Highlights

- Assertive Start: The Fed began the cutting cycle with a 50-basis point move, indicating they are willing to move more quickly toward neutral.

- Labor Market in Focus: The Fed has determined inflation is no longer the biggest threat to the economy. Instead, they are focused on the other side of their dual mandate to ensure 'no further weakening' in employment.

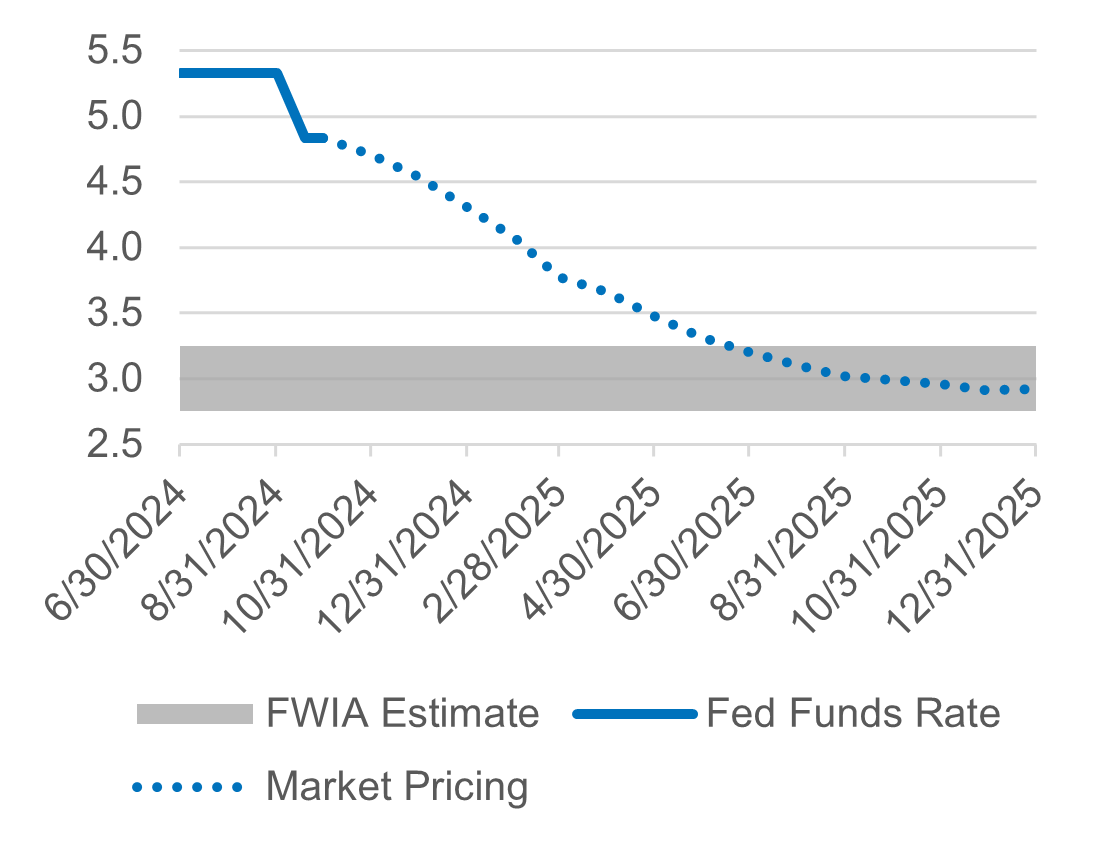

- Where Is Neutral: We believe the Fed will stop cutting around 3% toward the end of 2025, which aligns with current market pricing.

- Mortgage Rate Expectations: Our analysis indicates that mortgage rates don’t have much room to decline further outside of a larger economic slowdown.

Table of Contents

Macro Insights

A Decisive First Step

U.S. equities made new all-time highs in September, lifted by the decisive first step of the Federal Reserve (Fed) toward normalizing interest rate policy. After being slow to address the rise in inflation, investors had assumed the Fed would be reluctant to meaningfully reduce interest rates until it was clear the job on inflation was done. Last month’s larger-than-expected rate cut of 0.50% alleviated concerns the Fed would be too slow in acknowledging the cooling of the labor market, thus improving the odds of a soft landing. Notably, while short-term rates now appear poised to fall more quickly, interest rates at the long end of the curve rose modestly in the wake of the larger Fed cut, suggesting further rate relief for the mortgage market might be tougher to come by (see this month's Spotlight below for more detail).

