Key Takeaways

- Pensions provide guaranteed income with a predictable monthly check in retirement.

- 401(k)s offer flexibility and control, allowing you to choose your investments and manage savings.

- Employer contributions can boost your savings by maximizing your 401(k) with matching.

- Portability makes a 401(k) ideal if you change jobs frequently.

- Combining a pension and 401(k) offers diversification, providing stability and growth potential.

What is a Pension?

A pension, also known as a defined benefit plan, is a retirement plan in which your employer promises you a specific monthly benefit upon retirement. The benefit amount typically depends on factors like your salary, years of service, and age at retirement.

How Does a Pension Work?

Employers fund pensions, although in some cases, employees may contribute as well. Employers manage the investment of pension funds and bear the risk of ensuring enough money is available for retirees. The employer guarantees your pension benefit regardless of how well the investments perform.

The key feature of a pension plan is its promise of a stable, predictable income in retirement for life, which makes it an attractive choice for those looking for financial security.

Pension programs are less common today, especially in the private sector, as employers have moved towards more cost-effective retirement savings options. Pension plans are commonly offered in government, education, and unionized sectors.

What is a 401(k)?

A 401(k) plan is a defined contribution plan employers offer to help employees save for retirement. Unlike a pension, the 401(k) plan places the responsibility of funding and managing the retirement savings mainly in the hands of the employee.

How Does a 401(k) Work?

Employees contribute a portion of their salary to their 401(k), and many employers offer matching contributions, making it an excellent way to build retirement savings. With a 401(k), you can decide how much to contribute up to the annual IRS limit.

You make the investment decisions and choose how your contributions are invested, typically from mutual funds, stocks, and bonds.

The value of your 401(k) at retirement depends on your contributions, employer matches, and the performance of your investments. Unlike pensions, there is no guaranteed income; the amount you end up with can vary based on market conditions.

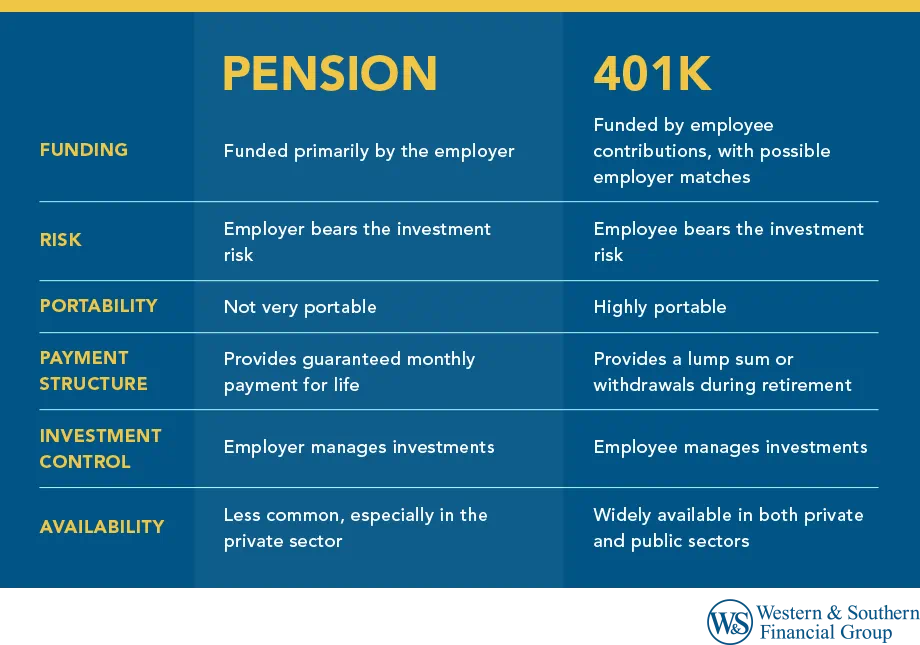

Key Differences Between Pension and 401(k)

Understanding the key differences between a pension and a 401(k), both employer-sponsored retirement plans can help you decide which works best for your retirement needs.

1. Funding and Contributions

- Pension: Funded primarily by the employer, with occasional employee contributions.

- 401(k): Funded by employee contributions, with possible employer matches.

2. Risk

- Pension: The employer bears the investment risk. The company is responsible for ensuring sufficient funds to pay retirees.

- 401(k): The employee bears the investment risk. If the markets underperform, the employee's retirement savings could be lower than expected.

3. Portability

- Pension: Not very portable. If you leave your job, you may be unable to take the full pension benefits, depending on how long you've worked there.

- 401(k): Highly portable. If you change jobs, you can roll over your previous employer's 401(k) to a new employer's plan or into an Individual Retirement Account (IRA).

4. Payment Structure

- Pension: Provides a guaranteed monthly pension payment for life. Having a consistent retirement income stream can be reassuring.

- 401(k): Provides a lump sum or withdrawals during retirement, which requires careful budgeting and planning to ensure the money lasts.

