Key Takeaways

- Before setting aside any profit, first understand how much you will need to live comfortably in retirement based on projected future expenses and the retirement lifestyle you desire.

- Determine the percentage of your profits to allocate toward retirement savings, keeping in mind that your income and revenue may fluctuate month to month as a small business owner.

- As you plan for retirement, ensure you have contingency savings for your business to maintain operations during client loss, slow business periods, or economic downturns.

- Whether you own a business or work for an employer, one of the golden rules of investing is to diversify your portfolio.

Launching a small business requires fearlessness and faith. Turning that business into a success requires a lot of sweat equity and perseverance.

If your business is doing well, you're likely reinvesting your profits back into the business. While this makes sense, there's another important long-term consideration: saving for retirement.

Retirement plans for a small business owner can vary depending on how much of your profits you allocate to retirement savings. There's no perfect formula for this, but there are strategies to consider when crafting your small business owner retirement plan.

Estimate How Much You Need for Retirement

Before you set aside any of your profit, you first need to understand how much you expect to need to live comfortably in retirement.

Much of this comes down to your projected future expenses and the kind of retirement lifestyle you desire. Right now, you may have a mortgage, child care costs and possibly college tuition expenses. But you may not have most (or any) of these when you get ready to retire. Your kids may have graduated from college or you may have paid off your mortgage by that time.

Use these projections to calculate your anticipated monthly expenses in retirement and multiply that number by 12 to determine an estimated annual retirement income you'll need. For example, if you determine your expenses will be $4,000 a month in retirement, that projects to needing approximately $48,000 a year in retirement income (before adjusting for inflation).

Next, create a plan for how much you'll save each month based on when you want to retire and how long you expect your retirement to be. Our retirement calculator can help you identify your target amount. Let's say you expect your retirement to last 20 years. Using the numbers above, that means you'll need $960,000 in total retirement savings. If you're in your early 40s and plan to retire in 25 years but have just started saving for retirement (essentially starting from $0), then you'll need to save $3,200 a month over the next 25 years to reach your savings goal.

While that number may seem overwhelming, it also illustrates why it's so important to begin saving for retirement as soon as possible so your money has time to grow.

Build a plan that outlines how much you need for a financially stable retirement. Start Your Free Plan

Determine How to Allocate Your Business Profits to Retirement

Whether your monthly savings number is $3,200 a month or $500 a month, you'll need to determine what percentage of your profits to allocate toward retirement savings.

One of the realities of being a small business owner is that your income and revenue likely fluctuate month to month. Still, you should review your financials over the past three to six months to determine what your average monthly income is. Once you know this number, you can decide what percentage of your profits to put toward retirement. For people who have a traditional 40-hour-per-week job, experts generally recommend saving 10%–15% of their monthly income for retirement.1 Using that same guideline, you may decide that setting aside 10% of your profits for retirement is possible and won't undermine the sustainability of your business.

Businesses also tend to have up years and down years, so it's important to build some flexibility into your strategy. Either way, make sure you have processes in place to streamline saving for retirement. Setting up an automatic transfer from your business banking account to your individual retirement account (IRA), solo 401(k) or brokerage account can make saving for retirement much simpler.

Create a Rainy Day Fund for Your Business

When your business is doing well, it's easy to forget that rainy days may come. But even as you plan for retirement, you need to have contingency savings for your business to ensure you can keep operations going even when you lose a client, when business is slow or there's an economic downturn.

How much you set aside in your business's rainy day fund will depend on your overhead. If you're a solopreneur without any employees, calculating your monthly outlay may be pretty straightforward. However, if you have employees or complex debt obligations and high monthly overhead, it may be more complicated to get an accurate financial picture. Using accounting software can make calculating your numbers much easier.

Just as you save 10%–15% every month for retirement, set aside a percentage of your profits every month for a rainy day fund. You may want to save at least three to six months of business expenses to help make sure you're covered. You also can open a separate business savings account for this purpose. Doing so will create some separation from the business checking account you use to pay expenses and employees.

Diversify Your Portfolio

Whether you own a business or work for an employer, one of the golden rules of investing remains the same: diversify your portfolio.