The labor market continues to normalize. Shortages seen in the aftermarket of the pandemic have been largely alleviated. The ratio of open jobs to those seeking them has returned to pre-pandemic levels, while new jobs and wage growth have considerably slowed. With inflation appearing to be on a sustainable path lower, the Fed can again focus on the other side of its dual mandate – maximum employment.

With the path of interest rates now better understood, we expect investors to focus principally on the developing economic conditions as a determinant of market movements, as opposed to the guessing game regarding Fed policy. While we acknowledge pockets of stress among consumers, the aggregate economic trend still appears largely favorable (albeit slower). Retail sales reported last month were better than expected, and near-term GDP projections appear solid.

We noted a month ago that equity market performance had begun to broaden, including outperformance of small cap and value. That trend failed to hold in September, with the Magnificent 7 and AI-linked stocks returning to leadership for the month.

With the Fed likely to act more aggressively than previously assumed to combat further weakening of the labor market, our base case assumption of a "soft landing" is strengthened. If our expectations of slower but non-recessionary growth play out, we could expect less concentrated returns going forward. Absolute gains in equities may be more modest given the strong gains to date and elevated valuations; however, pockets of opportunity remain – including areas that have lagged, such as small caps.

Fed Funds Forecast

Market pricing for the path of Fed Funds and Fort Washington’s anticipated range for the terminal rate.

Source: Fort Washington, Bloomberg, and Macrobond. | Chris Shipley, Senior Vice President, Co-Chief Investment Officer.

What to Watch

The focus of the month ahead will be labor market data as investors assess any potential slowing in the U.S. economy. In addition, markets will look for indications that rate-sensitive sectors are showing signs of recovery, such as housing and small businesses.

- The September Employment Report (unemployment, non-farm payrolls, etc.), released 10/4, will be closely watched for any indications of an uptick in job losses.

- The initial 3Q GDP print will come out on 10/30, and investors will examine consumer and business strength.

- Inflation figures have lost a bit of their importance, given forecasts for continued disinflation; however, the next PCE release is on 10/31. We will be looking for cooling on the services side, especially shelter.

Monthly Spotlight

Mortgage Rate Expectations

Now that the Fed has finally begun cutting rates, many Americans might be looking at mortgage rates to assess the economics of moving or refinancing. Currently, the average 30-year mortgage is about 6%, and we are going to examine where they might be going from here and why.

When determining the trajectory of mortgage rates, there are two components – rates and spread. The rate piece of mortgages is determined by Treasury yields, specifically the 10-year Treasury. This yield currently accounts for future Fed cuts, and we believe is in a fair value range of around 3.75%. In the event the market’s expectation for a soft landing unfolds, the rate component of mortgages doesn’t have much room to contribute to lower mortgage rates. Conversely, a slightly quicker pace of rate cuts may actually cause longer rates to increase as the odds of a recession are reduced, which we experienced after the 50-basis point cut in September.