Pros: Advantages of Pensions

Pensions have several advantages that make them attractive for long-term retirement security:

- Guaranteed Income for Life: One of the most significant benefits of a pension is its guaranteed monthly check, which provides predictable income throughout retirement. Consult a tax professional for specific advice related to tax planning.

- Less Responsibility for the Employee: The employer handles investments, which means less stress for the employee. You don't have to worry about market fluctuations or managing your portfolio.

- Spousal Benefits: Many pension plans offer spousal benefits, meaning that if you pass away, your spouse may continue to receive a portion of your pension benefits.

Pros: Advantages of 401(k) Plans

The 401(k) plan has its own set of advantages, particularly for those who want flexibility and control over their retirement savings:

- Tax Benefits: Contributions made with pre-tax dollars can lower your income taxes. There are also Roth 401(k) options, where contributions are taxed upfront, but withdrawals are tax-free in retirement.

- Employer Matching: Many employers offer a match to your contributions, essentially "free money," taking advantage of employer contributions to boost your retirement savings.

- Control and Flexibility: You decide how much you contribute and where the money is invested. This allows you to take a more aggressive or conservative approach based on your risk tolerance and goals.

- Portability: You can roll your 401(k) into a new employer's plan or an IRA if you change jobs, making it easier to maintain your retirement savings.

Disadvantages of Pensions

Pensions, while providing stability, also have some limitations:

- Limited Portability: Pensions are tied to your employer, and you may lose some or all of your benefits if you leave before you are fully vested.

- Employer-Dependent: Your pension is dependent on your employer's financial stability. If the company goes bankrupt or faces financial difficulties, your pension benefits could be at risk.

- Declining Availability: Fewer employers are offering pension plans today, especially in the private sector, making it a less accessible option for many workers.

Disadvantages of 401(k) Plans

While 401(k) plans offer flexibility, they also have certain downsides:

- Investment Risk: With a 401(k), the employee assumes all the investment risk. If your investments perform poorly, your retirement savings could be negatively impacted.

- No Guaranteed Income: Unlike pensions, income isn't guaranteed, so manage your withdrawal strategy carefully to ensure your funds last.

- Limited Investment Options: The 401(k) plan provider dictates your investment options.

- Fees and Expenses: 401(k) plans can come with management fees and investment expenses, affecting your retirement savings over time.

Choosing Between Pension and 401(k)

Deciding between a pension and a 401(k) depends mainly on your career situation, retirement goals, and risk tolerance.

- Long-term Employees: If you are likely to stay with one employer for a significant portion of your career, a pension plan can be an excellent source of guaranteed income for retirement. The stability and predictability of a pension can help offer peace of mind, particularly for those who prefer a hands-off approach to retirement savings.

- Job Hoppers: A 401(k) plan might be a better fit if you change jobs frequently. A 401(k) portability allows you to take your savings with you when you move from one employer to another, ensuring you are always building your retirement nest egg.

- Risk Tolerance: If you are comfortable taking on some level of risk and want more control over your investments, a 401(k) can be advantageous. The ability to select from various investment options means you can tailor your savings strategy to your personal risk tolerance.

- Employer Offerings: In some cases, you may not have a choice, as many companies today no longer offer pensions.

Conclusion

For those fortunate enough to have access to each type of retirement plan, leveraging both a pension and a 401(k) can help provide an excellent balance of security and growth potential to help you cover your retirement costs and help ensure a comfortable retirement.

The pension provides a guaranteed, predictable monthly retirement benefit, while the 401(k) offers flexibility and control over your investments with the potential for higher growth.

This strategy allows you to enjoy the stability of a pension while also benefiting from the potential upside of market participation through your 401(k), ultimately leading to a more robust and well-rounded retirement plan.

If your employer offers only a 401(k), it is essential to maximize your contributions, especially if they offer a matching program. Remember, it's never too early to plan for retirement.

See which retirement plan could work best for you. Start Your Free Plan

Frequently Asked Questions

Can you have both pension and 401k?

What happens to my pension if I quit?

What happens to your pension if you quit depends on your plan's specific rules and your vesting status.

If you're vested, you'll still receive benefits at retirement age, though the amount may be lower if you leave before working long enough to earn full benefits. Understanding your plan's vesting schedule and options for managing your pension benefits when changing jobs is crucial.

Is a 401k considered a pension?

While both are retirement savings vehicles, a 401(k) is not considered a pension.

- Pensions are defined benefit plans, meaning you receive a guaranteed monthly payment in retirement.

- 401(k)s are defined contribution plans where you contribute and manage investments with no guaranteed payout.

Can I collect both Social Security and my pension?

Yes, you can generally collect both Social Security and your pension. Social Security and pensions are distinct retirement income sources, with Social Security based on your work history and pensions from specific company employment.

There might be some exceptions for certain government pensions, or if you're receiving spousal Social Security benefits, so it's always wise to check with the Social Security Administration for your specific situation.