Highlights

- Policy developments in the U.S. and China have raised investors’ hopes for their respective economies. The Fed’s decision to lower rates at the September FOMC meeting by half a percentage point enhanced prospects for a soft landing and catapulted the U.S. stock market to record highs.

- China’s stock market rallied by more than 20% in late September following an easing of monetary policy and a larger-than-expected fiscal stimulus package. However, it’s too soon to tell the economic impact.

- Meanwhile, the 2024 presidential campaign has not impacted financial markets even though the economic policies favored by Donald Trump and Kamala Harris are markedly different. The presidential outcome is likely to be very close, and Congress may stay divided.

- Amid this, we are positioning investment portfolios with a modest overweight to risk as expensive valuations represent a limited margin of safety. Additionally, we are positioning portfolios generally neutral duration as we believe long rates are fairly valued.

Third Quarter Investment Returns: Equities Power Ahead

Heading into the second half of this year, the U.S. stock market had posted double-digit returns while returns for bonds were relatively flat. However, investors were uncertain about the strength of the economy and the extent of Federal Reserve easing amid signs the labor market was slowing. Stock market volatility heightened following a weaker-than-expected jobs report for July that raised concerns about a possible recession.

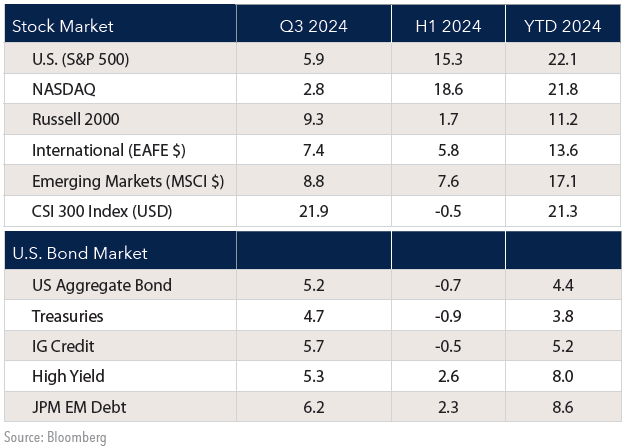

Investors became more confident about the economy, however, amid data that showed it was holding up despite high real interest rates. Following the Fed’s decision to cut the federal funds rate by 50 basis points to 4.75%-5.0% at the September FOMC meeting, the stock market set new highs. This boosted the YTD return for the S&P 500 Index to 22% by the end of the third quarter (see Figure 1).

Figure 1. Investment Performance by Asset Class for 2024

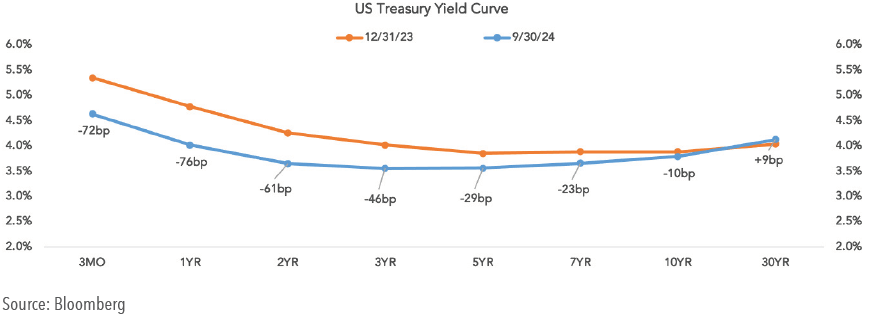

The policy action also lessened the inversion of the Treasury yield curve, as yields for shorter-dated instruments fell by a larger amount than long-term bond yields. The bond rally boosted YTD returns for Treasuries to 3.8%, while those for investment grade and high yield corporate bonds are 5.2% and 8.0%, respectively.

Outside the U.S., the Chinese stock market was among the poorest performers globally for a second consecutive year, as the long-awaited economic rebound from the COVID-19 pandemic failed to materialize. Investors clamored for the government to take strong action to bolster the country’s stock market and property market. The government’s actions in late September to ease monetary policy and to pursue fiscal stimulus to stabilize the property market sparked a stock market rally of more than 20%. Consequently, YTD returns for China’s stock market in U.S. dollar terms ended the third quarter at 21.3%.

U.S. Interest Rates on a Downward Trend

Prior to the FOMC meeting, the Fed had signaled it would begin easing monetary policy for the first time in four years. The main uncertainty was whether it would cut rates by 25 basis points or 50 basis points. It opted for the larger move on grounds that inflation was on a path to achieve its 2% target, while the labor market had cooled with the unemployment rate at 4.2% in August. Of note: since then, it declined to 4.1% in September amid stronger-than-expected job growth.

Fed Chair Jerome Powell indicated at a press conference that the economy is doing fine, but the Fed does not want the job market to soften much more. The Fed’s latest projections show officials anticipate the economy will grow at a 2.0% pace in the next few years, and the unemployment rate will peak at 4.4% later this year and into 2025.

The market and Fed’s median expectation calls for the fed funds rate to be lowered by 50 basis points to 4.25%-4.50% by the end of this year, and to decline to 3.0% by 2026. The stronger-than-expected September jobs report aligned market pricing with Fed expectations.

In this case, the path of Fed easing would be much more gradual than after the bursting of the tech bubble in 2000-2001, the 2008 financial crisis, and the COVID-19 pandemic. The primary reasons are that recent economic data and financial market indicators do not indicate a recession is imminent.