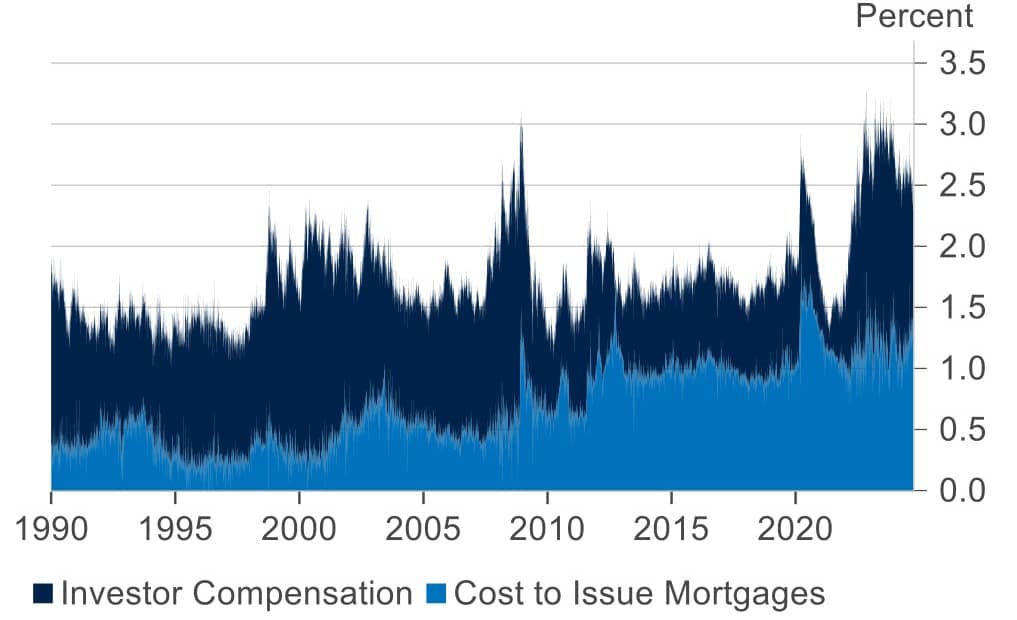

The spread component, as shown in the graph below, looks high compared to history. However, there are two elements of this spread. First, the additional yield that investors demand to buy mortgage products. Recently this figure came in line with the longer-run average and has minimal room to decline further. Notably the Fed was buying mortgages from 2008-2015, and it will be difficult for spreads to go back to those levels. The other component is the cost to issue mortgages (origination cost, margins, guarantee fees), and this element is a large reason why mortgage rates look high compared to history. When examining this at a more granular level, we observe the structural shifts within the industry following 2008; fees to originate mortgages and guarantee fees from government-sponsored enterprises (GSEs) are higher than pre-financial crisis. The cost to issue mortgages is likely to remain around these levels, and we believe there is only a small amount of room to contribute to lower mortgage rates.

In summary, we don’t believe mortgage rates have much room to come down further without Treasury yields declining. A significant decline in rates would likely result from a material economic slowdown (i.e., recession).

30-Year Fixed Mortgage Over 10-Year Treasury |

Investment Implications |

Mortgage Spread

Source: Fort Washington, Freddie Mac, Bloomberg, and Macrobond. |

Changes in mortgage rates and the effect on prepayments have a material impact on the return and volatility of residential mortgage-backed securities (RMBS). We believe the current mortgage rate environment represents a "sweet spot" in terms of prepayment risk. The lower rates relative to last year’s peak have reduced the "lock-in" effect dramatically; existing borrowers had a strong disincentive to move and lose a 3% mortgage for one near 8%. With rates around 6%, that disincentive has been reduced materially, which should result in housing turnover and raise the level of prepayments. Conversely, with the lessened risk of sub 5.5% mortgage rates, we expect an era of fairly stable and predictable prepayments for the majority of the mortgage universe. As a result, much of the non-agency RMBS market appears cheap. |