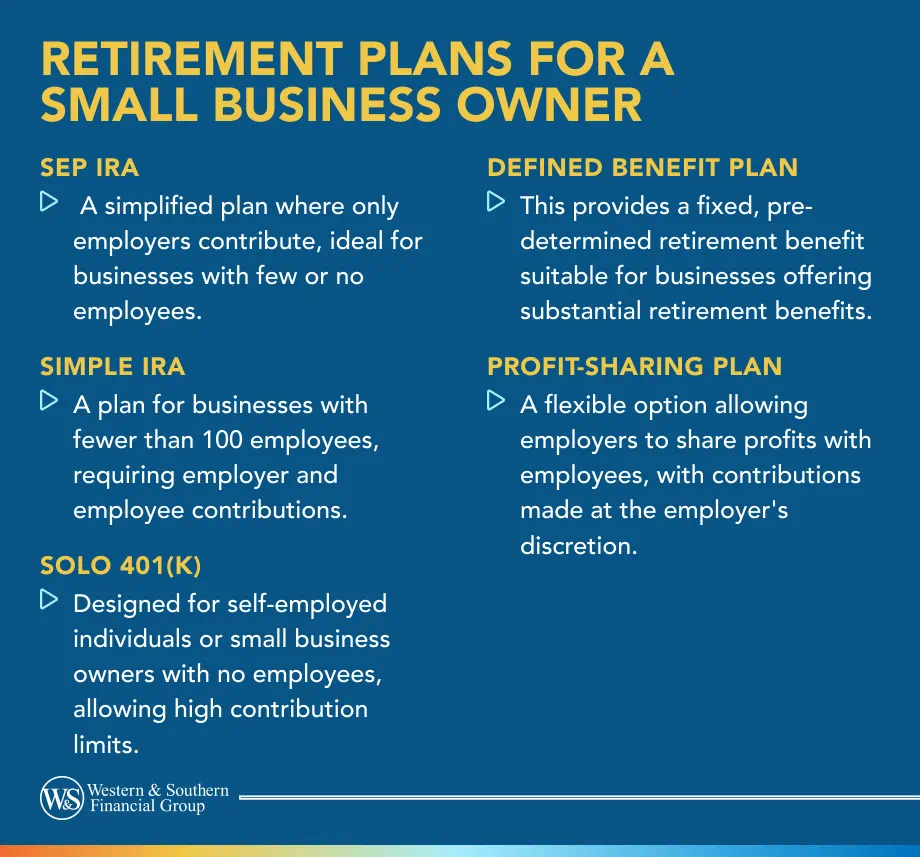

Retirement plans for a small business owner run the gamut from simplified employee pension plan (SEP) and Roth IRAs to solo 401(k)s and even taxable brokerage accounts. As you develop your business owner retirement plan, don't forget about diversification both in terms of the assets you hold and the types of retirement accounts you have. A few different options are available to small business owners:

SEP-IRA

For example, if you generate an annual salary of $100,000 a year from your business, you can contribute up to $25,000 pre-tax to your own retirement account. Keep in mind that if you have employees and open a SEP-IRA, you'll be legally required to contribute the same percentage to each eligible employee's IRA. If you contribute the maximum 25% to your own IRA, you'll also need to contribute 25% of each employee's salary to their IRA as well.

Maximize Retirement Contributions

Solo 401(k)

If you're the only employee for your business, you have the option of opening a solo 401(k). Solo 401(k) plans allow you to save money pre-tax for yourself and your spouse if they work for the business. For 2024, you can contribute up to $69,000 to a solo 401(k). If you're 50 or older, you also can make a $1,000 catch-up contribution every year, which is something that SEP-IRAs don't allow.3

The main advantage of a solo 401(k) versus a SEP-IRA is that while both offer tax deductions, a solo 401(k) often has higher contribution limits, which potentially means higher tax savings. These tax savings may free up additional money to reinvest back into your business, so it's another important consideration when choosing what type of retirement account to open.

Brokerage Account

Though tax-advantaged retirement accounts offer several benefits, flexibility also is an important part of retirement planning.

Consider incorporating a taxable brokerage account into your small business retirement strategy. Though these accounts don't offer any tax deductions and you'll likely have to pay capital gains tax when you withdraw your earnings, they give you the flexibility to withdraw profits (if any) you make on your investments at any time.

This flexibility is really critical if you plan to retire early, such as before the traditional age of eligibility for penalty-free retirement withdrawals, which is 59½. Another benefit of opening a brokerage account is that it could serve as a backup emergency account for your business. Though the principal purpose of this account should be saving for retirement, if business slows or you face a cash crunch, there may be some comfort in knowing you have additional funds you can access. Keep in mind that investments cannot guarantee growth or sustainment of principal value; they may lose value over time. Past performance is not an indication of future results.

Other Investment Opportunities

Along with these retirement savings accounts, consider investing in other assets outside of your primary industry. For example, if you're an IT consultant or restaurant owner, consider investing in real estate or even a partnership in another business in a wholly separate industry.

Even as you seek other investment opportunities, you also should be looking at your own business as an asset that has value. It may be worthwhile to sit down with a financial professional or firm that specializes in business valuation to see how much you could get for your business if you decide to sell either all of it or a portion of it. If you're nearing retirement, this number should factor into your retirement planning.

Don't Forget About Taxes

Tax mitigation also should be a part of your small business owner retirement plan. Along with the tax benefits of a SEP-IRA and solo 401(k), you should maximize every allowable tax deduction to have extra money to reinvest back into your business and retirement savings.

Keep accurate records of every single business expense, including startup deductions (if you're just launching your business), vehicle and mileage expenses, the cost of health and life insurance, and the cost of any services or service providers, such as accountants and third-party invoicing or bookkeeping software.

Focusing on tax optimization can help maximize your business profits and potentially give you more money every year to save for retirement or support your business's growth.

Good Retirement Plans for a Small Business Owner

As a small business owner, you likely have many competing priorities. In addition to your personal obligations, you need to run your business day to day, take care of your customers and possibly manage employees.

These considerations often take precedence over saving for retirement, especially if it's decades away. However, the foundation you lay now could help pave the way for a fulfilling retirement in your future. Consider taking some of your business's profits and allocating a percentage toward your retirement.

Saving for retirement is also another way to invest in other assets outside of your business, which could improve your financial sustainability long term and help safeguard your financial future. As a small business owner, you not only need to think about today but also tomorrow, so it's best to take a holistic approach to expanding your business and saving for the years ahead. Your future self will thank you.

If you feel like you could benefit from a personalized look at your unique situation, reach out to a financial professional for assistance.

Create a retirement plan that supports both your personal and business goals. Start Your Free Plan

Sources

- How much should I save each month? https://www.tiaa.org/public/learn/personal-finance-101/how-much-of-my-income-should-i-save-every-month.

- COLA increases for dollar limitations on benefits and contributions. https://www.irs.gov/retirement-plans/cola-increases-for-dollar-limitations-on-benefits-and-contributions.

- Simplified Employee Pension Plan (SEP). https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep.