up navigating strange territory.

Dividing an annuity — or having to forfeit one — during a divorce can have a long-term financial impact, especially if the annuity was originally purchased as an integral part of a retirement plan. If you're going through a divorce, your accrued joint assets may include an annuity and that annuity may be subject to division of property, here are important items you may want to consider while figuring out the terms of division.

1. Evaluating Annuity Contract Values

Since divorce attorneys practice family law and often lack expertise in tax or insurance contract law, you might consider hiring a tax attorney with experience in analyzing insurance products, or a certified divorce financial analyst to evaluate the cost basis, living benefits, present and future values, potential tax liability and death benefits of the contract. Such an analysis can help provide details of how a potential split of the annuity may or may not be an equitable benefit for either spouse.

2. Types of Joint Annuities

There are many different types of annuities. Each has its own unique benefits. A single premium immediate annuity pays an immediate income stream for a set period of time. Immediate annuities are quite different from the more complicated valuations of variable or fixed annuities. Constructing the true present and future value of a variable or fixed annuity is complex, and the complexities increase if the contract is still subject to surrender charges, has been credited with a bonus or includes benefit riders. These valuating factors could influence how the annuity is handled in a divorce proceeding.

3. Was the Annuity Purchased During Marriage?

An annuity purchased prior to marriage may not be subject to a division of property. However, if your annuity was purchased during your marriage, it may likely be included in the division of property. That may mean a contract split or total forfeiture by you or your spouse, depending on other conditions.

Annuities offer a reliable income stream for your retirement. Start Your Free Plan

4. Were the Premiums Paid With Inherited Money?

The source of the money used for the annuity's original premium payment may also influence how the annuity is handled in a property division. Was the money inherited? If the inheritance used to start the annuity was not commingled into a joint account, and no additional premium money was added from any joint account, the annuity will most likely be treated as sole and separate property of one spouse. In this case, it would usually not be included in the division of joint assets.

5. Was the Annuity Paid With a Rollover?

If your annuity was purchased during your marriage using qualified funds which were rolled over from any type of employer-sponsored qualified retirement plan — such as a pension, 401(k) or 403(b) — into an individual retirement account (IRA), the IRA rollover annuity may fall under the division of joint assets. If so, the annuity would undergo an analysis of present and future values in order to determine the most equitable assessment prior to division.

6. Obtaining a QDRO

If your annuity contract is currently part of a qualified employer-sponsored retirement plan, such as a pension, 401(k) or 403(b), a qualified domestic relations order (QDRO) may be required by the employer's plan administrator before detailed information can be provided to your or your spouse. A domestic relations order is a document declaring the payment of alimony, child support or other marital properties. A QDRO in particular is required to establish you or your spouse as an alternate payee with rights to receive "all or a portion of the benefits payable" from a retirement plan, according to the U.S. Department of Labor.1 This status would allow you both to access the information required to move forward.

7. IRA Annuities

If you purchased your annuity directly through an insurance carrier as an IRA rollover during your marriage, the issuing insurance carrier will determine how the contract will be split, pursuant to a filed domestic relations order. These rules will vary from carrier to carrier, however. A professional analysis is important here in order to determine the most equitable division of the annuity, as well as any potential tax liability. Important reminder: If you're not the owner of the annuity contract, your request for information will not be honored by the insurance carrier unless you have a valid domestic relations order or written legal authorization, signed by the annuity owner, to allow access to the details and values of the contract.

8. Non-qualified Annuities

Non-qualified annuities are funded using after-tax cash savings. The issuing insurance carrier will usually require a QDRO to split a non-qualified annuity. The process (and importance) of evaluating present and future values as well as potential tax consequences.

9. Alternatives to Splitting

Following a professional analysis of your annuity's present and future values and tax liability, it may make sense to allow one spouse to keep the annuity contract, using an equivalent of marital property to supplement the financial entitlement of the other spouse. That option will also depend on what other assets are available, their values and the financial needs of each spouse. You may want to seek further consultation with a lawyer or qualified financial representative at this point.

10. Will There Be a New Contract?

Be sure you understand exactly what features and benefits the new split contract will provide before you agree to proceed. Read the newly proposed contract in its entirety, and be certain to have a thorough understanding of the benefits, features, withdrawal options and any potential tax liabilities.

Once your divorce and annuities have been settled and you're ready to begin planning your future financial needs, you could seek the guidance of a financial representative. You might even find it refreshing to shift the focus of planning for your financial future to making a new start for the coming chapters in your life.

Annuities are an important part of long-term financial planning. Start Your Free Plan

Sources

- FAQs about Qualified Domestic Relations Orders. https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/faqs/qdro-overview.pdf.