The case for Fed rate cuts in this context is that with inflation approaching the Fed’s 2% target, monetary policy should be neutral rather than restrictive. Real interest rates are in the vicinity of 3%, which is above the historic average.

The debate now is whether the softening in the job market is a harbinger of economic weakness, or whether it is to be expected with the U.S. economy operating close to its productive potential.

Some observers contend the Fed is likely to be “behind the curve” if it waits for economic data to confirm economic weakness. However, market indicators suggest this may not be true. For example, the Treasury yield curve has steepened considerably recently, and corporate credit spreads versus Treasuries are very narrow (see Figures 2 and 3). They do not point to a looming recession.

Nor are there signs of strain in financial markets and the banking system. Accordingly, we continue to believe the most likely outcome is a soft landing.

Figure 2. The Inversion of the Treasury Yield Curve Has Lessened

Figure 3. Corporate Credit Spreads Are Very Narrow

China's Policymakers Shift Course

The biggest surprise during the quarter was the policy actions China’s government announced in late September to bolster the country’s property market and stock market. They represent a sea-change from Xi Jinping’s previous stance in which he refrained from undertaking bold government stimulus. Investors responded enthusiastically as the benchmark CSI 300 Index surged by more than 20% in late September (see Figure 4).

Figure 4. China's Stock Market Surges After Years of Poor Performance

The policy shift began with the People’s Republic Bank of China (PBoC) announcing it would cut interest rates, lower reserve requirements, and reduce the cost of existing mortgages. It will also take unprecedented action to bolster the stock market by enabling market participants to borrow government bonds from the PBoC by using stocks as collateral.

China’s Politburo subsequently devoted its September meeting to the economy, where it resolved to arrest the property market’s slide. It will issue an additional 2 trillion yuan of bonds, which is equivalent to about 1.5% of GDP. Half of the proceeds will be used to backstop local governments, while the other half will encourage spending by households and businesses.

These measures represent about one half of the “bazooka” package during the 2008 global financial crisis. The final tally eventually reached about 9.5 trillion yuan over more than two years, which is widely credited for China’s economy leading the global recovery.

The main question now is whether the recent actions will serve as a catalyst to revive China’s economy and renew foreign capital inflows. Views about China’s prospects are diverse. Optimists believe the country’s problems are cyclical, and they see the policy actions as a way to boost aggregate demand. By comparison, pessimists believe the country’s problems over the past decade are mainly a result of structural problems that will require the government to implement economic reforms. However, it has been reluctant to undertake reforms thus far.

Nonetheless, while the verdict is out about China’s long-term prospects, the recent policy actions should give China’s economy and markets a temporary boost.

U.S. Presidential Election Not a Market Factor

A surprising development is that the U.S. presidential election has not had much impact on financial markets even though there are stark differences in the economic policies that Kamala Harris and Donald Trump favor. One reason is polling results suggest the contest will be very close and a handful of battleground states will determine the outcome. Another reason is that it is not clear that either candidate will be able to enact legislation they espouse, because the House of Representatives and Senate may not be controlled by the same party as the president.

The looming issue for 2025 is whether the Tax Cuts and Jobs Act of 2017 will be extended and expanded as Donald Trump proposes, or whether tax hikes on corporations and wealthy individuals will be enacted as Kamala Harris is seeking. Trump favors reducing the top marginal tax rate for corporations from 21% to 15%, while Harris would increase it to 28%. The outcome could give the economy an added boost or serve as a drag.

Beyond this, assessing the budgetary impacts of the presidential campaign plans is particularly challenging now. Many of Kamala Harris’ tax policies remain unspecified, and she has not indicated how her spending priorities will align with the current FY2025 budget proposals. Donald Trump is campaigning on a grab bag of tax cuts that could collectively cost as much as $10.5 trillion over a decade, according to Bloomberg. However, this tally is highly unlikely to be enacted, and a portion could be offset by higher tariff revenues.

Unfortunately, neither candidate has campaigned to reduce the growth of federal debt outstanding, which is on an unsustainable trajectory.

Positioning Investment Portfolios

Equity and fixed income markets performed well during the third quarter, supported by decisive Fed policy action that improves the odds of a soft landing. However, expensive valuations are likely to limit upside while the market looks for easing financial conditions to improve growth forecasts.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. Despite our improved economic outlook, elevated asset prices result in a modest overweight risk posture within the strategy. Valuations generally reflect a high probability of a soft/no landing scenario with a limited margin of safety at current levels, though there are still downside risks as policy remains restrictive.

In fixed income, we are positioning portfolios with a modest overweight to credit risk. Credit spreads were largely range bound over the quarter and remain historically tight, representing limited upside. However, the improving economic outlook should support tight spreads. Portfolios are focused on compelling bottom-up opportunities while taking advantage of periods of strength by incrementally improving credit quality and liquidity. Interest rates declined materially over the quarter and are more fairly valued as a result.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations appear stretched for the aggregate market following a 54% return for the S&P 500 since the beginning of 2023 while earnings growth has been more modest. Market breadth has improved marginally, but fundamentals will need to strengthen for smaller companies in order for gains to continue. We are prioritizing high barrier to entry businesses with high returns on capital and maintaining a moderately defensive posture within portfolios.

Download 3Q 2024 Commentary: Fed Easing and China’s Stimulus Package Boost Equities

Download 3Q 2024 Commentary: Fed Easing and China’s Stimulus Package Boost Equities