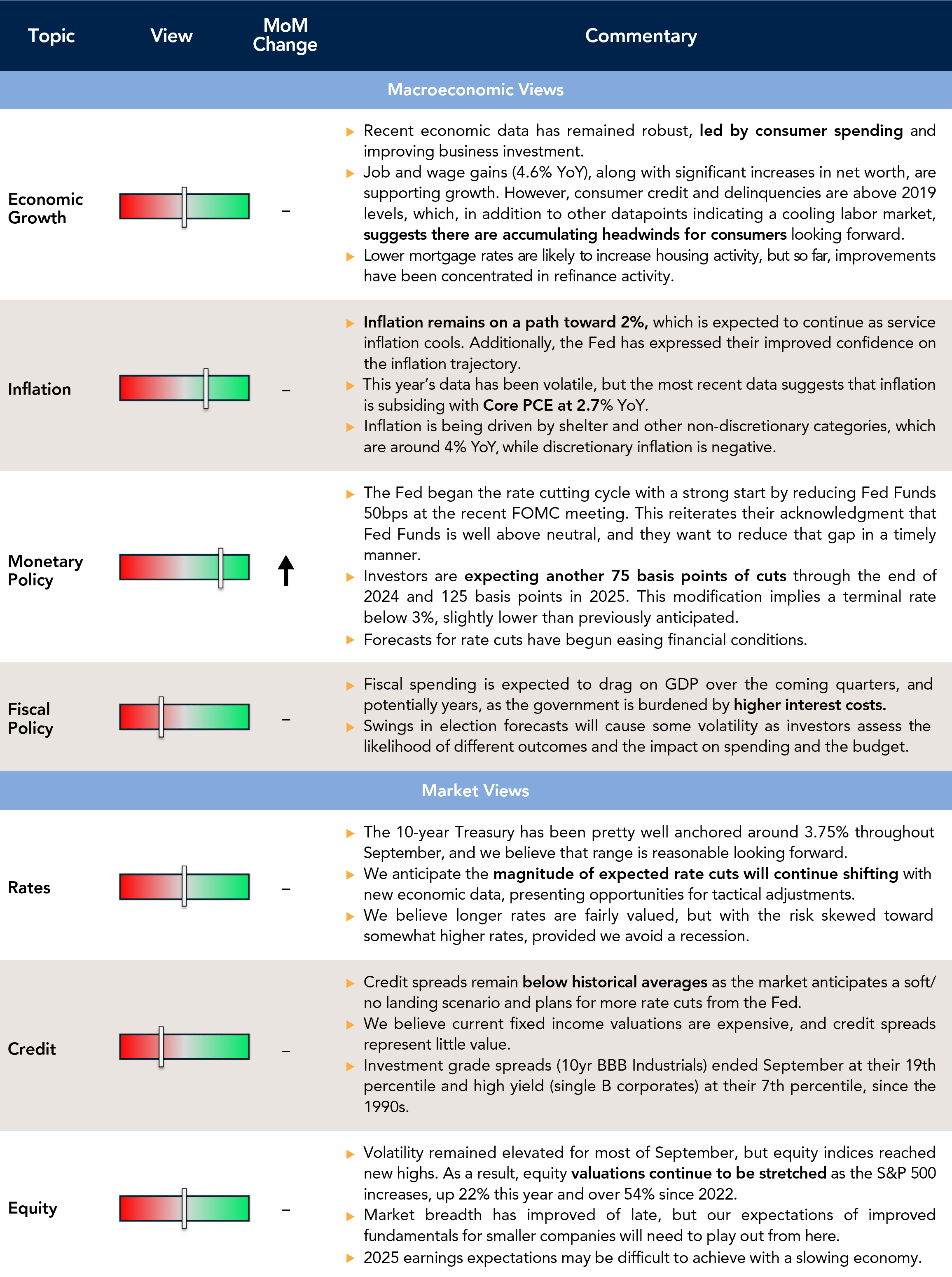

Current Outlook

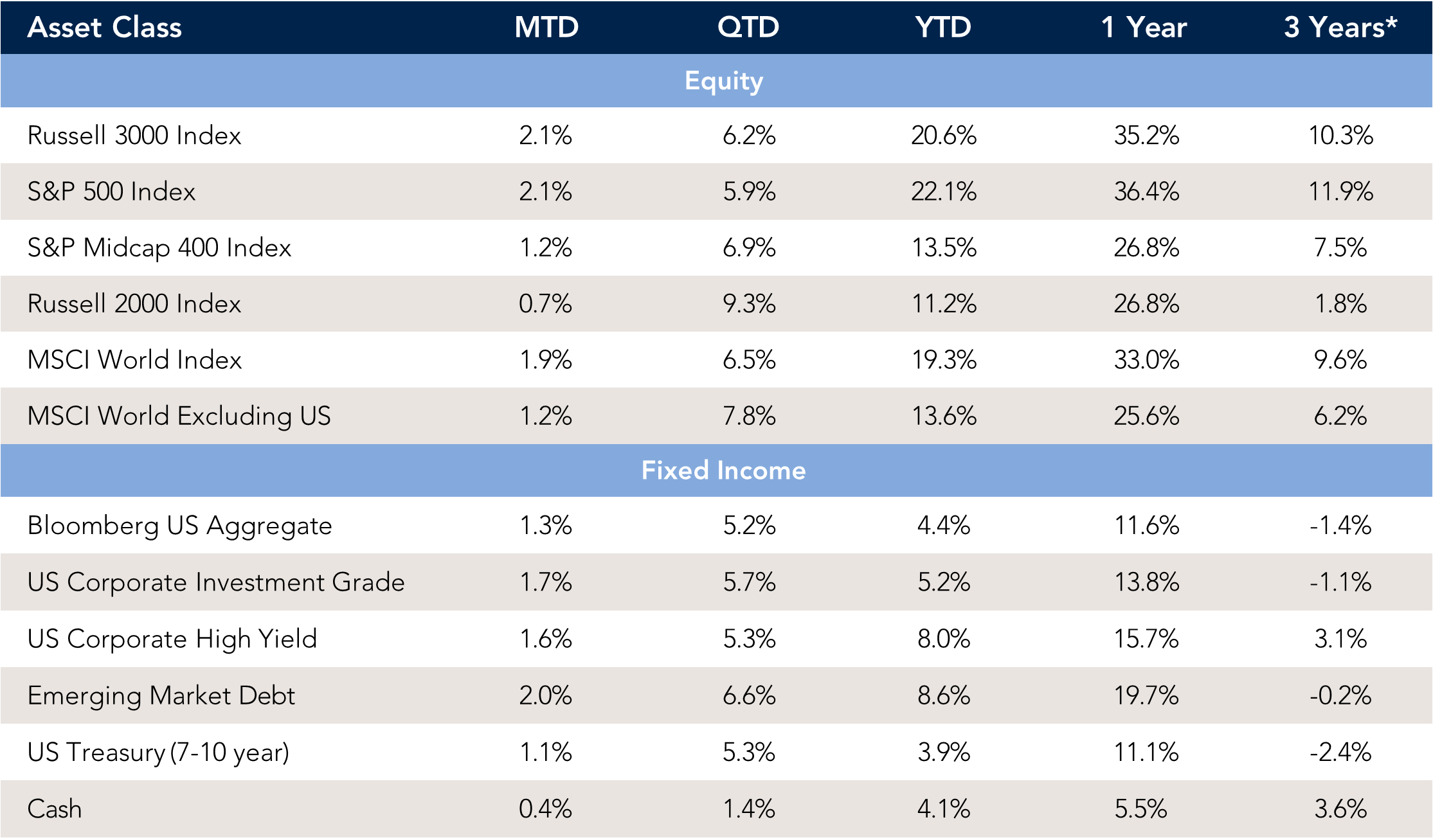

Market Data & Performance

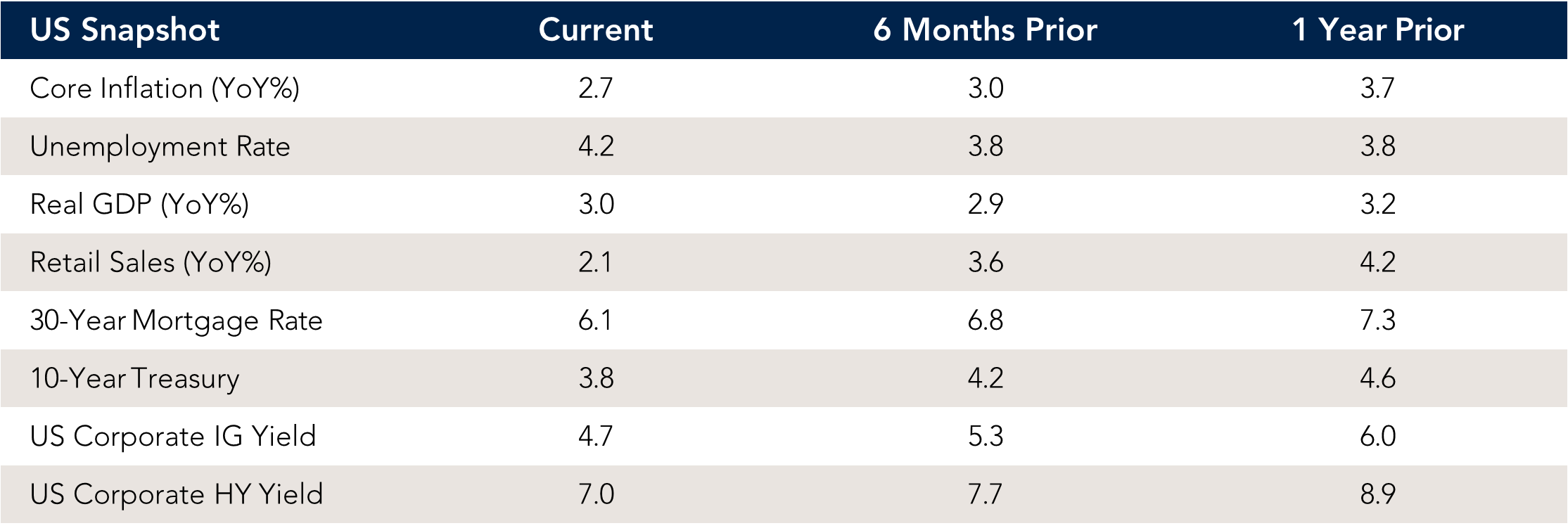

As of 09/30/2024

Source: Fort Washington and Bloomberg. *The 3-year returns are annualized. Past performance is not indicative of future results.